July 28 2023 - Earnings, Entertainment & AI

👋Happy Friday friends. Well, after a quiet week in tech, things are back in full swing. Earnings reports are in, and it's not all bad news - the Fed is following rate hike expectations, and AI + Entertainment are as spicy as ever. Let's get into it–

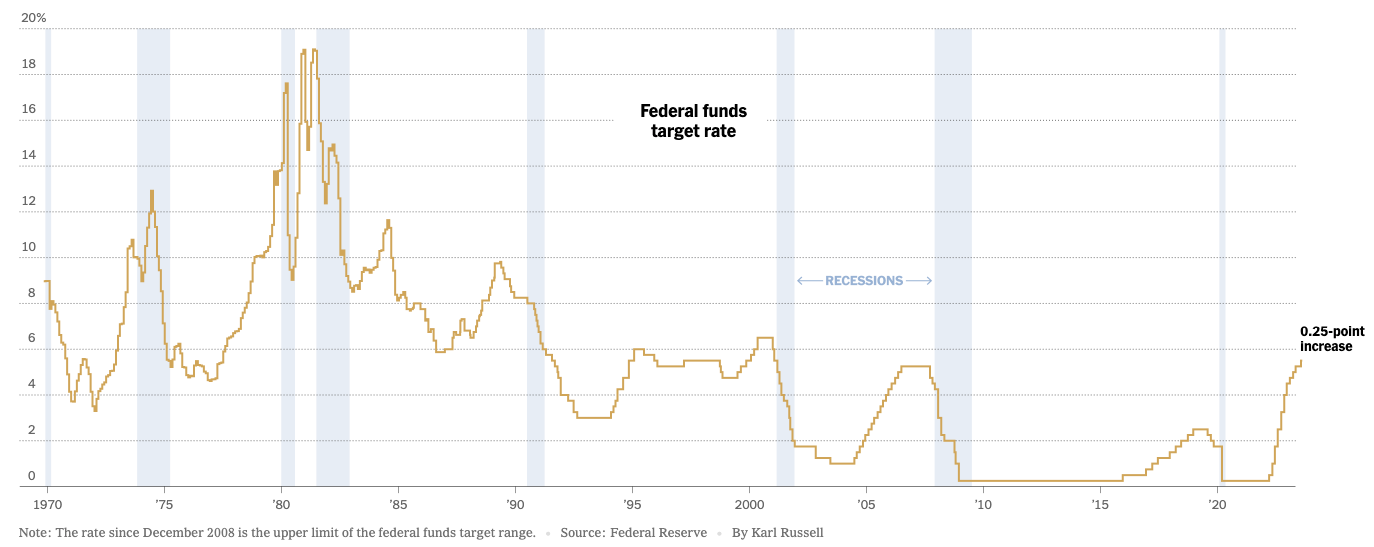

The Federal Reserve raised interest rates from 5.25 to 5.5 percent, the highest in 22 years, as part of their 16-month campaign to combat inflation and cool the American economy. The Fed left the possibility of more rate increases open in the future. Economists are cautiously optimistic that the Fed can slow inflation without causing a severe economic downturn, and officials upgraded their view of the economy's expansion from "modest" to "moderate". The Fed projected two more rate increases this year but has not committed to a specific timeline. The labor market is expected to slow, but the risk of a recession has diminished according to the Fed's staff economists

Gap has hired Richard Dickson, the president and COO of Mattel, as its new chief executive. Dickson played a significant role in improving Barbie's image through creative marketing campaigns and brand collaborations. Gap, facing falling sales and increased competition from online retailers, hopes Dickson can lead a turnaround similar to what he achieved with Barbie. His appointment comes after the success of the "Barbie" movie, which brought in $162 million at the box office. Gap's stock rose nearly 8 percent on the announcement. Dickson will step down from Mattel on August 3 and start at Gap on August 22.

Meta has reported an 11 percent year-over-year increase in revenue for the second quarter, reaching $32 billion. Profits rose 16 percent to $7.8 billion, thanks in part to improvements in advertising technology using artificial intelligence and other product adjustments. The company's successful financial performance indicates a potential turnaround after facing challenges, including a slump in ad sales and layoffs. Nonetheless, Meta's Reality Labs XR division reported an operating loss of nearly $4 billion in the latest quarterly results. The revenue for Reality Labs was down by 39% in Q2 2023 due to lower sales of the Quest 2 headset, marking the worst quarterly performance in the past two years. Despite aggressive spending on XR over the next few years, the revenue from Quest 2 hardware and software sales is only a fraction of the operating budgets in the billions. Meta expects continued operating losses in the future as it invests in product development efforts in AR/VR and ecosystem scaling.

Microsoft reported record sales of $56.2 billion and profits of $20.1 billion in the latest quarter, beating analyst expectations and its own estimates. The company's big bet on AI has contributed to its success, with generative AI features integrated across its products. Sales from Azure, its cloud computing product, were up 27% in the quarter, although there was a slight slowdown compared to the previous quarter. Microsoft's investments in generative AI have created high expectations, and the company plans to continue spending on data centers and infrastructure to meet demand. However, declining sales in personal computers have been a drag on Microsoft's business, with sales in its personal computing segment down 4% to $13.9 billion.

Google, Microsoft, OpenAI, and startup Anthropic have joined forces to create the Frontier Model Forum, an industry body aimed at overseeing the safe development of advanced artificial intelligence models. The group's main objectives include promoting research in AI safety, encouraging responsible deployment of advanced AI models, discussing trust and safety risks with policymakers and academics, and using AI for positive purposes like combating climate change and detecting cancer.

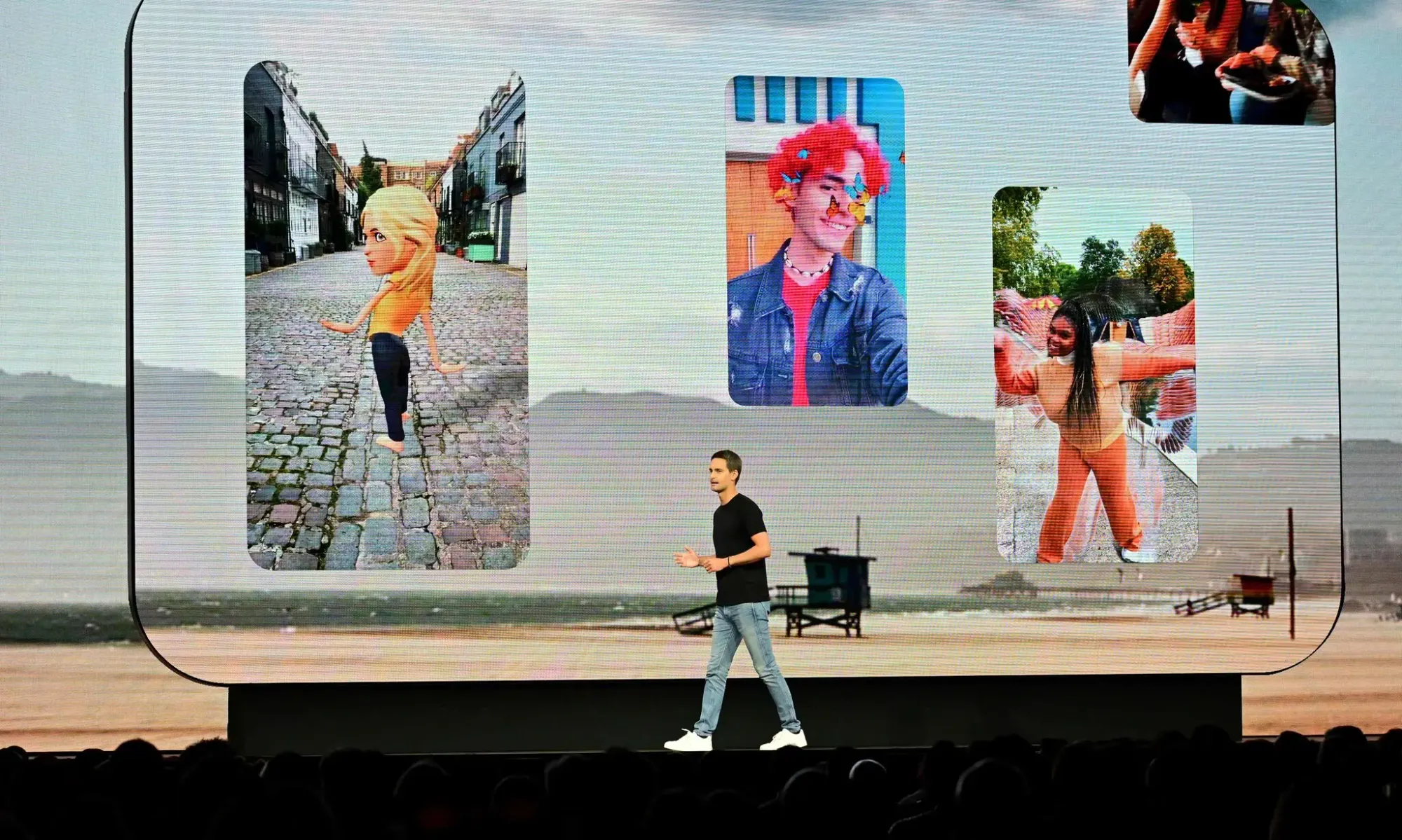

Snap reported a second consecutive decline in quarterly sales, with revenue for the second quarter down 4% from a year earlier. The company faced challenges in increasing advertising revenue and dealt with an ad slump in the industry. Snap's net loss for the quarter was $377 million, although narrower than the previous year. Despite efforts to attract advertisers and increase user engagement, Snap's challenges in the intensely competitive social media landscape persist. However, the number of daily active users rose to 397 million, showing a 14% increase from the previous year, with most of the growth coming from international users.

Alphabet reported a successful second quarter, overcoming concerns about a shaky ad market and competition in artificial intelligence. Google's ad business showed resilience, aided by accelerating revenue from search and YouTube. Despite the challenges posed by AI competition, Google's rebound indicates positive momentum, especially with YouTube's recovery against rivals like TikTok. The company's profit climbed 15% to $18.4 billion, beating Wall Street expectations.

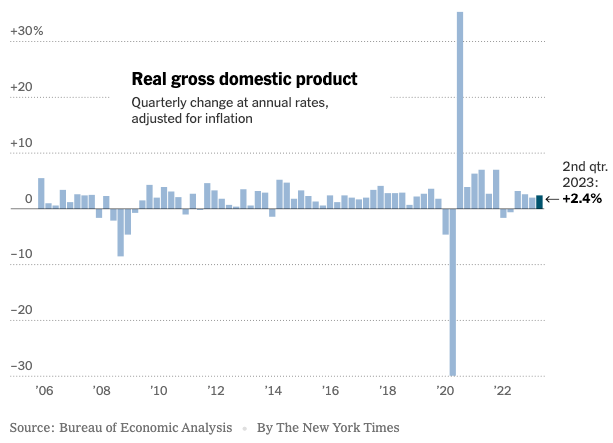

The U.S. economy rebounded in the second quarter, with gross domestic product (GDP) growing at a 2.4 percent annual rate, higher than forecasted and stronger than the previous quarter's 2 percent growth rate. Consumer spending played a significant role in the recovery, with spending on services, such as travel and dining, driving the growth. Business investment also rebounded, and increased spending by state and local governments contributed to the positive economic performance. The economy's resilience surprised economists who had expected high inflation to lead to a slowdown, but instead, the economy continued to show strength and inflation slowed significantly

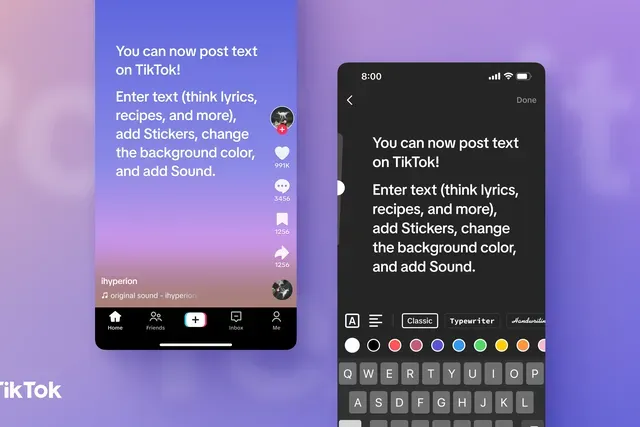

- TikTok has introduced a new feature that allows users to post text-based updates in addition to videos and photos. Similar to Instagram Stories, the text posts can include background colors, edited text appearance, and music and stickers. There is a 1,000-character limit for these text posts, and other users can engage with them through stitching, dueting, and commenting.

- Threads, has seen a significant decline, with the number of daily active users dropping about 70% from a peak in July. The average time spent on the app has also decreased substantially. Meta executives anticipated this drop after the initial surge in sign-ups and are not overly concerned, stating they are working on introducing new features to improve user experience. Meta aims to increase user numbers and enhance the platform's capabilities before considering monetization.

- LVMH reported a slowdown in the US luxury market due to economic uncertainty, with revenues rising only 3% in the first half of the year compared to a 24% increase in the same period last year. The strong dollar led US clients to purchase luxury items abroad, but economic pressure from inflation and reduced financial support impacted sales domestically. However, LVMH saw a rebound in sales in China, rising 24% in the first half, as Chinese consumers emerged from Covid-19 restrictions and resumed shopping. The luxury industry is expected to normalize this year, with the US market slowing down after a record growth in 2022.

- S4 Capital, the owner of MediaMonks and led by Sir Martin Sorrell, has downgraded its predicted 2023 organic revenue growth due to weak performance in Q2. The company had expected 6-10% growth but has now revised the target to 2-4%. Its 2023 target operational EBITDA margin has also been adjusted from 15-16% to 14.5-15.5%. The slowdown was attributed to challenging macroeconomic conditions and cautious clients, particularly in the tech sector. The content practice was the weakest performer, while data and digital showed satisfactory growth, and technology services continued to perform well. The company is prioritizing cost management but did not comment on job cuts.

- Fox has concluded its upfront talks as the third major publisher to do so, following Paramount and NBCUniversal. Fox Sports experienced growth in both price and volume, driven by NFL, MLB, college football, and the World Cup. Fox News Media had market-leading pricing and volume growth ahead of the upcoming election season. The AVOD Tubi saw its fourth consecutive year of volume growth. While specific details about CPM increases or decreases were not disclosed, this year's upfront is expected to be a soft market due to economic headwinds. Fox Entertainment increased upfront sell-out over last year and is well-positioned amid ongoing writers and actors strikes, with unscripted and animated programming set for fall.

- Meta, Microsoft, Amazon, and TomTom have teamed up to create the Overture Maps Foundation, an initiative aimed at challenging Google Maps and Apple Maps. They have released their first open map dataset, comprising over 59 million places of interest, buildings, transportation networks, and administrative boundaries. Third-party developers can use this data to create their own global mapping or navigation products, providing competition to the dominant mapping platforms. This initiative could potentially reduce the cost and increase accessibility for developers, who currently have to pay to access Google Maps' API and face charges from Apple for making non-native apps.

- Twitter has undergone a rebranding, changing its name to "X" under the direction of Elon Musk. The original blue bird logo has been replaced with an interim logo featuring a white X on a black background. Musk intends to transform the platform into an "everything app" similar to China's WeChat. The new X branding was projected onto Twitter's headquarters in San Francisco. Twitter's official legal entity name was registered as X Corp when acquired by Musk in October 2022.

- Dentsu has partnered with Microsoft to enhance employee access to generative AI tools. Through Microsoft's Azure OpenAI technologies, Dentsu can leverage GPT-4, and other AI tools. The partnership has led to the creation of specialized platforms, including Merkle GenCX, used for customer experience management, and AI Playground LATAM, focused on improving client efficiency in Latin America. Dentsu's internal group called AI Connective is driving the strategy behind these developments, aiming to deploy AI both internally and externally through market-ready products. The deal between Dentsu and Microsoft builds upon their pre-existing relationship, which previously resulted in a metaverse space for Web3 experimentation.

- YouTube has returned to growth, after three declining quarters, generating $7.7 billion in advertising revenue, up 4% from the previous year. The short-form video product, YouTube Shorts, showed promise with increasing watch time and monetization. Additionally, YouTube's subscription offerings, YouTube Music and YouTube Premium, contributed to Google's 24% year-on-year lift in "other" revenue. However, Google's Network division, revenue from selling ads outside its own properties, continued to decline.

- Spotify has gained 10 million subscribers since last year, reaching a total of 220 million paid users. Despite increasing subscription prices, Spotify faces challenges with relatively low ad growth, considering that 330 million people use its free ad-supported tier. Adding new ad-supported users may not immediately improve the situation, especially as the company is focusing on international markets with lower average revenue per user compared to the US. Spotify's CEO, Daniel Ek, believes that the lower ARPU is a temporary lag, similar to what other social platforms experienced during their early stages of strong user growth.

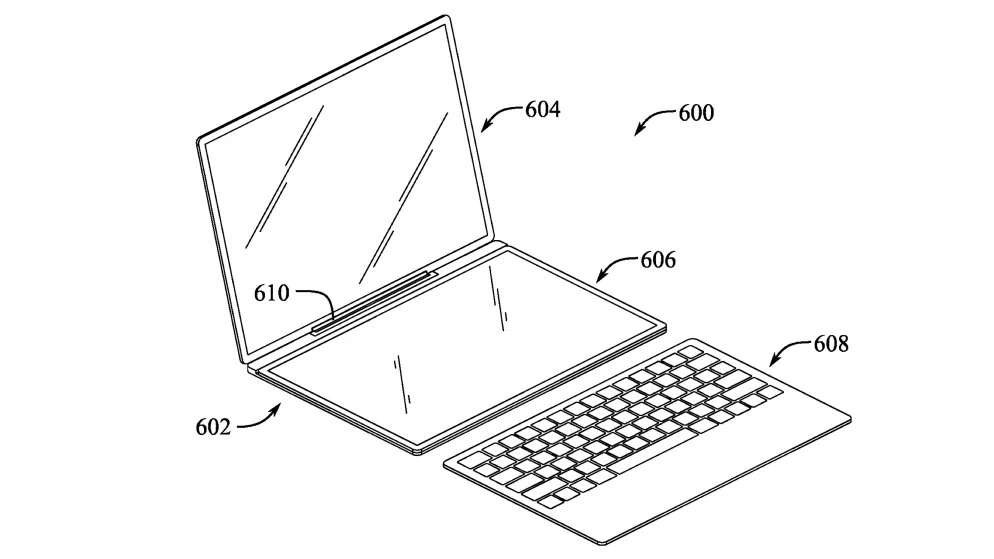

- Apple has been granted a patent for a potential modular MacBook, allowing users to detach and swap out parts like the keyboard and display. The patent describes a reconfigurable computing device with a rotating hinge and magnets to attach and detach devices, providing flexibility in configuring the laptop's components. Users could add or remove a display, use an L-shaped hinge to elevate the monitor, or even use the base unit as a tablet.

- Ad spending increased across major digital platforms owned by Google, Meta, and Amazon during the last quarter, with YouTube experiencing a surge of 31% in spending, outpacing other streaming platforms. The data from independent agency Tinuiti revealed that all five of the biggest tracked platforms, including Google Search, Facebook, and Amazon Sponsored Products, saw growth, reflecting a general uptick in spending. However, CPMs remained flat or decreased significantly on a CPM basis for all platforms. Instagram led the growth with 31% year-over-year, while Facebook had the slowest growth at 2%. Meanwhile, Netflix and Warner Bros. Discovery's Max commanded the highest CPMs among streamers, with Netflix's CPMs nearly three times higher than other streaming services.

- IPG reported a 1.7% decline in organic net revenue in Q2 2023 due to pullbacks in the tech and telecom sectors and underperformance at its digital agencies. Operating margins also decreased to 14.2% year over year. The decrease was attributed to lighter spending in the tech and telecom sectors and continued underperformance at digital agencies like Huge and R/GA. Reductions from tech clients significantly impacted IPG's growth in Q2. The U.S. market, which makes up 66% of IPG's revenue, was particularly affected by a pullback from domestic Big Tech clients. International markets also decreased overall. Despite the challenges, IPG saw growth in some sectors like auto, financial services, food and beverage, healthcare, and CPG. The company downgraded its full-year organic growth outlook to between 1% and 2%, with 3% to 4% growth expected in the second half of the year.

- Mattel reported a 12% decline in second-quarter sales and an even larger drop in profit. The company is facing challenges due to inflation impacting consumer spending and reduced orders from retailers. To counter the decline, Mattel is banking on the success of the Barbie movie, which had a strong opening at the box office. The company believes the movie's positive impact will extend beyond the current quarter. However, analysts caution that while the movie's success may provide a short-term boost, the company needs to continue finding ways to drive Barbie sales and expand its brands. Despite the challenges, investors have responded positively to the movie's release, and Mattel shares have risen about 19% this year

- Meta is considering using AI products, including chatbots, to help creators connect with their fans. Mark Zuckerberg sees various uses for AI agents, such as fostering communities and improving interactions between creators and their followers. “There are going to be a handful of experiences around helping people connect with the creators who they care about, and helping creators foster their communities,” he said.

- Apple's services chief, Eddy Cue, has ruled out the company's rumored bid for the broadcasting rights to the English Premier League for Apple TV+. Cue stated that Apple would be unable to obtain global rights, which are crucial for the company as a global brand with customers in every country. He emphasized that Apple is investing significant engineering resources into the product and is looking for partnerships with a major impact rather than small subset deals. Recent years have seen bidding wars for the Premier League rights among broadcasters like Sky Sports, BT Sport, and Amazon Prime Video. Apple has been pursuing sports content to attract new viewers to Apple TV+, and while they have deals with Major League Baseball and Major League Soccer, Cue emphasized the importance of global rights and significant investments in any potential sports content deals.

- SAG-AFTRA, the actors' union, held a large and star-studded rally in Times Square during the ongoing actors strike. The rally featured prominent actors such as Jessica Chastain, Bryan Cranston, and Chloe Grace Moretz, among others. The actors delivered passionate speeches, demanding fair treatment and protesting against job losses due to automation and inadequate pay.

- TikTok CEO, Shou Zi Chew, is taking measures to counter threats to the popular short-form video app, including regulatory scrutiny and slowing growth. Chew is empowering the policy team to address Capitol Hill concerns and making bigger bets on e-commerce and live-streaming to invigorate growth and increase profits. The departure of the COO and replacement by Chew's former chief of staff marked a significant shake-up in TikTok's management. The app faces challenges in the US and is dealing with slower user growth and weaker digital ad revenue. Chew believes that e-commerce and virtual tipping in live-streaming are major revenue opportunities for TikTok's future.

- The partnership between Apple and Goldman Sachs aimed to create the revolutionary Apple Card has soured. The companies underestimated the difficulty of combining their distinct cultures and priorities. Apple prioritized sleek technology and user experience, while Goldman focused on regulatory compliance and profitability. There were public relations problems surrounding credit limits, and the joint savings account faced customer complaints. Moreover, Goldman's consumer strategy shifted, making the partnership less strategic for the bank. This led to Goldman attempting to exit the deal, but limited options and Apple's approval have made it challenging. Despite the hurdles, both companies still consider the partnership successful and share responsibility for its shortcomings.

- Twitter, now known as 'X,' is attempting to entice advertisers back to the platform with advertising incentives. They are offering a 50% discount on video ads displayed alongside trending topics under the "Explore" tab for select advertisers in the US and UK. However, this offer ends just before a change to Twitter's ad policy, where advertisers not meeting certain spending thresholds will lose their official brand account verification. To retain the verified status, brands need to have spent at least $1,000 on ads in the prior 30 days or $6,000 in the last 180 days. This move comes as Twitter faced a drop in advertising revenue and is trying to boost its premium services like Twitter Blue subscriptions

- Waymo is scaling back its efforts to develop autonomous truck technology, shifting its focus to ride-hailing services instead. The company announced a pause in its commercial and operational efforts for trucking and laid off a small number of employees from its trucking unit known as Waymo Via. Waymo will continue working with Daimler on developing a driverless truck and plans to work on its Driver product, which can be scaled to different vehicle types. The move comes amidst California state legislators voting on a bill that could require human drivers to be present inside autonomous trucks at all times, potentially affecting the development of driverless trucks in the state.

- Apple is currently using an internal chatbot to assist its employees with tasks such as prototyping future features, summarizing text, and answering questions based on data it has been trained with. While Apple has not yet decided on how to use its Apple GPT chatbot for customer-facing purposes, it is exploring ways to expand the use of generative AI within the organization. One possibility is providing the tool to its AppleCare support staff to better assist customers with their issues. Apple is expected to make a significant AI-related announcement next year.

- Jell-O has undergone a rebranding with updated packaging and logos to target younger parents and kids. The new design features a more modern and colorful aesthetic with cartoonish fruits on the boxes to create a playful and sensorial experience. The Jell-O logo has also been updated with a slightly elevated "O." The rebranding is the first change for the brand since 2013. The new look will be rolled out across the entire Jell-O portfolio, and the brand plans to promote it through PR, in-store support, and e-commerce advertising. This rebranding is part of Kraft Heinz's efforts to revitalize its brands, including Jell-O, Kraft Singles, Velveeta, Kraft Mac & Cheese, and Lunchables.

- TikTok is planning to launch its e-commerce business in the US in early August, creating an online marketplace where users can browse and purchase products from sellers based in China. Similar to Amazon's "Sold by Amazon" program, TikTok will handle marketing, transactions, logistics, and after-sale services. Users will have the option to leave reviews for products sold by TikTok and external sellers. The company aims to avoid inventory issues by only paying Chinese suppliers once they find buyers in the US. Despite potential challenges, including bans in some US states and calls for a federal ban, TikTok's algorithm could position it as a rival to Amazon and other China-based retailers like Temu, Wish, and Shein.

- Samsung's mobile chief, T.M. Roh, discussed the company's vision for mixed reality in an interview. Samsung, Google, and Qualcomm are partnering to create a new mixed reality platform, and Roh mentioned that for the short term, mixed reality features and experiences would likely be connected to smartphones. Samsung aims to establish an open platform for MR and hopes to improve everyday experiences through mixed reality, similar to Apple's approach with the Vision Pro headset.

- Apple is launching a new program called "EasyPay Online Ordering" in August, allowing customers to purchase products at Apple stores and have them shipped to their homes or offices using Apple's EasyPay point-of-sale machines. This move aims to compete with online retailers like Amazon and provide a more convenient shopping experience for customers who live far from an Apple Store. Additionally, speculations suggest that this program could also pave the way for home delivery of Apple's mixed reality headset, Vision Pro, which offers various components and may be easier to manage through online ordering.

- The WGA has accused the studios of being in a "mutual suicide pact" due to their negotiating strategy, which has led to a "spectacular failure." The WGA is demanding that the companies address their demands to end the ongoing strike. Despite the strike being in its 86th day, the studios have not come back to the bargaining table. The WGA highlights the disparity between the studios' success in the streaming war and their shared resistance to labor rights.

- Warner Bros. Discovery has launched a startup accelerator program called Collider On The Lot in partnership with venture fund Acme Innovation. The program aims to invest in start-up media companies with future-forward approaches to engaging fans of beloved brands, using emerging technologies for production processes, and enhancing digital experiences for fans. Eligible companies should have raised at least $500,000, and those accepted will receive funding in exchange for equity. The program seeks to build relationships with innovators and collaborate on new ideas and technologies.

- R/GA has launched "The Associates," a program targeting the agency's alumni, offering them a minimum of 20 weeks of work per year. The program is a form of fractional hiring, providing flexibility to both employees and clients without the constraints of project-based work or part-time arrangements. The move comes as R/GA seeks to better manage skills, financial impact, and headcount in response to the rise in project-based client requests and the trend towards flexible work culture. Participants in the program will have access to office space, hardware, and benefits similar to full-time employees. While currently an R/GA-only pilot, the agency envisions the approach becoming industry-wide in the future.

- Samsung Electronics reported a significant 95% profit drop in the second quarter of 2023, attributed to weak chip demand and a declining smartphone market. These poor results are consistent with previous quarters, reflecting a combination of global economic challenges and excess supply resulting from Samsung's attempt to gain market share by increasing production when competitors scaled down.

- Apple's Incredibly Rare Sneaker From the '90s Selling for $50,000

- Madonna Has Been Quietly Releasing Albums Throughout 2023

- Why Cheech & Chong Ads Are Flooding Twitter

- M&C Saatchi CEO MacLennan Stepping Down

- Netflix lists AI job worth $900,000

- Sinead O'Connor has died at 56

- KFC converts restaurant into omakase experience to celebrate Teriyaki Burger

- In agency world, companies profess gaming investments, with mixed results

- Twitter commandeers @X username from man who had it since 2007

- How retail media has become a growing marketing channel

- Spotify Plans to Raise Price of Premium Plan in U.S.

- McDonald's Grimace Shake Trend Pays Off

- Warner Bros. Animation And Cartoon Network Workers Vote To Join The Animation Guild

- How the Threads design team branded the app

- Gut's Anselmo Ramos explains how to go 'from zero to best' agency in 5 years

- EU opens Microsoft antitrust investigation into Teams bundling

- Chief Brand Officer Anuj Bhasin Gets to the Core of Gatorade

- L’Oreal on lookout for further acquisitions after Aesop

- Facebook surpasses 3 billion monthly active users

- How Duolingo, Ikea & others are using anime to reach Gen-Z

- Sequoia Capital cuts back fund for crypto investments

- Roku Sees Pop In Q2 Ad Sales

Just going to leave this here....

Announcing our paper on Generative TV & Showrunner Agents!

— The Simulation (@fablesimulation) July 18, 2023

Create episodes of TV shows with a prompt - SHOW-1 will write, animate, direct, voice, edit for you.

We used South Park FOR RESEARCH ONLY - we won't be releasing ability to make your own South Park episodes -not our IP! pic.twitter.com/6P2WQd8SvY

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion