November 3 2023

👋Happy Friday friends. Earnings season is underway, the Fed keeps rates steady, legacy media struggles continue, tech stays strong, tech-focused agencies struggle, and media consolidation keeps on rolling. Let's get into it–

Disney is set to pay approximately $8.6 billion to Comcast’s NBCUniversal for its minority stake in Hulu. This follows Comcast's decision to sell its one-third stake in the service. Currently, Disney controls two-thirds of Hulu, and the payment represents the minimum amount owed to Comcast. Negotiations will continue to determine the full value of Hulu and any additional compensation. Hulu currently has 48 million subscribers and is one of the few profitable streaming services. This deal is part of the ongoing reshaping of Disney's strategy, as it sheds it's linear business and consolidates it's streaming portfolio.

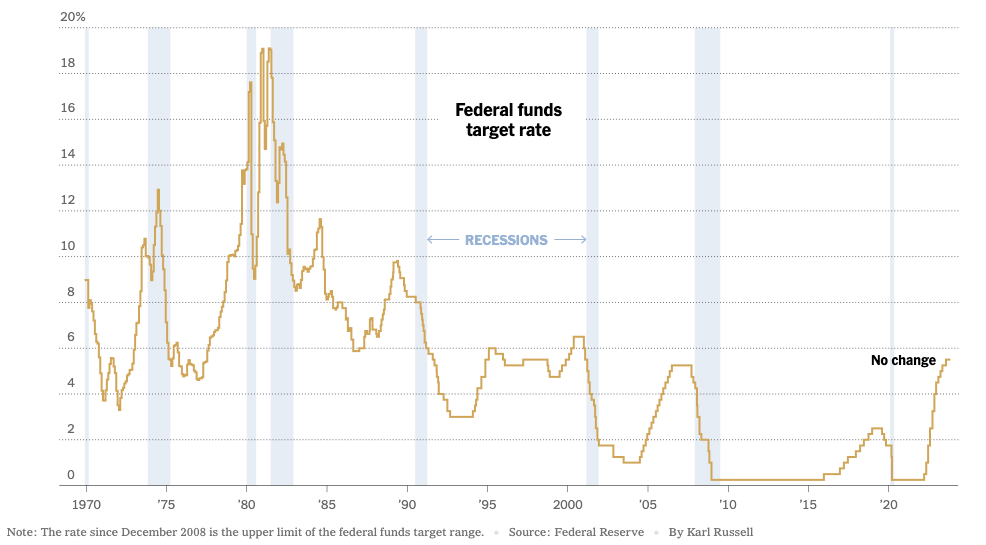

The Fed decided to maintain interest rates within the range of 5.25 to 5.5 percent, with the possibility of future increases as inflation remains a concern. Rates have been steady since July, part of the Fed's strategy to curb economic growth and mitigate inflation. Although the economy has performed well recently, with inflation decreasing to 3.4 percent as of September, policymakers aim to bring it back to 2 percent. The question of whether to make another rate increase remains open.

SAG-AFTRA is awaiting a response to their latest proposals regarding AI protections. After a flurry of rumors this week that a deal could be done, AMPTP (representing the studios) has yet to respond. While the picket lines were down at some studios (Fox & Universal), members continued to march at Netflix, Sony, Disney, Paramount, Warner Bros Discovery, and Amazon.

Pinterest reported record-breaking monthly active users (MAUs) of 482 million in the third quarter, with Gen Z users being a key driver of growth. Gen Z makes up 42% of Pinterest's user base, and are highly engaged, saving twice as much content in their first year on the platform compared to older cohorts. Pinterest's stock surged by 17% following this strong performance, as advertisers see potential in reaching Gen Z through the platform. Pinterest's "Shop The Look" feature, which offers lifestyle product advertisements based on user preferences, has contributed to the platform's advertising success. The company plans to introduce more tools for advertisers in 2024.

NBCUniversal faced an 8.4% decline in advertising revenue, dropping to $1.9 billion in the third quarter, mainly due to the softness in the TV/video advertising market. Despite this, overall NBCUniversal media revenue saw a marginal increase of 0.4%, reaching $6 billion, driven by a 3.8% rise in distribution revenue. NBCU's cash flow grew by 6.5%, totaling $723 million. Comcast Corp. also experienced a 12.4% decrease in local cable TV advertising sales, amounting to $960 million, primarily due to reduced political advertising compared to the previous year.

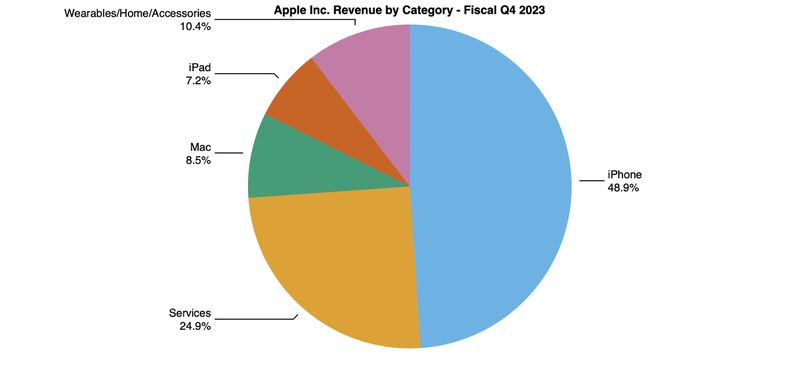

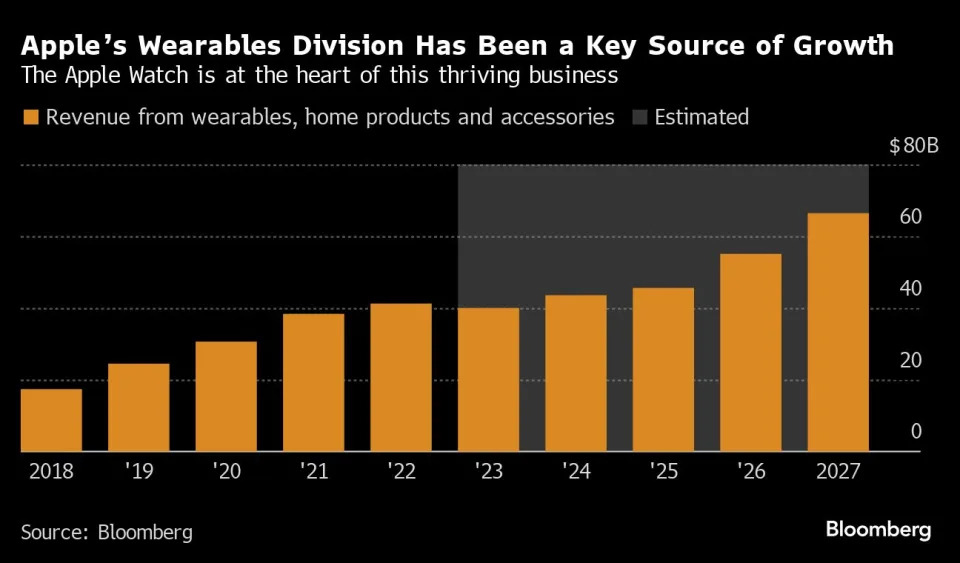

Apple reported a 1% decline in sales to $89.5 billion for the quarter ending in September, marking the fourth consecutive quarter of declining sales. However, profits increased by 11% to $22.96 billion. iPhone sales increased by 3% to $43.81 billion, driven by the release of four new devices, while sales for software and services, including Apple Music and cloud storage, grew by 16% to $22.31 billion. Other product categories, including Mac, iPad, Apple Watch, and AirPods, saw sales decline, leading to a 5% drop in total product sales to $67.18 billion. Apple's shares have declined by 11% from their peak this summer.

Paramount Global reported third-quarter earnings that surpassed estimates, with its direct-to-consumer unit, which includes the Paramount+ streaming service, reducing its losses to $238 million, lower than the expected $438 million. Paramount+ gained over 63 million subscribers, adding 2.7 million in the quarter. Subscriber revenue grew by 46%, and ad sales increased by 18%. The company now expects reduced streaming losses for the year, contrary to previous expectations of peaking losses. Third-quarter revenue reached $7.13 billion, with traditional TV networks revenue down 7.7% to $4.57 billion, and advertising down by 14%.

Stagwell has lowered its guidance for 2023, projecting negative growth of 4% due to various challenges. In the third quarter, Stagwell reported a 7% year-over-year decline in organic net revenue, primarily due to factors like reduced business from tech clients, the loss of First Republic bank as a client, marketer uncertainty, and strikes in the entertainment and auto industries. However, Stagwell did see growth in its Stagwell Marketing Cloud and its performance, media, and data unit. International growth, particularly in Europe, Latin America, and Asia-Pacific, provided some positive momentum. The company aims to return to growth in Q1 2024, with a focus on cost reduction, investments in growth areas like AI, and expansion of its services.

Shopify has reported strong third-quarter sales and profit that exceeded analyst expectations. The Canadian e-commerce company recorded $1.71 billion in revenue for the quarter, a 25% year-over-year increase, surpassing estimates of $1.68 billion. This positive performance was attributed to cost-cutting measures and a partnership with Amazon for its fulfillment network. Gross merchandise volume, representing the total value of merchant sales on Shopify's systems, reached $56.2 billion. The company expects revenue to grow at a "mid-twenties percentage rate" in 2023, driven by strong sales growth in the fourth quarter.

- Amazon is shutting down its two clothing stores, a move signaling a shift toward prioritizing its grocery stores. These closures come less than two years after the retail giant opened its first clothing store in May 2022. Amazon had initially touted these Style stores as offering a personalized and convenient shopping experience. This move aligns with Amazon's strategy of streamlining its physical retail operations, following the closure of 68 other brick-and-mortar stores last year.

- Media agencies continue to be the cornerstone of holding group profitability, with recent earnings reports from major holding groups highlighting their importance. These agencies have achieved organic growth rates in the mid-to high-single digits, consistently driving growth and profitability for their parent companies. Media divisions often derive margins from arbitrage around media buying, making them more profitable than other parts of holding companies.

"A business like this is a real asset, especially when things get choppy, as they have been this year. Advertising dollars, the lifeblood of these businesses, have been on the rise, albeit at a slower pace, as demand for the creative services they put a premium on continues to wane, and perhaps even decline. That makes competition for media dollars a lot tougher. Not to mention the ongoing decline of TV, which has traditionally played a crucial role in how many of these businesses maintain their profit margins in the advertising industry."

- Stagwell has acquired Movers+Shakers, a creative social agency known for its viral TikTok campaigns, for approximately $15 million in cash or up to 30% in shares of stock, with the possibility of contingent consideration up to $35 million based on future earnings targets. Movers+Shakers will join Stagwell's Constellation network of agencies, which includes 72andSunny, Instrument, and The Harris Poll. Despite Stagwell's third-quarter revenue decline, the acquisition is seen as an opportunity to bring Movers+Shakers' expertise in creating cultural relevance with Gen Z and millennials to Stagwell's clients. Movers+Shakers aims to expand beyond its TikTok niche with Stagwell's support.

- Google has launched its AI-powered Product Studio for US advertisers and merchants, enabling free text-to-image AI image creation. Users of Merchant Center Next in the US and the Google and YouTube app on Shopify will have access to this feature, which is aimed at helping businesses create professional images without incurring recurring photoshoot expenses. The generative AI model can enhance low-quality images, remove distractions, and fulfill various image requests, from changing background colors to creating specific scenes. Google is also introducing a "small business" attribute for Google Search and Maps to help customers identify small businesses and is enhancing the knowledge panel with more detailed information about businesses.

- Production workers at Walt Disney Animation Studios have voted to unionize with The Animation Guild (TAG) and IATSE, in an NLRB election. In the recent vote, 93% of the production workers voted in favor of unionizing with IATSE, with 96% voter turnout. Contract negotiations between the union and WDAS will commence if no objections to the results are filed in the next five days. This comes after VFX workers at Disney-owned Marvel Studios and Walt Disney Pictures also unionized in recent months.

- X (Twitter), recently granted its employees stock options indicating a company valuation of approximately $19 billion. This marks a significant decline from the $44 billion that Elon Musk paid to acquire the company just a year ago. The stock grants were issued at $45 per share in the form of restricted stock units, and employees who received shares under previous management will still be compensated at the $54.20 per share rate paid by Musk for the acquisition.

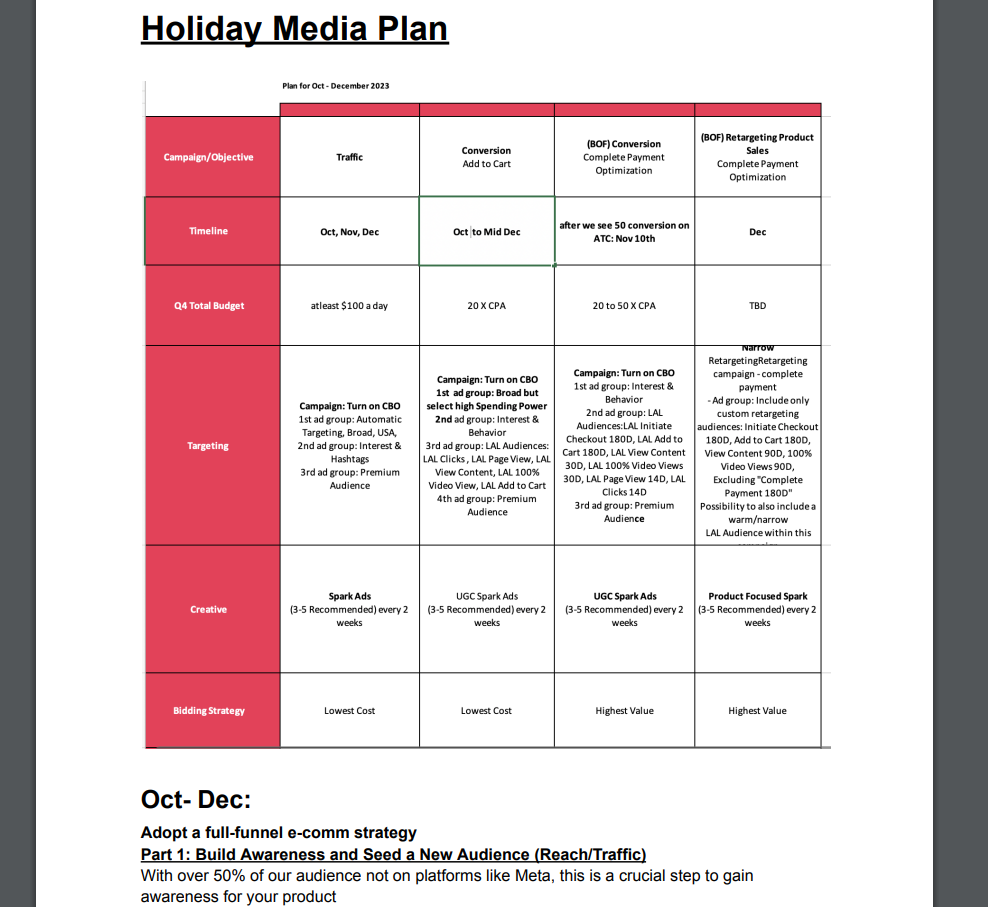

- TikTok is aiming to secure a larger share of advertising dollars during this year's holiday season. Some advertising agencies have reported significant year-over-year growth in spending on TikTok, and they anticipate continued growth in the fourth quarter. TikTok has sent sales materials to advertisers for the holiday season, providing a full-funnel approach to guide campaigns throughout Q4. The platform aims to emphasize its conversion capabilities and drive purchases on its platform, similar to established tech giants. The success of TikTok Shop is seen as crucial in attracting larger ad budgets.

- Bungie, the game development studio behind Destiny and Marathon, has reportedly laid off an undisclosed number of employees and delayed two highly anticipated games. The company has pushed back the release of the Destiny 2 expansion, The Final Shape, from February 27, 2024, to June. Additionally, the launch of the rebooted game Marathon has been delayed until 2025. These developments come after Sony's acquisition of Bungie for $3.6 billion last year.

- According to Parks Associates' latest ranking, Amazon Prime Video holds the largest number of U.S. subscriptions among streaming services, followed by Netflix, Hulu, Disney+, and HBO Max. Google's YouTube Premium entered the top 10 for the first time, displacing Starz. The research firm also reported that 89% of broadband households have at least one OTT service, 41% have used an ad-supported video-on-demand (AVOD) service in the past 30 days, and 29% subscribe to eight or more OTT subscriptions.

- ScienceMagic.Inc, formerly known as The Communications Store (TCS), has entered voluntary liquidation. The agency, which specialized in brand-building and communications, cited challenges such as securing investment in the current economic environment, global economic and political vulnerabilities, market conditions, sector challenges, and increasing business costs as reasons for its decision. ScienceMagic.Inc was launched in 2020 when David Pemsel, former CEO of Guardian Media Group, joined the company and rebranded it. Despite securing notable clients like Warner Bros UK, Versace, Dolce & Gabbana, and Pinterest, the agency experienced losses in 2020 and 2021.

- Netflix has announced that its ad-supported subscription tier has reached 15 million monthly active users (MAUs) in the year since it began running advertising. This represents significant growth from the 5 million MAUs reported in May. The Basic With Ads tier experienced 70% growth in the third quarter, according to the company's earnings report.

- Apple has been working on various health-related initiatives, including a non-invasive blood sugar monitor, as part of its efforts to revolutionize health care. While Apple has made progress in health tracking and disease prevention, it has also scrapped or slowed down work on some promising projects due to technical limitations, regulatory concerns, and philosophical disagreements.

- Electronic Arts (EA) reported solid fiscal 2024 second-quarter results, with strong performance from core sports franchises. The launch of EA Sports FC 24 (formerly FIFA) in September has gone smoothly with net bookings for the quarter reached $1.8 billion, up 5% year-over-year excluding currency effects. The Madden NFL franchise saw 6% growth, while FIFA 23 experienced strong engagement leading up to the FC 24 launch. Adjusted operating margin declined due to higher marketing expenses and R&D costs.

- Stagwell has agreed to sell its healthcare marketing agency, ConcentricLife, to Accenture Song for $245 million in cash. This sale is part of Stagwell's effort to streamline its focus on core digital services. Mark Penn, CEO of Stagwell, stated that the proceeds from the sale would be reinvested in digital capabilities across the company's agencies and in its AI-based product suite within the Stagwell Marketing Cloud. The funds may also be used for potential mergers and acquisitions. ConcentricLife, founded in 2002, serves clients like Pfizer, Novo Nordisk, and Abbott.

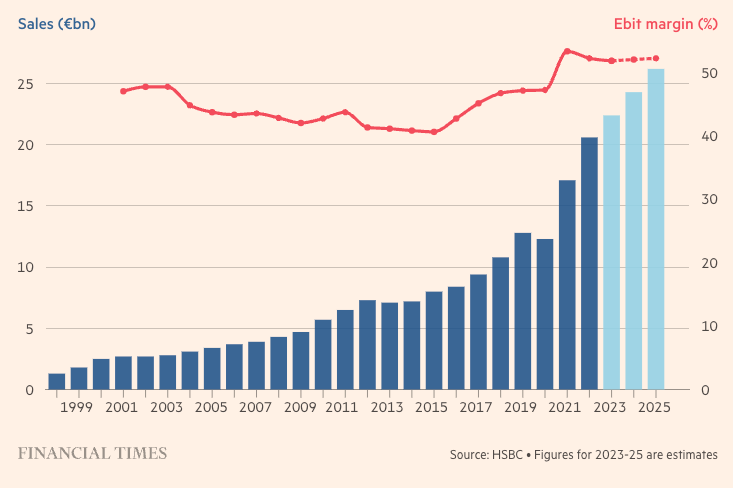

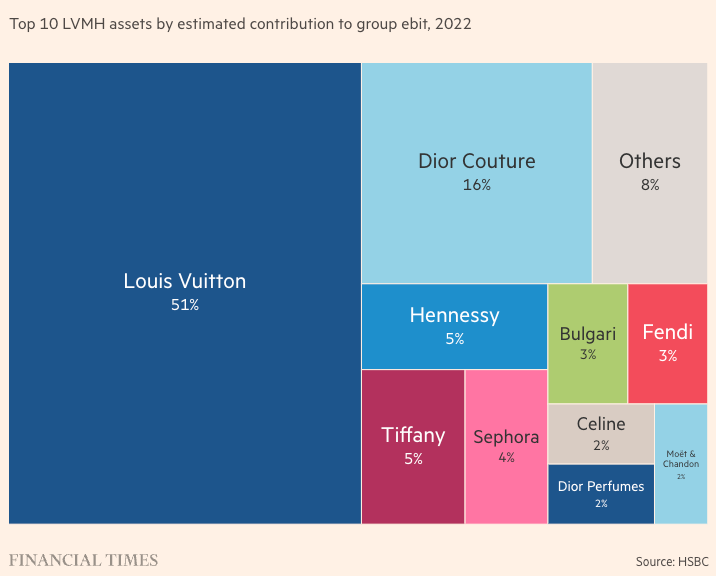

- Louis Vuitton has experienced significant growth in the past five years, becoming the first luxury brand to surpass €20 billion in annual sales. However, as the luxury boom slows down, the company faces the challenge of sustaining growth while preserving its luxury image. CEO Pietro Beccari aims to maintain desirability for the brand while expanding its cultural influence. The company's strategy involves diversifying into new product categories and experiences beyond traditional fashion, including perfume, cosmetics, homeware, and potentially hospitality offerings like hotels and restaurants. Despite a shift in economic conditions and changing consumer behavior, Louis Vuitton is expected to continue growing, with estimates projecting sales reaching €30 billion in the coming years.

- TikTok has entered into a partnership with DistroKid, allowing independent artists using DistroKid to feature their music on TikTok Music, the platform's subscription-based streaming service. This expands the reach of DistroKid artists and opens up potential viral opportunities on TikTok. Additionally, DistroKid music will be accessible on CapCut, TikTok's standalone video editing app.

- BuzzFeed is in advanced talks to sell Complex Media, which it acquired in 2021 for $300 million, to livestream e-commerce platform Ntwrk for approximately $140 million. The deal includes Complex Media's portfolio of websites, experiential business, intellectual property, and commerce operation but excludes franchises like First We Feast or Hot Ones. BuzzFeed is seeking to streamline its business, and the sale could provide a boost to its stock price, helping it avoid delisting from the Nasdaq. Ntwrk is financing the deal through existing investors like Goldman Sachs, Main Street Advisors, Jimmy Iovine, and Live Nation, and it is also in talks with potential strategic investors like Universal Music. The acquisition reflects the trend of media companies serving as customer acquisition tools for retail owners.

- Unilever's new CEO, Hein Schumacher, has outlined a strategy to boost the company's growth and refocus its approach to brand purpose. Schumacher acknowledged that Unilever had "underperformed" recently and that it had been guilty of "force-fitting purpose in every brand." While he still sees value in brand purpose when done well, he noted that some brands may not need an overt purpose, and brand leaders will have the flexibility to decide. Schumacher also plans to increase Unilever's investment in marketing and R&D, focusing on bigger platforms, digital channels, and effective allocation of resources. This strategy shift follows Unilever's pioneering role in brand purpose marketing during the tenure of former CEO Paul Polman.

- YouTube has announced its plans for the 2024 upfront week, revealing that its Brandcast event will return to New York's David Geffen Hall in Lincoln Center on May 15, 2024. The company also signed a deal to continue hosting Brandcast at the venue through 2026.

- Meta is introducing a paid ad-free option for users in Europe to comply with the continent's strict data privacy rules. Starting in November, users can pay about 10 euros per month for ad-free access on desktop browsers, with iOS and Android users paying roughly 13 euros. The fee will initially cover all linked Facebook and Instagram accounts, and from March, Meta will charge 6 euros for each additional account. This move comes after the European Union's top court ruled that Meta must obtain consent before displaying ads to users, potentially affecting its ability to personalize ads based on user interests and activity.

- Roku's stock surged by as much as 30% following the company's strong fourth-quarter guidance and signs of recovery in its advertising revenue. The company expects an adjusted EBITDA of $10 million in the fourth quarter, while revenue is projected to be approximately $955 million. Roku reported third-quarter net revenue of $912 million, an increase of 20% year-over-year. Although the net loss was wider than the previous year, the company witnessed growth in content distribution and video advertising.

- Media.Monks China has entered into a partnership with Baidu, serving as Baidu International Division's Reseller, helping international brands succeed in the Chinese market. Media.Monks will leverage Baidu's AI-powered Ad-tech products and provide integrated marketing strategies targeting mass audiences in China. The partnership aims to assist brands in navigating the complex landscape of China's digital market by offering services such as managed media, brand marketing, paid search, paid social, programmatic display, and data solutions.

- Amazon is expanding its advertising options on Fire TV to include all types of advertisers, not just media and entertainment brands. This move opens up the home screen inventory on Fire TV to a broader range of advertisers, similar to Roku's recent move. The available ad formats include rotating hero units on the home screen and sponsored tiles that appear beside search queries, with options for targeting by genre. Advertisers can now buy inventory specific to Fire TV Channels or devices, and bundling options with other streaming buys on Amazon are available.

- A24 has acquired the rights to the TikTok-famous "Magnolia Parks" novels by Jessa Hastings. The series of self-published books has gained popularity on TikTok and is described as a high-society London version of "Gossip Girl." A24 is in the early stages of developing the project and is close to securing partnerships for the TV series. The "Magnolia Parks" books have generated significant attention on TikTok, with hashtags related to the series amassing millions of views. Hastings, the author, retained the film and TV rights as part of her publishing deals for the books.

- Estée Lauder's shares experienced their largest one-day drop on record as the cosmetics company lowered its profit forecast due to a sluggish recovery in Asia and warned of an almost $80 million earnings impact from the Israel-Hamas conflict. The firm, which makes products like Aveda shampoo and MAC makeup, has revised its outlook multiple times in the past year, citing China's weakness as the second-largest economy grapples with its post-pandemic rebound.

- Home Depot has launched a shoppable connected TV (CTV) series titled "Merry & Bright" in partnership with Vizio. The holiday home renovation series, hosted by Jordin Sparks, includes three 10-minute episodes and short-form content. Throughout the series, QR codes direct viewers to curated pages on Home Depot's website, featuring products used in the makeovers. The partnership aims to gauge customer interaction with the content and assess the impact on sales.

- Mattel's Barbie brand is reviewing its creative agency account after the success of the "Barbie" film, which grossed over $1 billion in global box office revenue. The brand is looking for an agency to work on a new campaign, capitalizing on the momentum it has gained. Several agencies were invited to pitch for the account, but some declined due to concerns over the pitch fee and a non-compete clause that would prohibit participating agencies from working with competing clients for several months. Barbie has worked with agencies like BBDO, BBH, R/GA, and Deutsch in the past.

- Google Maps Now Uses AI to Find Where People Are Having Fun

- A day in the life of a delivery robot

- I can't decide if Burger King's ghost billboards are dumb or brilliant

- Doritos Develops AI Tech to Cancel its Crunch for Gamers

- WPP’s leadership issues go deeper than the holding company

- Uber Eats uses classic horror-movie quotes as promo codes this Halloween

- Airbnb's Chesky envisions turning app into "ultimate travel agent"

- Google is officially trying to make .ing domains a th.ing

- HBO Chief Calls Attack of Critics through fake Twitter accounts a ‘Very, Very Dumb Idea’

- No Tip for Your Delivery Driver? Then Be Prepared to Wait

- Twitch’s CMO says competition from rival platforms is good for creators

- Biden Issues Executive Order to Create A.I. Safeguards

- Why ad agencies are still relying on portfolio schools for hiring—inside the growing debate

- CBS Launches Its Second Performers With Disabilities Talent Initiative

- Instagram spotted developing a customizable ‘AI friend’

- Google’s Bard chatbot now responds in real time — and you can shut it up mid-sentence

- Wildbrain Animation Studios Workers Unionize With Canadian Animation Guild

- Humane’s Ai Pin could cost $1,000 — and require a subscription

- Meet the dwarfs from Disney’s live-action Snow White, which has been delayed

- Instagram tests collaborative carousels your friends can add to

- Is Crypto Financing Terrorism?

- Cruise Stops All Driverless Taxi Operations in the United States

- Paramount CTV Ad Inventory Now Directly Accessible

- Xbox is about to get better apps and web games

- Are Creator Startups Ripe For Rollups?

- MPA Sees “No Need” For New AI Copyright Legislation Or Special Rules, Warns Of “Inflexible” Guidelines

- Twitch ditches Switch

- Sam Bankman-Fried Found Guilty Of Fraud And Conspiracy

- ICRAVE unveils sci-fi interiors of MSG Sphere

- ‘Chicken For Linda!’ Sweeps Animation Is Film Awards

- How podcast networks use existing feeds to improve engagement and discoverability for new shows

- Why brands like Nascar are taking alternative approaches when working with college athletes

- TikTok Announces Integration For Salesforce Marketing Cloud

- Four Sponsorship Tactics Chase Leveraged at the US Open to Increase Engagement

- YouTube fumbles NFL Sunday Ticket streaming

- Google lays off employees working on its voice assistant

- Exxon posts $9.1 billion net, down from year-ago, up 15% from 2Q

You still reading? Cool, nerd out on this.

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion