November 17 2023 - (Almost) All the News That's Fit to Print

👋Happy Friday friends. This week really has it all. Earnings, layoffs, mergers, organizational shifts, questionable uses of technology, and obviously AI. Lot's of interesting signals throughout today's entire issue, so let's get into it–

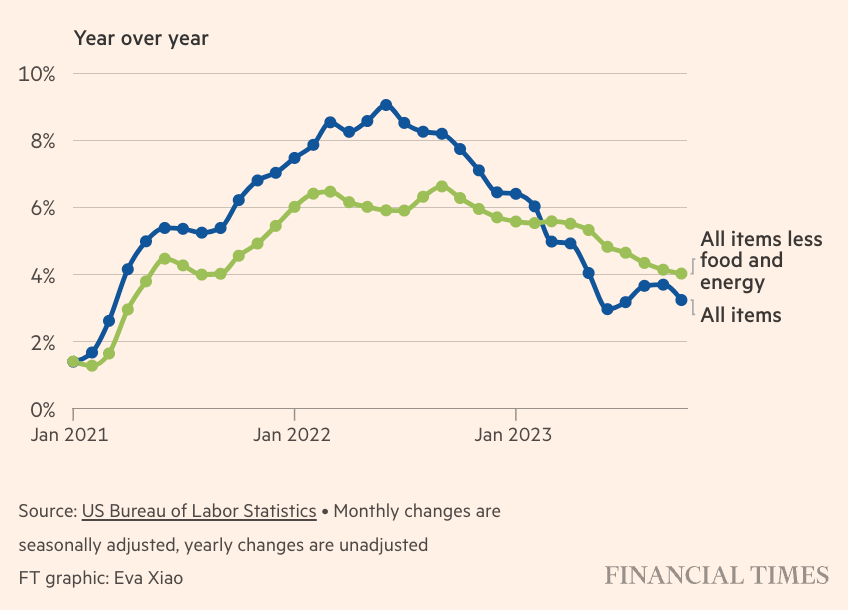

US stocks and bonds experienced a significant jump after inflation in October fell to 3.2%, more than economists had anticipated. This marked the first decline in four months and was lower than September's 3.7% rise. The core inflation rate also showed a slight decrease, further fueling optimism about a potential easing of monetary policy. However, Federal Reserve officials caution that they are prepared to tighten policy further if needed, emphasizing the need for more consistent data pointing to a sustained inflation slowdown.

News Corp reported a modest revenue increase in Q1 2024, totaling $2.50 billion—a 1% rise from the previous year. Despite challenging economic conditions, the company saw a 4% growth in profitability, partly attributed to a 5% reduction in workforce. While net income dropped to $58 million, the Book Publishing segment enjoyed an 8% year-over-year increase, reaching $525 million, thanks to higher physical book sales and resolving Amazon's logistical issues. Dow Jones' professional information business saw a 14% revenue surge. However, declines in the Digital Real Estate Service segment and a $14 million impact from foreign currency fluctuations dampened overall gains.

Amazon has recently eliminated around 180 jobs from its gaming division, including the entire Game Growth team and staff working on Crown, a Twitch channel sponsored by Amazon. This move is part of a broader restructuring effort to focus on growth areas, such as offering free monthly games for Prime subscribers. Christoph Hartmann, Amazon Games VP, mentioned in an internal email that this shift is in response to customer preferences. The Crown channel on Twitch, known for its original shows and traditional TV-style content, is reportedly shutting down following these cuts. Earlier reports had raised concerns about inflated viewership metrics on the Crown channel.

Target's stock saw a significant 18% rise, its best performance since August 2019, following a third-quarter earnings report that exceeded expectations with $971 million in profits. Despite this, the company is grappling with challenges, including a 4% decline in Q3 sales and a notable decrease in cash reserves over two years. The stock is down 14% year-to-date and about 50% from its 2021 high.

Walmart's shares declined 7.5% following a cautious earnings outlook, despite reporting third-quarter results that beat Wall Street forecasts. This cautious stance, particularly during the holiday season, overshadowed Walmart's stronger net sales growth forecast. The modest decline in general merchandise sales reflects shifting consumer spending towards essentials due to inflation and high interest rates. In contrast, retailers like Macy's and Target, which focus more on discretionary items, saw their stocks rise after their earnings reports, with Target recording its third-biggest daily jump on record.

CAA has launched CAA Evolution, an investment bank and advisory firm aiming to facilitate M&A, capital raising, and strategic advisory services across the sports, media, and entertainment industries. This new venture results from merging CAA’s Evolution Media Capital, with a 15-year history in merchant banking, and M. Klein & Company, a boutique strategic advisory firm. Based in New York, LA, and London, CAA Evolution broadens CAA's reach, offering specialized services like IPO advisement, fund and capital formation, and executive/board-level consulting. The pair have advised on over $1.5 trillion in transactions, positioning themselves to influence deals and strategies within these sectors.

Snapchat's shares rose over 7% after announcing a new deal with Amazon, allowing users to purchase Amazon products directly through the Snapchat app. This collaboration promises to provide real-time pricing, Prime eligibility, and other product details within the app. This move follows a similar partnership Amazon established with Meta, enabling Facebook and Instagram users to buy products on their platforms. For Snapchat, this agreement marks a significant development as it seeks to recover from ad revenue challenges, partly due to Apple’s 2021 privacy policy change that affected targeted advertising capabilities.

Dentsu's Q3 results reveal a 6.0% drop in organic revenue, continuing a downward trend with a 10.4% decrease in operating profit. Despite this, net revenue saw a 1.6% increase, aided by currency impacts and acquisitions. The company faces regional variances, with Japan reporting growth, but the Americas, APAC, and EMEA experiencing declines. Dentsu's focus on Customer Transformation and Technology contributes significantly to its revenue, aiming for 50% from this sector. Looking ahead, Dentsu anticipates a -5% organic growth for 2023 and is implementing leadership changes and cost control measures in line with its "One Dentsu" strategy for 2024.

- BuzzFeed announced a significant strategic shift, focusing on operating its brands – BuzzFeed, HuffPost, Complex Media, First We Feast, and Tasty – individually rather than as an aggregated network. This move aims to grow direct audiences and reduce reliance on social platforms, a response to changing dynamics in the media landscape. This change comes at a crucial time for BuzzFeed, as it faces challenges like the potential sale of Complex Media and the risk of its stock being delisted from Nasdaq.

- Meta has reached a preliminary agreement with Tencent to introduce a more affordable version of its virtual-reality headset in China, marking its return to the Chinese market after 14 years. Tencent will exclusively sell Meta's headsets in China, with sales expected to start in late 2024. This deal allows Meta to tap into China's vast consumer market. The headset will feature cheaper lenses and advanced graphics processing units, with revenue-sharing arrangements. The VR industry faces challenges, and Meta's move comes after it slashed prices due to reduced demand. The deal may require government approval due to regulatory uncertainties in China.

- Agencies are increasingly focusing on the creator economy, driven by marketers spending more on social media and influencer marketing, leading to a surge in social-only RFPs and agency assignments. A growing demand for social content, outstripping supply, with brands like Ford, Tinder, and BMW appointing specialized social agencies, indicating a shift towards creators and influencers becoming a central part of advertising strategies and an effective way to connect with younger, digitally-savvy consumer.

“RFPs for social-only assignments in the past were typically coming from smaller, younger brands looking to use limited funds really wisely,” said Mona Munayyer Gonzalez, chief growth officer of Pereira O’Dell. “Now we're seeing larger legacy brands reaching out with social-focused assignments. It is also taking up a bigger spotlight in pitch asks.”

- McDonald's has collaborated with Crocs to launch a footwear line inspired by its iconic mascots, including Grimace sandals and Hamburglar clogs. This limited-edition collection is available at Crocs.com, Crocs stores, and select partners. The launch is part of McDonald's strategy to appeal to superfans and create "future nostalgia" through innovative marketing.

- Grocery Shopping is showing notable resistance to tech disruption, despite significant VC investments in startups, most consumers still prefer traditional in-store shopping. The U.S. grocery market, valued at $1.5 trillion, remains predominantly offline, with only about 11% of grocery shopping done online. Amazon, too, is stepping up its efforts, announcing plans to open new grocery stores and expand delivery services. However, even with advances like cashless payment services and Amazon's attempt at a cashless store, consumer preference for in-person shopping continues to dominate, suggesting that a balance between online convenience and traditional shopping experiences.

- Tubi, a FAST platform, is taking a brand-focused marketing approach instead of promoting its content library. Nicole Parlapiano, CMO of Tubi, emphasized that Tubi aims to celebrate the individual tastes of its viewers and provide an experience rather than pushing specific content. Tubi's monthly active users have exceeded 70 million, with 33% not using other ad-supported streaming services. The platform's viewing time in the third quarter of 2023 saw a 65% increase compared to the previous year. Parlapiano discussed Tubi's Super Bowl advertising success and its strategy for responding to pop culture news and competition.

- GroupM, part of WPP, will shift its agencies, including EssenceMediacom, Wavemaker, MSix & Partners, and Mindshare, to a country-level profit and loss model starting in 2024. Agency heads will still oversee client growth and profitability but will have more time to focus on strategy and efficiencies, as the holdco attempts to streamline its operations and make the group more like a software company with centralized technology resources.

- Netflix has announced a new slate of games, including both original titles and classic games, as part of its Geeked Week celebrations. Some of the games are already available on Netflix's platform, while the rest are set to be released in 2024. The list includes popular titles like Hades, Katana Zero, and Death's Door, as well as a remastered version of the classic platformer Braid. Netflix is also releasing game adaptations of its own shows, such as Money Heist, Chicken Run: Eggstraction, and The Dragon Prince: Xadia. These games are part of Netflix's efforts to expand its social gaming offerings and attract more users to its platform.

- Disney is reconsidering its television network lineup as it faces viewership declines due to streaming competition. The company, is evaluating which channels are core to its future, with discussions underway about potentially placing some networks in its venture with Hearst, A+E Networks. Disney is looking to cut costs and improve its business while retaining valuable networks like ABC, Disney Channel, and FX. Disney is also exploring the option of combining some networks with A+E's channels to enhance deals with cable companies and advertisers. Excluding ESPN, Disney's traditional TV networks saw a 9.1% revenue decline in the last quarter.

- Warner Bros. Discovery's decision to shelve its completed Looney Tunes movie, "Coyote Vs. Acme," has attracted congressional attention, with Texas Representative Joaquín Castro asking the Justice Department and the FTC to investigate. He likened the move to "burning down a building for the insurance money" and criticized Warner Bros. Discovery for scrapping fully made films for tax breaks, deeming it predatory and anti-competitive. This controversy follows previous accusations of anticompetitive practices by Warner Bros. Discovery, including the cancellation of other projects.

- During Google's antitrust trial, it was revealed that Google pays Apple 36% of the revenue it earns from search advertising made through the Safari browser. Kevin Murphy, a University of Chicago professor, disclosed this figure during his testimony, despite both Google and Apple objecting to revealing details about their agreement publicly. The partnership between Google and Apple, which has been in place since 2002, makes Google the default search engine in Apple's Safari browser. This agreement has become a focal point in the Justice Department's antitrust case against Google, alleging that it illegally maintains its dominance in the search engine and search advertising markets.

- Richemont, the Swiss luxury group known for the Cartier and Van Cleef & Arpels brands, reported first-half profits fell short of expectations, signaling a potential slowdown. Its profits stood at €1.51 billion, significantly lower than the forecasted €2.17 billion. Chair Johann Rupert attributed this slowdown to various factors, including inflationary pressure, slowing economic growth, and geopolitical tensions impacting customer sentiment.

- Airbnb has acquired a secretive AI startup called GamePlanner.AI for around $200 million. GamePlanner.AI was co-founded by Adam Cheyer, one of the creators of Siri, and Siamak Hodjat, who previously worked with Cheyer at Viv Labs, which was acquired by Samsung to develop its AI assistant, Bixby. While it's unclear what GamePlanner does, Airbnb CEO Brian Chesky indicated that the startup's expertise in AI and design will be used to accelerate AI projects and enhance the Airbnb platform. Chesky has expressed his interest in using AI to create a "travel concierge" that learns and adapts to travelers' needs.

- YouTube has introduced new guidelines for videos utilizing AI on its platform. These guidelines aim to regulate videos that may appear realistic but rely on AI tools. YouTube will also introduce new labels to inform viewers when a video has been altered or synthetically generated. Creators who fail to disclose the use of AI in their videos may face content removal, suspension from the YouTube Partner Program, or other penalties. YouTube is working with creators to ensure understanding of these new requirements. This move comes amid growing concerns about the spread of AI-generated content and deepfakes on the platform.

- Nike's CMO, Dirk-Jan "DJ" van Hameren, is set to retire at the end of 2023 after over 30 years with the company. To lead its marketing efforts into the future, Nike has appointed Nicole Hubbard Graham, a former executive who has previously spent 17 years with Nike in various senior marketing roles. The move is part of an executive shakeup aimed at future-proofing the business in the face of competitive challenges and consumer spending constraints. Nike is also making changes in its product innovation, design, and technology departments to enhance its offerings and consumer experiences.

- Roblox is testing in-game video advertisements that link directly to brand experiences within the platform, expanding on its portal ads. These video ads aim to enhance user engagement with brand content on Roblox. The feature is expected to fully launch in the first half of the next year. Portal ads have been a core product in Roblox's immersive advertising package, with over 34% of brand activations this year including them. Over 90% of the traffic generated by portal ads came from new users. Additionally, Roblox plans to allow brands to drive users from their Roblox experiences to their websites via a direct link to bridge the gap between virtual and physical commerce.

- The NFL regular-season viewing has seen a significant increase, with the average game among five major TV platforms up 10.4% to 17.7 million viewers through 10 weeks. This improvement is partly attributed to the addition of ABC simulcasting "Monday Night Football" games on ABC, ESPN, and ESPN2. The average viewing for "MNF" games is 20.1 million viewers, a substantial increase from the previous year's 14.1 million viewers. Amazon Prime Video's "Thursday Night Football" has also contributed to the growth, with an audience of 12.2 million viewers, up 26% from the previous year. Other major network series have maintained viewing levels similar to 2022. Overall, estimated national TV advertising spend for the NFL is at $2.2 billion, up 9% from the previous year.

- Omnicom Media Group has appointed several Chief Media Officers in recent months, including Alex Siddall at Hearts & Science USA, Suhaila Hobba at OMD, and Melissa Wisehart at PHD. These appointments are part of OMG's "Agency as a Platform" approach, aiming to enhance integration among its agencies to create customized solutions for clients. The goal is to better connect media, content, and commerce capabilities, using the Omni operating system, which leverages AI and analytics to inform marketers' strategies. OMG believes that strategy should not be independent of media placement decisions, leading to multidisciplinary CMO roles that integrate various aspects of media planning and execution. These executives will work closely with client business leads and directly with clients to facilitate integration across agency teams.

- Microsoft has launched a slightly terrifying tool called Azure AI Speech text-to-speech avatar, which allows users to create photorealistic avatars of people and make them say things they didn't say. Users can upload images of a person they want the avatar to resemble and write a script, and Microsoft's tool uses a model to drive the animation while a text-to-speech model reads the script aloud.

- Apple has reportedly struck a deal with Amazon to limit ads from competing brands on Amazon product pages and search results for Apple devices. This agreement aims to create cleaner and less cluttered product pages and search results for Apple's products, such as iPhones, iPads, and MacBooks. While Amazon still lists competing products, it restricts the number of ads displayed above, below, and between the search results for Apple devices. This deal was initiated in 2018 when Apple started selling its products on Amazon. The move sets Apple's product pages apart from competitors on the platform.

- PayPal has announced senior leadership changes and the creation of three new business units: Consumer, Small Business, and Large Enterprise. Isabel Cruz will join PayPal as Chief People Officer, Michelle Gill will serve as EVP and General Manager of the Small Business and Financial Services Group, and Diego Scotti will be EVP and General Manager of the Consumer Group and Global Marketing & Communications organization. These changes aim to enhance PayPal's commitment to serving its customers and driving profitable growth. The restructuring is part of PayPal's strategy to organize its teams into defined business units, focusing on customer needs and leveraging data and platform capabilities to deliver faster and innovative solutions.

- Diageo is facing a significant slowdown in its operations, particularly in Latin America and the Caribbean. Madeleine Speed's report highlights that the renowned drinks group, known for brands like Johnnie Walker, Tanqueray, and Guinness, has experienced a sharp 20% drop in sales in these regions. This downturn is severely impacting Diageo's profits, leading to an 8% decrease in its shares. The company, which had previously anticipated accelerated operating profit growth in the first half of the fiscal year, now expects a decline compared to the same period last year. Diageo attributes this slump to macroeconomic pressures causing reduced consumption and consumer downgrading in the affected regions. This trend is not isolated to Diageo, as competitors like Pernod Ricard, Campari, and LVMH’s wine and spirits division are also reporting similar declines in sales.

- Netflix has reportedly reduced the number of employees in its feature animation division by at least one-third as part of a divisional restructuring. The layoffs, which took place on November 1, targeted "overhead" staff, including executives, business affairs, and production management. No artists were included in the layoffs. Netflix cited a strategic shift in its feature animation division as the reason for the layoffs, noting that it plans to focus on delivering two Netflix-owned tentpole films a year. Despite the layoffs, Netflix remains committed to its animation ambitions and plans to release several animated features in the coming years.

- X (Twitter) has launched its job search tool on the web. While a beta version of this feature was initially available to verified users in August, it is now open to all users on X. The job search tool currently lists open positions at various tech companies, including SpaceX, Tesla, Neuralink, X, and x.ai. However, it primarily serves as a job listing and description platform, redirecting users to third-party websites to complete job applications. X has been experimenting with job-related features, and its updated privacy policy suggests more advanced job-finding features may be in development.

- Amazon has introduced Map View, a totally not creepy feature that allows users to create a digital floor plan of their home and assign connected devices to each room. Map View is currently available in public preview, and it works with a variety of devices, including lights, smart plugs, thermostats, cameras, and Echo devices. Users can drag and drop devices on the map and control them directly from the interface.

- Verizon is reportedly considering offering a subscription bundle that combines HBO Max and Netflix for just $10, according to reports. This bundle would include the ad-supported versions of both streaming services, with individual subscriptions costing $9.99 per month for HBO Max and $6.99 per month for Netflix's ad-supported plan. This move is seen as an attempt to reduce customer churn and compete with other streaming services in an increasingly competitive market.

- Amazon has collaborated with Hyundai to introduce a new way for customers to purchase cars directly through its platform, set to launch next year. This partnership will enable customers to seamlessly browse and buy vehicles, choosing between dealership pick-up or home delivery. Importantly, Amazon will serve as the intermediary in this process, with the dealers retaining their role as the ultimate sellers of the vehicles.

- Meta has teased new AI-powered editing tools that will allow users to edit photographs and create videos using text descriptions. One of the tools, called "Emu Edit," enables users to precisely alter images based on text inputs, allowing them to remove or replace objects and people in photographs without advanced editing skills. The second tool, "Emu Video," generates videos from text prompts, reference images, or a combination of both inputs. These tools are built on Emu, Meta's foundation model for image generation. The release date for these editing capabilities has not been announced yet.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/25089427/Meta_Emu_hero.jpg)

- Uber and Spotify have revealed insights into changing consumer behavior, challenging the notion of short attention spans. Spotify's data shows that people spend around two and a half hours a day on its platform, offering marketers opportunities for longer-form storytelling. Younger generations are engaging with deeper content and podcasts throughout the day. Uber sees its car rides as a "lean back" experience, with passengers open to new content. As people spend more time in cars, particularly with the rise of ride-sharing and self-driving vehicles, this space becomes a valuable medium for delivering content and ads.

- Italy has implemented a ban on the production of lab-grown meat, citing concerns about its impact on the country's agricultural industry and culinary heritage. Agriculture minister Francesco Lollobrigida hailed the ban as a bold move that places Italy at the forefront of such actions globally. The ban also prevents companies and restaurants from using meat-related terms to describe plant-based products.

- Burberry faces challenges amid a luxury spending slowdown. In the last quarter, comparable store sales grew by just 1%, down from 18% the previous quarter. The company expects to miss its double-digit revenue growth target for the year, leading to a 10% cut in operating profit estimates. Although these struggles aren't attributed to designer Daniel Lee's collection, the brand highlights its increased mentions and efforts to improve "brand clarity" and association with Britishness and heritage. Despite creative campaigns, translating prestige into higher prices and margins remains a challenge, leading to a valuation discount compared to peers.

- If Creativity Is Automated, What Happens to the Joy of Surprise?

- Mojo Supermarket names itself its own social AOR

- There will probably be a Frozen 4, by the way

- Dungeons & Dragons' 24-Hour FAST Channel Is Here

- I Saw ‘Coyote Vs. Acme’ And It’s As Wonderful As Everyone Says It Is

- A near-perfect inflation report

- AI is starting to outperform meteorologists

- I’m in love with the entire Tiffany x Pokémon collection

- Meta promotes Nick Baughan to global head of agencies

- Pizza Hut Adds Mischief @ No Fixed Address as Social Agency

- TikTok Allows Users To Save Songs Directly To Spotify, Amazon, Apple Music

- Gawker Acquired By Caldecott Owner: Reports

- TikTok’s latest feature lets users make AR filters

- Google is going to let you annotate search results

- Exxon Makes Lithium Play in Long-Term Bet on EV Demand

- NFT Sales Hit $129 Million in November in an Unexpected Surge

- DDB Worldwide CCO Ari Weiss exits to set up independent shop

- TBWA\Chiat\Day appoints its first-ever US CEO

- Improve Your Company’s Use of AI with a Structured Approach to Prompts

- Final Frontier Officially Opens for Business in the US

- IBM suspends advertising on X after its ads were placed next to pro-Nazi content

- Unity launches a suite of AI tools intended to simplify game creation

- Alphabet dissolves stake in trading app Robinhood

- Dr Martens hires Apple exec as first-ever chief brand officer

- Pereira O’Dell is holding focus groups with AI-generated consumers

- Hornet Signs Director Edward Andrews for US Representation

- How to use OpenAI’s new GPT Builder

- Google DeepMind breaks new ground with ‘Mirasol3B’ for advanced video analysis

- Visit Bluey's House at CAMP Los Angeles and Meet the Heeler Family

- Amazon is officially killing the Comixology app, forcing users over to Kindle

- Apple announces RCS support for iMessage

- Toys 'R' Us Made a Very Ambitious Announcement. Why It Just Might Work

- Alibaba ditches plans to spin off cloud business and list supermarket

- Thousands of Starbucks Workers Strike on 'Red Cup Day'

- Shoppers Are Finally Getting a Break on Prices

- U.K. Inflation Slows to 4.6%, Lowest in Two Years

- Uber is testing a service that lets you hire drivers for chores

- Macy’s Brings AR Disney Princess Experience to Herald Square

- Mercedes-Benz opens its first 400kW EV charging station in the US

- Apple Films a Love Letter to Hollywood After Strikes End

- Lego’s Holiday Store Windows Feature an AR Snowball Fight

HEY! Your favorite editor-in-chief was interviewed on the School of Motion Podcast. We talked business development, the state of the creative industry and everything in between. It's a great primer on my philosophy, so please go watch and enjoy!

Had a lot of fun scoring Coyote Vs Acme. As no-one will be able to hear it now, due to bizarre anti-art studio financial shenanigans I will never understand, here is a bit of behind the scenes footage of our “Meep Meep” Roadrunner choir, with apologies to Tchaikovsky… pic.twitter.com/HL7h00rXpp

— Steven Price (@SteveBPrice) November 10, 2023

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion