May 3 2023 - WGA, NewFronts & Earnings

👋Happy Wednesday friends. Well, earnings have been generally positive across the board, yet mass layoffs and job openings at all time lows. All eyes on the Fed meeting today and potential rate hikes. All this and more below –

Quick Take

- WGA announces strike, impact is immediately felt

- Another day of positive earnings across the market

- NewFronts + new ad products galore

The Writers Guild of America announced that 11,500 television and screenwriters have gone on strike, ending 15 years of labor peace in Hollywood. The strike, which began after the union's three-year contract expired, has already impacted many productions. The dispute centers around union proposals for compensation and work conditions, with studios balking at mandates to staff television shows with a set number of writers. The WGA says the survival of writing as a profession is at stake.

Uber reported a 29% increase in revenue in Q1 2023, driven by demand for its ride-share and delivery services, and beating Wall Street's expectations. While the company posted a loss, adjusted earnings before interest, taxes, depreciation and amortization hit $761 million, a figure Uber executives consider important in signalling a path to profit. The company also projected continuing growth, and expects adjusted earnings of between $800 million and $850 million in the current quarter. The delivery business continues to expand, and its advertiser base has grown more than 70% year on year.

US job openings dropped to their lowest level in nearly two years in March and layoffs rose sharply, led by job losses in construction, leisure and hospitality, and healthcare industries. The data suggests that demand for workers is cooling down, a year after the Federal Reserve began lifting interest rates to combat inflation. Meanwhile, the unemployment rate in March remained near a 53-year low, showing that the labor market remains solid.

Starbucks has reported an increase in net income of 35% for Q2 2023, citing higher prices and improved operations for the boost. The company's CEO said that better employee retention helped keep drinks and customers flowing through its cafes, although wage and supply costs still impacted profits at Starbucks's North American stores. The coffee chain's US same-store sales were up 12% for the quarter compared with the same period last year.

Ford reported a $1.8 billion net income in the first quarter of 2023, as high-end model sales and increased demand for F-series pickups and SUVs boosted profits. Ford lowered prices on its electric Mustang Mach-E for the second time this year, cutting the sticker price up to 8% on some versions, to be more competitive with Tesla. However, Ford's EV unit reported a loss of $722 million for the quarter, reflecting its status as a startup building scale.

- Apple has been granted a patent for an augmented reality windshield display system for vehicles that could display information about the vehicle's speed, warn drivers about entering a school zone, provide clearer road signs, and highlight important landmarks. The patent describes how a graphical overlay could be used on the windshield to provide drivers with relevant information based on the vehicle's environment. The AR display system could determine a blind spot and simulate one or more objects in the environment. It could also provide a representation of a particular driving zone in the environment, such as a school zone or a zone associated with differently-abled individuals.

- NewFronts kicked off with digital content platforms and publishers pitching new ad offerings and slates of video shows. Platforms such as YouTube, Vizio, and Amazon focused on their ability to engage specific audiences, particularly Gen Z and diverse and passionate entertainment and sports viewers. The IAB reports that ad spend in the US grew twice as fast in the digital video space compared to the overall digital media market in 2022, and digital video advertising is projected to hit $55 billion in 2023.

- Cohere, a Toronto-based start-up founded by ex-Google AI researchers, has raised $250 million in funding, with a valuation of around $2 billion. Cohere builds AI technology for chatbots, search engines and other products, and is among a few start-ups in competition with OpenAI and other tech giants in the field of generative AI. Cohere's investors include Salesforce, Nvidia, Inovia Capital and Index Ventures.

- TikTok's head of trust and safety for the US, Eric Han, is leaving the company on May 12th. Han was a key leader for the separate entity TikTok recently created to try and avoid a US ban. His departure comes as TikTok is still trying to clinch a deal to avoid a ban by the US government. TikTok's fate in the US feels as uncertain as ever right now, with states like Montana trying to ban the app and the bipartisan RESTRICT Act making its way through Congress.

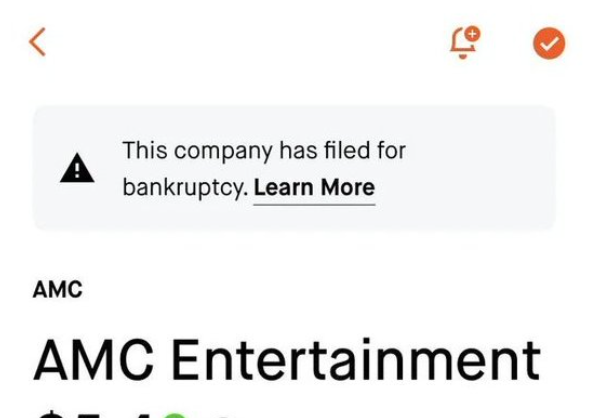

- Robinhood mistakenly posted a banner that AMC Entertainment had filed for bankruptcy, which was quickly removed after three minutes. This error drew criticism from the CEO of AMC, Adam Aron, who called the mistake ludicrous, wrong, and irresponsible. The first-quarter earnings of AMC will be published on Friday.

- Apple and Google have proposed industry-wide standards to address the misuse of Bluetooth trackers like Apple's AirTag. The proposed universal settings would make Bluetooth devices detectable by both Apple iOS devices and Google Android. The proposed specs would require all devices to include at least one open Bluetooth connection detectable by outside apps and devices. The constant signal would hide the device's identity but allow for "non-owner unencrypted connections to the accessory."

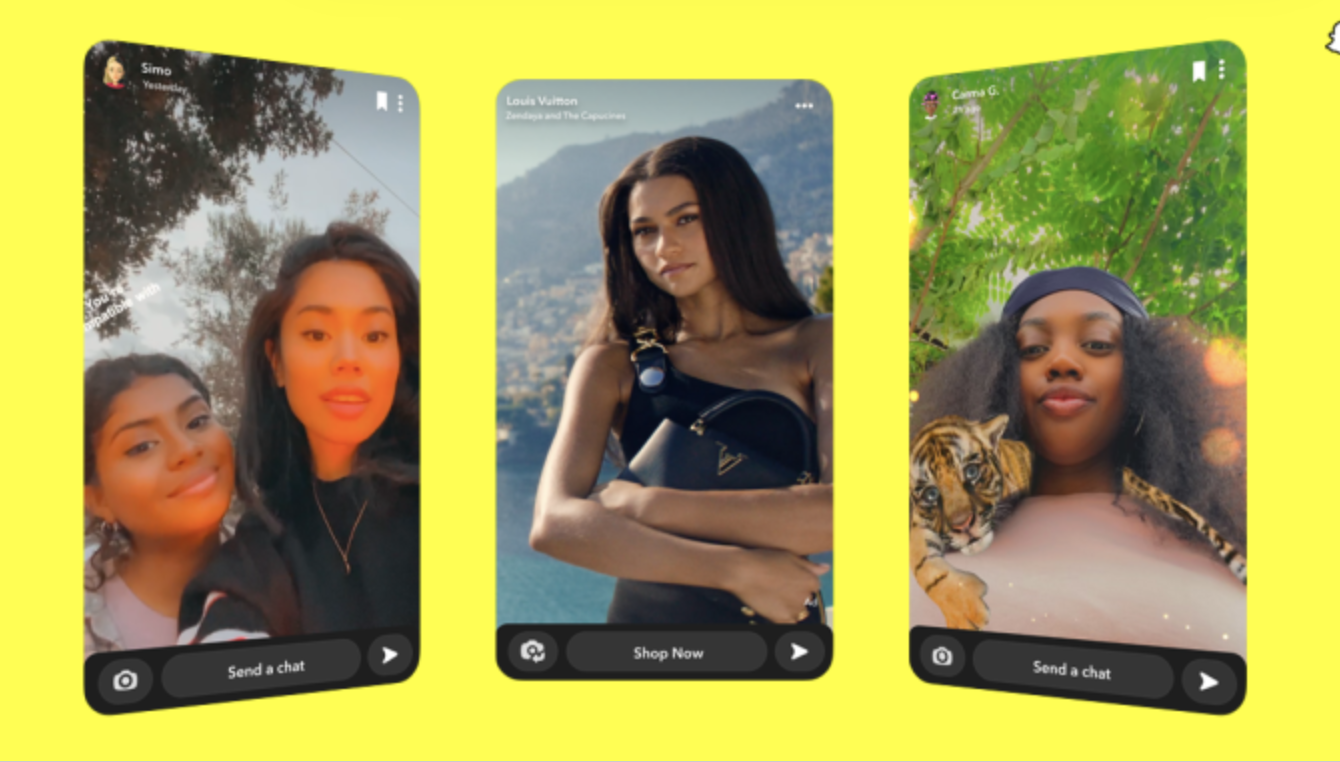

- Snapchat presented new features for brands at the NewFronts, including "First Story," which lets brands reserve the first video seen by Snapchat users between Friend Stories. The unit has the potential to reach more than 50 million daily users in the US. Other features included ads on the Spotlight platform, Snap Star Collab Studio, sponsored links inside AI offering My AI, and content deals with media companies, including exclusives for the Women’s World Cup and the 2024 Summer Olympics in Paris.

- In-house agency trends are confirmed to be here to stay, according to a new study by the Association of National Advertisers. The study found that 82% of ANA members now have an in-house agency, up from 78% in 2018. Cost efficiency was cited as the primary benefit of an in-house agency. Despite the growth of in-house capabilities, 92% of respondents still use external agencies. Challenges for in-house agencies include managing growth and talent. The study, conducted every five years, surveyed 162 respondents in February and March 2023.

- Is S4 Capital’s brave bid to challenge the ad establishment running out of gas?

- Oatly has partnered with Minor League Baseball (MiLB) to create a new approach to sports marketing that avoids the traditional logo slapping approach. Oatly and MiLB have created new half-time shows, new rituals, a designated “oatfield”, a “sixth-inning shrug” and an “eighth-inning eye roll.” The partnership includes 120 stadiums in the US and Canada, with Oatly’s dairy-free frozen bars available at more than 50 ballparks.

- Peacock has unveiled four new ad formats to create an overall cinematic experience for marketers at the IAB NewFronts presentation. Among these formats is Spotlight+, which offers full brand takeover and Marquee Ads, an interactive format to engage viewers. NBCUniversal’s streamer is also evolving its pause ads with the Power Break format, which produces data-informed pause ads to customize a brand's message. Peacock is integrating shopping into its platform with AI-powered Must ShopTV, allowing fans to buy products that appear in NBCU content. The streamer is bringing Universal Filmed Entertainment Group movies 45 days after their theatrical release, with pre-roll and pause ads emulating cinema previews.

- CEO David Droga discusses the business of creativity, emerging tech, and lessons learned as a leader

- Ashton Kutcher's venture capital firm, Sound Ventures, has raised $240 million to invest in AI companies. The firm already has OpenAI, Anthropic and StabilityAI in its investment portfolio. Sound Ventures will invest in AI businesses at a foundational model layer, believing it will play a significant role in all areas of life, including the entertainment industry. Sound Ventures, co-founded by Kutcher and talent manager Guy Oseary, manages over $1 billion in assets and has previously backed companies such as Airbnb, Uber and Spotify.

- In an excerpt from his new book, Marcus Collins, head of strategy at Wieden+Kennedy and marketing professor at the University of Michigan, argues that brands need to focus on cultural connections to truly engage consumers. He explains that brands have evolved from being legal marks of ownership to trust marks, love marks, and finally, identity marks. Brands that dominate culture have evolved into "tribal marks," where people use them to project themselves based on the meaning and ideological associations they carry.

- SNL cancels Pete Davidson-hosted episode due to WGA strike

- Samsung bans staff’s AI use after spotting ChatGPT data leak

- This Robot Can Paint. But Is It Art?

- McDonald’s appoints international CMO

- BP Beats Expectations With $5 Billion Profit

- Box is partnering with OpenAI to bring generative AI tools across the platform

- Here Are The Best Memes From The 2023 Met Gala

- Twitter backtracks, lets emergency & traffic alert accounts keep free API access

- Pfizer first-quarter results beat expectations despite COVID-19 vaccine sales plunge

Minute Maid rebrand via It's Nice That

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion