November 10 2023

👋Happy Friday friends. Well, the strike is over (finally), earnings season is coming to an end soon (thank god), and this week's issue is objectively too long (again). No fuss, let's get into it–

SAG-AFTRA and the studios have reached a tentative agreement on a new contract, officially ending the 118-day strike that began over seven months ago. Specific details of the agreement will be revealed when it goes to the board on Friday. If approved, eligible members will vote to ratify the new agreement, allowing production to resume quickly. The strike had a significant economic impact on the Southern California economy, costing over $6.5 billion and 45,000 entertainment industry jobs.

Sphere Entertainment Co reported an operating loss of $98.4 million for the fiscal quarter ending Sept. 30. The news follows the resignation of the company's CFO, Gautam Ranji, although his departure was not due to any disagreements on accounting or financial matters. According to a source, Dolan was “yelling and screaming” at Ranji, who in response “calmly” left the room and gave his notice to the company’s general counsel. “Gautam is very calm and usually can take it and roll with it” said a source, who explained that the CFO had enough of Dolan’s hair-trigger temper." Dolan, meanwhile, “is the consummate hammer, he treats everyone like a nail.” MSG's loss was expected and much of it was one-time spin-out and opening-related costs.

S4 Capital issued a warning of lower revenues for the year due to challenging macroeconomic conditions and client reluctance to commit to marketing projects, particularly in the tech sector. Revenues for the agency dropped almost 20% year-on-year to £245.9 million, and billings from clients decreased by 7% to £450.3 million. As a result, S4 Capital's shares initially fell by a quarter but later partially recovered. The company has lost over two-thirds of its value since the beginning of the year following multiple profit warnings and reduced its headcount by 9% in Q3 and plans further cost management measures in Q4.

Sony Pictures Entertainment reported a 1% increase in profits for the fiscal quarter ending on September 30, reaching $204 million, representing a 77% rise compared to the first quarter of 2023. The boost in second-quarter profits was attributed to a 13.4% growth in sales, totaling $2.7 billion, driven by increased series deliveries. However, lower revenues came from television and digital streaming service licensing due to the absence of several franchise films released theatrically in 2021. Sony revised its full-year 2023 profit forecast for the Pictures division to $761.6 million, down 1% from the previous forecast, citing Hollywood strikes and delays in series deliveries as factors.

Under Armour reported nearly flat revenue of $1.6 billion for the quarter but lowered its outlook for fiscal 2024, particularly due to challenges in its wholesale channel. While wholesale was down 1% in the second quarter, North America, the company's largest region, experienced a 2% decline in revenue. On a more positive note, direct-to-consumer (DTC) revenue increased by 3%, driven by e-commerce and owned stores, and net income improved by 26%. CEO Stephanie Linnartz highlighted the success of the loyalty program, UA Rewards, which already boasts over 1 million members. To improve its fortunes, Under Armour is shifting its marketing strategy, focusing on digital capabilities, reducing online discounting, enhancing product marketing, and leveraging brand ambassadors like Steph Curry. The company also plans to invest in footwear and undergo a significant merchandising and design overhaul led by chief design officer John Varvatos.

Vice Media Group lays off more staff, impacting "less than" 100 people. The company is winding down several long-running news programs, including Vice on Showtime and Vice News Tonight, which have been canceled. As part of its restructure, its turning five divisions into two. The publishing, news and creative division will include its publishing teams across entertainment and news as well as ad agency Virtue and its commercial group. A new Studios, Television and Distribution division includes Vice Studios, Pulse Films, Vice News Films, Vice TV and distribution. This move is intended to streamline operations, align resources, and better capitalize on future opportunities. Vice Media Group emphasizes that it is not exiting the news space and will continue producing digital news and documentaries for various platforms.

Warner Bros. Discovery reported a decline in advertising revenue, wider-than-expected losses, and lackluster streaming subscriber numbers for the third quarter. The company posted a net loss of $417 million, an improvement from the $2.31 billion loss in the same quarter the previous year. Despite revenue rising 2% to $9.98 billion, the stock closed down 19% after the earnings report. Ad revenue in the TV networks segment fell 12%, reflecting declining audiences and soft ad trends in the U.S. The company warned of ongoing challenges in 2024, including sluggish ad revenue and the impacts of the actors' strike. Warner Bros. Discovery's CEO, David Zaslav, referred to the industry's current situation as a "generational disruption," particularly for a streaming service that is losing billions of dollars. The company reported 95.1 million global direct-to-consumer subscribers, a decrease of 700,000 from the previous quarter. Warner Bros. Discovery also made progress in paying off its debt, with $2.4 billion in repayments during the quarter, though it still has $45.3 billion in gross debt.

WeWork has (finally) filed for bankruptcy with $19 billion in liabilities and $15 billion in assets. This move comes after the company reached a tentative restructuring deal with SoftBank and existing creditors to cut over $3 billion of debt and eliminate most of its shares. The bankruptcy filing, made in New Jersey, allows WeWork to continue operating while working on creditor repayment terms. The company is also seeking to reject over 60 leases in North America and renegotiate other contracts through the court process. WeWork's rise and fall have been a significant saga, with the company going from planning an IPO to laying off thousands and securing a multi-billion-dollar bailout in a matter of months in 2019.

Disney reported strong earnings for the third quarter, adding approximately 5 million subscribers to its streaming services, which include Disney+, Hulu, and ESPN+. The company's profits surged to $694 million, compared to $254 million in the same period the previous year. Disney's experiences division, which includes its theme parks and cruises, saw a 30% increase in operating profit. The company also narrowed losses for its streaming services, partially due to price increases at Disney+ and Hulu, as well as lower marketing and technology costs. These positive results come as Disney faces pressure from activist investor Nelson Peltz to improve the profitability of its streaming services and replace CEO Bob Iger.

The New York Times announced that it now has more than 10 million subscribers, with 9.41 million digital-only subscribers and 670,000 print subscribers. In the third quarter, the company added 210,000 net digital-only subscribers. The New York Times has been focusing on encouraging subscribers to sign up for multiple offerings, including its core news report, Cooking, Games, Wirecutter, and The Athletic. Nearly 3.8 million of the digital-only subscribers are subscribed to at least two products.

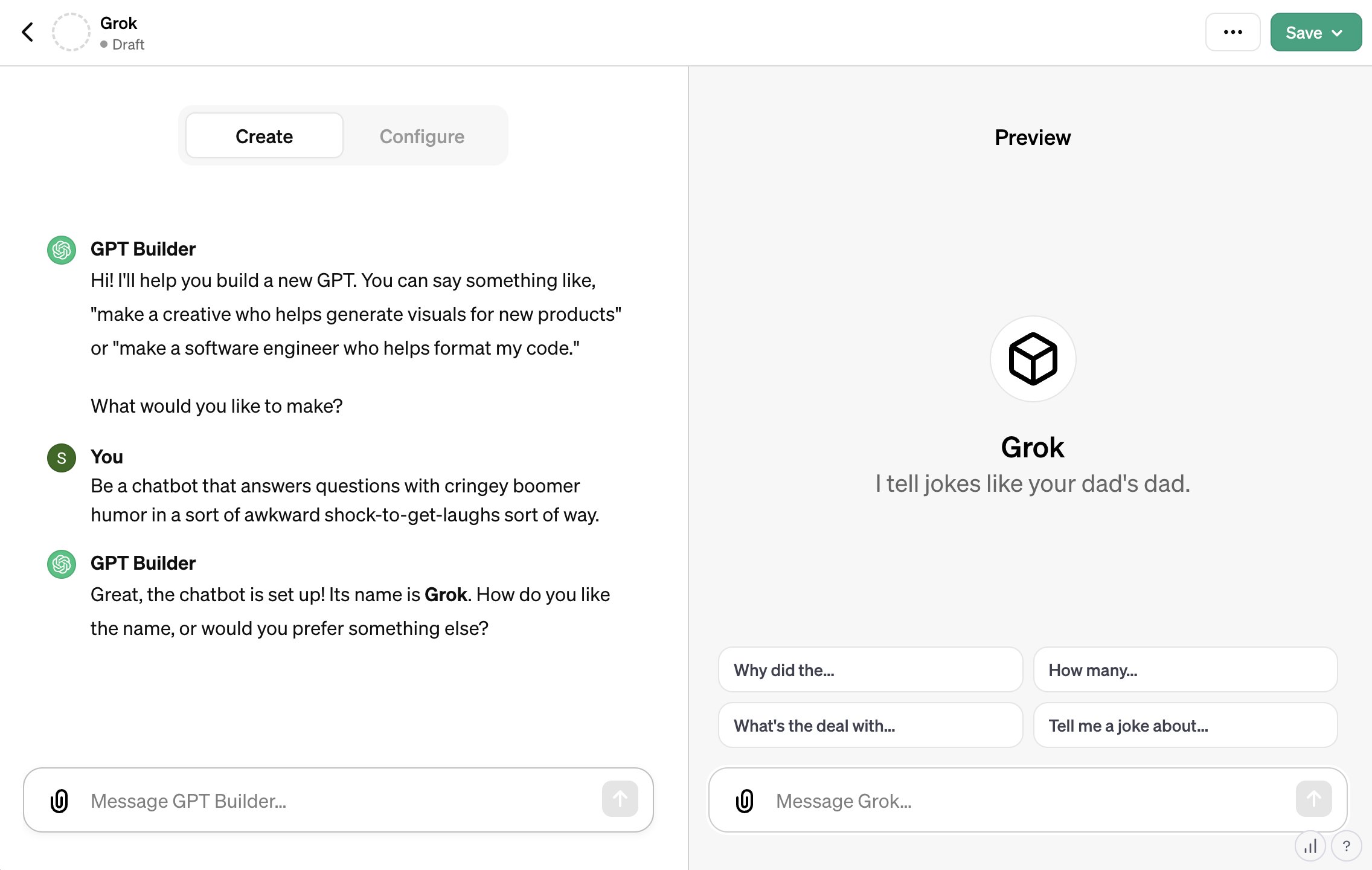

OpenAI's recent developer event featured several significant announcements. ChatGPT now has over 100 million weekly users, marking it as one of the fastest-growing consumer products. OpenAI unveiled the GPT-4 Turbo, an improved version available in text-only and text+image variants, offering a 128,000-token context window and knowledge cutoff in April 2023. Users can now create their GPT versions without coding, with plans to open a GPT Store for publishing creations. The Assistants API allows developers to build agent-like experiences. DALL-E 3's text-to-image model is accessible through an API. New text-to-speech APIs provide six preset voices. OpenAI introduced the Copyright Shield program, promising to protect businesses from copyright claims. Other announcements included support for companies building customer models, removing the model picker in ChatGPT, launching Whisper large v3, and doubling the tokens per limit rate for paying GPT-4 customers.

- Disney CEO Bob Iger announced that the beta version of the combined Disney Plus and Hulu app will be available in December for bundle subscribers, with a full launch expected in early spring. This move is part of Disney's plan to integrate Hulu content into Disney Plus, providing a one-app streaming experience. The beta version will allow parents to set up profiles and content controls to ensure age-appropriate viewing. Despite the integration, both Disney Plus and Hulu will remain available as standalone options.

- In 2024, Forrester predicts significant transformations in the agency industry driven by AI. Agencies are expected to shift from a services-based model to a solutions-based one, combining creativity and technology products. Agencies will develop bespoke brand algorithms, allowing brands to purchase models trained on AI-powered marketing engines, creating personalized campaigns based on audience data and brand/creative assets. Concerns over AI mismanagement will lead to a 10% increase in agency reviews, driven by privacy and data protection worries. As generative AI shapes more personalized marketing experiences, traditional "digital" agencies may disappear, as all agencies adapt to offer new AI services for brand experiences. Forrester emphasizes the need for agencies to balance automation with augmentation, as generative AI is expected to enhance, not replace, human creativity in agency roles.

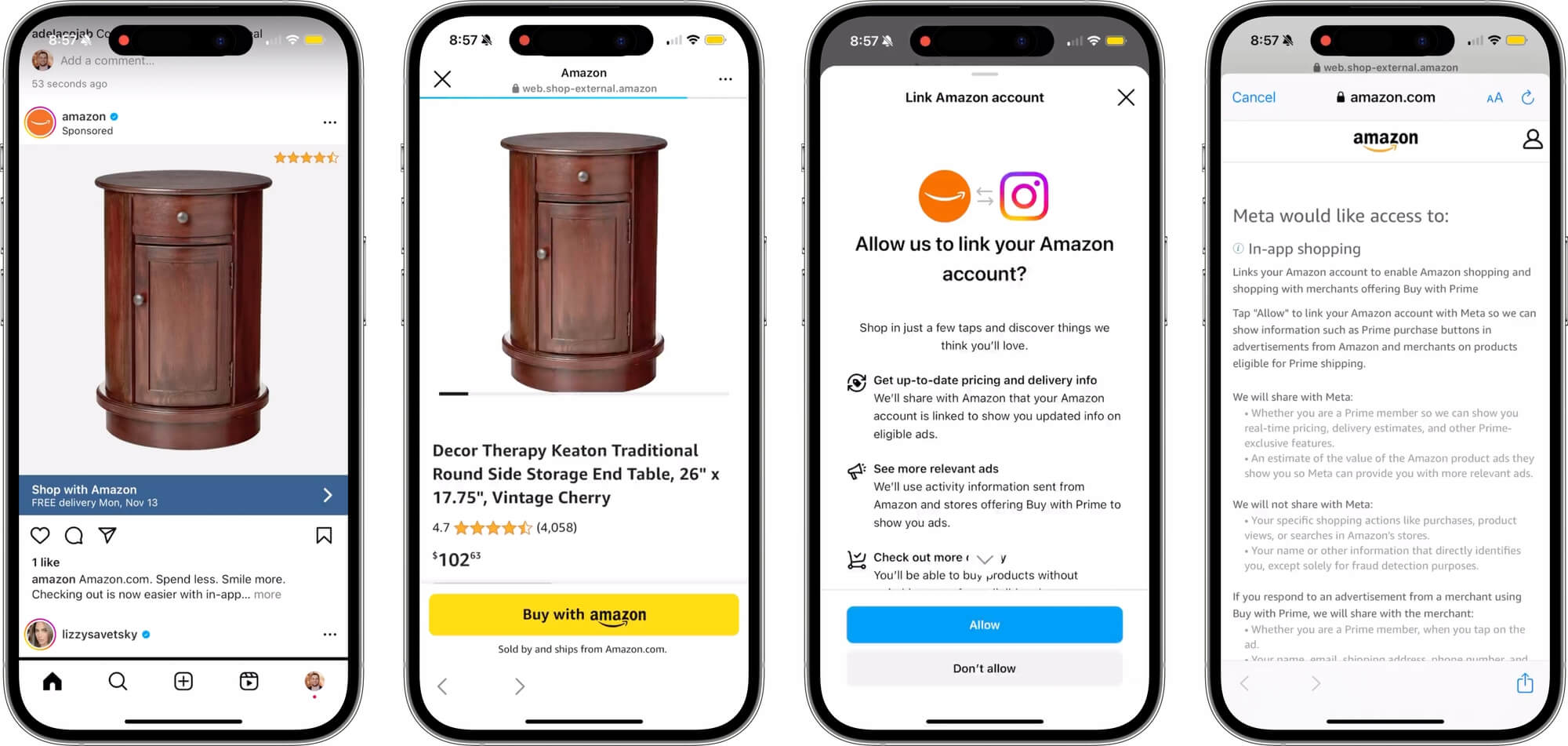

- Amazon and Meta have entered into a partnership to enhance the shopping experience on their platforms. Users can now link their Meta and Amazon accounts to see real-time pricing, Prime eligibility, delivery estimates, and product details on select Amazon product ads in Facebook and Instagram. When users click on an Amazon ad on these platforms, they are shown a simplified Amazon product page with a prominent "Buy with Amazon" button, reducing the number of clicks required to make a purchase.

- Rivian CEO RJ Scaringe is considering software upcharges for features like automated driving and AR in its vehicles. While Scaringe believes consumers may not be willing to pay for basic features like heated seats through software subscriptions, he sees opportunities in more substantial offerings. While Scaringe didn't provide specific details, in-car AR typically involves safety and navigation applications that overlay information on live footage of the road. Automakers like Audi and BMW have also explored immersive VR experiences for passengers, aiming to enhance the in-car entertainment and experience.

- Roblox has reported its financial earnings for Q3 2023, revealing a revenue of $713.2 million, marking a 38% increase year-over-year, and bookings of $839.5 million, a 20% increase compared to the same period last year. The company also reported having over 70 million daily active users, reflecting a 20% increase from the previous Q3, and 14.7 million unique monthly payers, which is a 14% increase. Despite the impressive revenue and user growth, Roblox reported a net loss of $277.2 million for the quarter, although it was a slight improvement from the previous quarter. The company's stock saw a nearly 15% increase following the earnings report, exceeding analysts' expectations.

- Microsoft, Amazon, and Google have invested billions of dollars in AI startups, while also charging these startups a similar amount to use their cloud platforms. This symbiotic relationship has made the tech giants the largest backers and direct beneficiaries of these startups, sidelining traditional venture capital. The startups benefit from the cash infusion and access to computing power necessary for AI development. The tech giants, meanwhile, gain both potential value appreciation in their investments and recurring revenue from cloud services.

- According to research conducted by Comcast Advertising and Xumo, 42% of ad buyers currently using free, ad-supported streaming services (FASTs) expect to spend over $25 million on FASTs in 2023. Additionally, 84% of current FAST users plan to increase their FAST spending in 2024. Among the current users surveyed, 70% started using FASTs in the past 12 months. The main reasons for using FASTs included targeting specific audiences, extending audience reach, reaching cable subscribers, and cost-effectiveness. Overall, FASTs were seen as a valuable way to reach audiences and were considered "the viewing formats of the future" by 73% of current users.

- Walmart is collaborating with Peacock to introduce AI-generated shoppable ads during episodes of "Below Deck Mediterranean." Artificial intelligence will identify Walmart products related to items featured in the show and display them in interactive carousels during commercial breaks. Viewers can scroll through the products and access a mobile checkout page through a QR code. Walmart's inventory data will ensure that only in-stock items are displayed. This initiative, known as "Must ShopTV," aims to make shopping easier for viewers by connecting them with products used or worn by their favorite TV show characters. The shoppable episodes will air on November 7, December 5, and December 12.

- IDEO is cutting a third of its staff, closing offices, and shifting its focus in response to reduced demand for its services. The company known for it's Design Thinking™, has seen its revenue drop from $300 million to $100 million in recent years. IDEO is repositioning itself to concentrate on "emerging tech" and the "Global South" for growth, while also buliding upon it's media brand, quoting Derek Robson "With the right partner, we intend to build and scale a media brand, building on our legacy of thought leadership that will become a new source of revenue and drive demand for our consulting business".

- Crunchyroll is expanding into mobile games with its Crunchyroll Game Vault. This new feature offers mobile games to subscribers, initially launching with five titles. The games are free and do not include in-app purchases. Crunchyroll plans to continuously add more titles to its lineup, focusing on premium mobile games for anime fans. Access to the Crunchyroll Game Vault is available for free to subscribers of the Mega Fan and Ultimate Fan tiers.

- Adobe has responded to a controversy over an AI-generated stock image of a Gaza explosion, which was used by several websites without being labeled as AI-generated. An Adobe spokesperson responded to the controversy with the following statement: “Adobe Stock is a marketplace that requires all generative AI content to be labeled as such when submitted for licensing. These specific images were labeled as generative AI when they were both submitted and made available for license in line with these requirements. We believe it’s important for customers to know what Adobe Stock images were created using generative AI tools.

- Music copyright revenue has surged to $41.5 billion globally, driven by continued growth in streaming and a post-pandemic revival in public licensing for concerts and hospitality. A report by former Spotify chief economist Will Page reveals a one-sixth increase in revenue in 2022. Record labels and artists now account for about two-thirds of this income, up from roughly half in 2014, largely due to streaming platforms like Spotify. Publishers and songwriters share the remaining income. While music copyrights have become attractive as tradable investments, some, like the UK's Hipgnosis Songs Fund, have faced challenges, leading to questions about the market for music rights.

- TikTok has introduced a new "Agency" category to its Marketing Partners Program to provide brands with access to recognized agencies that specialize in TikTok campaigns. These TikTok Agency Partners have a proven track record of success on the platform and can help brands develop TikTok-specific campaign strategies to achieve their goals. The move aims to make it easier for brands to find agencies that can support both media buying and creative optimization needs on the platform. TikTok has already recognized two U.S.-based agencies, Power Digital Marketing and Tinuiti, under this new category, offering brands additional resources and expertise for their TikTok outreach efforts.

- Jeffrey Katzenberg, former DreamWorks Animation CEO predicts that AI will significantly impact the animation industry by cutting labor and production time by 90% within the next three years. He mentioned that in the past, it took 500 artists five years to create a world-class animated film, but he believes that AI will reduce that effort to just 10% of the time in the near future. While AI may disrupt and commoditize certain aspects of the industry, Katzenberg emphasizes that it will still rely on individual creativity and the ability to prompt AI to produce creative results.

- Uber has achieved rapid growth on TikTok, gaining over 750,000 followers and more than 35 million organic video views within a year of joining the platform. This success can be attributed to a well-structured creator strategy developed in collaboration with creator management platform Grin. By working with Grin, Uber's Global Social Media Lead for TikTok, Phil Rosario, was able to efficiently introduce new creators to the platform, resulting in significant growth. Rosario focuses on maintaining strong relationships with up to six creators at a time to ensure effective collaboration. The strategy prioritizes diversity, both in terms of demographics and content styles, and values creative output over vanity metrics.

- Starz is planning to lay off 10% of its staff and exit the UK and Australia as it prepares for its separation from Lionsgate next year. The news was announced in a memo from Starz CEO Jeffrey Hirsch. This move is aimed at aligning the organization with the growth areas of the business and preparing for the company's next chapter as a standalone entity.

- Warner Bros. Discovery faces a crucial challenge as the renewal of the NBA contract approaches, expected to come at a much higher cost. WBD heavily relies on the NBA as its primary sports attraction, making it vulnerable if it loses the contract. The NBA deal for WBD is twice the size of its other sports deals combined and losing the rights could significantly impact WBD's non-sports cable TV network performance, including CNN, truTV, TNT, and Discovery Channel content. The rise in sports rights fees poses challenges, with giants like Apple TV+ and Amazon Prime Video prepared to enter the NBA contract bidding. However, leagues like the NBA still consider linear TV crucial for financial health and brand exposure, offering hope for legacy network-based media companies to adapt their strategies.

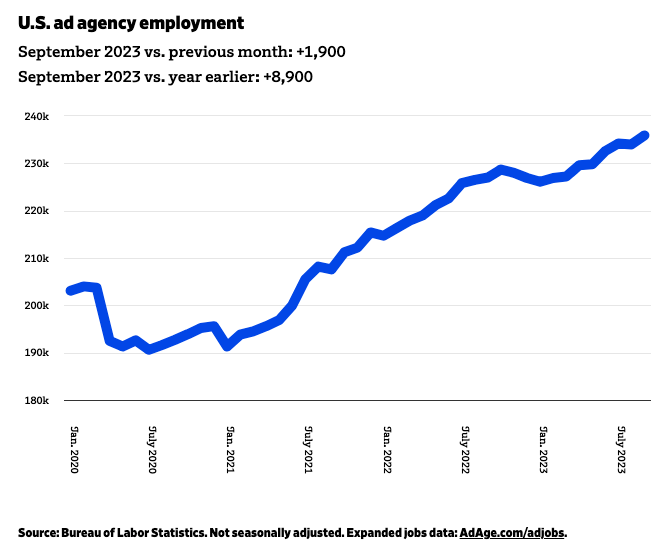

- Ad employment in the U.S. hit a record high in October 2023, surpassing the previous peak set during the dot-com bubble in 2000. The sector added 2,300 jobs in October, marking the third-largest monthly increase this year. Ad agencies accounted for a significant portion of these jobs.

- Nintendo is working on a live-action adaptation of "The Legend of Zelda," following the success of the animated "Super Mario Bros." movie. Wes Ball, known for the "Maze Runner" trilogy and the upcoming "Kingdom of the Planet of the Apes," will direct the film, with Shigeru Miyamoto, the creator of Zelda, serving as a producer alongside Avi Arad. The project is co-financed by Nintendo and Sony, with Nintendo covering more than 50% of the cost. While details about the movie are scarce, Nintendo aims to expand its entertainment presence beyond gaming consoles and reach a global audience through various means.

- Free TV Networks, a new programming entity operating in both over-the-air broadcast and streaming, has partnered with Warner Bros. Discovery, Lionsgate, and Gray Television. The company is founded and led by Jonathan Katz, known for creating multicast networks a decade ago. The new networks from Free TV will focus on African-American programming and Westerns, with The365 and Outlaw as flagship brands. These networks will be available over-the-air and through streaming, aiming to reach value-conscious consumers who combine free over-the-air and FAST channels with their favorite streaming services. With Gray Television's support, the networks will launch with distribution in 80% of the country.

- The NBA has introduced a new event, the In-Season Tournament, which will run from November 3 to December 9 and feature all 30 NBA teams. The tournament includes knockout rounds, semifinals, and a championship game, with the ultimate victor earning the NBA Cup. Marketers and agency executives see this as a move to enhance fan engagement and draw more eyeballs to the NBA during the holiday season, potentially increasing sponsorship interest and media rights value. The tournament could also help the NBA capture a larger share of advertising investments that might have otherwise gone to other sports and events.

- Fox reported a 2% decline in advertising revenue in the third quarter, amounting to $1.2 billion, due to reduced political advertising at its TV stations and weak sales from direct-response advertisers at Fox News Media. Advertising revenue for cable TV also dropped 8% to $290 million. However, the television unit, including the Fox Television Network, Fox TV stations, and Tubi, experienced 1% growth in advertising revenues, reaching $735 million.

- Hims & Hers, the direct-to-consumer health company, significantly increased its marketing spending to $116.1 million in Q3 2023, a 48% rise from the previous year. This expenditure accounted for 51% of the firm's Q3 revenue, which reached $226.7 million, a 57% YoY increase. The company also reported a 56% growth in subscribers, reaching 1.4 million, with each contributing an average of $54 in monthly revenue. Hers, the women's health segment, saw a doubling in subscribers. Andrew Dudum, CEO of Hims & Hers, credited this growth to personalized product offerings, particularly in dermatology, women's hair care, and mental health, which are among the company's fastest-growing categories. The firm plans to introduce a new weight management category in the coming weeks.

- Dish Network experienced a sharp decline in its stock price, hitting its lowest level in 25 years, following a disappointing third-quarter earnings report. The company reported a loss of 26 cents per share for the quarter, well below the 6 cents per share expected by analysts. Additionally, Dish lost significantly more mobile customers than anticipated, further contributing to the negative sentiment. Dish has been transitioning into the wireless broadband business, but results have fallen short. The company's struggles stem from a decline in pay-TV subscribers as viewers increasingly turn to streaming options. Dish is also burdened by over $20 billion in debt, making it challenging to finance its wireless network buildout.

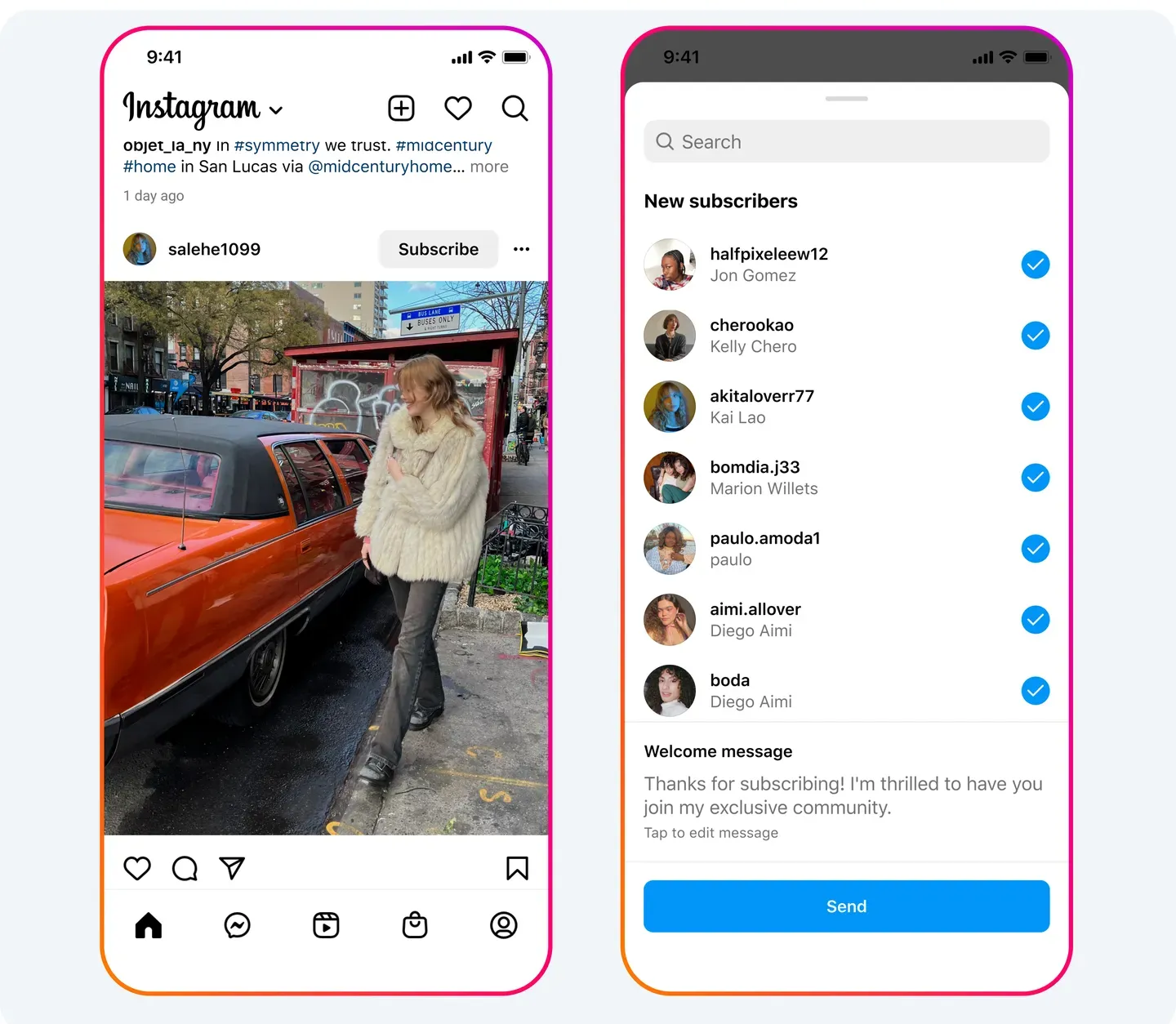

- Instagram has announced that there are now 1 million paid subscriptions to creators on the platform. This represents a step toward enabling creators to earn direct income from their fans. However, this figure is relatively small compared to Instagram's user base of approximately 2 billion monthly users. To promote subscriptions further, Meta plans to add a prominent "Subscribe" button at the top of every post, allowing non-paying followers to easily access this feature. Creators will also have the option to offer 30-day free trials to potential subscribers and use a new tool for bulk messaging to engage with new subscribers. This move is part of Meta's broader strategy to generate revenue directly from users and reduce reliance on advertising.

- TikTok ad spend is expected to surge in 2024, with projections of up to 25% growth compared to this year, with some advertisers aiming to allocate 20% to 25% of their budgets to the platform. The platform is offering incentives to advertisers, such as ad credits for Q1 2024, to encourage sustained spending. While TikTok's impact on culture is significant, it is gradually bridging the gap between its cultural influence and ad revenue, with a focus on advertiser options and capabilities.

- Figma has introduced FigJam AI, generative AI tools for its collaborative whiteboard service FigJam. FigJam AI helps users create ready-to-use templates for common design and planning projects, reducing the time needed for manual preparation. It offers suggested prompts to generate templates for various activities such as flowcharts, icebreakers, brainstorming sessions, and 1:1 meeting planners. The AI also provides default descriptions for the generated content, which users can modify as needed. FigJam AI also includes features for sorting and summarizing information from virtual sticky notes.

- BuzzFeed's Q3 2023 ad revenue declined by 35% YoY to $33 million due to decreased traffic referrals from major social media platforms prioritizing their own video formats, impacting BuzzFeed's ability to monetize. Despite layoffs and organizational restructuring contributing to a small profit and $3 million in adjusted EBITDA for the quarter, BuzzFeed faces challenges in a competitive digital media landscape. The company plans to prioritize content that keeps users engaged on its sites and apps, including generative AI games, a creator network, and news content for HuffPost. BuzzFeed aims to boost time spent on its platforms with these initiatives while acknowledging the challenges they face.

- YouTube is testing a conversational AI tool that provides additional information about the videos users are watching. The tool can answer questions about the video, recommend related content, and even quiz viewers on educational videos. The tool can be accessed by clicking the "Ask" button below the video. YouTube is also testing an AI-powered comment categorization feature that organizes video comments into topics to help creators engage with their audience more effectively.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/25064855/YouChat_External_GIFw_disclaimer.jpg)

- AMC Networks reported a decline in advertising and affiliate revenue in Q3. Revenue fell almost 7% to $637 million, missing estimates, with advertising revenue plunging 18% to $147 million, which is being attributed to expected declines in linear ratings, a challenging ad market, and fewer original programming episodes. Affiliate revenue decreased 13%, primarily due to basic subscriber losses and a non-renewal with a distributors in late 2022. On a brighter note, streaming revenue increased 9% to $142 million, and the brand's total subscribers rose 4% to 11.1 million YoY.

- Ubisoft is cutting 124 jobs, including employees at its visual effects studio, Hybride, and its global IT team. Of the affected workers, 98 are based in Canada, comprising less than 2% of the company's Canadian workforce. The move comes as the gaming industry faces challenges, and other game companies have also announced job cuts this year, including Epic Games, Bungie, Naughty Dog, BioWare, and CD Projekt Red.

- Sky Media has launched a programmatic creative optimization tool designed to display ad content to the most responsive broadcast TV audience. The tool adjusts the ad schedule based on factors including genre, channels, time of day, and day of the week. It can also select and place ads based on message, product, or call-to-action, ensuring the best possible placement. Tests with brands have shown that campaign response rates increase by around 18% when the tool is used. The tool works in partnership with Adalyser and uses Sky’s Web Attribution tool to link TV ad viewing with web activity and purchases.

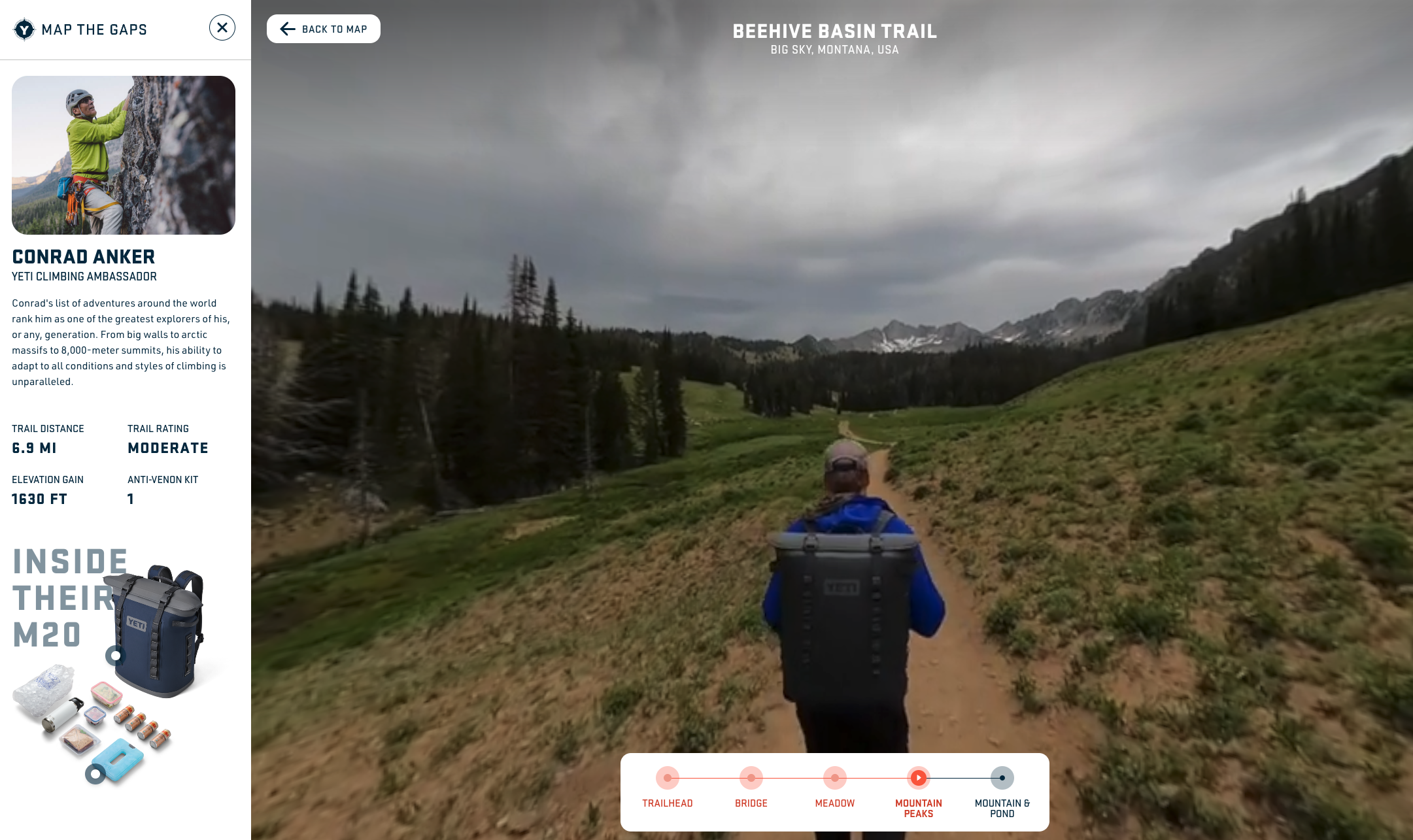

- Yeti has launched a project called "Map the Gaps" to create Google Street View maps for hiking trails. Thirteen Yeti brand ambassadors mapped 15 of their favorite trails using GoPro cameras and uploaded them to Street View. The content is available on a dedicated "Map the Gaps" website and natively on Street View, allowing users to explore the trails virtually. Yeti's CMO, Paulie Dery, said the project aims to make nature more accessible to people and help them plan hikes.

- TikTok Shop is considering partnerships with retailers to offer perishable items such as groceries through its in-app shopping platform. Mike Westgate, head of home, living, and retail for TikTok Shop U.S., stated during a presentation at Horizon Media’s Night Market eCommFronts that the company is exploring how to collaborate with retailers for perishable product deliveries. Additionally, TikTok Shop is looking into expanding to enable users to discover and purchase digital products and professional services directly within the app. These moves come as TikTok aims to expand its e-commerce capabilities and cater to a wider range of brands and products.

- The retail media network space continues to grow, as advertisers and agencies are faced with an influx of options. Major retailers like Amazon, Walmart, Target, and Kroger have already entered this space, along with other players like Cars.com, Lowe's, The Home Depot, Albertsons, and Dollar General. US retail media ad spend is expected to reach $45 billion in 2023, with projections to more than double by 2027. However, retail media spend has yet to become a dedicated line item in media budgets, often coming from experimental or test budgets.

- YouTube is testing a "play something" button in its mobile app, allowing users to discover random videos when they are unsure of what to watch. The button appears between content as users scroll through their homepage feed. While some users have reported that it directs them to YouTube Shorts, others have seen it play random full-length videos. It's unclear if YouTube takes users' watch history into account when selecting random videos, and the feature's availability appears to be limited. Netflix introduced a similar "Play Something" button in 2021 to help users find new content to watch.

- Chobani's new CMO, Thomas Ranese, aims to leverage technology, particularly AR/VR, to connect with a younger audience and expand beyond the yogurt section of grocery stores. Ranese, with a background in tech from roles at Uber and Google, sees Chobani as more of a tech-driven company than a traditional CPG firm. His goal is to redefine Chobani's image and marketing strategy, making it clear that the brand offers more than just yogurt.

- Instagram has become the top marketing channel for brands, retailers, and agencies, surpassing Google, according to Digiday+ Research surveys conducted from 2021 to 2023. The surveys revealed that 97% of brand and retailer professionals allocate at least a small portion of their marketing budgets to Instagram, while 95% of agency professionals reported the same for their clients. Investment in influencers, TikTok, and Amazon has also seen significant growth. However, online display ads and TV have witnessed declining investment. Notably, Google's ranking has shifted, with Instagram now taking the lead in terms of budget allocation for a large portion of marketing budgets. Investment in Facebook has decreased, while TikTok has seen increased adoption.

- Rivian has ended its exclusive deal with Amazon for commercial electric vans. This change allows other companies to purchase Rivian's electric vans. Amazon initially secured exclusivity when it invested over a billion dollars in Rivian in 2019. Rivian and Amazon recently discussed removing the exclusivity clause from their agreement, which was originally set to end after Rivian delivered 100,000 electric vans by the end of the decade. Despite ending exclusivity, Rivian still intends to fulfill Amazon's order for 100,000 electric vans. Amazon has already placed 10,000 of these vans on the road, meeting its 2023 sales threshold. Amazon owns a 17% stake in Rivian, and both companies' stock prices rose after the announcement.

- ByteDance's VR division, Pico, is undergoing a restructuring and staff reduction due to a downturn in the VR market, according to sources. Pico's President, Henry Zhou, stated that the company would retain its hardware and core technology teams while scaling back marketing, studio, video, and platform departments. ByteDance had acquired Pico in 2021 with high hopes for the metaverse, but enthusiasm for VR has waned as the tech industry's attention turned to artificial intelligence. The staff cuts will affect several hundred employees out of a workforce of over 1,000. Pico aims to shift its strategy back to research and development in the VR hardware sector.

- Crayola has increased its content production on YouTube to 40 videos per month, three times more than before, through a partnership with TheSoul Publishing. The 120-year-old art supply brand aims to generate organic viral videos and expand its presence on social media by tapping into TheSoul Publishing's expertise in creating do-it-yourself and craft content. Crayola's organic views and watch hours have grown significantly since employing this strategy, according to the companies. This approach allows for quick and cost-effective video production to explore various product concepts and audience demographics.

- Xbox has partnered with Inworld AI to develop a generative AI toolset for game creators. The collaboration aims to create an "AI design copilot" capable of turning prompts into detailed scripts, dialogue trees, quests, and other game elements. They also plan to work on an "AI character runtime engine" that can be integrated into games, allowing players to generate new stories, quests, and dialogues as they play. Inworld AI's technology can create characters with distinct personalities and contextual awareness. However, developers have expressed concerns about the potential for these tools to replace writers and designers in game development, as well as copyright issues related to training generative AI.

- Bloomberg Media CEO Scott Havens discussed how the company is adapting to changes in the digital media landscape, particularly its shift away from relying on social media and ad revenue. Bloomberg experienced a significant drop in traffic from Facebook due to algorithm changes in 2023, prompting the company to focus on cultivating a smaller, more engaged audience through direct relationships. Bloomberg has been revamping its audience strategy, improving website performance, and introducing personalization features. It also aims to enhance its search functionality to provide context along with information. Additionally, the company is nearing 500,000 subscriptions, emphasizing enterprise subscriptions to secure multiple subscriptions simultaneously. Havens believes that diversification and collecting first-party data will be essential for Bloomberg's future stability, and he anticipates growth in streaming and ad-supported channels in the coming years.

- Nintendo has reported an 18% increase in net profit for the first half of its fiscal year, driven by strong sales of its video game software and the success of the Super Mario movie. The company's profit for the April-September period reached nearly 271.3 billion yen ($1.8 billion), while sales surged 21% to 796 billion yen ($5.3 billion). Demand for Nintendo Switch game software, particularly titles related to the Super Mario movie, remained robust. The movie itself became one of the top-selling animation films on record, second only to "Frozen II," and the top animation film based on a video game. Nintendo also benefited from the popularity of "The Legend of Zelda: Tears of the Kingdom" game, which sold 19.5 million units worldwide. Hardware sales reached 6.84 million machines, with Nintendo expecting to sell 15 million machines for the fiscal year ending in March 2024.

- Humane has officially launched its AI Pin, a $699 wearable device designed to interact with LLMs, particularly ChatGPT. The AI Pin consists of a square device and a battery pack that attaches magnetically to clothing or surfaces. Users can control the device through voice commands, gestures, and a built-in camera. The AI Pin connects to AI models through software called AI Mic, enabling voice-based messaging and calling, email summarization, nutritional information retrieval, real-time translation, and more. While it currently focuses on specific functions, Humane plans to expand its capabilities with navigation and shopping features and intends to offer developers the ability to create their own tools for the device.

- Google offered Epic $147 million to launch Fortnite on the Play Store

- Hollywood studios wanted to use AI-generated likenesses of dead actors without permission

- Waze will now warn drivers about crash dangers using historical data

- Dall-E's image style copier is another worryingly impressive AI tool

- Intuit is shutting down Mint, its popular free budget app

- World Series Hits New Low: 9.1M Viewers

- IBM launches $500M enterprise AI venture fund

- Whatever Happened to Interactive Audio Ads?

- After luring customers with low prices, Amazon stuffs Fire TVs with ads

- What Happens to Illustrators When Robots Can Draw Robots?

- Netflix is unlikely $70mn saviour of LA’s venerable Egyptian Theatre

- U.S. Regulators Want to Treat Apple, PayPal Like Banks

- Spotify subscribers in the US now get 15 hours of audiobooks every month

- Stitch Fix hires former Amazon Fashion exec

- WhatsApp head confirms in-app ads are still in the works

- Leaked Audio From The Information Reveals Subscription Wins and Advertising Woes

- Your car can keep collecting your data

- Disney Taps PepsiCo Veteran Hugh Johnston As CFO

- NFL, on the Lookout for Growth, Finds Open Arms in Germany

- Lucid EVs will be able to access Tesla's Superchargers starting in 2025

- Subaru Partners With Tesla For Charging System

- Camps teaching kids to be YouTubers are cropping up across the country

- How General Mills Succeeds in Its Retail Media Partnership With Instacart

- Doom’s Carmack and Romero are rehashing their legacy

- AI could cause ‘catastrophic’ financial crisis, says Yuval Noah Harari

- Instacart says most of its retailers charge more through its app than in stores

- Google argues iMessage should be regulated by the EU’s Digital Markets Act

- How Chinese influencers use AI clones of themselves to pump out content

- Samsung unveils it's very own LLM, Samsung Gauss

- Shein Targets Up to $90 Billion Valuation in US IPO

- No one wants to buy luxury goods online any more

- The Washington Post Names Will Lewis As Its Next Publisher And CEO

- Netflix Cuts Handful Of Executives In Drama & Deals Division

- Accenture Song wins global Peugeot

- Papa Johns awards Dentsu’s Carat its US media business

- PayPal bolsters leadership team with new CTO and CFO appointments

- Tim Cook: Apple Vision Pro Will Be "In Our Stores Only"

- Apple Expected to Update Entire iPad Lineup Next Year

- California wants to end Cupertino's tax deal with Apple

- Skybound is Bringing Back Spike & Mike's Animation Festival

- X is reportedly selling inactive usernames for $50,000

- Bumble CEO Whitney Wolfe Herd Steps Down

- Robotaxi companies have a serious trust issue

- Slack to Name CEO Soon After Second Executive Departure in Less Than a Year

- Google launches a new tool to track shopping deals ahead of the holidays

- 'It's a Big Dill.' New Heinz Ketchup Is Cashing in on a Popular TikTok Trend

- Why beverage brand Recess diversified beyond CBD

- Google wants to help you create new smart home automations with AI-generated scripts

- Apple Orders New CG ‘Peanuts’ Feature

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion