November 24 2023 - A Thanksgiving Miracle!

👋Happy Friday friends. I hope everyone has a fully belly, as we dive into some brand-sanity, on this holy black friday. Sam Altman technically has the same job he had a week ago - so we're just gonna leave that there (meme roundup at the bottom). Lots of other news, as we see brands continue to focus on sports and music, with AI continuing to impact...Everything. Let's get into it–

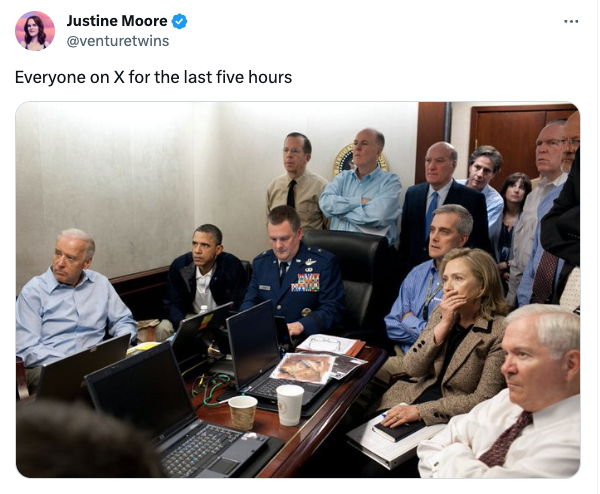

OpenAI had a rollercoaster week, as Sam Altman was reinstated as its CEO after his initial removal by OpenAI's board and a subsequent campaign by it's staff and investors, advocating for his return. The board of directors will undergo major changes, removing several members who opposed Altman and retaining Adam D’Angelo of Quora, with Greg Brockman also returning as OpenAI's president. The new board will feature notable figures like Bret Taylor of Facebook and Salesforce, former Treasury Secretary Lawrence Summers joining as well. Microsoft expressed support for these changes, emphasizing the need for stable and effective governance.

BMI announced its sale to New Mountain Capital, a private equity firm. BMI is known for representing a vast number of songwriters, including artists like Taylor Swift, Dolly Parton, Kendrick Lamar, and Lady Gaga. The organization, alongside ASCAP, plays a critical role in the music industry as a performing rights organization, managing legal rights for song streaming and distribution, and distributing billions in royalties to songwriters and music publishers. Additionally, CapitalG, affiliated with Alphabet (Google's parent company), is acquiring a minority stake in BMI. This move follows BMI's transition from a nonprofit model to a for-profit organization, a change that has raised concerns among songwriters about the impact on their royalties. BMI, which represents over 1.4 million songwriters and publishers, collected $1.57 billion and distributed $1.47 billion in its 2022 fiscal year. New Mountain Capital aims to modernize BMI's operations amidst the evolving music industry.

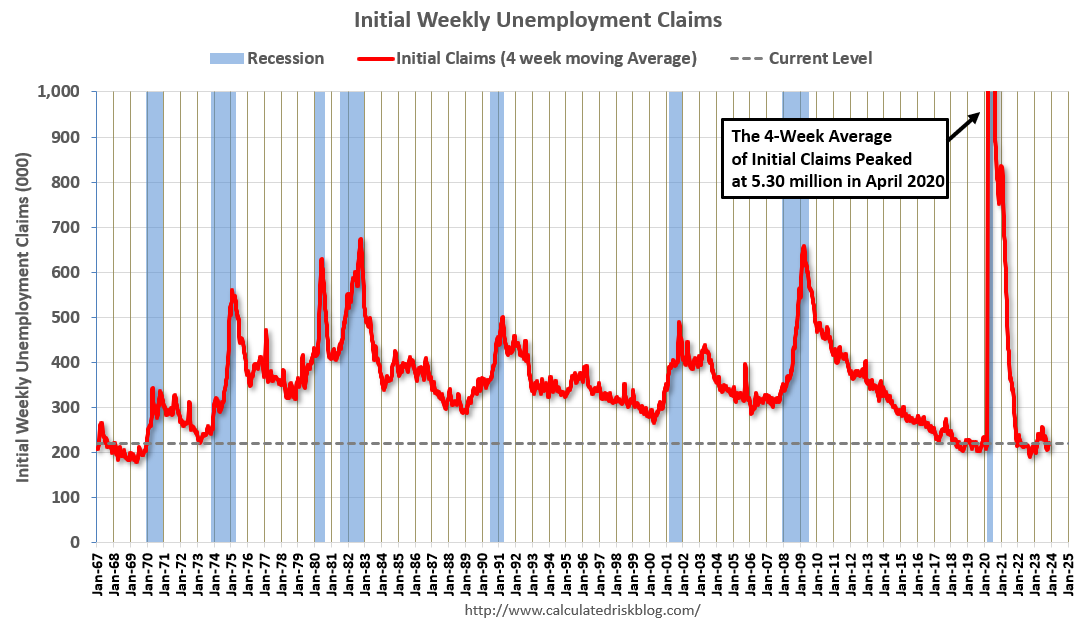

The U.S. Department of Labor reported a significant decrease in unemployment claims for the week ending November 18, with the number falling to 209,000. This represents a substantial drop of 24,000 from the previous week's. Additionally, the four-week moving average, a more stable measure of unemployment trends, also decreased, settling at 220,000. The current data, notably lower than consensus forecasts, indicates a positive trend in the labor market, suggesting fewer people are filing for unemployment benefits. This decrease in weekly claims can be seen as a healthy sign for the U.S. economy, reflecting stability and potential growth in the job market.

Consumers are exhibiting increased caution as they head into the holiday shopping season, influenced by persistent inflation and rising interest rates. This shift in spending is noticeable among major retailers, such as Walmart and Target, where customers are prioritizing essentials and seeking discounts, moving away from high-cost items. October saw a minor decline in retail sales, the first in six months, signaling a broader trend of financial prudence. Payment methods are also changing, with a noticeable uptick in "buy now, pay later". The economy also reflects these trends, with a significant increase in credit card debt and higher interest rates, although the overall financial health of American households remains relatively strong. Despite this, consumer sentiment is low, driven by concerns over essential goods prices and wider economic uncertainties.

- GroupM is undergoing a major restructuring, similar to WPP's creative agencies. This shift includes centralizing budget control away from individual media agencies. Amid cost-cutting efforts to save £100m after disappointing results, WPP has consolidated its creative agencies into two main entities: VML and Ogilvy. GroupM's leader, Christian Juhl, views this change as a strategy to enhance efficiency, though it comes with challenges like reduced budget autonomy. High-level exits are occurring, including GroupM North America boss Kirk McDonald, and several other senior figures from Mindshare and Wavemaker. Despite still leading in headcount and revenue, WPP's market value lags significantly behind Publicis, indicating a possible need for downsizing to regain its competitive edge.

- YouTube is currently piloting a new ad program focused exclusively on YouTube Shorts. This development follows the introduction of new ad offerings during YouTube's NewFront event in the spring, where the option to run ads between top-viewed Shorts was first presented. Previously, advertisers could only buy Shorts inventory bundled with other YouTube inventory, with limited control over specific placements. The new program allows targeting based on basic demographics, geolocation, and content categories like gaming or cooking, although targeting specific channels or videos isn't possible. Advertisers participating in the pilot can access metrics such as reach, frequency, and view-through rates. This initiative represents YouTube's effort to monetize Shorts more effectively as its usage has significantly grown, now generating over 70 billion views per day.

- Apple's latest holiday ad, "Fuzzy Feelings," is a modern take on the Scrooge tale, blending stop motion and live action. Directed by Lucia Aniello and Anna Mantzaris, the four-minute ad was developed by TBWA\MAL.

- The Golden Globes have secured a new broadcasting deal with CBS, marking a significant shift for the awards show. This comes after the show lost its long-standing broadcast partnership with NBC, largely due to revelations in 2021 about the lack of diversity within the Hollywood Foreign Press Association (HFPA), leading to a boycott from stars and studios. The 2023 edition of the Globes, broadcasted by NBC on a one-year agreement, with a near-record low viewership of 6.3 million. Post-scandal, the HFPA has undergone reorganization and is no longer in existence by name. The rights and properties of the Globes have been acquired by Dick Clark Production and Eldridge Industries, with a new for-profit organization set to vote on the awards.

- Meta has divided its Responsible AI team, with most members being reassigned to either the company's generative AI team, which was established in February to develop generative AI products, or the AI infrastructure unit, which is responsible for the systems and tools needed to build and operate.

- Landor & Fitch rebrands, now known simply as Landor. The new identity, featuring visual, verbal, sonic, and motion elements, signifies a shift in the agency’s approach, incorporating more comprehensive and multi-dimensional brand strategies. This change is embodied in a new grotesque typeface, Landor Sans, developed by its custom type studio in Milan, emphasizing Landor's increased focus on typography. CCO Teemu Suviala highlights the agency's adaptation to the omnipresence of brands in the modern world, necessitating engagement across multiple channels and sensory experiences. Landor's capabilities have expanded in recent years, including the acquisition of sonic branding specialists Amp and the integration of architectural experts BDG and motion studio ManvsMachine.

- Spotify has announced changes to its royalty model, projected to generate $1 billion for artists over the next five years. This new policy aims to direct more revenue to popular artists and labels, establish a minimum threshold for music streaming royalties, and combat streaming fraud. Starting next year, tracks will need at least 1,000 streams in the past 12 months to earn royalties. This change won't increase Spotify's profits but will redistribute existing funds to increase payments for eligible tracks, addressing the issue of small payments that often don't reach artists due to minimum withdrawal amounts and transaction fees set by labels, distributors, and banks. The new policy also targets artificial streaming and system gaming. Spotify will charge labels and distributors for tracks involved in artificial streaming and increase the minimum track length for functional noise recordings to two minutes to be eligible for royalties. This measure is to deter bad actors who exploit the system by creating short noise tracks for outsized royalty payments.

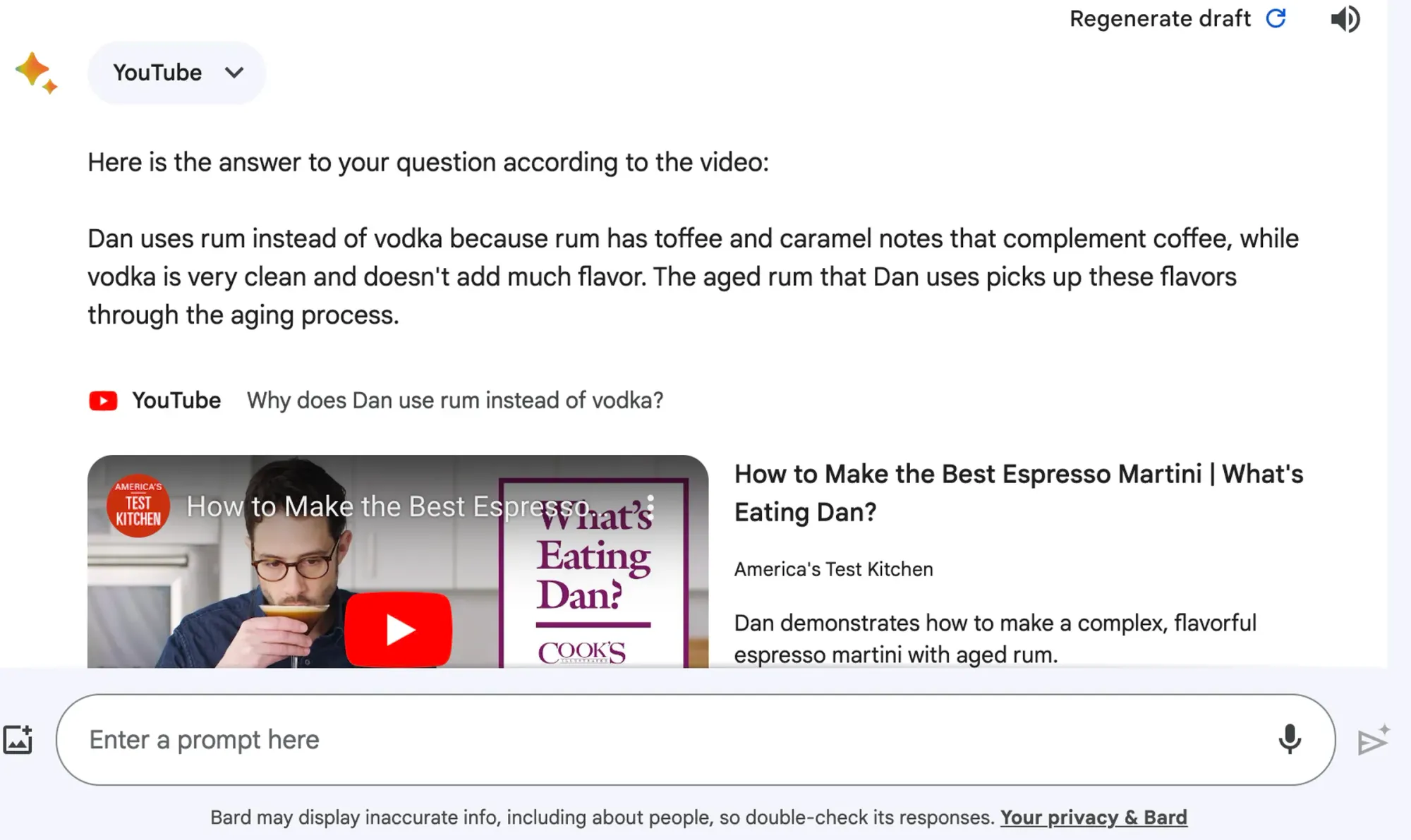

- Google's AI chatbot Bard has received an upgrade allowing it to analyze individual YouTube videos and provide specific information like recipe ingredients and instructions. This feature allows users who need quick summaries or specific details from videos. Allison Johnson, tested Bard on an America’s Test Kitchen video for an Espresso Martini recipe and found that Bard accurately summarized the ingredients and steps, despite a minor discrepancy in shaking time.

- Netflix is exploring new territories in live sports, inspired by the success of its sports documentary series. A report suggests they're considering bidding for an NBA documentary-series package, which would include live games from the NBA's new ‘In-Season Tournament’. This strategy follows Netflix's success with series like “Formula 1: Drive to Survive” and extends to other sports such as tennis and cycling. These sports docu-series are not only potentially more cost-effective than scripted content but also offer a unique perspective for not only sports fans, but a gateway for non-sports viewers. By blending drama-tinged real-life content with live sports, Netflix hopes to attract a diverse audience, including younger and female viewers, similar to recent efforts by sports franchises like the NFL. This approach could provide Netflix a way to enter the live sports arena, expanding its content portfolio and audience reach, without bidding on expensive distribution rights.

- TikTok's influence on music streaming has been reaffirmed by a new report from Luminate. The "Music Impact Report" shows that TikTok users are twice as likely to discover and share new music, often through viral challenges on the app. This trend correlates with increased music streaming numbers, aligning with TikTok's recent partnerships with Spotify and Amazon Music. The report also highlights that a large majority of users engage with music streaming services, with a significant number willing to pay.

- Netflix's $55 million sci-fi series project with Carl Erik Rinsch, the director of "47 Ronin," has turned into a costly debacle. Initially, Rinsch's project, centered around artificial humans, attracting interest from multiple studios', with Netflix ultimately securing the deal with an offer that included an unusually high degree of creative and financial control, including the final cut. However, after receiving over $55 million from Netflix, Rinsch's behavior took a turn, with his actions ranging from investing a significant portion of the funds in the stock market and cryptocurrencies, to purchasing luxury items like Rolls-Royces and furniture. The project, which had already faced production issues and missed deadlines, was further jeopardized by Rinsch's unpredictable behavior. Netflix and Rinsch are now embroiled in a confidential arbitration proceeding, with Rinsch claiming that Netflix breached their contract, and owes him at least $14 million in damages. Netflix denies owing him anything, labeling his demands as a shakedown.

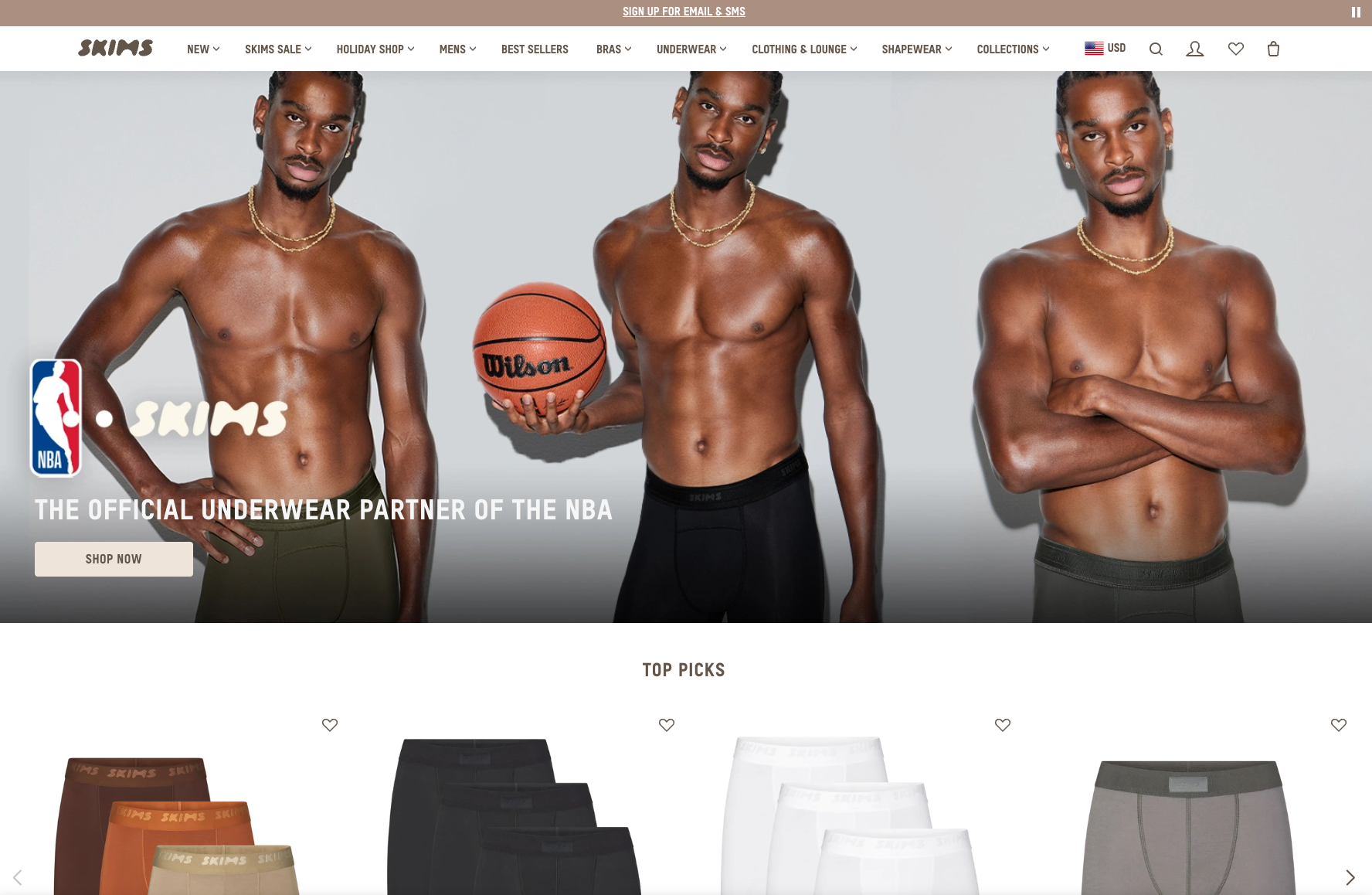

- Skims' partnership with the NBA, WNBA, and USA Basketball marks a strategic repositioning for the brand, traditionally known for women's shapewear and loungewear. This aligns with the growing convergence of sports and fashion, capitalizing on the sports apparel market, projected to generate over $213 billion in revenue in 2023. Skims' entry into this market was further solidified by the launch of its men's line, featuring prominent athletes like Neymar Jr and Nick Bosa, redefining the brand as a broader lifestyle label.

- In a legal battle against Google, Tim Sweeney, CEO of Epic Games, testified in a San Francisco federal courthouse, asserting Google's monopolistic control over mobile game developers on its Play Store. The dispute began in 2020 when Epic Games, creators of Fortnite, challenged Google's 30% fee for app purchases and subsequently integrated its own payment system in the Fortnite app on Android. Google retaliated by removing Fortnite from the Play Store, leading to Sweeney's lawsuit. The case, now in front of a nine-person jury, is expected to conclude next month.

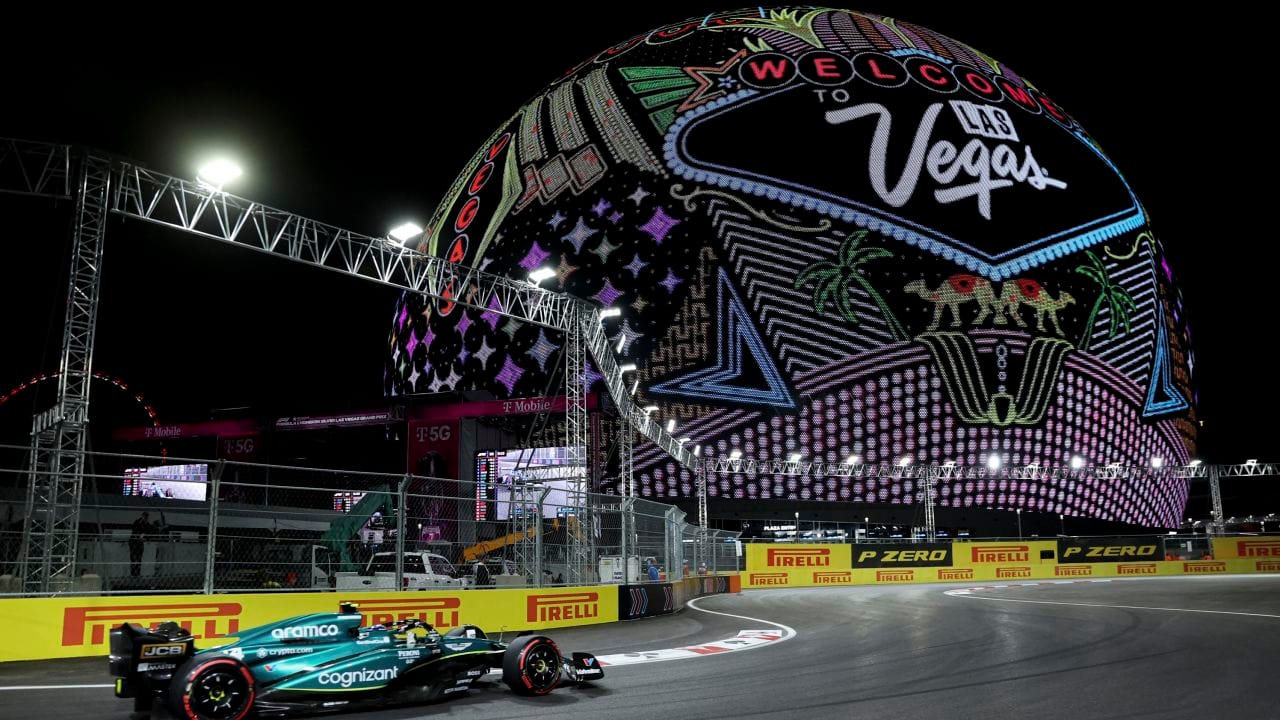

- Formula One's recent return to Las Vegas proved to be a significant draw for late-night TV viewers in the U.S., attracting a peak audience of 1.5 million viewers between 1:15-1:30 a.m. EST, with an average viewership of 1.3 million. This race marked one of the largest audiences for the series this season and was the most-watched F1 race since June's Canadian Grand Prix on ABC, which had 1.76 million viewers.

- WhatsApp has entered a multi-year partnership with the Mercedes-AMG Petronas Formula 1 Team. This collaboration aims to enhance fan engagement with the eight-time world champions and provide access to exclusive content. WhatsApp will be the primary communication tool for the Mercedes-AMG F1 team, with the Petronas Team already utilizing WhatsApp's Channels broadcast to share behind-the-scenes content.

- Coca-Cola has embraced generative AI for its latest global holiday campaign, "Create Real Magic". This initiative allows the public to generate personalized holiday cards using AI tools. Leveraging GPT-4 & Dall-E 2, users can create holiday-themed content, combining Coca-Cola imagery with text input.

- In the evolving landscape of gaming and esports marketing, McDonald’s and Coca-Cola are cautiously navigating their approach. Both brands, still in the experimental phase of gaming marketing, are focusing on traditional metrics like brand awareness and loyalty to gauge success. Their partnership with Brag House, a college gaming platform, highlights this, as the brands are focusing on casual gaming experiences over professional esports, which is seen as a more inclusive to a broader field of gamers. Both brands are looking to refine their understanding and evaluation of gaming as a marketing channel, moving into a more strategic and measured approach in 2024.

- Leica is expanding into the luxury watch market with a new collection of timepieces. The German company has invested over €10 million in its watch division, with a goal to produce 3,000 mechanical watches annually within three years. Despite mixed opinions on the venture, Leica sees it as a natural extension of its brand, capturing time in a different form. The company's financial stability, with a 16% increase in revenue to €450 million in June 2022, supports this initative without immediate pressure for profitability.

- Binance CEO Changpeng Zhao, also known as CZ, has resigned following a $4.3 billion plea deal with the US Department of Justice for money laundering violations and operating without a license. Zhao personally will pay a $50 million fine. This settlement concludes a three-year investigation into Binance's illegal activities. Richard Teng, previously Binance's Global Head of Regional Markets, will take over as CEO. Zhao's resignation marks a significant shift for the world's largest cryptocurrency exchange and underlines the increasing regulatory scrutiny of the cryptocurrency industry.

- Kodak is finally set to release its new Super 8 film camera. Slated for sale in limited quantities in the US on December 4th, the camera is priced at $5,495. This price is significantly higher than the initial projection of $400 to $750 in 2016 and even surpasses the updated estimate of $2,500 to $3,000 in 2018. The camera incorporates modern features like a four-inch LCD viewfinder, a microSD card slot for audio recording, and a Micro HDMI output. Each $35 Super 8 film cartridge allows for approximately two and a half minutes of footage at 24fps.

- Amazon is implementing another round of layoffs, mainly affecting its Alexa voice assistant team, as part of a shift in focus towards generative AI products. Despite Alexa's widespread use and the Echo devices' market dominance, Amazon has struggled to profit from the technology, with Alexa reportedly losing $10 billion in 2022. The layoffs come amid broader struggles within Amazon's devices division, which has seen significant job cuts, leadership changes, and scaled-back hardware ambitions. This shift also includes a recent court order for Amazon to pay $46.7 million for patent violations related to Alexa. Amazon's future strategy involves enhancing Alexa with generative AI, aiming to improve efficiency and conversational capabilities.

- Stability AI, the company behind Stable Diffusion, has introduced a new product called Stable Video Diffusion, now in research preview. This tool allows users to create videos from a single image, generating 14 to 25 frames at speeds between 3 and 30 frames per second with resolutions of 576 × 1024. It can perform multi-view synthesis from a single frame and has been found to surpass other closed models in user preference studies. The tool was trained on millions of publicly available videos, though the data set's origin is under scrutiny after Stability AI faced a lawsuit from Getty Images.

- Apple has joined Meta and TikTok owner ByteDance in contesting their classification as "gatekeepers" under the EU's Digital Markets Act (DMA). This legislation targets dominant companies, allowing the EU to fine them for behaviors that restrict consumer-friendly competition. The DMA imposes severe penalties for non-compliance. Companies can face fines of up to 10% of their global turnover, which can increase to 20% for repeated offenses, along with periodic fines of up to 5% of their average daily turnover. The legislation also allows for other penalties, such as the divestiture of business parts following market investigations. This development reflects the increasing regulatory scrutiny faced by major tech companies in the EU.

- BlizzCon 2023, marking Blizzard's return to in-person events after four years, highlighted the evolving nature of gaming conventions. Focused on creating immersive and interactive experiences, BlizzCon transformed the Anaheim Convention Center into themed areas for games like Overwatch and Diablo, emphasizing the social and community aspects of gaming. Despite the shift to online events in recent years, BlizzCon's success reaffirms the appeal of physical conventions, where fans can engage with games and each other in a uniquely immersive environment, with community-building elements.

- The Titmouse Foundation, in collaboration with Warrior Art Camp and Amazon Studios, is launching the Future Art Directors Program, a scholarship-based online course aimed at nurturing the next generation of animation directors. It marks the first partnership between Warrior Art Camp and an animation studio, with the curriculum covering both technical and soft skills, including style guide creation, script breakdown, asset packaging, and team collaboration. Taught by Arthur Loftis, the program is open to U.S. candidates with at least 4 years of animation experience.

- Global streaming revenue is projected to grow by 14% in 2023, reaching $65.7 billion, but the growth rate is expected to slow down, according to a Wells Fargo analysis. The focus for streaming services is likely to shift towards pricing strategies as subscription growth slows and price hikes continue. In the third quarter of 2023, streaming revenues increased by 4% from the previous quarter, totaling $16.7 billion.

- Huel is reconsidering its plans for a London IPO due to the current market conditions. CEO James McMaster revealed that while the company had explored the possibility of going public, the declining IPO market has made the option less attractive. Huel has been performing well financially, the company, valued at £440 million a year ago, reported a 28% increase in sales to £184 million for the year ending in July. Huel recently received investment from Morgan Stanley's investment management arm and had raised £20 million from investors including Highland Europe and actor Idris Elba about a year ago.

- In October, sports programming significantly boosted broadcast viewing, while streaming maintained its dominant share in the overall TV viewership. According to Nielsen, streaming held a 36.6% share of total day viewing, with broadcast TV seeing an increase to 24.6%, up from 23.0% in the previous month, largely driven by NFL, college football, and other sports content. Individually among streamers, YouTube's share increased slightly to 9.1%, while Netflix experienced a drop to 7.2%, down from 7.8%.

- Amazon Web Services (AWS) and the NFL have collaborated to create “Playbook Pass Rush,” an online game aimed at engaging Gen Z with generative AI-powered stats. This game, which leverages real-time NFL data, allows players to devise plays using a feature called pressure probability. It utilizes four AI models analyzing over 90,000 football plays from the past five years to predict the likelihood of each defender creating pressure during plays.

- United Airlines is considering using its customer data to show personalized advertisements to passengers, as reported by The Wall Street Journal. This initiative could see targeted ads being displayed on seatback screens on United aircraft or through its mobile app. The concept is to use an individual's travel data and preferences to suggest relevant content or products, such as movie titles linked to the passenger's vacation spot or recent purchases.

- The Estée Lauder Family Built a Beauty Empire. A Succession Rift Threatens It

- OpenAI and Microsoft hit with copyright lawsuit from non-fiction authors

- Ikea mocks Balenciaga's $ 925 towel skirt

- Airbnb is Interbrand’s fastest-growing brand of 2023

- AMV BBDO bags Lay's creative account & rekindles PepsiCo relationship

- The Evolution of Disney Animation Over 100 Years of Art

- Alain Sylvain, founder of innovation consultancy Sylvain, dies at 47

- Snoop Dogg’s giving up smoke announcement is actually an ad for Solo Stove

- FCB NY Partners with Pitch to Create Decks with Help from AI

- Bayer Told to Pay $1.56 Billion After Losing Roundup Case

- Teenage Engineering’s new synthesizer is powerful, portable, and gorgeous

- Use Google Lens to Determine the Value of a Vintage Item

- Teenage Engineering’s new synthesizer is powerful, portable, and gorgeous

- A Brand Storyteller’s Guide To Content Creation

- Anatomy of a slowdown

- Louis Vuitton stacks travel trunks for Claridge's Christmas tree

- Samsung Touts FAST Viewership Growth, Product Update

- Aardman Says Its Future Is Fine After Clay Shortage Worries

- The secret environmental cost hiding inside your smart home device

- How consumers fell out of love with The Body Shop

- Ilya Sutskever did not attend OpenAI's party celebrating Sam Altman's return as CEO

- Use these lesser-known features to become a Google Docs pro

- Anthropic's ChatGPT rival Claude can now analyze 150k words in one prompt

- Users of Venmo, Cash App and Other Digital Wallets Get a Tax Reprieve

- Altman Agrees to Internal Investigation Upon Return to OpenAI

- Medialab hires new head of planning from IPG

- Meta’s Head Of AR Software Stepping Down

- Rivian CEO RJ Scaringe is now taking over the top product role

- Your Favorite PBS Cooking Shows Now Share a Dedicated FAST Channel

- What do the current crop of Christmas ads say about our industry?

- The UK's Most Creative Marketers

- The Impact Of Focus On Brand Success

- DNEG Vancouver Has Unionized After Labor Board Confirmation

- The role of brand in M&A: Healthcare

- Amazon Launches Free AI Classes

- Bill Gates says a 3-day work week where 'machines can make all the food and stuff' isn't a bad idea

- Flurry Of Brands Launch Interactive Holiday AR Lenses On Snapchat

- Eminem is coming to Fortnite’s The Big Bang event

- Spotify’s new royalty scheme picks the winners

- Braun: Designed to Keep is a book worth holding onto

- Google Chrome will limit ad blockers starting June 2024

- Teenage Engineering made a toy car that costs $250

- What's New on Netflix in December 2023

- Adobe’s Expressive A!: A Study in Illustration and Design

- Consumers prefer AI content from influencers, research suggests

- Titmouse Foundation Partners With Warrior Art Camp To Advance Diverse Animation Talent Through Scholarship Program

- Eagles-Chiefs 'MNF' Rematch Earns 29M Viewers

- Trolls Band Together With $30 Million Opening Weekend Haul

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion