October 20 2023

👋Happy Friday friends. Okay, today's newsletter is objectively too long, but I think we're seeing a lot of trends turn into established patterns. We're entering what I'll call Entertainment 2.0, as more interactive functionality drives attention (in a segmented world). Consolidation, M&A and layoffs are still active, while social platforms fight for e-commerce supremacy. And it's all going to be powered by AI. Let's get into it–

WPP is merging two of its creative agencies, VMLY&R and Wunderman Thompson, to simplify its business offerings for marketers. The combined agency will be known as VML and will employ over 30,000 people in 64 markets. This move follows WPP's strategy to streamline its services for clients, especially as the landscape evolves with a broader scope, including data consulting, e-commerce, and technology-related services.

Microsoft has successfully completed its $69 billion acquisition of Activision Blizzard, marking the completion of the largest consumer tech acquisition since AOL bought Time Warner over two decades ago. This deal, despite regulatory challenges, signals that major tech companies can still use their financial resources for expansion. Microsoft secured approval from dozens of countries and agreed to provide continued access to Activision's flagship franchise, Call of Duty, on other gaming platforms like Nintendo and Sony. However, the FTC has appealed a decision in the US, so the risk of regulatory action remains. This acquisition could reshape the video game industry, boosting Microsoft's presence in mobile gaming with titles like Candy Crush and expanding Xbox Game Pass with marquee titles from Activision's portfolio.

LinkedIn has announced that it will cut approximately 668 jobs, which is about 3% of its workforce. This marks the second round of layoffs for the professional social networking platform this year, following the reduction of 716 employees in May. The job cuts will affect LinkedIn's engineering, product, talent, and finance teams. The company, which has 19,500 employees globally, did not provide specific reasons for the layoffs but mentioned streamlining decision-making and continued investment in strategic priorities.

Netflix added 9 million subscribers in the third quarter, reporting revenue of $8.5 billion, an 8% increase from the previous year. Despite Hollywood strikes affecting content production, Netflix's net income rose by almost 20% to $1.6 billion. The company expects to spend around $13 billion on content this year, down from the original $17 billion estimate due to the strikes. Netflix also announced a price increase for its premium ad-free service in the United States, raising it to $22.99 per month from $19.99. In addition, the company will raise prices in the UK and France. This move comes as Netflix faces rising production costs and aims to boost revenue.

Omnicom has reported a 3.3% growth in Q3 2023, accompanied by a 3.9% increase in overall revenue, reaching $3.6 billion. The company anticipates a 4% growth for the full year and is optimistic about the coming year, particularly with the prospects of significant new business wins, especially in the media sector. By discipline, advertising and media registered a 6.1% growth, precision marketing increased by 4.3%, healthcare grew by 3.8%, and experiential marketing units posted a notable 9.2% increase.

Nokia is laying off 14,000 jobs, approximately 16% of its workforce, over the next three years. The move comes as the company reported a 20% drop in sales and a 69% decline in profits in the most recent quarter. Nokia aims to reduce its costs by $1.3 billion through this restructuring. The company has been facing challenges, including macroeconomic uncertainty, higher interest rates, and competition from Chinese rivals like Huawei. The company, which was a former leader in the mobile phone market, has shifted its focus to providing telecom infrastructure to businesses and wireless companies.

- YouTube is introducing new features aimed at helping creators generate more revenue from shoppable videos. These features include the ability for creators to add timestamps to videos for their tagged products, allowing the shopping button to appear at relevant points in the video. YouTube found that people who saw these timestamps clicked on tagged products twice as often during testing. Additionally, creators can now tag affiliate products across their video library in bulk based on products mentioned in the video's description. YouTube is also teasing upcoming insights and analytics for affiliate products. These enhancements come as YouTube seeks to compete with TikTok's expanding e-commerce features in the U.S.

- Netflix is expanding its push into the video game industry by creating more titles based on popular Netflix movies and TV shows. While the company has primarily focused on mobile games so far, it is taking steps to expand into higher-end games that can be streamed from TVs or PCs. The move is seen as an effort to keep subscribers engaged and attract new ones, especially during periods when there are no new seasons of their favorite shows. Netflix games have been downloaded 70.5 million times globally as of September 2023, up from 30.4 million in September 2022, according to Apptopia. However, fewer than 1% of Netflix's 238 million subscribers are playing its games daily. Netflix aims to test its game-streaming technology and improve the user experience as it expands its gaming offerings.

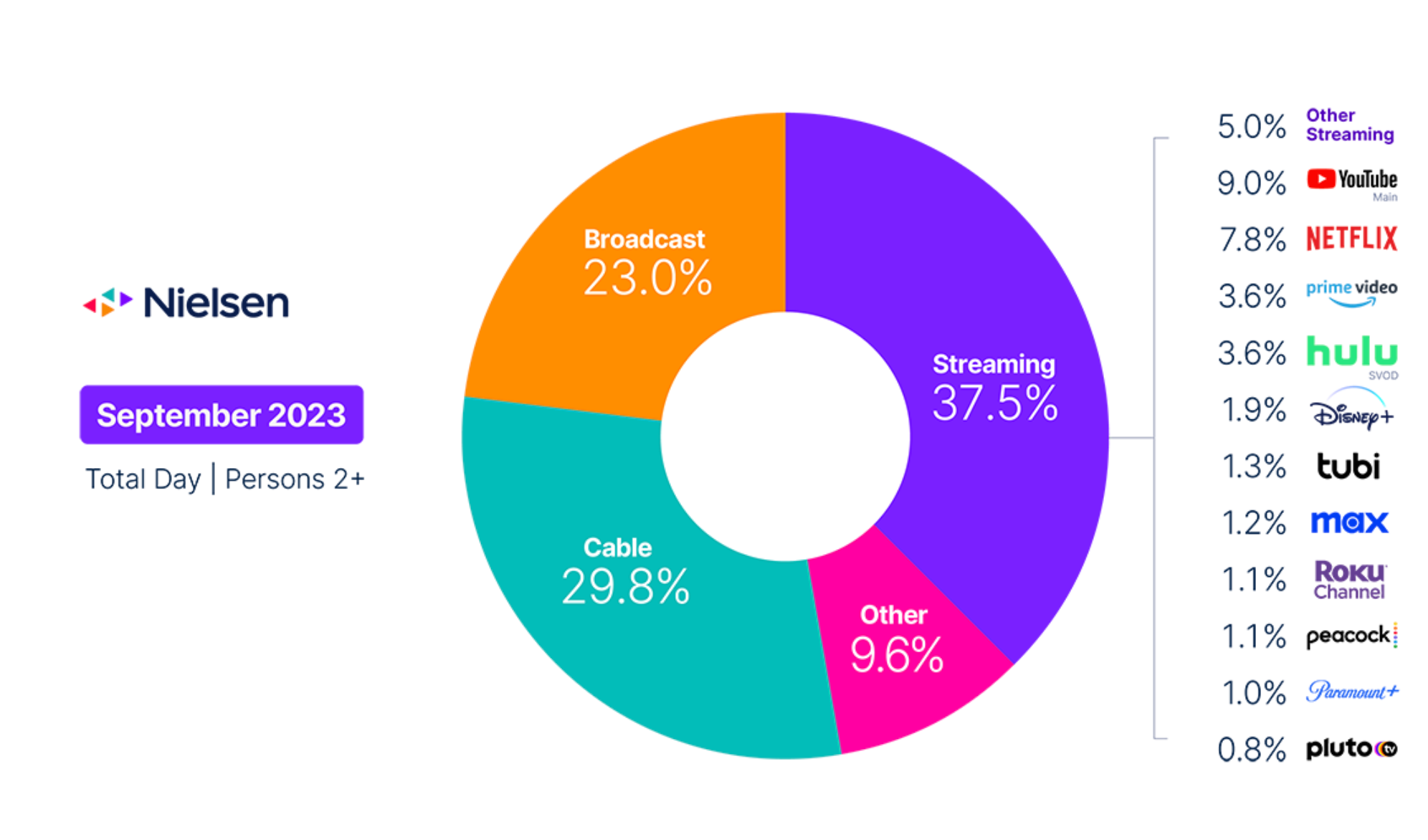

- FAST channels, short for: Free, Ad-supported Streaming TV, are on the rise, with 17 separate channels recently launched by various companies. Despite concerns about oversaturation, agency executives see a positive outlook as viewership is steadily expanding, with a projected 4% year-over-year increase in 2024, reaching 104.4 million people, roughly 31% of the U.S. population. Ad buyers' perspective on FAST channels often focuses on the platform level rather than individual channels. They prioritize buying ads on FAST channels through the FAST platforms themselves, emphasizing cost-effectiveness. Larger FAST channels owned by major TV networks can secure direct deals with advertisers. More channels are expected to emerge as companies look to capitalize on their programming libraries and replace declining syndicated TV revenue.

- P&G increased ad spending by $445 million in Q1 2023, beating analyst expectations. This marks the second consecutive quarter of significant spending hikes. Sales for P&G brands like Tide, Pampers, Gillette, and others rose 6% to $21.9 billion in Q1, with organic growth at 7%. P&G plans to continue aggressive spending, focusing on healthy ROI and refining its targeting methodology. Despite global volume declining by 1%, P&G gained share, particularly in the U.S. and China.

- Group M has partnered with Amazon Ads to offer creator-led shoppable content for its clients, with the offering developed by The Goat Agency. This collaboration will enable Group M clients to place sponsored creator content on websites within Amazon's Ad platform. Additionally, clients can purchase an "above the fold" Amazon.com ad placement, exclusively available to Group M and Goat clients. This partnership aims to connect creator marketing with Group M's commerce capabilities, offering brands the opportunity to create their own brand store and feature influencer content.

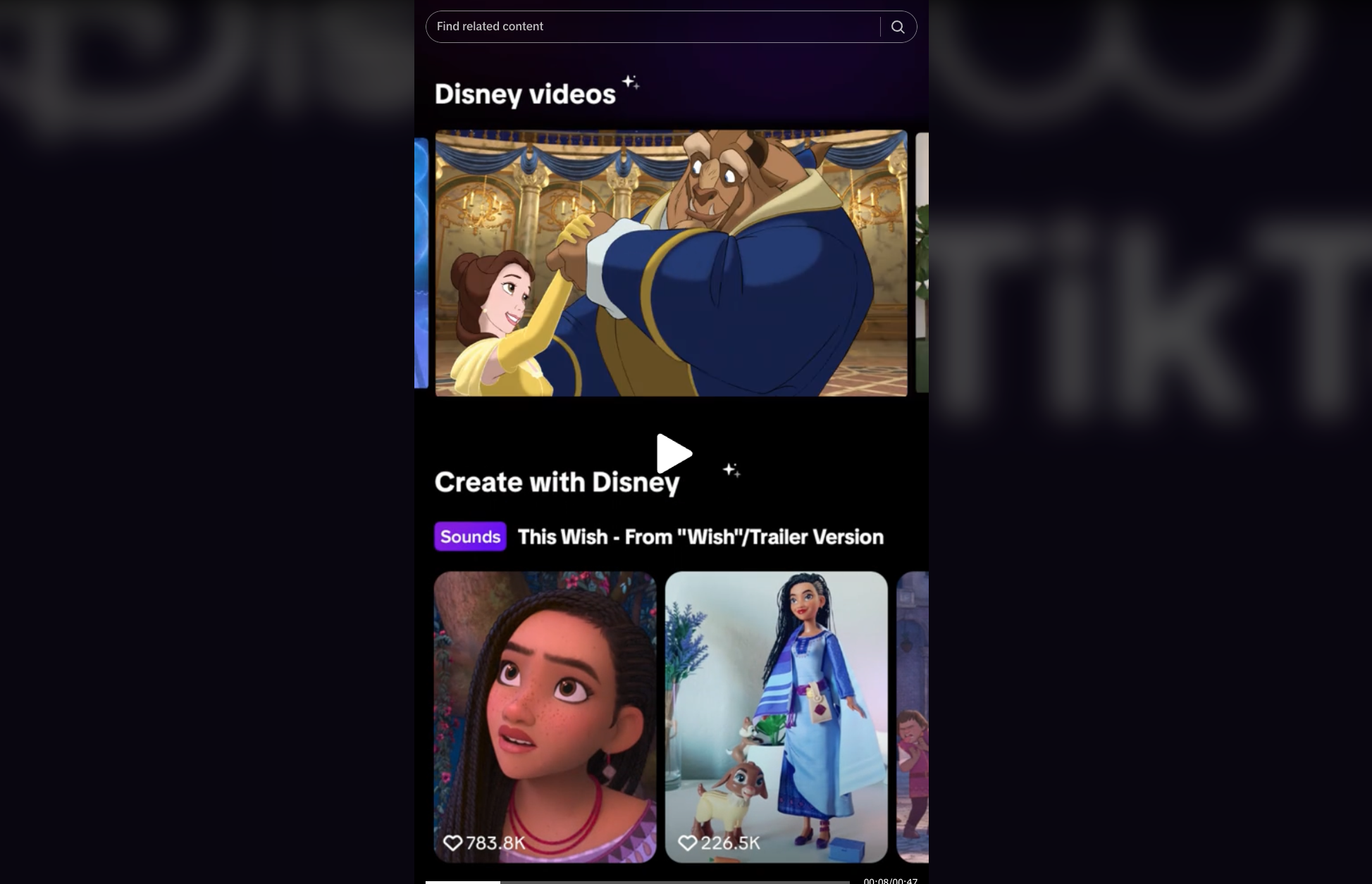

- Disney has partnered with TikTok to create a dedicated hub on the platform to promote its movies and TV shows as part of Disney's 100th-anniversary celebration. The "Disney100" hub features clips, quizzes, and a collectible card game, marking TikTok's first branded space for a partner. The hub includes games, promotional banners for various Disney titles, Disney-themed videos, and links to Disney accounts on TikTok.

- Netflix is set to broadcast it's first live sports event, The Netflix Cup, featuring a golf tournament between athletes from its Full Swing and Formula 1 shows. With the event, Netflix will join a number of other SVOD services offering live sports to its subscribers. The Netflix Cup will leverage the streamer’s relationship with Formula 1 and the PGA but doesn’t involve any expensive rights packages, which the company has repeatedly said is not a business it’s interested in at the moment. “We really think that we can have a really strong offering for sports fans on Netflix without having to be part of the difficulty of the economic model of live sports licensing,” co-CEO Ted Sarandos said during the company’s second quarter earnings call in July. “We’re super excited about the success of our sports-adjacent programming.”

- TikTok is expanding its advertising opportunities for brands through a program called "Out of Phone." This initiative takes existing ad campaigns and brings them to real-world locations such as billboards, movie screens, bars, restaurants, airports, gas stations, and retail stores. TikTok has partnered with various DOOH companies, to make this program possible. The move allows brands to extend their TikTok content to a broader audience, reaching billions of screens globally.

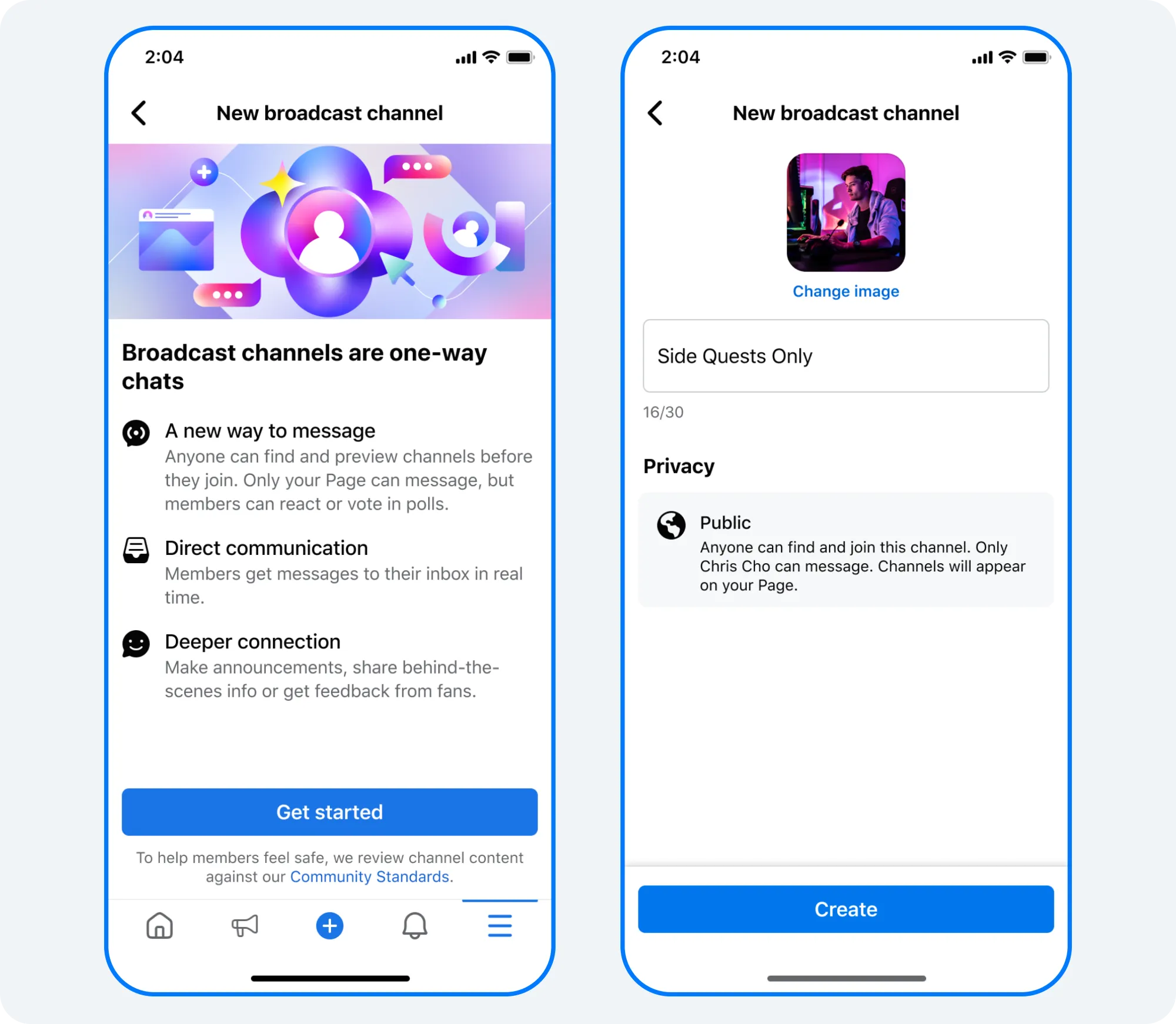

- Meta is extending its "broadcast channels" feature to Facebook and Messenger after previously introducing it on Instagram and WhatsApp. The feature allows creators and public figures to share messages, images, polls, and more with their followers as a one-to-many communication, with only the channel's creator able to send messages, while viewers can react and participate in polls. This feature aims to provide a direct and engaging way for creators to communicate with their audience. Pages on Facebook will soon be able to create broadcast channels, expanding the feature's reach.

- Los Angeles saw a significant decline in summer film and TV production, with a 41% drop compared to 2022. While contract disputes with WGA and SAG-AFTRA contributed to the decline, on-location filming in the region has been declining for seven consecutive quarters. Scripted TV production was hit hardest, with a 99% drop in TV drama and a 99.4% drop in TV comedy production. No projects eligible for the California Film & Television Tax Credit Program were filmed, and no TV pilots were produced. Feature film production also fell by 54.6% in the third quarter, with most projects being smaller, independent productions. Reality TV remained a primary production driver, with a 23.2% decline year-over-year. Commercial production declined by 25.8%, not directly related to industry strikes but due to the loss of production to rival locations.

- Bandcamp's new owner has laid off half of the company, after a change in ownership. After being acquired by Epic last year, it was subsequently resold to music licensing platform Songtradr. In the process, Bandcamp lost half of its employees, with Songtradr stating that "50% of employees received offers" to continue working under the new ownership. This move was attributed to the need for cost-cutting and ensuring the sustainability of the company. The layoffs affected various departments, and Bandcamp employees were in the process of unionizing, which may have played a role in the ownership changes. Songtradr confirmed that Bandcamp will continue to serve its fan and artist community as a stand-alone solution within its organization.

- Google is experimenting with adding a Discover Feed to its desktop homepage. The feed would show recommended content alongside the traditional search box, displaying news headlines, weather forecasts, sports scores, and stock information. This experiment is currently being tested in India. While Google has previously added the Discover Feed to its US homepage on mobile devices, this marks an experiment to incorporate it into the desktop experience. Google's homepage is one of the most visited websites globally.

- 72andSunny has launched the 72andSunny Strategy studio, a brand and marketing consultancy aimed at solving clients' challenges in creating brand architecture and strategies with high relevance. Miné Cakmak, the head of consulting, is rejoining the agency from consultancy FNDR. She is accompanied by senior strategist Aviva Mann, formerly of Landor & Fitch. The Strategy Studio is designed to provide upstream thinking and actionable blueprints for growth.

- Amazon is making a unique pitch to brands that already invest in search ads on its e-commerce platform: if they purchase streaming TV ads, Amazon will create the ads for them. This demonstrates Amazon's determination to expand its streaming ad business. In response, Amazon has recently been covering the costs of producing commercials, including writing, shooting, and editing, for brands that commit to spending at least $15,000 to run them on streaming platforms like Freevee and Twitch.

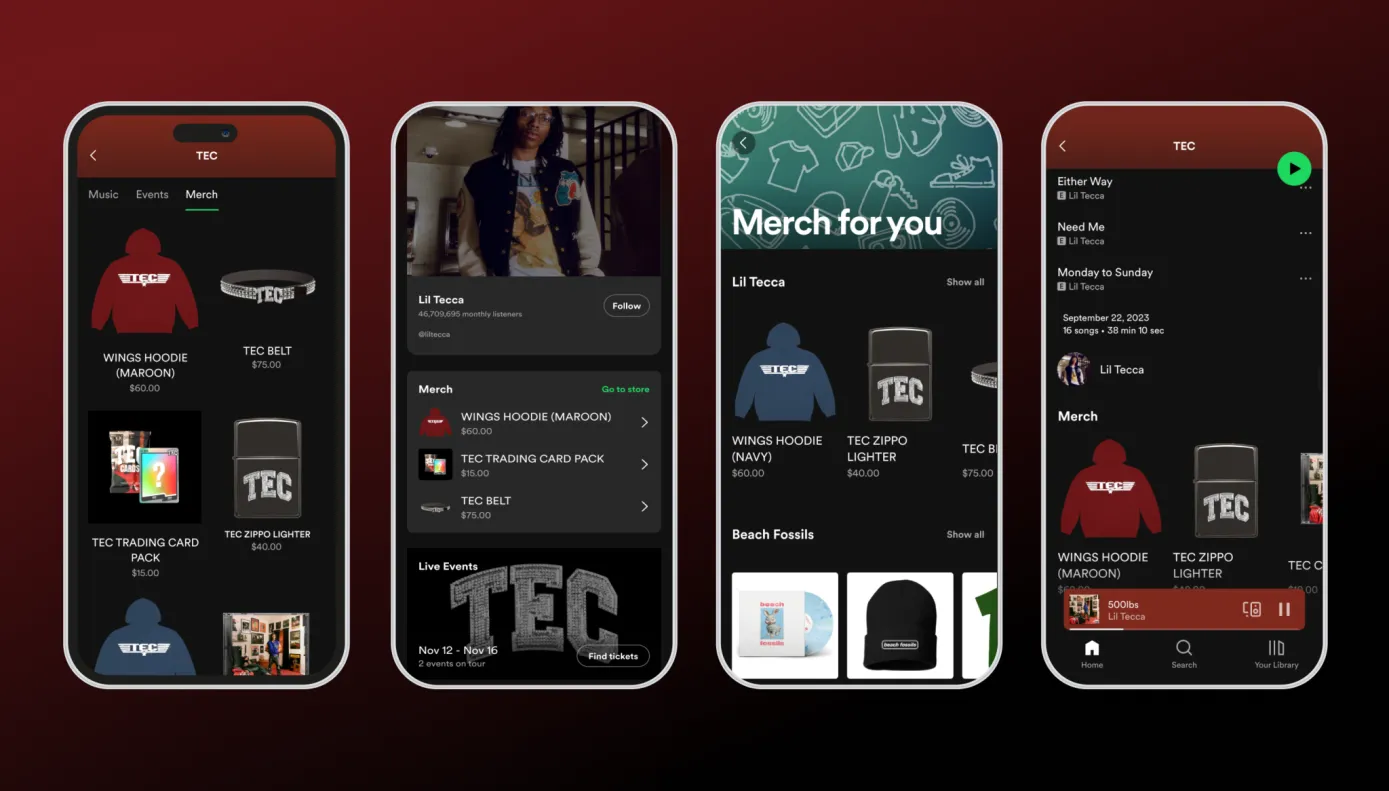

- Spotify is launching a personalized in-app Merch Hub, allowing users to access all artist merchandise in one dedicated place, and they can browse and purchase items through the artist's Spotify store thanks to a partnership with Shopify. The Merch Hub aims to connect listeners with ways to support artists and focusing on Spotify's mission of enabling artists to make a living from their art.

- ESPN could be worth $22 billion, according to analysts. This assessment is based on financial results that Disney made public for the first time. While ESPN's margins were lower than expected, the division remains fairly profitable, even in the face of challenges from a weaker TV advertising market and cord-cutting trends. ESPN generated operating income of $2.71 billion on sales of $17.3 billion in the previous fiscal year. Disney's disclosure of ESPN's financials highlights the company's urgency to attract investors and shift towards a direct-to-consumer streaming model.

- Ad demand for the 2024 Paris Olympics is growing as NBCU reports selling out key sponsorships ahead of all previous NBCU-hosted games. These sponsorships include the Opening Ceremony and halftime for group sports, encompassing both linear TV and streaming. Streaming is becoming increasingly vital for the Olympics following record-low ratings for the 2022 Beijing Winter Games and 2021 Tokyo Summer Games. Auto and pharmaceutical categories have shown strength in ad demand, with next year's Olympics positioned as a major event between the Republican and Democratic national conventions.

- Donald Glover has collaborated with Bose for a self-written and directed ad titled 'Sound Is Power.' The spot was created by Glover's creative studio Gilga, in partnership with Doomsday Entertainment, known for working with Glover on his award-winning music video "This Is America." The ad is airing on TV, digital, and social platforms in the US and UK.

- Freuds Group has acquired Lawless Studio, a London-based creative agency, described as an on demand creative community of visual artists based across Europe. Founded in 2020 by Josh Moore, Lawless collaborates with artists to create campaigns for brands, charities, and companies using various art forms, from murals to digital installations. Some of its clients include Adidas, Patagonia, Samsung, KFC, and The National Lottery. The acquisition will enable Freuds to expand its offerings to clients and support artists in gaining recognition for their work.

- Music publishers Universal Music, ABKCO, and Concord have filed a lawsuit against artificial intelligence company Anthropic, alleging that it misused copyrighted song lyrics from over 500 songs to train its chatbot, Claude. The publishers claim that Anthropic infringed on their copyrights by copying lyrics without permission and that Claude reproduces lyrics in response to various prompts. This case is one of the first involving song lyrics and the first against Anthropic, which has backing from Google, Amazon, and former cryptocurrency billionaire Sam Bankman-Fried. The publishers seek damages and an injunction to stop the alleged infringement.

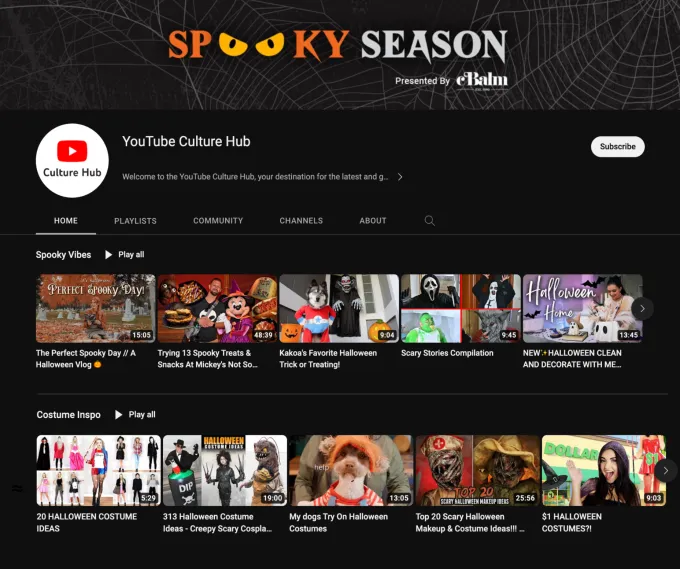

- YouTube is introducing a new advertising package called "Spotlight Moments," which uses Google AI to automatically identify popular YouTube videos related to specific cultural moments, such as holidays, awards shows, or sporting events. Advertisers can then serve ads across videos related to the chosen topic or event through a branded YouTube channel with a dynamically updated playlists. Marketing agency GroupM is among the first to offer its advertising clients access.

- Snapchat is now allowing websites to embed public content from its platform, including Lenses, Spotlight videos, Public Stories, and Public Profiles. Snapchat aims to increase traffic to its app and website by enabling embeds, a feature already offered by rivals like Instagram and TikTok. The move is part of Snapchat's strategy to reach 475+ million daily users by 2024, increase Snapchat+ subscribers, and boost non-advertising revenue.

- A survey conducted by Samsung Ads and Kerv Interactive revealed that smart TV users are embracing shoppable ads and two-screen experiences. The survey of 1,000 smart TV owners found that over a quarter of respondents shop online or on mobile devices while watching TV, with 28% browsing for items seen on TV. Moreover, 55% of respondents recalled seeing a shoppable ad, and 50% interacted with one. Among the respondents who recalled seeing shoppable ads, 54% saw them on TV and 55% on their smartphones. The survey indicates that shoppable ads are becoming more memorable and valuable in the streaming ecosystem, with 79% of respondents either scanning a shoppable QR code or looking up a product online after seeing an ad.

- ESPN BET has unveiled it's logo. The Disney-owned sports giant is set to launch its sports betting app next month, aiming to challenge market leaders FanDuel and DraftKings using its substantial audience and sports equity. ESPN's entry into sports gaming was facilitated by a $2 billion, 10-year deal with Penn Entertainment, rebranding Barstool Sports sportsbook to ESPN BET. With a growing interest in sports betting, especially among younger viewers, ESPN seeks to provide betting content with minimal friction for its audience. Sports gambling is now permitted in 35 states, with more states in the process.

- IKEA's Content Factory, which was established in 2022, has significantly expanded the brand's in-house content creation capabilities. It comprises an 80-strong team based in Malmö, Sweden, and is a key component of IKEA's marketing transformation. The Content Factory operates in a hybrid model, focusing on agility, innovation, and "meaningful affordability" in content creation to address the challenges posed by inflation. The team works closely with marketing, digital, and other departments.

- WPP has launched the WPP Creative Capital Index, to evaluate the value of creativity in driving growth. The index combines Influence and Creativity scores to demonstrate the financial benefits of high Creative Capital scores for brands. It reveals that brands with high Creative Capital in Australia have delivered double the financial returns of the average brand measured by BAV over five years. In addition, these brands also boast 1.2 times higher consumer advocacy, 1.4 times greater brand love, and 1.1 times more pricing power. The Creative Capital Index is based on survey research of a globally representative sample of consumers who rate brands on key image, equity, and advocacy metrics.

- Olipop has launched its first out-of-home OOH advertising campaign in Chicago. The campaign includes 61 billboards and one mural designed by Chicago artist Rahmaan Statik. The move to OOH comes as Olipop diversifies its marketing strategy beyond digital channels like TikTok and streaming TV. The brand, which has seen significant growth, aims to expand its popularity in the Midwest, focusing on markets like Chicago to reach a broader audience. Olipop’s sales grew 223% in 2022, making it the fastest-growing refrigerated functional beverage in the U.S., ending the year with $73.4 million in gross revenue.

- Powell Says Strong Economic Data ‘Could Warrant’ Higher Rates

- Peter Thiel was reportedly an FBI informant

- Minecraft has sold over 300 million copies

- It's Getting Too Expensive to Have Fun

- Tech Leaders Say AI Will Change What It Means to Have a Job

- Rite Aid Is Closing 154 Stores

- Netflix To Take More Ad Operations In House

- X is introducing a $1 per year fee

- Jets vs Eagles: Record Setting Audience On Fox

- Digiday+ Research: Publishers’ use of X falls off

- OpenAI Is in Talks to Sell Shares at $86 Billion Valuation

- Lego: the brick behemoth that wants to be as big as Disney

- Apple's corporate reshuffle includes many VP promotions

- ChatGPT live web browsing exits beta, DALL-E 3 enters beta

- Goldman Sachs dodges questions about its relationship with Apple

- The creator of Apollo for Reddit has moved onto smaller and weirder things

- Small banks are struggling. Big ones are next

- Sam Altman Says He Has 'No Interest' in Competing With Smartphones

- Netflix Is Finally Getting Subscribers On Its Ad-Supported Tier

- Apple's climate change efforts far exceed rivals

- Tesla’s Quarterly Profits Plunge 44%

- Gartner: Generative AI will be everywhere, so strategize now

- Amazon’s drones begin delivering prescription medications in Texas

- Twitch launches stories for streamers

- DTC brands experiment w. programmatic podcast ads—but find mixed results

- NFL Ponders Super Bowl In London, Regular Season Games In Brazil & Australia

- Neal Stephenson’s open metaverse unveils Avalanche Web3 plans

- Google just changed how you log in to your account

- Lego opens 'superpower academy' to connect families with the power of play

- Roblox says employees must return to office

- Google antitrust trial has been locked down — NYT just filed a motion to open it up

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion