May 11 2023 - Google I/O, AI & The Economy

👋Happy Thursday friends. Another busy day with a flurry of new products/services from Google I/O, earnings mania, AI news and the strike. Let's get into it–

Quick Take

- Google I/O dedicated roundup section below w/ everything announced

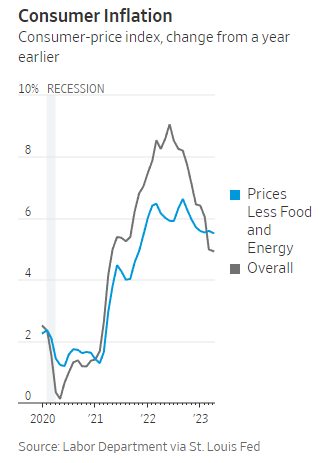

- CPI data shows inflation easing, but we still have a long way to go

- Disney earnings call had lots of nuggets of information, one big call out, quoting Bob: "We will soon begin offering a one-app experience domestically that incorporates our Hulu content via Disney+”

The latest Consumer Price Index (CPI) report by the Labor Department shows that inflation has slightly eased in April, but it remains historically high. The CPI rose by 4.9% compared to a year earlier, which is down from March's 5% increase. The core prices, which exclude volatile food and energy costs, rose by 5.5% from a year earlier, indicating a slightly slower increase than in March. The report suggests a risk that interest rates may need to remain high for longer than assumed. The Federal Reserve is looking to see signs of inflation declining towards its 2% target, and they may pause rate increases at their next meeting. Investors see a 14% chance that the Fed would raise rates at the meeting

Disney has reported a smaller loss from streaming for the last quarter, with its operating losses coming to $659m. This marks a significant improvement from its operating losses of $1.1bn in the previous quarter, Disney's linear networks reported a decrease of 35% from the previous year. The company's earnings were buoyed by its theme parks and cruise ships, with operating profit in this segment climbing by 22% to $2.2bn.

BuzzFeed's Q1 earnings call revealed the company's shift towards influencer-led video and generative AI while downplaying its recent decision to close its Pulitzer Prize-winning news division. Despite facing a 27% YoY decline in overall revenue to $67.2m, BuzzFeed is relying on its affiliate marketing business to grow commerce revenue 6% to $11.3m. The company is focusing on growing HuffPost's audience, which it says attracts more direct traffic than "platform-dependent" BuzzFeed News. BuzzFeed is bullish about using AI to generate more sponsored content as audiences, quote "love the interactivity, personalization and shareability" of such content.

TikTok, has delayed the rollout of its shopping platform in the US, as concerns about the video-sharing app's future are deterring merchants from joining. Originally intended for early spring, the opening of the shop has been postponed to June at the earliest due to slow adoption of live-streaming e-commerce and merchant concerns about a possible ban of the app. The delay is a setback in ByteDance's most lucrative market outside China, as its U.S. business faces headwinds that include rising geopolitical tensions and intensifying e-commerce competition.

The New York Times added 190,000 digital subscribers last quarter, partly driven by subscriptions to a bundle of products that includes The Athletic sports site, bringing the company's total digital subscriber base to 9 million. However, the company's adjusted operating profit was $54 million, a drop of 11% from a year earlier, as the new subscription revenue was offset by higher operating costs and lower advertising revenue. The Times has been trying to offset declines in its print business with new revenue from digital subscribers, offering readers a bundle of online utilities including a cooking app, a shopping service, games, and The Athletic.

Electronic Arts reported a strong Q4 performance for fiscal year 2023, with net bookings rising 11% YoY to $1.9bn, propelled largely by its biggest franchises like Apex Legends and FIFA. EA CEO Andrew Wilson noted that Apex Legends had an average of 20 million monthly active users throughout the year, while FIFA 23 was the most successful launch in franchise history and saw net bookings grow 31% YoY compared to FIFA 22. EA also released its forecast for fiscal year 2024, predicting net bookings of between $7.3bn and $7.7bn, in part due to lower sales for EA Sports FC following the change in branding.

- Pixel Fold / Pixel 7a / Pixel Tablet

- Android 14

- Wear OS

- PaLM 2 AI Model

- Search Labs

- Bard

- AI in Photos & Workspace

- ML Hub

- Bard + Adobe Firefly

- Disney CEO Bob Iger announced that a single streaming app, combining programming from Disney+, Hulu, and ESPN+, will be rolled out by the end of this year. The three services will continue to be available as standalone offerings, and the combo will bring greater opportunities for advertisers and a more unified streaming experience for bundle subscribers. Additionally, Disney will rationalize its streaming content output and investment. The company would take a $1.5 billion to $1.8 billion impairment charge related to content cuts and other streamlining related to the move.

- Amazon has launched a new shopping platform called Amazon Anywhere, which allows customers to buy real items within virtual worlds like games. The company is rolling out this feature within Peridot, Niantic's new AR pet simulator mobile game, where players can purchase physical merchandise within the game's app if they link their Amazon account. Amazon Anywhere could be rolled out to other games or virtual worlds in the future. The VP of Amazon's consumer electronics says this partnership with Niantic showcases new ways for customers to discover products beyond traditional online storefronts.

- Google and Adobe have announced that they will be incorporating Adobe's Firefly AI image generator and Express graphics suite into Bard, allowing users to generate, edit, and share AI images directly from the chatbot's command line. Users will be able to generate an image with Firefly, then edit and modify it using Adobe Express assets, fonts, and templates within the Bard platform directly. The companies will also use Adobe's existing Content Authenticity Initiative to mitigate some of the threats to creators that generative AI poses. Bard users can expect to see the new features begin rolling out in the coming weeks.

- Pentagram and social enterprise Ambessa Play have partnered to create a DIY flashlight kit that will be sent to children in refugee camps. The Ambessa Play flashlight, which operates on a battery-free wind-up mechanism, is designed to be easy for children to assemble and has a colourful and tactile appearance. Pentagram partner Jon Marshall led the industrial design of the flashlight, which was chosen through workshops with children in refugee camps. The flashlight's external design was finalised by the children, who chose the flat, wallet-sized shape because it was the most compact and could be placed upright for reading.

- Asos has reduced marketing spend by 8% YoY for H1 2023 to prioritize profitability over top-line growth. The online fashion retailer saw active customers decline by 600,000 YoY to 24.9 million. CEO José Antonio Ramos Calamonte said the focus was on improving core profitability, while Asos reduced investment in customer acquisition and curtailed marketing spend in weak consumer demand periods and regions.

- Uber has started offering train, bus and flight bookings in the UK through a partnership with travel booking agency Hopper. Train bookings have been popular since being added to the app, with sales growing 40% every month. Uber will take a small commission from each sale and may add a booking fee in the future. Although flight bookings are only available in the UK at present, the company hopes to expand to more countries in the future.

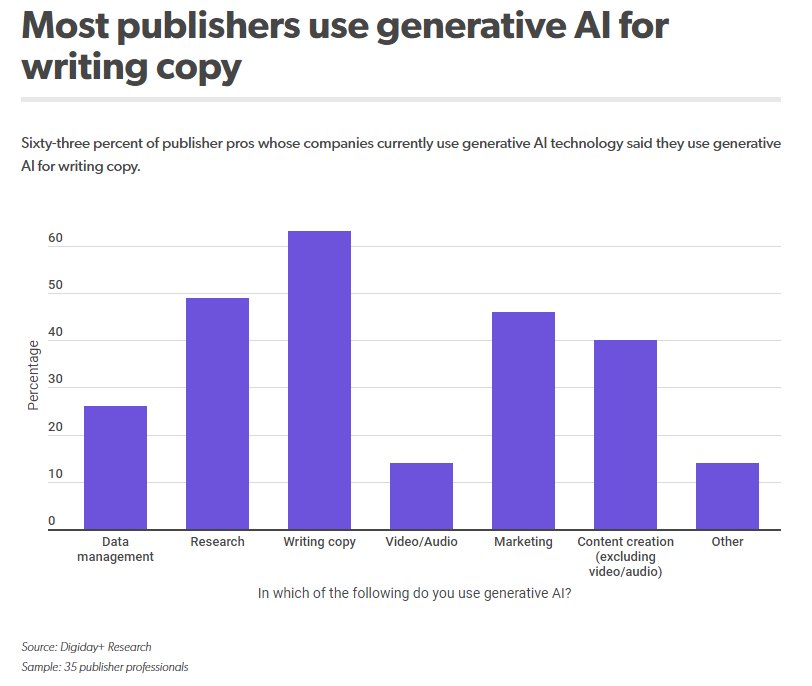

- A survey by Digiday+ Research found that 49% of publishers are already using generative AI, with 54% of those who are not using it saying they plan to incorporate it in the next year. Of those who said they are already using generative AI, the largest percentage (63%) said they use it for writing copy, followed by research (49%), marketing (46%), content creation (40%), and data management (26%). Publishers like BuzzFeed, Forbes, and Ingenio have dedicated teams overseeing their AI initiatives and are looking to incorporate AI in new AI-based products, cut costs, and find new revenue opportunities.

- Intel has confirmed plans to reduce its workforce but did not disclose how many employees would be affected. The semiconductor chip manufacturer made the decision after it reported its largest quarterly loss in company history last month, with a net loss of $2.8bn and a 36% YoY fall in revenue. Despite the loss, Intel paid out $1.5bn in dividends.

- Meta has announced that it will no longer allow creators using its Horizon Worlds social VR platform to create dedicated events, according to the v109 update notes. Meta is positioning the change as the shutdown of a feature that doesn’t meet its standards, but creators are concerned that it will be much more challenging to build communities on the platform without the ability to create dedicated events.

- Google has opened up access to its MusicLM text-to-music AI, which generates music based on text prompts. The public version does not allow users to generate music with specific artists or vocals, which could help avoid copyright issues. Users can try prompts based on mood, genre, and instruments, and the AI generates two tracks for selection by the user to help improve the model. Google has been working with musicians like Dan Deacon to explore how the technology can empower the creative process.

- Microsoft's CEO, Satya Nadella, has informed company managers that full-time staff will not receive raises this year due to "tumultuous economic conditions," although hourly employees are still eligible. Nadella also stated that bonuses and stock awards will not be overfunded, and employees will still be able to pursue promotions within the company. The decision was not taken lightly, and the company believes it is necessary for long-term success. Microsoft's decision to cut raises for full-time employees follows lay-offs of over 10,000 employees in January, indicating that the company is having trouble balancing its finances.

- Apple TV's top executive in charge of its video and sports businesses, Pete Distad, is departing from the company this month. His departure marks the latest major exit from Apple's services division, which accounts for about a fifth of the company's sales. Apple has been pushing sign-ups of its services through various promotions and bundles. Distad was responsible for Apple's ambitious push into television shows, movies, and sporting events. His division negotiated deals with Major League Soccer and Major League Baseball, and turned the Apple TV set-top box into a hub for video content.

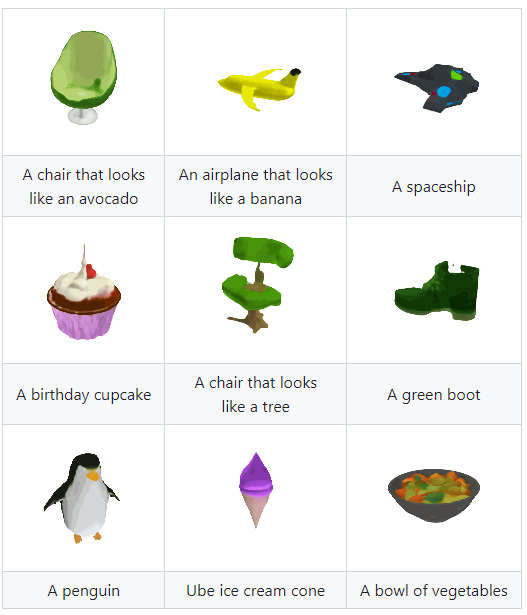

- OpenAI has created a new model called Shap-E, which generates 3D objects from text, similar to how Dall-E creates 2D images. Unlike other 3D generative models that produce a single output representation, Shap-E generates the parameters of implicit functions that can be rendered as both textured meshes and neural radiance fields. The model is trained on a combination of mapping 3D assets and a conditional diffusion model. Shap-E is free to download from GitHub and can be accessed on Microsoft Paint 3D, and it works when converted into an STL file, which allows the renders created to be brought to life via 3D printers.

- Meta is testing a new performance-based payment model for ads on Reels that will compensate creators based on total views instead of a share of ad revenue. The company is growing the pool of eligible creators for Facebook's Ads on Reels program and will soon begin testing the model on Instagram.

- A Delaware court has rejected a shareholder lawsuit over Jack Dorsey-controlled Block's purchase of music streaming service Tidal for around $300m, despite calling the acquisition a "terrible business decision." The judge said the independent board had the right to make bad decisions as long as it acted in "good faith." Block's senior executives had opposed the purchase, which was approved unanimously by independent directors including Sequoia Capital's Roelof Botha. The judge's ruling could be seen as a setback for corporate governance. Tidal was facing a criminal probe in Norway for "artificially inflating its streaming numbers" at the time of the acquisition, while Jay-Z had to lend the platform $50m in 2020.

- Every known Apple TV+ show cancelation so far

- Kidrobot Chief Creative Officer Frank Kozik Passes Away

- AI will create ‘a serious number of losers’, warns DeepMind co-founder

- Uber Launches Global Media Agency Review for $600 Million Account

- The new Google Home app is finally here

- WGA Raises $1.7 Million To Help Industry Workers Impacted By Strike

- Sonos stock tanks 21% after audio equipment maker cuts guidance on ‘softening demand’

- Disney CEO Bob Iger Calls AI “Disruptive,” Difficult To Manage From An “IP Perspective”

- VW ID Buzz electric camper van with portable toilet and mini fridge is a vibrant luxury hotel on wheels

- Airtable is bringing AI to your workflow

- The Companies Trying to Make Live Shopping a Thing in the U.S.

- WGA Strike: Chanel Event At Paramount Has Big Names Confused About Picket-Line Protocol

- NBCU Previews 'Powerful' Upfront Event Amid CEO Upheaval, WGA Strike

- Epic’s Fall Guys adds a creative mode so players can design their own levels

- TikTok offers brands performance marketing tips in new advertiser hub

Creatures That Don’t Conform

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion