September 8 2023 - Headline Heatwave

👋 Happy Friday, friends. September is here, it's hot, and we've got a lot of news. No need for fuss, let's get into it–

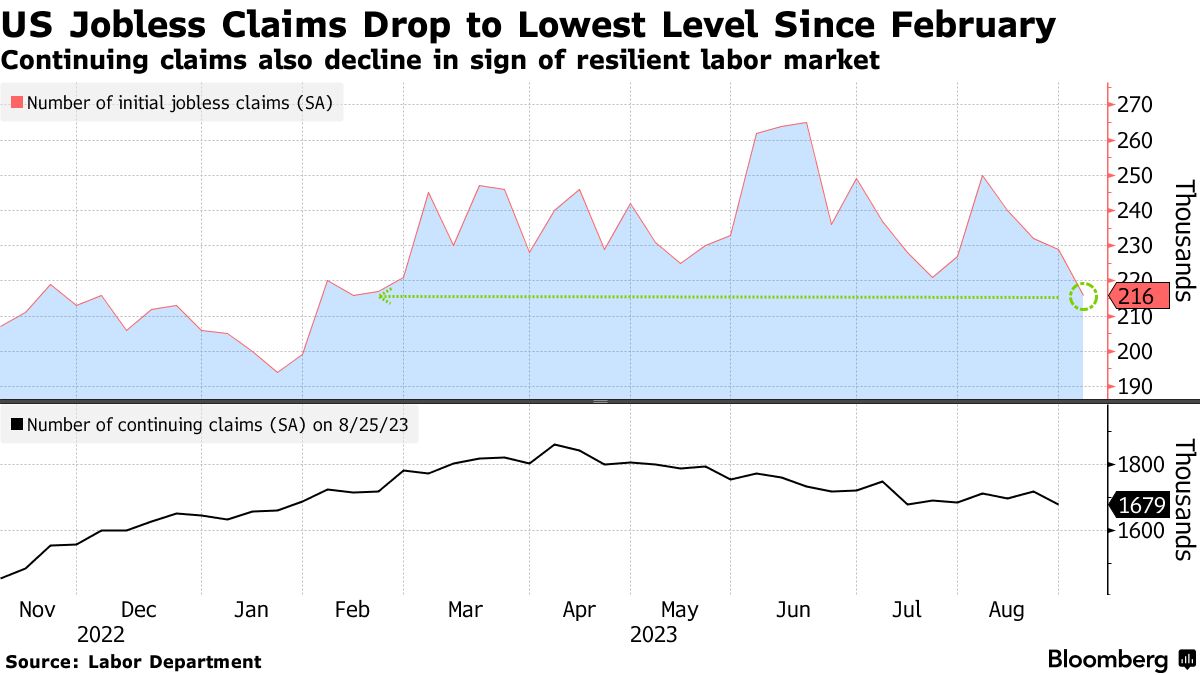

US initial jobless claims fell to 216,000 in the week ending September 2nd, the lowest level since February. Continuing claims, which represent the number of people receiving unemployment benefits, dropped to 1.68 million, marking the lowest level since July. The data suggests a resilient labor market, with strong hiring and limited layoffs, supporting consumer spending and economic optimism. While the labor market is gradually softening, it remains tight, but more moderation in job growth may be needed to keep interest rate hikes at bay, according to economists.

Roku is laying off more than 300 employees, representing 10% of its workforce, as part of cost-cutting measures. The company is also removing streaming content from its platform, consolidating office space, and reducing external service expenses in an effort to reduce year-over-year operating expenses. Roku will incur $65 million in impairment charges related to the removal of content, along with $45 million to $65 million in severance benefits for outgoing employees and up to $200 million for office space abandonment. This marks the third round of layoffs for Roku in less than a year, totaling around 25% of its workforce.

CAA is being acquired by France's Pinault family's Artémis, taking a majority stake from private equity firm TPG. While the exact transaction details remain undisclosed, Artémis will take around 53% of CAA from TPG. CAA, with an enterprise value of $7 billion and approximately $1.7 billion in 2022 sales, will be purchased at a multiple of 13 times earnings before interest, tax, depreciation, and amortization. The acquisition will be funded using a combination of cash and debt, marking a significant move for the Pinault family, traditionally focused on the luxury industry.

Comcast and Disney have agreed to expedite negotiations regarding Comcast's stake in Hulu. Previously, both companies had expected discussions to conclude sometime after January, but now they aim to reach a resolution by the end of September. Comcast's CEO, Brian Roberts, emphasized the high value of Hulu and the belief that it's worth more than the previously agreed-upon valuation of $27.5 billion. Hulu currently has over 48 million subscribers and is a key player in the streaming industry. The outcome of these negotiations will impact the ownership and future of the streaming platform.

- The Hollywood strikes have cost California's economy nearly $5 billion over four months, surpassing the $2.1 billion impact from the last major Hollywood strike in 2007-08. The strikes have shut down most Hollywood productions, while also affecting various supporting industries like catering, dry cleaning, drivers and rental companies. “All these different people who provide support services that make productions happen — they’re getting nailed”. The strike is now in its 125th day.

- Max is reportedly planning to offer free access to live sports for a limited period starting later this year. This move aims to attract more viewers by featuring live basketball, baseball, and hockey games. However, it's expected to transition to a paid model in February or March next year. Warner Bros. Discovery owns media rights to various major sports leagues, including the NBA, MLB, and NHL. The company may leverage events like March Madness college basketball games to promote its sports streaming tier, as well as incorporate content from Bleacher Report.

- MediaMonks has appointed Joanna Cotton as managing director of its UK operations. Cotton, formerly one of Oliver's global managing directors, aims to reposition MediaMonks as a full-service digital agency in the UK, moving away from its perception as a production agency. She intends to expand the agency's relationships with clients by identifying new revenue avenues, including e-commerce opportunities, and making it more client-centric and rounded in its offering. Cotton replaces Martin Verdult, who has taken on a client-focused EMEA role.

- Miro has unveiled its new visual identity system. The company worked with AKQA to create a system that showcases innovation and collaboration. This involved refining the brand's iconic yellow color to balance its energy, elevating the "M" logo, and adopting an illustration style for a diverse and inclusive representation of creators.

- YouTube is experimenting with a "Playables" section that introduces games playable on both its desktop and mobile platforms. Initially available to a limited number of users, games like Stack Bounce we're featured in this experiment. The move represents YouTube's diversification into gaming content, expanding beyond its core offerings of short videos, streaming, music, and more.

- The 4A's is advising ad agencies not to accept long payment terms, particularly those reaching 120-180 days. In a report titled "The Ripple Effect of Extending Payment Terms," the trade organization highlights the negative impact these extended terms can have on agencies and their cost structures. It also urges agencies not to accept supply chain financing, a program where third-party banks pay agencies on behalf of marketers but charge high interest rates.

- Tubi, the free ad-supported TV streaming service owned by Fox, has reported impressive growth, with over 74 million monthly active users, up from 64 million in February. The platform has also recorded nearly four billion streaming hours in the first half of the year. Tubi's success aligns with the broader trend of viewers turning to free ad-supported streaming services and moving away from premium subscriptions. The platform offers a vast content library of over 200,000 movies and TV episodes, nearly 250 FAST channels, and 200 original titles, making it a competitive player in the streaming landscape.

- Riot Games has been cautious about integrating brands directly into its games. Riot's approach is driven by a commitment to preserving the player experience and ensuring that brand integrations enhance rather than disrupt gameplay. The company is open to partnerships but emphasizes co-creating experiences that resonate with players.

- The US advertising industry is expected to grow by 5% in 2023, marking a return to pre-pandemic conditions. While this signifies a slight slowdown from the previous year's 6.5% growth, it is seen as stability. Factors like increased e-commerce during the pandemic contributed to the industry's rapid growth. Key insights include digital platforms driving growth, retail media investments reaching $42 billion, declining margins in publishing, and challenges for the TV sector due to cord-cutting and strikes.

- Duolingo is expanding its offerings to include music lessons. Users will be able to learn to play music through a series of interactive lessons that cover notes and tunes from a library of over 200 songs. The lessons are designed to be bite-sized and gamified, making the learning experience engaging and effective. Duolingo believes language, math and music are universal, and it aims to provide a comprehensive learning experience in one app. The full app will be revealed at Duolingo's Duocon conference on October 11th.

- The ongoing dispute between Disney and Charter has resulted in the blackout of Disney-owned channels for Spectrum cable subscribers. Charter seeks to incorporate Disney's streaming platforms (Hulu, Disney+, ESPN+) into its cable service without extra fees. Disney claims 71% of Charter subscribers watch its content, while Charter argues just a quarter of subscribers view Disney's networks.

- Warner Bros. Discovery has lowered its full-year adjusted earnings outlook due to ongoing Hollywood labor strikes, which it initially expected to resolve by early September. However, with no clear end in sight, the strikes are now anticipated to impact the company's financials through the end of the year. Warner Bros. Discovery now projects full-year adjusted earnings between $10.5 billion and $11 billion, down by $500 million from previous guidance. Despite this, the company has raised its free-cash-flow outlook to at least $5 billion, partly attributed to the success of the Barbie movie.

- Clubhouse is undergoing a significant pivot. It's shifting from its signature "drop-in" audio conversations to friend-centric voice chats in a bid to make the platform more like a messaging app. Users will now be encouraged to join private groups called "chats" where they can exchange voice messages with friends and friends-of-friends. The app is also introducing private audio messages, which it calls voicemails or VMs, replacing text-based direct messages. This change positions Clubhouse more as a Snapchat-like platform focused on private or semi-private communication rather than a Twitter-like open platform.

- Patreon is introducing group chats for content creators to engage with their fans, allowing up to four chats at once. Creators can control access to these chats based on subscriber tiers and customize chat names and topics. While similar to Discord, Patreon does not intend to replace it but instead offer creators a native option for building a community. This move is part of Patreon's strategy to provide more features in-house rather than relying on third-party platforms.

- FaZe Clan, an Esports lifestyle company, went public in July 2022 at a valuation of $725 million through a SPAC merger, however, its stock price has plummeted by approximately 97% since then, resulting in a market cap of around $20 million. For the first half of 2023, FaZe reported earnings of $24.2 million but incurred a net loss of $28.4 million, reflecting a 30% decrease in earnings and a 50% increase in net losses compared to the same period in 2022.

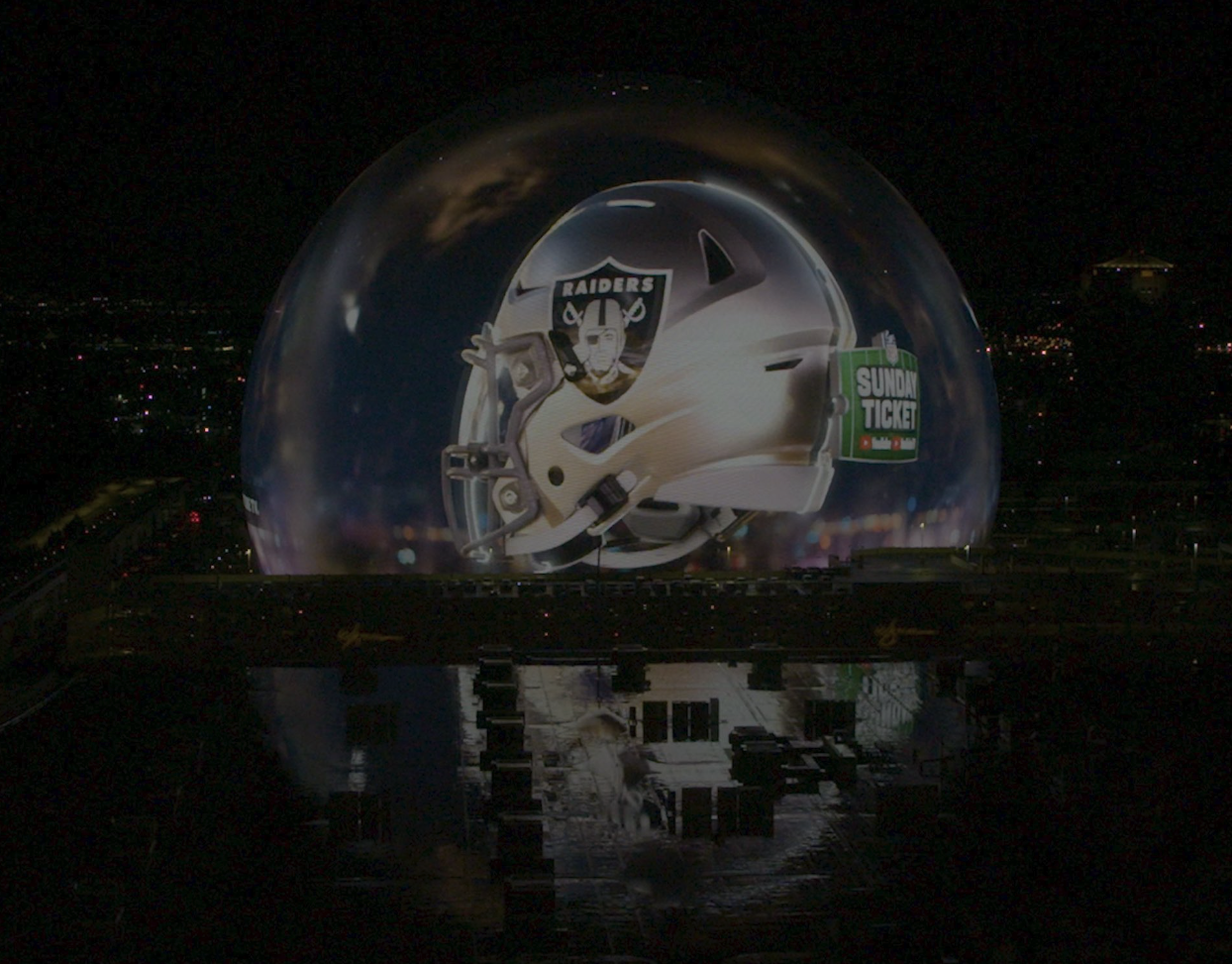

- YouTube has made its first significant ad buy on the Exosphere in Las Vegas, the largest LED screen on Earth. YouTube's marketing team and Google Media Lab worked with YouTube's internal Creative Studio team and agency partner Media Monks on the creative, while GroupM’s EssenceMediacom handled the media buying.

- E3 is facing uncertainty as its organizer, the ESA has parted ways with ReedPop, the organizer of PAX events. This comes after several major gaming companies, including Microsoft, Sony, and Nintendo, withdrew from the event in recent years. However, the ESA has not officially canceled E3 and is reportedly planning a "complete reinvention" of the event in 2025.

- The LEGO Group's internal creative agency, Our LEGO Agency (OLA), has made three senior creative hires as part of its efforts to adapt to the evolving consumer landscape and advance the LEGO brand vision. Andy Grant has been appointed as global creative lead, brand; Clarence Chiew as creative director, China; and Rudi Anggono as creative director in the Americas region. OLA is responsible for global advertising campaigns and local activations across the LEGO brand's play experiences.

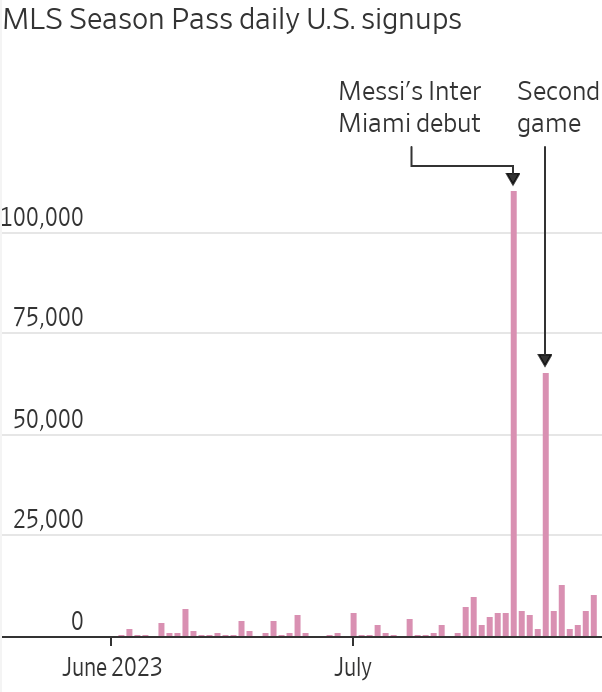

- Apple TV+ and MLS Season Pass experienced a significant increase in U.S. subscriptions following soccer superstar Lionel Messi's North American debut with Inter Miami. On the day of Messi's debut, MLS Season Pass saw over 110,000 new U.S. sign-ups, while Apple TV+ also enjoyed a boost in subscriptions in July, marking its strongest month for new U.S. customers this year. The partnership between Apple and MLS highlights the potential benefits of rights and distribution agreements with major sports leagues for streaming platforms. As consumers cut the cord and migrate to streaming services, the integration of live sports becomes crucial in attracting and retaining subscribers.

- Apple is significantly increasing its spending on AI development, focusing on conversational AI, LLMs, and language generation. Apple's AI chief, John Giannandrea, initiated the development of conversational AI four years ago. Apple's Foundational Models team, led by Ruoming Pang, consists of former Google engineers and is testing chatbots for potential use in customer service. Additionally, Apple's Siri team plans to incorporate these models to enable users to automate complex tasks via voice commands.

- Meta is considering offering paid versions of Facebook and Instagram to users in the EU that would not include advertisements. This move is seen as a response to increased regulatory scrutiny regarding data privacy and advertising practices. By offering a paid subscription option without ads, Meta aims to provide an alternative for users concerned about privacy and data collection.

- Kraft Heinz is intensifying its marketing efforts aimed at schools, students, and parents, including distributing special versions of its Lunchables products to schools. The company has introduced a campaign called "FUNdamental Textbooks," where packaging resembles textbooks and contains information related to Kraft Heinz products. The campaign is drawing criticism from health advocates, quoting: “The Lunchables on the cafeteria line are different from what’s in the grocery store,” said Sam Hahn, a policy coordinator for school foods at the Center for Science in the Public Interest. “But kids don’t know that, and it could lead them to associate this with what’s in the grocery store".

- VCCP London is expanding its creator team and on-site facilities to tap into the growing creator economy. The team is headed up by two social creative directors, David Feldman and Milan Desai formerly of TikTok and Expedia. The whole team will consist of ten in-house creators with access to a network of five million external creators. The offering also includes the VCCP Creator Studio, a dedicated space for production.

- PepsiCo has increased its global first-party data records by 50% in the last 18 months by collecting people's email addresses through reward programs, QR codes on product packaging, in-store point-of-sale systems, and TV ads. The strategy aims to offer consumers incentives to share their email addresses, leading to better-targeted marketing and increased revenue. To foster strong consumer relationships and gather first-party data, PepsiCo has expanded its strategy from one-off engagements to an ongoing approach spanning different markets. This approach involves understanding local culture and consumer behaviors to tailor rewards and incentives accordingly.

- What I Learned from Selling a Show to Netflix

- BMW drops plan to charge a monthly fee for heated seats

- The Rise and Fall of ESPN’s Leverage

- UFO videos, newly declassified, now live at this Pentagon website

- The End of Airbnb in New York

- One in 10 agency staff has quit their job due to stress of pitching

- Spotify's $1 Billion Podcast Bet Turns Into a Serial Drama

- TikTok is making a notable push into messaging

- Will US mortgage rates remain above 7%?

- Meta is back in the office three days a week

- TikTok & TBWA Unveil Joint Whitepaper Encouraging Businesses to Embrace Creativity

- Ghostwriter is back with a new song and is chasing a Grammy

- Sony: more features for PlayStation are best bet for sales growth

- Inside Meta’s AI Drama: Internal Feuds Over Compute Power

- Apple Quietly Made a Big Change to Its Website

- What We Can Learn From AI Startups in Y Combinator’s Latest Batch

- Spotify is reportedly limiting ad payouts for white noise podcasters

- Health-Insurance Costs Are Taking Biggest Jumps in Years

- Why AI Will Unlock a Massive Market for Online Consumer Services

- Should adland stop using outdoor mock-ups?

- Apple reduces cost of MLS Season Pass to $29 for the rest of the season

- Musk Reportedly Took A $1 Billion Loan From SpaceX Just Before Buying Twitter

- Are We Over-Analysing Advertising?

- OLIVER Sets Up Global AI Client Council

- Google will require election ads to ‘prominently disclose’ AI content

- Sun-Maid Names quench as Lead Social Media Agency

- Audi names new CMO, expanding the role to include communications

- Why DTC brands are increasing out-of-home marketing

- How Montana’s Attorney General Made Banning TikTok a Top Priority

- Illumina Names New Chief Executive

- Anthropic’s Claude AI chatbot gets a paid plan for heavy users

- What kind of password reset scam is going on at Facebook?

- Intel joins Apple, Alphabet and Samsung as an Arm investor

- OpenAI will host its first developer conference on November 6

- HubSpot unveils strategy to integrate AI across the platform

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion