July 7 2023 - Friday Roundup

👋Happy Friday everyone and welcome to the summer edition of brandtrackers. We're pushing to video roundup out a week due to an overheating camera (trust me, I tried) - more to come next week. That being said - we've got plenty to catch up on, so let's get into it–

Instagram has unveiled a new app called Threads, which is being positioned as a rival to Twitter. The app allows users to have real-time, public conversations with each other and is closely tied to Instagram. Users can import their Instagram followers to Threads and post text-based messages, photos, and videos. Instagram's goal is for Threads to work across multiple apps in what they call the Fediverse, allowing seamless operation with other platforms.

BuzzFeed CEO Jonah Peretti is seeking to sell Complex Networks, a group of websites focused on hip-hop, fashion, and sports, for $150 million. If successful, this sale would allow BuzzFeed to pay off its debt and potentially improve its stock price, which has been trading at a low level. Interested buyers include talent manager "Scooter" Braun, Ntwrk (backed by Jimmy Iovine), Group Black, and SpringHill Co. Some potential bidders are interested in specific parts of Complex, while others are considering the entire company. Peretti aims to retain Complex's food site, First We Feast.

Federal Reserve officials have signaled their determination to resume interest rate increases in order to address high inflation in the US economy. The minutes from the June FOMC meeting reveal that "almost all" officials believe additional rate increases would be appropriate. They cited a tight labor market and upside risks to inflation as key factors shaping their outlook. Although some officials favored a rate increase in June, the committee ultimately supported a pause to gather more information about the economy. The Fed is expected to raise rates further, with two more quarter-point increases projected.

Goldman Sachs is in talks with American Express to end its partnership with Apple and transfer its Apple credit card and other ventures to Amex. Goldman had previously announced plans to scale back its consumer business but had maintained its commitment to the Apple partnership. However, it is now looking to offload those businesses to Amex, effectively ending its consumer-lending business. The deal with Amex is not imminent, and Apple's agreement would be required for a transfer. Exiting the Apple partnership would also mark the end of Goldman's aspirations to become a full-service bank.

Actors in Hollywood are preparing for a potential strike alongside the Writers Guild if negotiations between SAG-AFTRA and the AMPTP fail to reach an agreement by the extended deadline of July 12. If a strike occurs, SAG-AFTRA members are expected to hit the streets on July 13. The last joint strike between the Writers Guild and Screen Actors Guild occurred in 1960.

The UK's Competition and Markets Authority has announced that it is proceeding with an in-depth investigation into Adobe's proposed $20 billion acquisition of digital design rival Figma. The CMA has provisional concerns that the merger could lead to a "substantial lessening of competition" in the UK's designer market. Adobe and Figma have five days to submit proposals addressing the CMA's concerns. The European Commission and the US Department of Justice are also investigating the acquisition. The CMA's initial findings suggest that the merger would remove a significant competitor for Adobe and reduce competition in the market. Adobe maintains that the merger will bring value to customers and is not intended to compete with Figma in the broader product design realm.

Apple is facing major cuts to production forecasts for its Vision Pro headset due to manufacturing difficulties and the complexity of the design. The company had initially hoped to ship 1 million units in the device's launch year of 2024, but it is now expected to produce fewer than 400,000 units. The scaling back of targets has also resulted in the delay of a more affordable version of the headset. Apple's supply chain for the Vision Pro is facing challenges in manufacturing the sleek screens, which include micro-OLED displays. The company is already working on later generations of the headset, including a more affordable version in collaboration with Samsung and LG. Despite the setbacks, market analysts believe Apple will surpass a user base of 20 million within five years of launch.

- A federal judge will decide whether to allow Microsoft's acquisition of Activision Blizzard to proceed, as federal antitrust enforcers have sued to block the $69 billion deal. The decision could hinge on whether Microsoft's control over the distribution of the blockbuster game franchise Call of Duty would harm competition. Microsoft has called on its CEO Satya Nadella and other executives to testify in favor of the merger. The Federal Trade Commission has requested a temporary injunction to delay the deal for review, but Microsoft and Activision argue that such a delay would force them to abandon the deal. The ruling in this case will be a significant test for the FTC's increased scrutiny of the tech industry.

- Snap has chosen Ogilvy PR as its agency of record. Ogilvy will provide consumer PR, corporate reputation, and B2B communications support to further enhance the Snapchat brand in Australia and drive audience and revenue growth. The appointment was the result of a competitive pitch, with Ogilvy's ability to tap into cultural trends and build community connections being key factors. Ogilvy will also collaborate with Snap's team to highlight technology leadership, augmented reality innovation, and platform safety.

- Backslash, the cultural intelligence unit of TBWA, has released a new report titled "Future of Food." The report draws insights from 42 culture spotters worldwide and goes beyond observation, providing opportunities for businesses in the future of the food industry. TBWA utilizes its proprietary research tool, the Disruption Index, to analyze cultural shifts and consumer behavior. The full report is available for download on Backslash's website at https://www.backslash.com/reports

- Media.Monks discusses AI's impact in a recent session with LBB. The agency emphasizes the importance of providing an overview of AI developments to equalize knowledge among clients and highlight the need for businesses to adapt and change in response to the real-time disruption. While AI can prompt creative ideas and assist in output generation, the agency believes that the role of creatives is still crucial. Media.Monks has AI ambassadors in each division to lead the adoption of AI tools and explore its potential applications. The agency is particularly interested in emotional AI (EAI) and using data to emotionally connect with target audiences.

- Agency holdcos like WPP's Ogilvy, IPG, Omnicom Group, and Havas are adopting strategic approaches to using generative AI, both internally and with clients. Agencies are forming cross-department AI task forces to navigate the opportunities and limitations of AI, which has led to winning new business and enterprise partnerships. These agencies are implementing AI policies to ensure transparency, appropriate data governance, and ethical use of AI tools. The policies include guidelines for employee usage, client transparency, content review processes, and protection of privacy and intellectual property. The agencies are using generative AI to save time and lower production costs, but caution is exercised due to potential risks such as factual inaccuracies and IP infringement. The task forces consist of agency leaders from various departments, who work together to drive practical applications of generative AI and ensure legal and ethical compliance.

- Coty Group aims to expand its business in China and generate 10% of its global sales in the country. With the Chinese beauty market experiencing post-pandemic growth, Coty has modified its development strategy and repositioned its brands. Additionally, they will emphasize skincare, launching new products, and collaborating with local partners.

- Dentsu Group has finalized its acquisition of Tag Group, a global omnichannel digital marketing production company. The acquisition strengthens Dentsu's creative production capabilities and expands its integrated, full-service offerings. Tag will operate as Dentsu's sixth agency brand, providing digital infrastructure and services for content creation at speed and scale. The acquisition brings in 2,800 additional colleagues across 29 countries and enhances Tag's client offering with its martech platform called Digital Interact (Di). Tag will continue to be led by its global CEO, David Kassler, and maintain its distinct brand within Dentsu, headquartered in London.

- Volkswagen Group has resumed its global media agency review, which was put on hold in 2021. The review covers all group brands, including VW, Audi, Skoda, and Seat. The process, overseen by Jason Lusty, head of group marketing, involves selecting potential partners for the future operating model of the group and its brands. While it is unclear if incumbent agency PHD is involved, it is likely given Omnicom's historical relationship with Volkswagen. PHD has been handling Volkswagen Group's media business since 2017. The review comes as Volkswagen explores more data-driven media models and aims to define its future strategy.

- Cosmetics company Oddity Tech, which owns the Il Makiage makeup and SpoiledChild skin care brands, has filed for an initial public offering. The company's revenue grew by nearly 50% in 2022, and it could achieve a valuation north of $3 billion based on comparable multiples. Oddity has differentiated itself from other DTC brands by focusing on online sales, avoiding wholesale deals and physical stores. This strategy, along with its high-priced products, has led to a high gross margin and solid profits. Oddity's success is tied to maintaining a strong base of customers and content creators on social media platforms like TikTok.

- TikTok is entering the music streaming market with the launch of its subscription-only service called "TikTok Music" in Brazil and Indonesia. The service allows users to sync their TikTok accounts, listen to, download, and share songs, and includes catalogs from major record labels. TikTok Music offers features such as personalized music recommendations, real-time lyrics, collaborative playlists, and a music identification feature. It will replace ByteDance's existing streaming service, Resso. TikTok has not disclosed plans for launching the service in the United States. The subscription prices range from $2.96 to $3.49 per month, with a one-month free trial available. By entering the music streaming market, TikTok competes directly with Spotify, Apple Music, and Amazon Music. The addition of podcast and radio content in the future could further enhance its competitiveness.

- Twitter is threatening to sue Meta, the parent company of Instagram, over its new text-based platform called Threads. Twitter accuses Meta of poaching former Twitter employees and using Twitter's trade secrets and intellectual property to develop Threads. Twitter's lawyer sent a letter to Meta demanding that they stop using Twitter's confidential information and warning of potential legal action. A source from Meta denies the accusations, stating that none of the Threads engineering team are former Twitter employees.

- IPG and McCann Worldgroup, have joined the Partnership on AI to Benefit People and Society (PAI). They are the first of their kind to join the nonprofit partnership, which aims to promote responsible AI governance and equitable deployment. IPG and McCann Worldgroup will contribute to developing resources and recommendations in various AI-related areas. They will prioritize equity, humanity, and understanding the impact of AI on human issues. By joining PAI, they seek to harness AI's potential for creativity while ensuring inclusive and ethical practices.

- Humane, a secretive hardware startup founded by former Apple employees, has unveiled its first product called the Humane Ai Pin. The wearable gadget features a projected display and AI-powered capabilities. It can perform tasks such as providing email and calendar summaries, language translation, phone calls, and object recognition. The Ai Pin can also project an interactive interface onto nearby surfaces. Humane is collaborating with Qualcomm to develop the internal hardware, using an unnamed chip from Qualcomm's Snapdragon series. The company has partnerships with SK Networks, Microsoft, OpenAI, LG, and Volvo, and has raised $230 million in funding.

- Apple is seeking to appeal to the Supreme Court in an effort to overturn the rulings in the Epic Games antitrust case. The case centers around Apple's App Store guidelines, which prevent apps from including their own payment options and require them to use Apple's in-app purchase system, from which Apple takes a 30% cut. The dispute began when Epic Games introduced a direct payment feature in Fortnite, violating Apple's policy and leading to the removal of Fortnite from the App Store. Lower courts ruled in favor of Epic Games, stating that Apple must allow apps to provide their users with third-party payment systems. Apple argues that the rulings exceed the court's authority and wants the Supreme Court to reverse them. Meanwhile, Apple will also have to adapt to new European Union regulations requiring it to allow third-party app stores by 2024.

- Spotify is reportedly considering adding full-length music videos to its app as a way to compete with Apple and YouTube. The streaming service is said to be in talks with potential partners, although specific details and a timeline for the feature's arrival are unclear. Currently, Spotify only offers limited video content such as podcasts, short clips for artist storytelling, and looping GIFs. By adding music videos, Spotify aims to match Apple's offering and attract viewers who would otherwise watch videos on YouTube.

- ByteDance has launched a new music production app called Ripple in closed beta in the United States. The app allows users to create and edit audio, using machine learning to turn melodies into instrumental songs. Ripple features a "virtual recording studio" where users can record, cut, trim, and edit audio files on their mobile devices. While Ripple doesn't have a direct integration with TikTok, creators can use the app to create background audio for their TikTok videos. ByteDance plans to add more mobile-friendly tools to enhance audio editing efficiency in the future. The closed beta is invite-only, and there are no plans to launch Ripple in other countries at this stage.

- Pinterest is reportedly testing a new system that would scan users' email inboxes to gain insights and offer customized content based on their interests. The system would analyze emails connected to a user's Pinterest account and generate boards and posts related to the identified topics. However, this raises privacy concerns, especially in the current regulatory climate focused on data privacy. Additionally, the effectiveness of the system may be limited due to the need to filter out spam and irrelevant emails. It's worth noting that Google discontinued its scanning of personal Gmail content for ad targeting in 2017.

- Advertising agencies, including The Martin Agency, Dagger, and Known, are venturing into the entertainment space by launching their own entertainment units. Recognizing that consumers are more attracted to entertaining content rather than traditional advertising. Unlike traditional ad creative, agencies creating original content have a financial stake in the programs they create, providing a potential new revenue stream and ownership of the work.

- Amazon CEO Andy Jassy is closely examining the spending of the company's Hollywood studio on original TV programming. As part of a cost-cutting program, Jassy has requested detailed budget analyses for some of the studio's major shows. Amazon Studios has been spending billions on original content but has seen mixed success with audience reception. Several expensive series, such as "Citadel," have failed to generate significant viewership. Jassy's scrutiny comes as the company aims to reduce costs and improve the performance of its TV offerings.

- Sriracha Prices Explode on eBay Amid Year-Long Shortage

- Apollo and other popular third-party Reddit apps have shut down

- No Scripted TV Shows Are Filming On Location In L.A. As WGA Strike Enters Third Month

- How actors are losing their voices to AI

- UK universities draw up guiding principles on generative AI

- How The-Artery Crafted New Mercedes Spots Using Virtual Production

- Mark Swift departs Paramount after 18 years

- GQ Removes Article Critical of Warner Bros. Discovery C.E.O.

- Hollywood comes for Formula One

- The Stream Deck is getting a paid app store later this year

- Nike sales stumble in North America as competition intensifies

- Inside the race to build an ‘operating system’ for generative AI

- Apple Plans To Launch a Mac Monitor That Doubles As a Smart Home Display

- Grand Ex 2023: Reddit and Giant Spoon Score the Campaign of the Year with ‘Find Your People’

- Spotify’s Former VP of Design Dan Sormaz Joins Fubo

- Samsung Headset Reportedly Being Redesigned In Response To Apple Vision Pro

- Instagram CEO Adam Mosseri admits it was 'hugely contentious' to launch Threads as a standalone app. He calls it a 'high-risk' bet

- UTA plans push into sports as UK becomes focal point

- Consumer Spending Stalled Last Month

- Jenny Craig is being saved from bankruptcy by the Nutrisystem owners

- Pickleball is taking off — and fashion brands are cottoning on

- Apple Is the World's First $3 Trillion Company

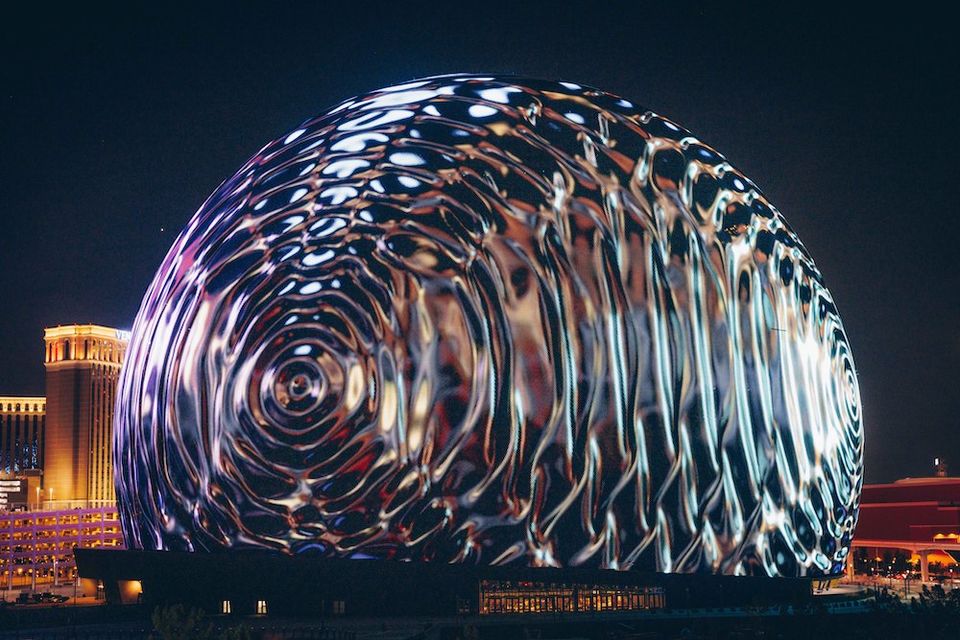

Can't wait for those final Sphere specs to start dropping on deliverables lists

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion