October 27 2023

👋Happy Friday friends. Well, earnings season is back– and things are looking a little different than they did a few months ago. It feels like everyone reported this week, so you know the drill, no fuss – let's get into it.

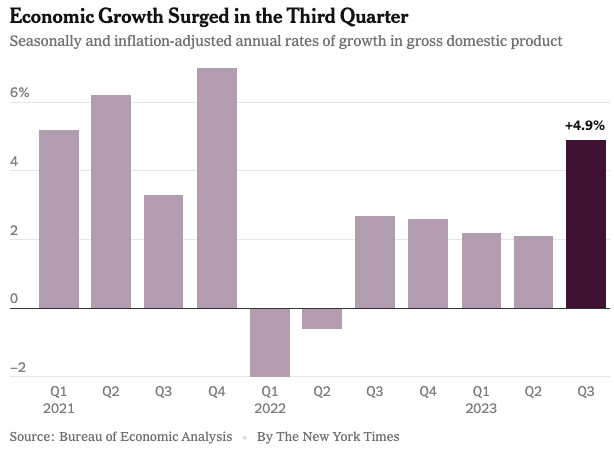

The U.S. economy experienced a significant boost in the third quarter, with a 4.9% GDP growth rate from July to September. This growth was driven by strong consumer spending, aided by lower inflation and a growing job market. Slower inflation allowed for increased purchasing, even as wage growth slowed. Wealth accumulation during the pandemic has also fueled continued spending. Higher-income earners contributed to job growth in service industries, while certain sectors returned to normal levels.

Amazon reported a profit of nearly $10 billion for the third quarter of 2023, with strong sales in cloud computing, advertising, and retail units contributing to its rebound from post-pandemic lows. The company's revenue increased by 13% to $143 billion for the quarter. AWS, saw a 12% increase in sales to about $23 billion. Additionally, its advertising segment revenue grew by 26% to $12 billion. Amazon is betting on generative AI opportunities within AWS to drive future revenue growth.

Meta reported strong financial results for the third quarter, with the company's revenue increasing by 23% to $34.15 billion, surpassing estimates, while its profit more than doubled to $11.6 billion compared to the previous year. This growth was driven by a rebound in digital advertising and cost-cutting measures, with expenses falling by 7%.

Alphabet has reported robust financial results for Q3 2023. The company's earnings reached $76.7 billion, marking an 11% increase from the same period last year, with a net income of $19.7 billion. The growth was primarily attributed to strong performance in the retail sector, including search and YouTube advertising. Alphabet's CEO, Sundar Pichai, emphasized the importance of AI, retail, and YouTube as key priorities for advertising. Additionally, the company discussed the potential of generative AI search products to drive revenue and the role of Performance Max (PMax) in enhancing advertising effectiveness in the retail sector.

Microsoft reported strong Q3 results with $56.5 billion in revenue, a 13% YoY increase, and $22.3 billion in profit, up 27%. The company's generative AI investments are paying off, notably in Azure, which grew by 29% compared to the previous quarter. Microsoft expects AI to contribute to Azure's growth, driven by offerings like ChatGPT. Sales of commercial subscriptions for productivity suite tools, including Excel and Teams, rose by 18%.

Spotify reported robust financial results for the recent quarter, with a profit of €65 million (approximately $69 million), a notable improvement from the €166 million ($177 million) loss in the previous year. Operating income also improved to €32 million, compared to an operating loss of €228 million in the same quarter last year. These gains were driven by a three percent increase in Premium subscribers, totaling 226 million, and a four percent growth in monthly active users (MAUs), reaching 574 million by September 30th.

Snap reported a 5 percent increase in revenue for the latest quarter, marking a reversal from two consecutive quarters of revenue declines. The company's revenue reached $1.19 billion in the third quarter, surpassing estimates. The company reported a 12 percent increase in daily active users, reaching 406 million in the third quarter. Additionally, Snap expanded its paid subscription services user base from four million in June to five million.

IPG reported a 0.4% decline in organic growth in Q3, marking its second consecutive quarter of decline. The drop was attributed to reduced spending by tech and telecom clients and underperformance by its digital specialist agencies R/GA and Huge. The US, which accounts for 65% of IPG's business, saw a 1.2% organic decline, while Europe had better performance, with the UK growing by 2.2% organically and Continental Europe up by 3.9%. APAC declined by 5%, and LATAM grew by 5.7%. IPG's forecast for Q4 organic growth is 1% YoY, likely missing the full-year target of 1-2% set in Q2.

WPP reported a surprise decline in Q3 revenues, with a drop of 0.6% to £2.83 billion. The company downgraded its annual revenue forecast for the second consecutive quarter and expects profit margins to be lower as well. The decline was attributed to weak performance in North America, particularly in the technology sector, and in China. WPP aims to make £100 million in savings by 2025 through simplifying its operating model at Group M and the merger of VMLY&R and Wunderman Thompson to create VML Group. WPP CEO Mark Read hopes to minimize job losses while implementing these cost-saving measures. The company's full-year revenue growth is now expected to be between 0.5% and 1%, down from earlier forecasts of 3% to 5%.

- FAST services (Fast Advertising-Supported Streaming TV) have become the fastest-growing type of streamer in the US, with 47% of households using them weekly, according to Kantar's Entertainment on Demand service. However, Kantar found that average view time across all types of streaming services declined slightly in Q3, with 11% of streaming going unused every week, up 10% from Q2. Price sensitivity became evident amid new content delays, as NBCUniversal's Peacock lost 2% in share of viewing time in August after price hikes in July. The report suggests that price increases become harder to justify when new content is scarce.

- Apple has raised the monthly subscription price for Apple TV+ by $3 to $9.99. This is the second price increase for Apple TV+ since October 2022. The move comes as other streaming services, like Netflix, Max, Discovery+, Disney+, and Hulu, have also increased prices on their ad-free tiers. While Apple TV+ has primarily relied on self-promo ads, the company's recent hire of ad exec Lauren Fry suggests plans for a with-ads tier. Apple's Services business, which includes subscriptions, generated $21.21 billion in revenue in the fiscal third quarter, up 8% YoY, making it second only to the iPhone in contribution.

- Louis Vuitton is deepening its involvement in sports sponsorship, returning as the title partner for the prestigious America's Cup yacht race in 2024. This move follows the company's sponsorship of major sporting events like the World Cup, NBA Finals, and Formula 1 Grand Prix de Monaco, where it provided trophy trunks. Louis Vuitton is also part of a broader initiative within its parent company, LVMH, to promote sports and athletes, including sponsorship of the 2024 Paris Olympics.

- YouTube Music has introduced a feature that allows users to create custom cover art for their playlists using generative AI. Users can access this feature by tapping the pen icon on their playlist's cover art and selecting a category, such as animals, food and drink, colors, nature, or travel. They can then choose from various prompts or randomize the art, and the AI will generate five different images for them to choose from. Once the user selects an image, it becomes the playlist's cover art.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/25027668/youtube_music_ai_generator.jpg)

- Google reportedly paid Apple approximately $18 billion in 2021 to maintain its position as the default search engine on Safari for Apple devices. This figure, revealed amid the ongoing US v. Google trial, is at the high end of previous estimates, which ranged from $10 billion to $20 billion. The partnership not only secures Google's prominent placement on Apple devices but has also discouraged Apple from developing its own search engine. According to testimony, Apple had considered building its search engine but was concerned about competing with Google and potentially losing its lucrative deal.

- Twenty-six agencies with B Corp status have demanded that B Lab strip B Corp status from agencies working with fossil fuel companies and major environmental polluters. This move follows Clean Creatives' issuance of an "F-list" documenting contracts between fossil fuel firms and advertising and PR agencies. Several Havas-owned agencies with B Corp status are set to work on the Shell account, which sparked the demand.

- In the third quarter, household TV ad impressions increased by 1.4% year-over-year, while national TV ad spending saw a decline of 5.95%, according to iSpot.tv's TV Transparency Report. Regarding streaming services, Paramount+ led with a 16.42% share of ad impressions in Q3, followed by Disney+ (10.85%), Hulu (10.8%), Max (8.3%), Prime Video (6.18%), Peacock (6.02%), YouTube TV (4.45%), Pluto TV (4.38%), Fox Nation (3.86%), and Sling TV (3.54%). YouTube TV experienced the most significant year-over-year rank change, climbing 31 places to reach the seventh position, while Max gained seven positions to land at No. 4. NFL games accounted for 9% of Q3 TV ad impressions for streaming services, making it the top program in this category.

- Satya Nadella, has shared some insights into the company's plans following its $69 billion merger with Activision Blizzard. Nadella emphasized that gaming is one of Microsoft's key pillars, alongside developer tools and proprietary software. Microsoft is now the second-largest game publisher by revenue globally, and expressed the company's commitment to doubling down on game production and publishing. He also mentioned that Microsoft plans to focus on consoles through 2030, including new Xbox hardware.

- WPP has fired an executive from GroupM China, who was detained on alleged bribery charges. The executive, Rycan Di, was terminated following allegations of rebate mismanagement. Two other former employees, Yao Lan and Diana Hong, were also detained in connection with the incident. Patrick Xu, GroupM China's CEO and country managing director for WPP China, was questioned by the police but not detained. WPP is cooperating with Chinese authorities and conducting its own investigation.

- Apple Pay Later, the buy now, pay later service from Apple, is rolling out to all users in the United States. The service was initially launched in early access in March and is now widely available within Apple Wallet. Apple Pay Later allows users to make purchases and pay for them in four installments over six weeks without any interest or late fees. It can be used for purchases between $75 and $1,000. Apple has partnered with Mastercard and Goldman Sachs for the service, despire reports that Goldman Sachs is looking to exit its partnership with Apple.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/25028821/apple_pay_later_launch.png)

- AMC Networks has introduced programmatic ad buying for three of its linear networks: AMC, WE tv, and BBC America. Following a successful pilot program in September, the offering enables advertisers to purchase both linear and digital ad inventory within a unified campaign through existing programmatic buying platforms. The move aims to improve the management of reach and frequency while expanding opportunities for advertisers to reach audiences that were previously digital-only. L'Oréal, in collaboration with Omnicom Group, was the first national advertiser to participate in the pilot program. The initiative was launched in partnership with FreeWheel, The Trade Desk, and Canoe Ventures.

- A global survey of chief marketers conducted by Campaign has revealed that the majority of advertisers that in-house their creative and media requirements have expanded their teams in the past 12 months. Among the respondents, 60% said they had increased the number of staff in their in-house department in the past year, with most indicating that their team had grown by more than 10%. Overall, three-quarters of the 58 marketers surveyed said they used internal teams for functions more typically provided by agencies.

- In Q3, the gaming industry saw 33 M&A transactions worth approximately $5 billion, according to a report by Drake Star. While the deal value increased compared to recent quarters, it had the lowest number of transactions since Q1 2021, with a 60% decline compared to the same quarter the previous year. The drop in deals was attributed to market uncertainty and depressed valuations of public gaming companies. Private placements also declined, with 182 deals in Q3 2023, down 20% from Q3 2022, totaling around $1 billion in disclosed funding. The majority of funding rounds (85%) went to early-stage startups.

- Twitch and YouTube are shifting away from offering big-money content deals to top live-streaming gamers. For years, these platforms made significant offers, sometimes in the seven- or eight-figure range, to lure gaming influencers. However, this strategy has led to unsustainable bidding wars. Twitch's CEO, Dan Clancy, expressed the need to reduce custom deals and move toward standard contract terms. Twitch also stopped requiring exclusivity in its contracts with top streamers in 2022. YouTube is reportedly following a similar path, reducing the size of deals with top gaming live-streamers and shortening contract lengths.

- Disney is focusing on attracting more local TV advertisers to its streaming platforms by offering better targeting capabilities through its self-serve programmatic platform, Disney Campaign Manager. The company has rebranded the platform, which was originally known as Hulu Ad Manager, to reflect its inclusion of streaming inventory from Disney+ and ESPN+ in the future. Disney Campaign Manager allows advertisers to target based on ZIP codes, district market areas (DMAs), content genre, age/gender demographics, and interest-based segments. Since opening self-serve access, Disney has seen approximately 800 new agencies join the platform, a quarter of which represent hyperlocal advertisers. The number of local ad buyers working with Disney has increased by 50% due to the self-service offering.

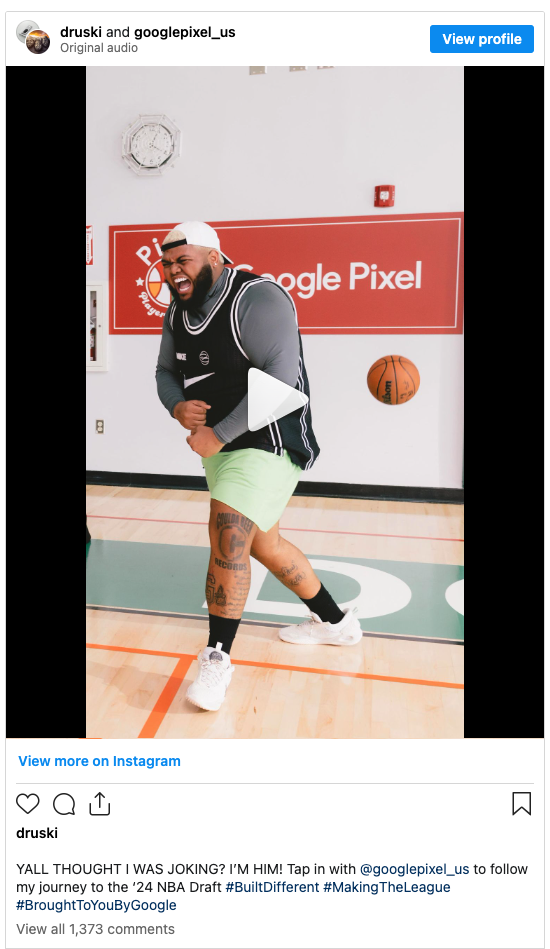

- Google has shifted its marketing strategy for its Pixel smartphone, focusing on long-term partnerships with social media creators, athletes, and artists. The company has partnered with influencers such as comedian and actor Drew Desbordes (Druski), pro soccer player Megan Rapinoe, and several NBA and WNBA players. These partnerships aim to build brand awareness and trust among consumers. Google believes that influencers play a crucial role in driving brand awareness and sales, leveraging both organic and paid social channels. The success of these partnerships is measured through traditional metrics like awareness and consideration, as well as brand lift studies that highlight the impact of creator content in driving consideration for the Pixel.

- Apple is reportedly planning a major redesign of its Apple TV app, consolidating its video offerings exclusively within the app on all devices. This update, expected to launch around December. The move aims to streamline the user experience and remove redundancies in Apple's offerings.

- Amazon is currently in negotiations with agencies regarding its new Prime Video ad tier. However, media buyers are expressing hesitation due to the high pricing, despite Amazon's CPMs being lower than those of competing streaming services. Amazon has reportedly priced the Prime Video ad tier at $30 to $38 CPMs, which is more manageable than Netflix's rates but still high for a soft market. Amazon is also requesting substantial commitments from major media holding companies, further complicating negotiations. Some buyers feel that Amazon poorly timed the launch, as budgets have already been allocated for the coming year. Nevertheless, advertisers are attracted to the potential audience for Prime Video ads, which includes 115 million monthly viewers in the U.S. and access to Prime Video originals.

- The city of Annecy, known for hosting the world's largest animation festival, is set to begin construction on the Cité Internationale du Cinema d’Animation, a $27.5 million project aimed at creating an international hub for animation. The center will feature a 330-seat screening room, spaces for artist residencies and training, temporary and permanent exhibition spaces, a bookshop, and a gift store. The goal is to establish a cultural hub similar to the French Cinematheque in Paris or the Lumiere Institute in Lyon, attracting animation enthusiasts and artists worldwide. The venue is expected to open in the second half of 2025.

- Amazon has unveiled several new media tools and updates at its flagship advertising conference, Amazon Unboxed, as it seeks to strengthen its position in the digital advertising space. The company announced a clean room service for publishers and updates to its demand-side platform (DSP), including enhancements to Amazon Marketing Cloud (AMC) and Amazon Ads APIs. The updates aim to provide advertisers with better audience insights, campaign planning, activation, and optimization controls, while also simplifying the user interface.

- PayPal has selected GroupM as its global media AOR after a review process that lasted over a year. The decision was influenced by GroupM's full-funnel performance marketing approach, which utilizes data and analytics tools to reach both businesses and consumers across various platforms. With over 431 million active accounts worldwide, PayPal aims to adapt to rapidly changing customer needs and behaviors and expand its role beyond online payments. The specific spending amount for the account has not been disclosed. In the U.S. alone, PayPal spent $112.2 million on measured media in 2022. Havas Media previously managed the majority of PayPal's media business in Europe, while PayPal also collaborated with agencies like Publicis' Spark Foundry, S4's Media.Monks, and Dentsu's iProspect.

- The U.S. ad market experienced a 0.1% increase in September compared to the same month the previous year, marking the third consecutive gain following a period of sequential declines. While this indicates some level of stability, it is essential to consider the broader economic context, which includes concerns about a potential U.S. and global recession. Despite the modest growth, September 2022 was down 2.0% from the same month in 2021. Smaller ad categories contributed to most of the year's stability, with a 1.7% increase in spending compared to September 2022, while the top 10 advertising categories experienced a 1.0% decrease during the same period.

- TikTok is hosting an in-person music festival, "TikTok In the Mix," featuring artists like Cardi B, Anitta, Charlie Puth, and Niall Horan, along with lesser-known artists behind viral TikTok soundtracks. The event, described as a real-life version of TikTok's For You page, will take place in Mesa, Arizona, on December 10th. It will include live performances, small business pop-ups, and creator activations. The festival reflects TikTok's significant focus on the music industry, with viral trends and challenges propelling songs to fame and the platform expanding into music-related ventures, such as TikTok Music and music competitions.

- Amazon has introduced a new generative AI feature called the "Amazon AI product image generator" for vendors on its marketplace. This feature enables vendors to upload product photos and add AI-generated backgrounds using Amazon's Ad Console service. By placing products in lifestyle contexts, like a toaster on a kitchen counter, vendors can apparently boost click-through rates by up to 40% compared to standard product images. The feature also includes themes, allowing users to enhance images with props and objects to fit different thematic categories.

First look at our new Amazon Ads GenAI capability (in beta). All sellers or brands need to do is upload a product photo and description to quickly create unique lifestyle images that will help customers discover products they love. https://t.co/FPvjb72fyj pic.twitter.com/unxcrx1d8l

— Andy Jassy (@ajassy) October 25, 2023

- Instagram tests a verified-only feed

- More Companies Like Mastercard Are Creating Signature Scents for Clients

- Google Play Games for PC is getting 4K support and console game controllers

- Why creators are the future of the gaming industry

- Spotify looks set to overhaul its royalty model next year

- Dozens of states sue Meta over youth mental health crisis

- After laying off thousands, Meta expects to add jobs next year

- Amazon will now let you access Crunchyroll’s anime library right from Prime

- Imax Sees Quarterly Revenue Surge Led By ‘Oppenheimer’, Stock Pops

- Faze Clan acquired for $17 million, one year after its $725 million SPAC

- Cruise’s Driverless Taxi Service in San Francisco Is Suspended

- I did my expenses in VR and I liked it

- Microsoft's CMO, Chris Capossela, is stepping down after a 32-year tenure

- Type Directors Club Announces Global Jury for TDC70 Competition

- All I want is Homer Simpson singing Smells Like Teen Spirit

- Apple discussing using Vision Pro for Mental Health Diagnosis, Treatment

- YouTube and Snap Results Suggest Consumers Cooling to Short-Form Video

- Uncommon opens New York studio and bags Sam Shepherd to lead

- OpenAI forms new team to assess ‘catastrophic risks’ of AI

- Jon Stewart’s Show on Apple Is Ending

- HubSpot & TikTok Announce CRM Partnership

- Dropbox handing over 25% of SF HQ as commercial real estate softens

- Okta’s latest hack fallout hits Cloudflare, 1Password

- Stellantis drops out of CES, blames UAW strike

- TikTok is testing 15-minute uploads with select users

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion