May 4 2023 - NewFronts, WGA & The Fed

👋Happy Thursday, and wow did it come quick. We've got the Fed raising rates, your daily NewFronts/WGA rundown, and yes– the AI beer commercial as well. All this and more below.

Quick Take

- The Fed raises rates, but signals at potential future pause

- NewFronts - Day 2, more splashy presentations, more ad products - but sentiment on buying seems sluggish

- WGA strike might actually be financially beneficial for the studios looking to reduce costs

The Federal Reserve has raised interest rates by another quarter percentage point, marking its tenth consecutive rate increase to battle inflation. Officials signaled that they could be done lifting rates after that, by cutting a phrase from their previous policy statement in March, which had said some additional policy increases might be appropriate. The statement said they would monitor economic and financial-market developments to determine the extent to which additional policy firming may be appropriate to return inflation to 2% over time. All 11 voters on the rate-setting Federal Open Market Committee agreed to the decision.

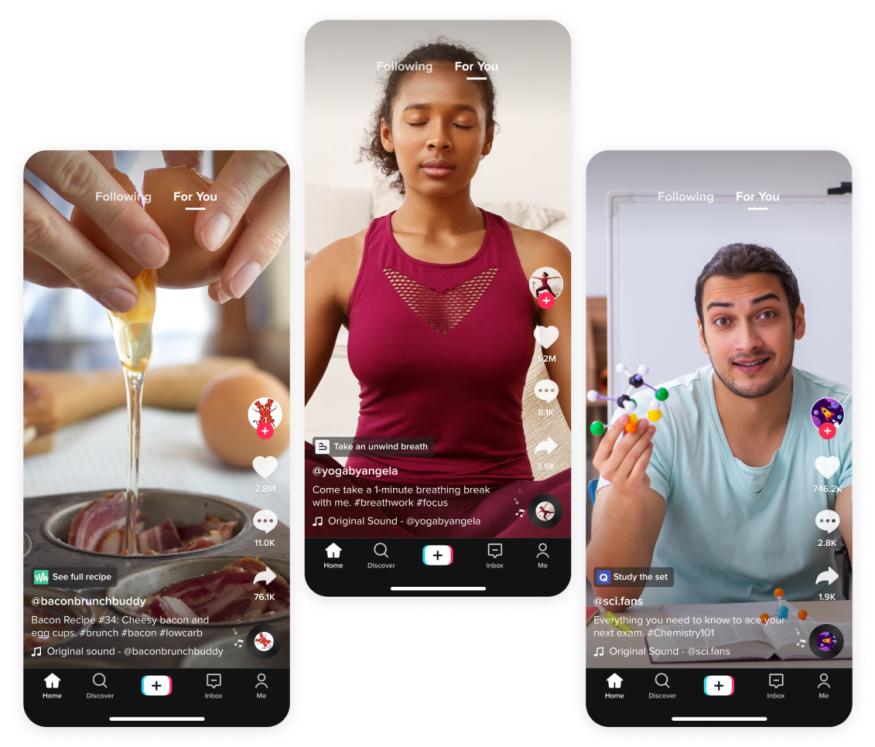

TikTok is launching a new ad product called Pulse Premiere that will allow select publishers, such as Condé Nast, BuzzFeed, and NBC, to sell ads alongside their posts, taking home 50% of the revenue. The new product, which is the evolution of TikTok's Pulse program for elite creators, will sell ads against all posts from participating publishers. The move creates another revenue opportunity for TikTok, while publishers get to generate revenue directly on the platform.

The WGA' strike may allow studios and streaming services to save money by terminating contracts. In the event of a prolonged strike, studios are expected to try to exit deals with writers by invoking "force majeure" provisions in contracts, which allow parties to sidestep contractual obligations in extraordinary circumstances outside of their control.

Unity has laid off 600 staff members in its third round of layoffs and will reduce the number of its offices from 58 to 30 or less over the next few years due to fears of an economic recession. The CEO stated that the layoffs are about "setting ourselves up for higher growth" by reducing the number of layers within the company. Unity plans to restructure specific teams and expects to incur $26 million in charges in connection with the restructuring.

- The WGA is seeking to restrict the use of generative AI in writing film and TV scripts as part of an ongoing strike. WGA writers have two main concerns about automation in writing: they don't want their material to be used as training data for AI systems, and they don't want to be tasked with fixing AI-generated "sloppy first drafts." WGA writers are fighting to make sure that a ChatGPT-generated first draft would not be counted as "literary material" or "source material," which are terms defined in their contract. The WGA argues that existing scripts should not be used to train AI systems, to avoid potential IP theft.

- R/GA has announced the launch of its new government practice led by Tish Karunarathna, which will oversee a newly formed partnership between the agency and the Australian Government as its founding client. This work will see the global creative and digital product agency build a large-scale team that leverages R/GA’s core practices and services the client in Canberra, Sydney, and Melbourne. R/GA’s new practice will focus on bridging the gap between public policy and citizen engagement by leveraging the agency’s existing capabilities across brand, communications, experience, data, and technology.

- NewFronts: According to a recent survey by Digiday, publishers are less optimistic about this year's NewFronts and upfronts compared to last year. While 35% of publishers expect buyers to spend somewhat more during this year's NewFronts, that's down from 45% who said the same last year.

- Microsoft's Chief Economist, Michael Schwarz, has warned that artificial intelligence will cause "real damage" if it falls into the wrong hands. Speaking at a panel event in Geneva, Schwarz said he was confident that AI would be used by bad actors and urged regulation to curb its misuse. Microsoft has invested billions of dollars in AI, and has acknowledged that advanced AI presents serious risks.

- Sephora has hired Zena Srivatsa Arnold, formerly a senior VP at PepsiCo, as its new chief marketing officer. Arnold will start her role in early summer and will oversee Sephora's marketing leadership team, including personalization and performance marketing, loyalty, creative marketing, integrated marketing, and external communications. With more than 20 years of experience in marketing, Arnold has also worked for Kimberly-Clark, Google, and Kellogg. Her appointment comes after Deborah Yeh moved into a global chief purpose officer role at Sephora in January, leaving the CMO role vacant.

- TRIPTK, Havas' brand transformation studio, has appointed Alex Cripe as Managing Partner, Strategy and New Ventures, TRIPTK London. Cripe brings 15 years of brand strategy experience with innovation agencies and client-side brand leadership roles. In his new role, he will be leveraging his consumer insights, innovation, and partnership expertise to drive transformative brand strategies, new revenue models, and strategic venture initiatives. TRIPTK has grown by 400% since its inception in 2018 and established a global footprint with a data and analytics hub in Amsterdam, a design studio in Mexico City, and regional hubs in London and Singapore.

- Minute Maid's Reimagined Billboards Help You Enjoy an Extra Dose of Vitamin D

- CEOs of Google, Microsoft, OpenAI, and Anthropic have been invited to a meeting with Vice President Kamala Harris and top administration officials to discuss key AI issues, including privacy violations and bias.

- Jenny Craig, the weight loss and nutrition business is set to shut down its company-owned centers after four decades of operation due to failed attempts to secure additional financing. The company had been seeking a buyer and plans to move to an online-only model. With increased competition, including from new weight loss drugs, and the pandemic forcing customers to stay home, the brand has struggled. The closure will affect over 1,000 workers.

- Airbnb announced over 50 new features and upgrades to its platform on Wednesday, including the introduction of "Airbnb Rooms," which will enable travelers to stay with locals in their spare rooms. Airbnb has also partnered with buy-now-pay-later service Klarna and changed the fees guests are charged for longer-term stays. The company revealed that it has bookings in over 72,000 cities worldwide ahead of the summer.

Meet Airbnb Rooms — an all-new take on the original Airbnb pic.twitter.com/SMN8frTWMJ

— Brian Chesky (@bchesky) May 3, 2023

- CVS Health's Q1 revenue rose to $85.28 billion from $76.83 billion a year earlier, beating Wall Street estimates, while the company's profits fell. The healthcare company has cut its earnings projection for the full year due to the impact of its acquisitions of Signify Health and Oak Street Health, which represent a significant expansion of its services in the healthcare sector. CVS said it may consider more acquisitions in the future, but for now, it will focus on digesting Signify and Oak Street.

- The NFL utilized Gen Z content creators and social media influencers to connect with younger audiences during the NFL Draft. The NFL had over 40 content creators on the ground during the event and plans to continue leveraging social media influencers for future events. The NFL's revamped youth-focused strategy aims to put a spotlight on creators to move the needle in terms of NFL viewership

- Stripe has announced a strategic payments partnership with Uber in which the two companies will work together on selected services in eight of Uber's biggest markets, including the U.S., the U.K., Canada, Mexico, Australia, and Japan. Financial terms of the deal were not disclosed. Stripe will power bank account payments for Uber's ride and food delivery services through its Financial Connections and Link tools. Stripe has recently signed enterprise deals with Amazon, Microsoft, and BMW.

- Yum Brands has reported a $1bn year-on-year increase in digital mix, which now represents nearly $7bn or 45% of global sales. Taco Bell saw an 8% improvement in digital mix after adding delivery through its app. Recommended ordering AI that recommends how much product restaurant managers should order each week has reduced off-cycle and transfer orders at Taco Bell by 70%.

- Ford CEO Jim Farley confirmed that the company has no plans to drop support for CarPlay, Apple's in-car infotainment system. In contrast, General Motors announced plans to phase out support for both CarPlay and Android Auto starting in 2023. Farley mentioned that Ford has no intention of abandoning CarPlay due to its popularity with Ford customers, with 70% of its customers in the US being Apple users. Additionally, Farley stated that Ford is focused on safety, security, autonomy, and productivity features instead of content consumption, which he believes has already been lost to other companies.

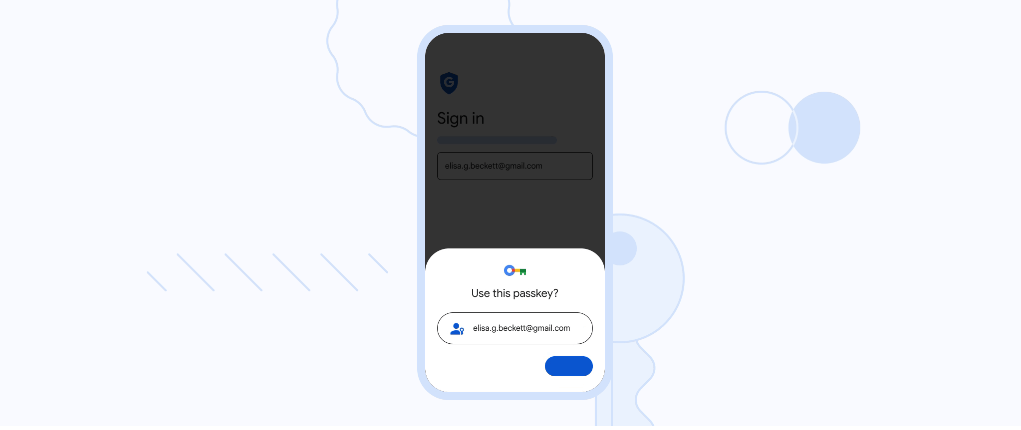

- Google has started rolling out passkeys as an alternative to passwords on all major platforms, including Google Accounts. Passkeys allow users to sign in to apps and websites using their device's fingerprint, face scan or screen lock PIN instead of passwords. Passkeys are more secure than passwords because they are resistant to online attacks.

- Discord is growing up, so everyone needs to pick a new username

- My Weekend With an Emotional Support A.I. Companion

- How This CPG Brand Convinced Target to Put Food in the Toy Aisle

- Aldi plans to open 120 new stores this year as the no-frills German grocer doubles down its US expansion

- Starbucks CEO worked in stores and said he found too many shortages and 1,500 combinations for cups and lids

- Morella Chocolates visual identity and packaging design

- WGA Plans Rallies For May 15 In L.A. And New York As Strike Enters Second Day

- Meta warns Facebook users about malware disguised as ChatGPT

- You Can Now Claim a .Dad Domain for Your Website. Cue the Dad Jokes

- Slack’s CEO Wants You to Stop Slacking So Much

- FTC seeks to ban Meta from monetising children’s data

- Blue verified checkmarks are coming to Gmail

Had to post the Twitter link because the Smash Mouth song makes it

this AI beer commercial looks exactly like how an alien intelligence would understand our beer commercials pic.twitter.com/mn3OzW32ww

— Armand Domalewski (@ArmandDoma) May 1, 2023

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion