June 29 2023 - Economy, Entertainment & AI

👋Happy Thursday friends. Well, Powell is signaling to us that we still have plenty of interest rate pain ahead of us, CPG taking a hit (not good) and I'm still wondering why we didn't get a Barbie x Liquid Death cross over. All this and more below–

General Mills reported underwhelming sales in its most recent quarter. The company experienced a decline in volumes and lower sales in its international and North American retail markets. Additionally, inventory reductions by North American retailers negatively impacted their sales performance. Despite these challenges, General Mills managed to increase prices on certain products, which contributed to a 3% rise in its top line. Looking ahead, the company expects annual sales to grow by 3% to 4% through marketing efforts and further price adjustments. The company also expects adjusted earnings to increase by 4% to 6% from the previous fiscal year. Although General Mills' profit fell by about a quarter compared to the previous year, its pet-food business showed positive growth, with higher prices driving revenue up by 7% and operating profit increasing by 18%.

Central bankers, including Federal Reserve Chair Jerome Powell, are facing uncertainty regarding the outlook for inflation. Despite raising interest rates rapidly to combat inflation, they are unsure if they have done enough. Powell has indicated that the Fed is likely to raise borrowing costs again in the near future. Inflation and economic activity in affluent economies have not slowed as anticipated, adding to the uncertainty surrounding rate hikes. The Fed left rates unchanged at its recent meeting but is projected to raise them further this year. The European Central Bank (ECB) has also raised rates and expects another increase in July. The ECB's president, Christine Lagarde, warned of sluggish productivity leading to higher wage costs and the need for further rate hikes.

Edelman has laid off approximately 240 employees, which accounts for 4% of its global workforce. The job cuts primarily affected senior-level employees. The CEO, Richard Edelman, attributed the layoffs to macroeconomic conditions and the need to restructure the organization. In an internal memo, he mentioned the hiring freeze implemented earlier and the need to restore a more balanced pyramid structure in order to meet client needs effectively. Edelman expressed confidence in the future of the firm despite the challenging decision. The company will support the affected employees in their career transitions and provide additional assistance programs. Edelman reported revenue growth in 2022, surpassing $1 billion globally, and made strategic acquisitions during that period.

Google faces allegations of misleading advertisers and violating its own guidelines, according to a report. The study claims that Google may have charged advertisers for TrueView ads on third-party websites and apps that did not meet the company's criteria. Adalytics, the advertising research organization, found instances of ads running in small video players, muted ads, and ads with limited user interaction. The report also highlighted hidden or obscured skip buttons. Google's director of global video solutions dismissed the findings, stating that advertisers are only billed for viewed ads and that real-time ad quality signals are used to determine engagement. The company asserts that the majority of campaign ads are served on YouTube rather than third-party sites.

The Biden Administration is reportedly considering imposing additional restrictions on China's access to high-end chips used for AI, such as those made by Nvidia and AMD. The move aims to address concerns over China's AI capabilities posing a national security threat. However, these curbs could impact semiconductor manufacturers and their revenues. Tech stocks, including Nvidia, dipped following the news. The administration aims to strike a balance between limiting technological capacity aiding China and minimizing the impact on private companies. The potential measures may strain U.S.-China relations.

- Liquid Death has released its third album, "Greatest Hates Vol. 3," featuring '80s dance-pop style songs with lyrics based on internet hate directed at the brand. The album includes 10 synth-soaked tracks, with titles like "I'd Rather Die" and "It's Dumb and I Won't Buy It". The album features guest appearances from artists like Mark McGrath and Tony Hawk.

- Stagwell has earned a spot on the prestigious Fortune 1000 list, which ranks the 1,000 largest American companies based on revenues. Stagwell's digital-first strategy, global expansion efforts, and integrated services approach contributed to its growth and recognition. With nearly $2.7 billion in GAAP revenue for FY 2022, Stagwell stands out as the only global marketing network with a majority-digital revenue services mix. The company's inclusion in the Fortune 1000 list validates its innovative approach to client services and its commitment to digital transformation in the marketing industry.

- Dentsu has become a founding partner of the Roblox Partner Program. The strategic partnership with Roblox expands their existing relationship and allows Dentsu to offer its clients deeper education and access to the platform. Dentsu will support brand innovation, develop immersive advertising models, and collaborate with Roblox to expand the roster of developers.

- Meta is experiencing a resurgence in its stock as analysts express optimism about its AI-driven advertising growth on the Reels video platform. The company's stock has seen impressive returns recently, and Wall Street sees reasons for further growth. Citigroup analyst Ronald Josey upgraded his price target, citing advertising growth on Reels. Meta's use of AI to optimize ads and drive more viewers has contributed to its revenue growth. Despite setbacks and controversies, analysts expect Meta's earnings to grow significantly this year and in 2024, leading to a "moderate buy" consensus among analysts.

- Doordash has unveiled its largest app update ever, introducing several new features for gig workers, consumers, and merchants. For gig workers, the update includes a set hourly minimum rate that they can choose to work under, allowing for more predictable pay. The app also enables workers to share safety information with contacts and receive orders along their commute. For consumers, the update brings a universal search function, the ability to have multiple carts, and specific navigation tabs for grocery and retail. Doordash is also allowing consumers to tip up to 30 days after their orders have been delivered and is enabling SNAP/EBT payments. Additionally, merchants on the platform can access personalized growth recommendations and offer store rewards to encourage repeat business.

- Warner Bros Discovery has finalized the creative-side structure at Turner Classic Movies following concerns raised by directors Steven Spielberg, Martin Scorsese, and Paul Thomas Anderson. Under the new plan, Spielberg, Scorsese, and Anderson will actively work alongside Warner Bros Motion Picture Group executives Michael De Luca and Pam Abdy. Charles Tabesh, the SVP of Programming and Content Strategy, will remain at TCM. The channel will continue to be overseen by Kathleen Finch's U.S. networks, and on the business side, Michael Ouweleen, the president of Adult Swim, Cartoon Network, Discovery Family, and Boomerang, will run TCM. The restructuring aims to enhance TCM's programming and engagement with fans while preserving its mission of celebrating film history.

- CNN is reportedly exploring the possibility of adding more of its news offerings, including live programming, to the Warner Bros. Discovery streaming platform Max. This move would be the network's most ambitious foray into streaming since the shutdown of its standalone subscription service, CNN+. However, the inclusion of live news on Max is complicated by existing carriage agreements with cable and satellite networks. While Warner Bros. Discovery CEO David Zaslav has previously indicated the consideration of live programming for Max, it remains to be seen how the logistics and agreements will be worked out. Other networks like Fox News and MSNBC have also ventured into streaming with their own offerings targeted at international audiences or specific programming lineups.

- On day three of the FTC v. Microsoft hearings, significant developments took place regarding Sony's concerns over Microsoft's acquisition of Activision Blizzard. PlayStation chief Jim Ryan's video deposition revealed Sony's alarm bells ringing after Xbox chief Phil Spencer provided a list of Activision games that Microsoft would keep on PlayStation, excluding Overwatch 2. Ryan expressed worries about sharing information on the PS6 with Microsoft and criticized Xbox Game Pass as "value destructive" for publishers. The testimony also explored Sony's reluctance to share dev kits, its fears of Activision games becoming Xbox exclusives, and the importance of Call of Duty in the competition between Sony and Microsoft. The day included quantitative analysis by the FTC's economic advisor, Robin Lee, discussing the potential impact of withholding Call of Duty from PlayStation and the role of cloud gaming and subscriptions.

- Costco is implementing a new policy to crack down on membership card-sharing. The company will require members to show proof of identification at checkout counters, especially if their membership card does not have a photo. Costco aims to prevent non-members from receiving the same benefits and pricing as its members. The move aligns with Netflix's recent efforts to combat password-sharing among users from different households. Costco has not disclosed the exact start date of the policy but emphasizes that membership fees contribute to keeping prices low. Despite increased revenue and a substantial membership base, Costco has not raised its membership costs since 2017.

- Influencers involved in a lawsuit against Montana's TikTok ban have revealed that TikTok itself financed their legal expenses. While the creators were not directly paid for their involvement, TikTok covered their legal costs, as confirmed by several creators named in the suit. The ban, scheduled to take effect in January 2024, could significantly impact their lives and businesses. TikTok acknowledged its support for creators in defending their constitutional rights, citing concerns about the potential impact of the ban on their livelihoods. The company approached creators, offering them the opportunity to be named plaintiffs in the lawsuit and covering the legal representation fees. This is not the first time TikTok has backed creator efforts against bans, previously supporting travel expenses for creators opposing nationwide bans. The company's involvement in the lawsuit has raised transparency concerns, which may further affect its reputation.

- OpenAI has announced plans to open its first international office in London. The London location will focus on advancing research and engineering capabilities in artificial general intelligence (AGI) development while collaborating with local communities and policymakers. London was chosen due to its status as a hub for AI research and talent, with DeepMind, Google's AI division, being based there. The city is also a prominent center for AI startups, with a large number of companies and significant venture funding. OpenAI's expansion to London reflects its intention to attract top talent and contribute to the development and deployment of safe AI. The move also holds political significance as OpenAI seeks to influence AI regulations in the UK and potentially comply with the EU's AI Act.

- Pixel fucked: Inside Hollywood's VFX crisis

- Elon Musk Enlists Help From UFC Champion Ahead of Potential Zuckerberg Brawl

- Why we need more working-class creatives

- Lanebreak on the Peloton Tread turned me into an immersive fitness believer

- Longtime BBDO executive Jim Moser to leave the network

- Why brands need to stop ‘purpose’ pandering

- Walmart and Adobe pay the most for social posts, creators and influencers

- The return of quantitative easing

- NASA's Perseverance Rover Finds an Other Worldly Treat on Mars

- Adobe’s ‘Office Space’ Sendup Starring Hasan Minhaj Is a Tribute to 30 Years of the PDF

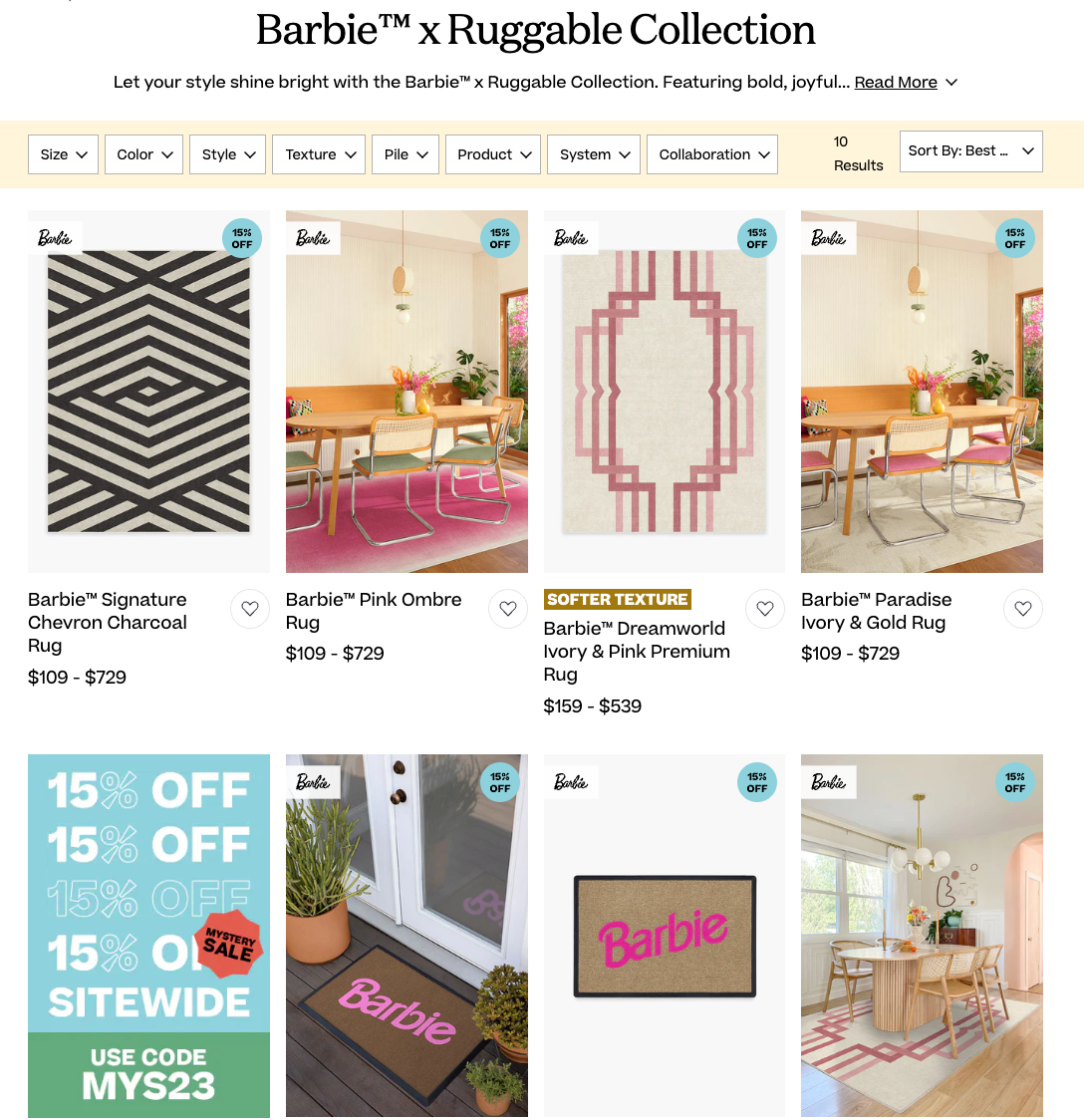

The Barbie Marketing team has been busy

😏

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion