May 10 2023 - Earnings, AI and The Strike

👋Happy Wednesday all. Well, after a slow Monday/Tuesday, we're making up for it today. Let's get into it –

Quick Take

- Earnings Winners: AMC Networks, Coty & Oatly – while Fox, Airbnb and others miss expectations

- Layoffs at LinkedIn and MTV News is closing it's doors

- Watch Google I/O Keynote here at 10a PST / 1p EST

Fox Corp. reported a $50 million loss, compared to a $290 million profit in the same quarter last year. The loss was largely due to the cost of a legal settlement with Dominion Voting Services, which cost the company $800 million to settle a defamation lawsuit. Despite this, sales jumped by 18% to $4.08 billion, driven by advertising revenue which increased by 43%, largely due to the impact of Super Bowl LVII, a higher volume of NFL games, and continued growth at Tubi.

Spotify has removed tens of thousands of songs generated by Boomy, an AI company that lets users create tunes and then receive royalties from streams. Spotify removed the tracks because the number of streams had been artificially boosted by suspected bot use, following a warning from Universal Music. Spotify said in a statement that it works to protect royalty payouts for honest artists and is trying to stamp out artificial streaming.

AMC Networks reported a 22% jump in streaming subscribers in Q1 2023, bringing the total to 11.5 million, partly boosted by the success of Anne Rice's vampire franchise. However, traditional revenue streams are struggling, with ad revenue decreasing 20% due to falling TV viewership and marketers cutting back on spending, and affiliate revenues down 11.7% due to subscriber declines. Despite this, the company's Q1 revenue increased 1% to $717m, beating analysts' estimates, thanks to increased content distribution. The company also saw a 69% increase in content licensing revenue, partly attributed to the timing and availability of deliveries, including the final season of "The Walking Dead" on Netflix.

Airbnb reported a profit of $117m in Q1 2023, up from a $19m loss in Q1 2022, beating analysts' expectations. However, the company's outlook for the second quarter was mixed, with Airbnb expecting slower growth in nights booked compared to revenue growth, and predicted a slight decline in average daily rates compared to a year earlier. Despite revenue for Q1 being up 20% YoY to $1.8bn, investors were spooked by Airbnb's outlook, with shares falling 11% in after-hours trading. The company also purchased $2bn of its own stock over the past nine months and has authorized up to $2.5bn in additional repurchases.

Oatly has announced that Jean-Christophe Flatin, the current global president, will take over as CEO from Toni Petersson, who will become co-chairman effective June 1. Oatly, which has struggled to keep up with demand for its oat milk, also reported that its revenue rose almost 18% to $195.6m in Q1 2023, while its net loss decreased to $75.6m. The company aims to achieve profitability in 2024 and recently announced a shift towards an "asset-light" supply-chain strategy. The announcement of Flatin's appointment saw Oatly's shares rise 5%.

Paramount Media Networks, a division run by President and CEO Chris McCarthy, has laid off 25% of its domestic team, mostly on the operations side, as part of consolidation. MTV News was among the units that were shut down, after already undergoing significant downsizing over the last six years. Showtime/MTV Entertainment Studios was largely spared this time after it was hit hard in February when the two studios were combined.

- Wendy's is partnering with Google to launch an AI chatbot-powered drive-thru experience in Columbus, Ohio next month. The chatbot will be built on Google's large language model and is designed to understand various dialects and accents, while also cutting through background noise. The AI will feature words, item names and acronyms unique to the franchise, like "biggie bag" and "JBC". Wendy's CEO Todd Penegor said the chatbot will be "very conversational" and customers won't know they're talking to anyone but an employee. The chatbot is also programmed to upsell customers by asking for larger sizes, add-ons, or meals.

- LinkedIn is cutting 716 positions, equating to about 4% of its workforce, due to the need for increased agility. The announcement was made by CEO Ryan Roslansky, who also revealed that the company will be shuttering its Chinese local jobs app, InCareer, due to “fierce competition and a challenging macroeconomic climate.” The cuts come after LinkedIn laid off an undisclosed number of workers on its talent acquisition team back in February.

- Former Netflix senior counsel Kay Kimmel has been hired by Hollywood's Teamsters Local 399 as the local's in-house counsel, effective May 2. The current contract between Local 399 and the Alliance of Motion Picture and Television Producers will be up for renegotiation next year, and Kimmel will be part of the negotiations team and help with increased contract enforcement.

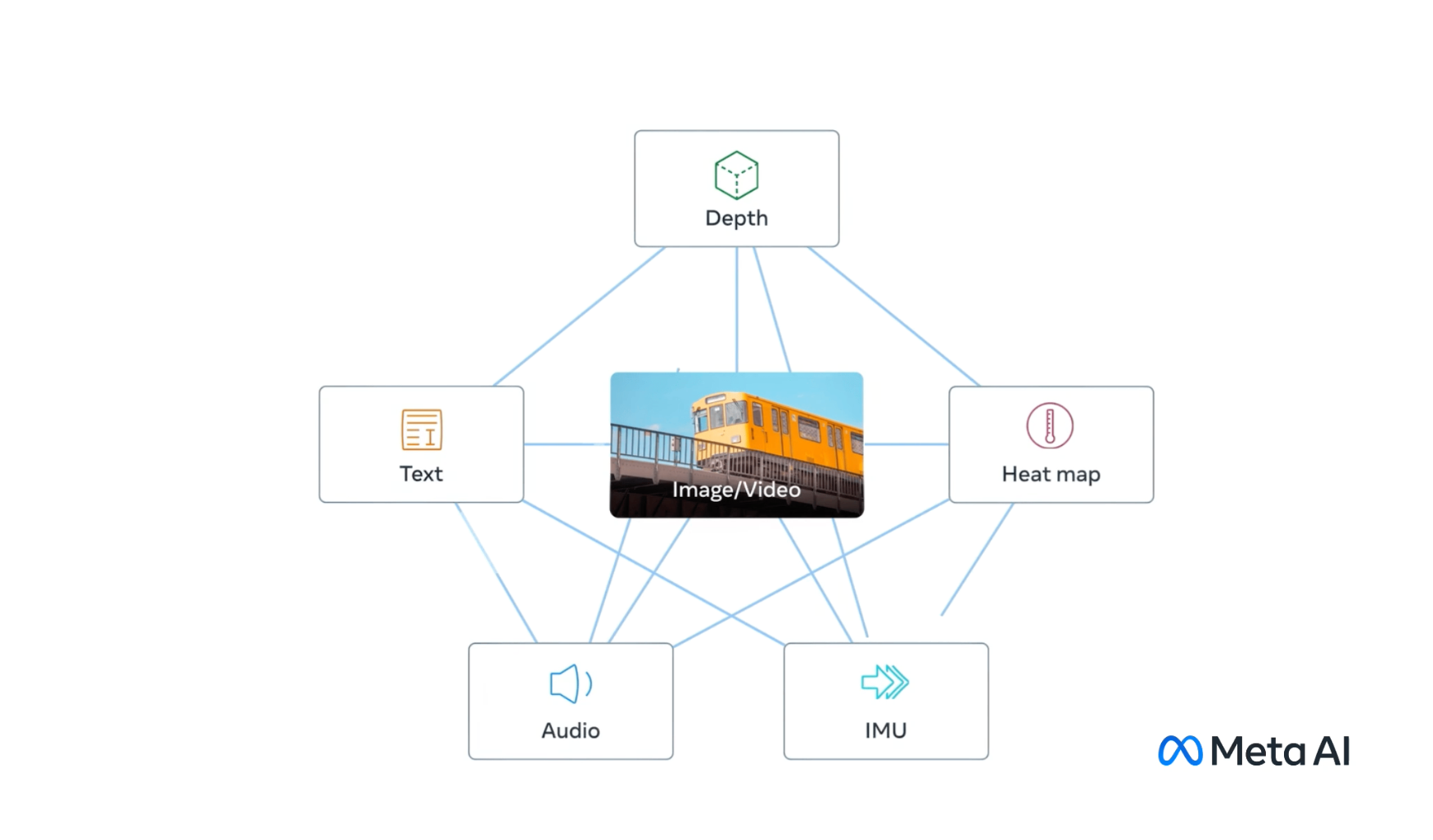

- Meta has unveiled ImageBind, an open-source AI model capable of binding information from six different modalities, including text, image/video, audio, sensors that record depth, thermal, and inertial measurement units (IMU). ImageBind enables machines to analyze different kinds of data holistically by allowing the different modalities to “talk” to each other and find links without observing them together, outperforming prior specialist models trained individually for one particular modality.

- Apple co-founder Steve Wozniak has raised concerns that bad actors could use artificial intelligence to make it harder to spot scams and misinformation. He called for AI content to be labelled and for regulatory measures to be put in place. He added that while we can’t stop the technology, people can be educated to spot fraud and malicious attempts to steal personal information.

- Nintendo has reported a 22% decline in Switch unit sales in the last fiscal year, with its profits and software sales also down. The company attributed the drop in sales to shortages of semiconductors and other components, which impacted production. However, digital sales rose from 42.6% in the previous fiscal year to 48.2% of total software sales, and Nintendo cited a combination of a rise in packaged software and Switch Online sales as well as the weakness of the yen. The company's outlook for fiscal year 2024 indicates it expects Switch and software sales to decline by almost 17%.

- Google has reportedly agreed to give around $100 million to The New York Times over three years in a broad deal that allows the tech giant to use the newspaper's content on some of its platforms, including Google News Showcase. The deal covers distribution, subscriptions, marketing, and ad products. Google News Showcase, which launched in 2020, is a global content licensing program that pays participating publishers to curate quality journalism for an improved online news experience that benefits readers and publishers.

- Marketers seeking to improve media performance are turning to full-funnel audio, which offers a radio, podcasts and digital streaming. Audio drives 45% of listeners to purchase, outperforming TV, social media, video and other platforms, according to Nielsen's Commspoint Influence. Brands can target ads by audience segments and measure the journey of listeners, and multiplatform audio now delivers a larger audience than linear TV. Despite these benefits, total audio accounts for just 9% of ad dollars in media plans, according to WARC.

- DEPT has teamed up with textile innovations company Evrnu to create a new brand identity that highlights its mission to reduce the fashion industry’s environmental impact. The initiative seeks to bring clarity and direction to the organization and its Nucycl brand, with DEPT creating distinct visuals for each.

- Forrester Research has published a report that calls for brands and agencies to overhaul the pitching process, describing it as broken, bloated, and overly complex. The report urges brands to evaluate potential partners based on real work rather than "performative showmanship" and for agencies to embrace project-based work instead of costly pitches. The research argues that by rejecting the current model and adopting these strategies, everyone involved could benefit economically and find happier partnerships.

- Epic Games is transforming Fortnite Creative, giving creators more control, including advanced tools to build out deeper mechanics. The company is building out the same tools and infrastructure for in-game creators inside Fortnite to make it approachable as video production. Fortnite users spend roughly 40% of their total playtime exploring experiences inside the game’s Creative mode.

- Mirinda has launched its new global brand platform, with a vibrant new visual identity system that focuses on creativity and uniqueness. Developed by PepsiCo Design and Innovation, the new visual identity features playful color palettes and illustrations that convey a sense of playfulness and energy.

- IBM has unveiled Watsonx, a new AI platform that aims to assist businesses in building AI models. Watsonx provides access to pre-trained models for generating computer code, text and more, with the aim of providing a solution to the challenges businesses face when deploying AI.

- Meta has appointed Alvin Bowles as its new VP of global business group Americas, responsible for building and managing Meta’s sales strategy in the Americas and working with advertisers on strategic initiatives. Meta's ad business is in transition as it focuses on monetizing Reels videos and navigates AI, and is revamping its ad platform to handle data-sharing changes from Apple and Google. Meta saw a return to advertising growth last quarter, up 3% year-over-year to $28.65 billion, after declining year over year in the previous three quarters of 2022.

- General Motors has hired former Apple executive Mike Abbott to lead its software division. As the new executive vice president of software, Abbott will be responsible for software development as GM focuses on bringing it in-house to launch revenue-generating digital services and features for its customers. The move comes as software plays a key role in the automotive industry with companies attracting buyers with "software-defined vehicles." Abbott's team will oversee three software departments, including software-defined vehicle and operating systems, information and digital technology, and digital business.

- Fascinating history of Nintendo and their logo

But Nintendo was founded in Kyoto way back in 1889, and before it made video games, it made playing cards. Its first product was a pack of hanafuda cards. This is a Japanese style of playing card that was designed to replace the Portuguese-introduced European cards when Japan banned foreign influences in the 17th century. On this pack, the Nintendo logo appears as three kanji characters: nin, ten, do, under a red roof.

- ByteDance's subsidiary Lemon Inc has filed a trademark application with the United States Patent and Trademark Office for a range of book publishing products and services under the name "8TH NOTE PRESS." The registered products and services include an app for reading, downloading, & discussing ebooks, retail bookstore services, printed and digital formats, audiobooks, and physical books. ByteDance is likely exploring new ways to monetize its overseas users, & book publishing and distribution could be its next logical step after the success of #BookTok on its platform.

- During the first quarter of 2023, home prices dropped in nearly a third of metro areas in the US, marking the highest percentage of price declines in over a decade, according to the National Association of Realtors. Housing markets most affected were in California and the Mountain West, with San Francisco recording a 14.5% drop in median prices YoY, while San Jose median prices fell 13.7%. However, in the Midwest, South and Northeast, home prices are still rising, reflecting the split nature of the US housing market.

- Stagwell, the agency holding company, has reported a 3% YoY decline in Q1 revenue, amounting to $622m. The firm also posted a 1% YoY drop in Q1 net-new business, totalling $53m. The company has plans to deploy artificial intelligence across the company, particularly in media operations, with the aim of increasing efficiency over time. The firm has a guidance of 7.5% to 10% organic net revenue growth for the remainder of 2023.

- Meta, has announced plans to phase out shops on its platforms that don’t use the checkout feature, encouraging more in-app purchases and limiting referral traffic. Brands will be required to use the checkout feature on Meta from next April, enabling people to purchase directly on Instagram or Facebook, rather than being redirected to a commerce website in the US. The move will provide Meta with greater visibility over attribution, and while convenient for consumers, there are concerns about data capturing, traffic driving and operational limitations that could impact traffic and sales.

- DGA Leaders Lay Out Goals For Contract Talks That Start Wednesday

- Apple is launching Final Cut Pro and Logic Pro on iPad later this month

- Coty's fragrances sweeten profit forecast after strong beat

- WGA Strike: Netflix Also Suspending Overall Deals

- Tribeca Festival Reveals 2023 Immersive Lineup

- Adam McKay Launches Climate Content Studio Yellow Dot

- Daft Punk Launches AR Experiences ‘Around The World’

- All The Animated Shows That Are Impacted By The WGA Strike

- The Decline of the Five-Day Commute Is a Boon to Suburban Retail

- Why ‘godfather of AI’ Geoffrey Hinton thinks humanity it at a crossroads

- Inside the ‘brutalist’ design of this crazy agency website

- Square’s “Made to Order” Is A Vibrant, Kinetic Campaign Directed by GLP’s Nikki McMorrow

- Twilio's stock tumbles 15% on weaker-than-expected revenue guidance

- Growing Pains Intensify for EV Startups Lucid and Fisker

Throwback to Paul Rand’s Ford presentation

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion