July 14 2023 - The Strike, The Merger & The Iger

👋Happy Friday friends. WOW there is a lot to get through. The SAG-AFTRA strike is official, Microsoft and Activision are in the home stretch, and Disney will look very different in one year. All this plus the Friday roundup video below. Let's get into it–

SAG-AFTRA, the actors' guild representing 160,000 television and movie actors, has voted to go on strike, joining the screenwriters who have been on strike since May. This marks the first industry-wide shutdown in 63 years. The strike is a result of failed negotiations with studios over a new contract, with streaming services and artificial intelligence being key points of contention. The strike will affect cities across the United States where scripted shows and movies are produced. Both actors and screenwriters are demanding fair pay and protections against the use of AI technology in their industry. This is the first major strike by actors since 1980 and comes at a time when the entertainment industry is still grappling with the impact of the pandemic and the rise of streaming platforms.

A federal judge has ruled against the FTCs attempt to delay Microsoft's $70 billion acquisition of Activision Blizzard. The judge stated that the FTC had failed to demonstrate that the merger would result in a substantial reduction in competition harmful to consumers. This decision paves the way for Microsoft and Activision to proceed with the merger as early as this month. The ruling has put the U.K.'s competition regulator, the CMA, in a challenging position, which rejected the acquisition in April, is now the only major regulator standing in the way of the merger. The CMA has stated that it will need to conduct a fresh investigation if any changes are made to the deal to address its concerns, potentially delaying the completion of the acquisition before the companies' self-imposed July 18 deadline.

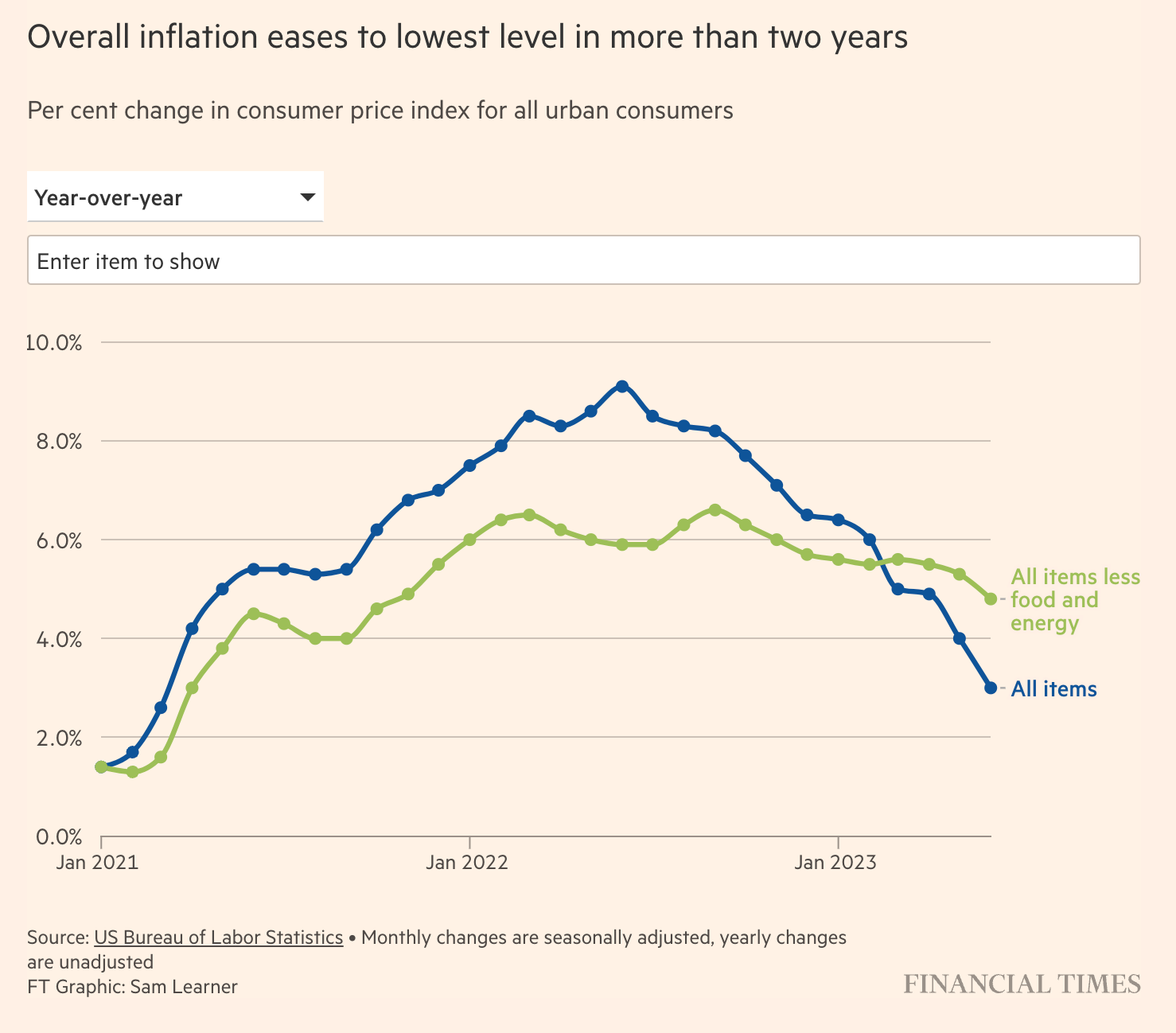

US inflation dropped to 3% in June, signaling the Federal Reserve's success in curbing price pressures. The decline in inflation sent the US dollar lower, with the dollar index hitting its weakest level in 15 months. Despite the moderation in inflation, the Fed is expected to continue raising interest rates to bring core inflation closer to its 2% target. The Bank of England, on the other hand, is struggling to control inflation at 8.7%.

Bob Iger has extended his tenure through 2026, as the search for his successor remains challenging. The board requested the extension, emphasizing the importance of the succession process. The company faces challenges in various areas, including the performance of its movie studios and the debt incurred due to the pandemic. Additionally, Disney's traditional television business has been impacted by cord-cutting, leading to a greater reliance on streaming services. Despite these challenges, Disney's theme park business continues to be a source of profit and growth.

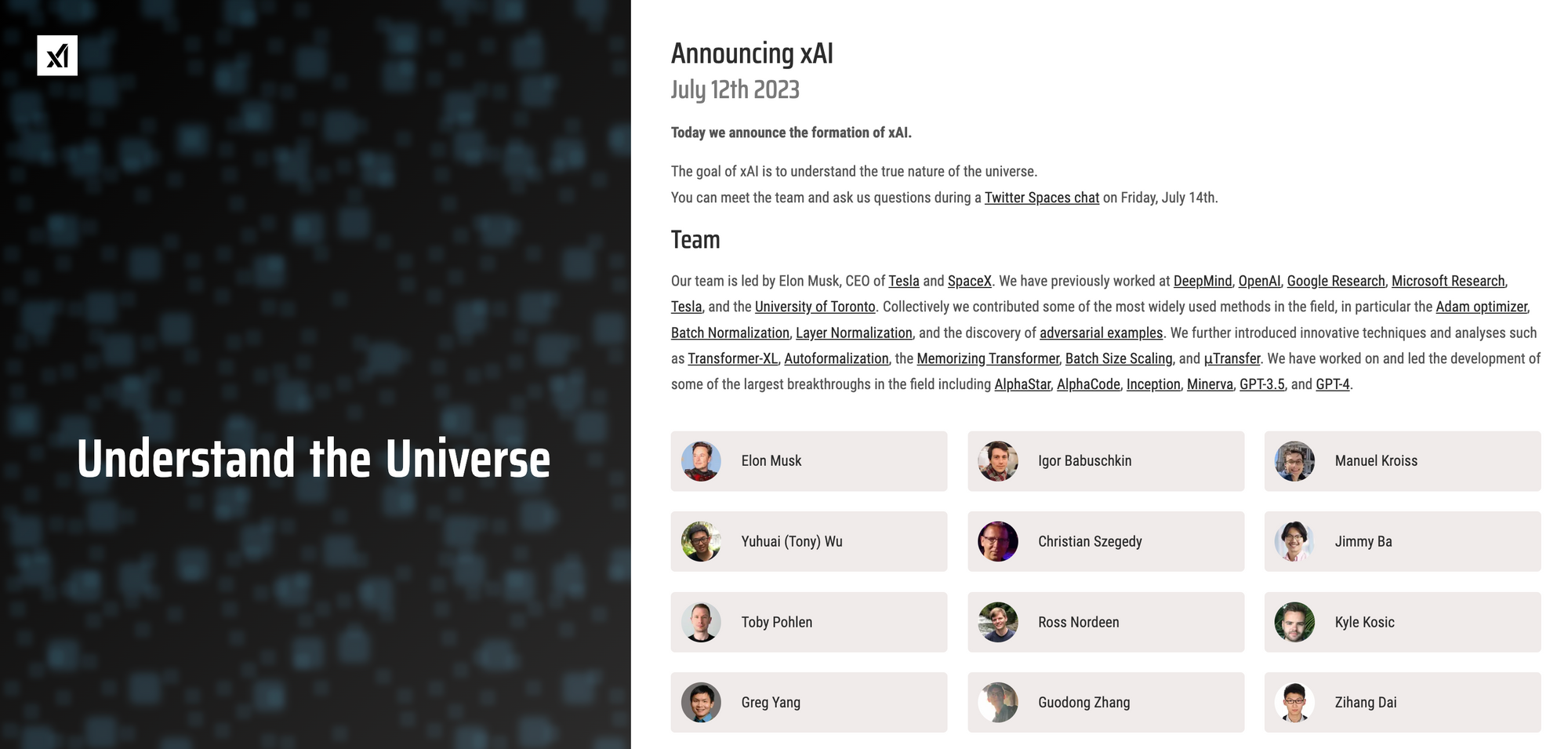

Elon Musk's newly formed AI company, xAI, has been unveiled with a website that outlines its mission to "understand the true nature of the universe." Led by Musk, the team includes members with experience at major AI companies such as OpenAI, Google Research, Microsoft Research, and DeepMind. The website also mentions that xAI will work closely with Musk's other ventures, including Tesla and X Corp. The company plans to host a Twitter Spaces discussion on July 14th, providing an opportunity for people to meet the team and ask questions. This announcement follows previous filings indicating Musk's involvement in founding xAI earlier this year.

Liquid Death has hired Goldman Sachs to lead a potential IPO, aiming to go public as early as spring next year. The decision comes amid a sluggish IPO market but with signs of potential recovery and growing investor demand for newly listed companies. Liquid Death has raised $200 million in venture capital and is backed by Science.

Disney CEO Bob Iger has stated that the company's TV and cable businesses may not be core to the company and that they will be open to exploring opportunities for those properties, including a potential sale. He also discussed Disney's plans for ESPN and Hulu, expressing a commitment to the sports business and a decision to keep Hulu to support the profitability of Disney's streaming business. Iger addressed challenges in the media industry's shift to streaming and expressed optimism about Disney's future, highlighting the success of the parks and studio businesses.

- Huge has announced further layoffs of its global staff and a reorganization of its executive team. The agency is undergoing a transformation to become a consultancy and is adding more AI capabilities. The internal memo from CEO Mat Baxter stated that the changes are being made to deliver more value to clients and build a sustainable business. The exact number of layoffs was not disclosed. Katie Klumper, founder and CEO of Black Glass, has been appointed as the new global client president.

- Billy Seabrook, Global Chief Design Officer for IBM iX, discussed the impact of generative AI on workflows and roles in the marketing industry. Seabrook highlighted concerns about the increased pace of work and the ability of humans to keep up with the possibilities offered by generative AI. The risk of creative homogeneity was also mentioned, with the need to mix different models and create original work.

- Havas has acquired a majority stake (51%) in Uncommon Creative Studio, a highly awarded independent creative company in the UK. The deal, valued at £80-120 million, allows Uncommon to retain its brand and decision-making autonomy while benefiting from the resources and global network of Havas and parent company Vivendi.

- Hulu and creator Adam Rose have struck a deal to feature the first sponsored ad on Threads. The ad, promoting the return of the TV show "Futurama," appeared as a sponsored Thread labeled as a "Hulu Partner" message. While the app does not have a formal ads program yet, Hulu saw an opportunity to experiment. Meta is reportedly working on integrating paid promotions into the app. The deal between Hulu and Adam Rose was facilitated by Influential, a creator and social media marketing ad firm.

- Fast Retailing, the parent company of Uniqlo and Muji, has reported a surge in quarterly profits driven by strong post-pandemic sales in China. The company upgraded its guidance for the year, expecting record operating profits. The company attributed the growth to the lifting of Covid restrictions and increased demand for summer products. Fast Retailing has made aggressive investments in marketing and branding and increased wages for workers, positioning itself to capture demand when the market recovered. Similarly, Ryohin Keikaku, the owner of the Muji brand, reported a doubling of its third-quarter operating profit, highlighting strong demand for essential daily goods.

- PepsiCo experienced strong sales and profit growth in the latest quarter. Despite price increases, consumers continued to spend on snacks such as Doritos and Cheetos, leading PepsiCo to raise its revenue outlook for the year. The company's North American snacks unit saw a 14% increase in revenue, while its North American beverage business experienced a 10% increase. PepsiCo's price/mix, which includes prices and product mix, rose 15%, mainly due to price hikes aligned with commodity price increases. However, there are signs that price increases are impacting demand, as sales volumes declined in several business units, except for the Frito-Lay snacks business.

- TikTok aims to compete with platforms like YouTube and Twitch in the gaming industry by leveraging its unique approach to gaming content. Unlike other platforms, TikTok plans to focus on celebrating the culture of gaming rather than gameplay, tips and tricks.

- Roku and Shopify have announced an expanded partnership that allows customers to purchase products directly from Shopify merchants through Roku Action Ads. Viewers can press "OK" on their Roku remotes when they see an ad to learn more about the product and make a purchase using Roku Pay. This integration marks the first commerce integration for independent Shopify merchants on TV streaming.

- Paul Finebaum, a longtime ESPN contributor, has expressed his disappointment and confusion regarding the recent layoffs at the sports network. Finebaum called it the "worst day" in his 10 years at ESPN and couldn't understand the thinking behind the decision. He mentioned that the uncertainty surrounding the layoffs caused anxiety among employees, including himself. Finebaum acknowledged that the layoffs were a business decision but emphasized that it still hurts, especially for the well-known personalities who were let go. ESPN personality Stephen A. Smith also commented on the cuts, expressing that his former co-workers deserved better and hinting that more layoffs may be on the horizon. Among the personalities affected by the layoffs were Jeff Van Gundy, Jalen Rose, Max Kellerman, Keyshawn Johnson, and Steve Young.

- According to sources, Hollywood studios and the AMPTP are planning to let the WGA strike continue until writers start running out of money, with the intention of resuming talks in late October. The studios and AMPTP believe that after several months on strike, financially strained writers will be compelled to demand a restart of negotiations, putting the studios in a stronger position to dictate terms. This strategy is seen as an attempt to break the WGA and prevent future strikes in the industry. While the AMPTP refutes the claim, insiders confirm that the approach is aimed at the bottom line and viewed as a "cruel but necessary evil." The WGA has not yet responded to the reports.

- PepsiCo has announced a global partnership with EA Sports for the "EA Sports FC" football game series. The deal involves Pepsi, Gatorade, and Lay's, and will feature branded in-game events and activations based on PepsiCo products. PepsiCo's head of global sports and partnerships, Adam Warner, emphasized the mutual value and audience reach that the partnership brings to both brands. Warner also mentioned that the partnership expands into the broader gaming and esports spaces, indicating a move away from dedicated esports spending. In-game advertising will play a significant role in the partnership, with both companies aiming for seamless brand integrations. The decoupling of EA and FIFA last year likely facilitated the partnership, as it freed EA from involving FIFA in discussions with potential brand partners.

- Microsoft has introduced a new default font called Aptos, replacing Calibri after 15 years. Aptos was chosen from five new fonts commissioned by Microsoft and will now appear as the default font across Word, Outlook, PowerPoint, and Excel for millions of users. Designed by Steve Matteson, Aptos is a sans serif font with a slight humanist touch, aiming to be professional yet relatable. It features varying geometric shapes, clean-cut stem ends, and subtle circular squares within the contours of letters for enhanced legibility.

- 160over90 has acquired London-based creative brand experience agency XYZ, expanding its capabilities and presence in Europe. With the acquisition, XYZ's managing director, Will Mould, and executive creative director, Paul Stanway, join 160over90 as senior vice presidents. XYZ specializes in designing and producing campaigns for lifestyle and luxury brands, offering services such as creative strategy, experience design, content creation, and live event production. The 35 full-time employees of XYZ will now operate under 160over90, adding to the agency's existing London-based team.

- Twitch has announced that it will be introducing Stories and a Discovery Feed feature to its platform. The Stories feature, similar to those on Instagram and Snapchat, will allow Twitch users to record and share content starting in October. The Stories will be subject to Twitch's guidelines and safety systems, and creators will have the option to limit the visibility of their Stories. The Discovery Feed, which will also be introduced in the fall, aims to help creators grow their audiences by showcasing live and recorded content on the Twitch mobile app. Twitch will conduct limited testing of the Discovery Feed before making it available to all users later in 2023. Additionally, Twitch is working on improving its built-in clip editor to allow creators to export vertical videos directly to TikTok, and it is giving creators more control over when ad breaks play during their streams with the introduction of a chat countdown timer.

- Ogilvy has been selected as the global creative partner for Pernod Ricard's Irish whiskey brand, Jameson, after winning a competitive pitch against TBWA and Publicis New York. The agency will handle Jameson's global creative strategy, with the UK office leading the account and support from the US team. Ogilvy's global presence and ability to adapt to the brand's essence and truth were key factors in the decision. Jameson aims to reinforce its presence in established markets like the US while also pursuing success in emerging markets.

- Researchers at Netflix have developed a new green screen technique called Magenta Green Screen, which combines digital cameras' blind spots with AI to make removing green screens easier and potentially more accurate. Instead of using traditional green or blue backdrops, the technique involves bathing actors, props, and set pieces in a mix of blue and red light, resulting in a heavy magenta tint. The technique overcomes challenges such as matching colors, dealing with fine details, and working with transparent objects. However, it requires a machine learning colorization technique to remove the magenta tint. The approach offers the advantage of allowing on-screen talent to wear any colors and is potentially faster with more accurate results, but it presents new challenges for on-set visualization and real-time application.

- According to Tumblr CEO Matt Mullenweg, the social media platform is losing approximately $30 million annually. Despite efforts to improve profitability, including rolling out new features and increasing revenue through offerings such as blue checkmarks for $8, Tumblr has struggled to grow its user base. While there is potential for growth amid the exodus from Twitter, Tumblr has not experienced significant user number increases. The company recently shared its core product strategy, aiming to address issues such as user confusion and improve algorithmic ranking capabilities.

- VaynerMedia has been appointed as the global brand agency of record for Bose, following a multi-month review process. The agency will be responsible for executing one of the largest assignments for VaynerMedia's London office to date. Indie media agency PMG won the performance media review, while Ipsos and Hill+Knowlton secured Bose's analytics and business accounts, respectively. VaynerMedia impressed Bose with its data-informed creative planning strategy and its novel approach to linear TV buying. The agency will work closely with Bose's internal teams to create content across multiple platforms. This partnership is part of VaynerMedia's focus on expanding its global footprint and expertise in linear buying.

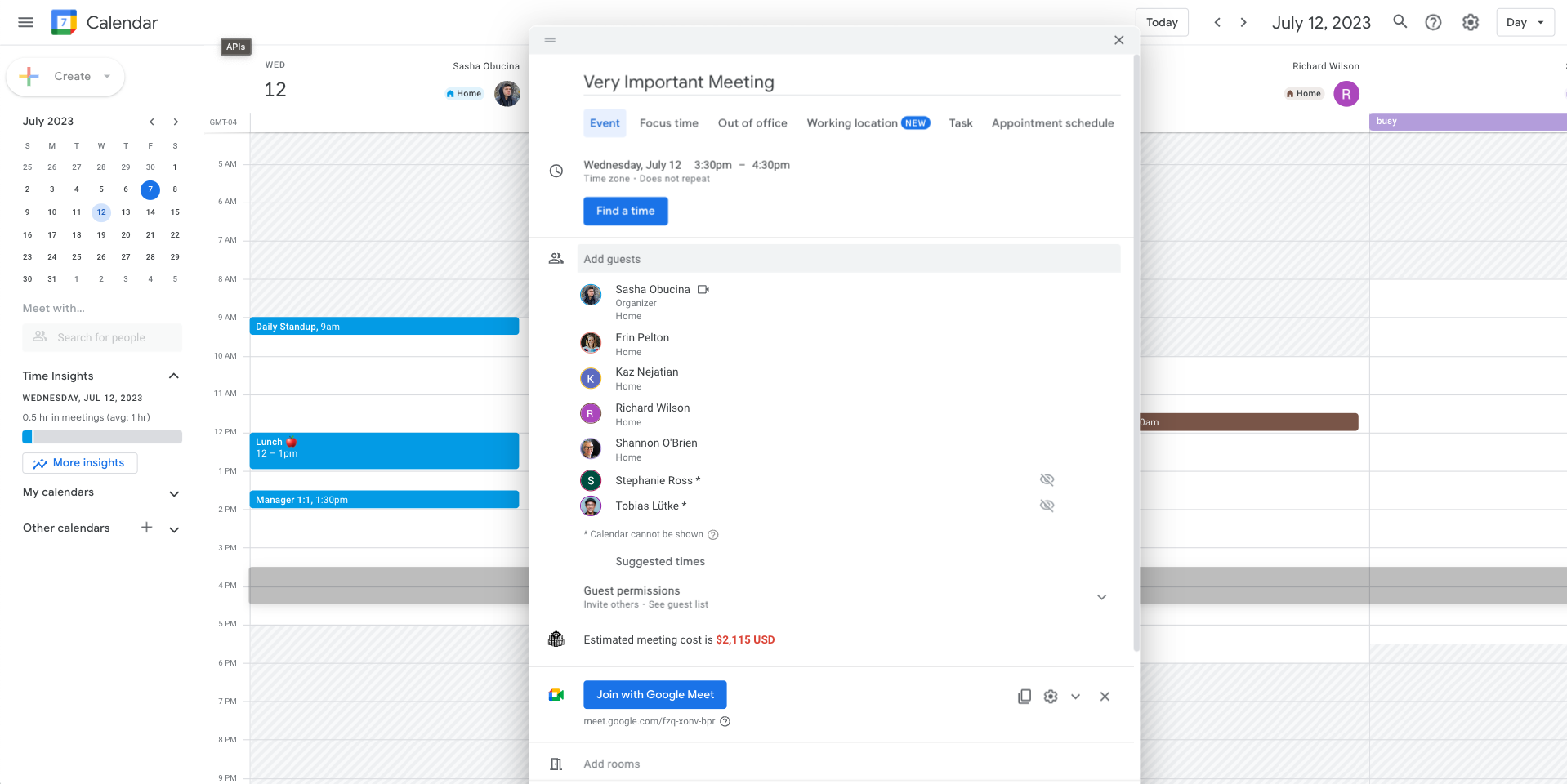

- Shopify has introduced an internal calculator embedded in employees' calendar app to estimate the cost of meetings with three or more people. The tool calculates the cost based on average compensation data, meeting length, and attendee count. Shopify aims to reduce unnecessary meetings and has already eliminated recurring meetings with more than two people. The company plans to cut out 322,000 hours and 474,000 meetings in 2023. The initiative aims to change the default answer from "yes" to "no" and raise awareness about the value of time. Noncritical meetings waste about $100 million per year in large organizations.

- Monster Beverage has been granted approval by a judge to acquire Bang Energy out of Chapter 11 bankruptcy for $362 million. The sale is expected to save at least 300 jobs for Bang. The deal had been uncertain until July 3 when Monster and Bang entered into an asset purchase agreement. The sale is still subject to standard closing conditions. Monster and Bang Energy had previously faced legal battles, with Monster winning a lawsuit against Bang for false advertising.

- Snap's efforts to attract creators back to its platform are showing early signs of success. The company has been testing a new program that allows creators to earn a portion of revenue from ads shown between their posts. The program, called Snap Star, has attracted several thousand creators and is part of Snap's broader strategy to reverse declining sales. By offering a revenue-sharing incentive, Snap aims to provide creators with a more lucrative opportunity compared to flat fee payment programs.

- The New York Times has announced that it will disband its sports department and rely on coverage from The Athletic, a sports website the company acquired last year. The move is part of The Times's strategy to focus more on high-impact news and enterprise journalism related to the intersection of sports with money, power, culture, politics, and society. The coverage of games, players, teams, and leagues will primarily come from The Athletic, and articles from The Athletic will also be featured in The Times's print newspaper. The transition is expected to be completed by the fall, and no layoffs are planned as journalists from the sports desk will move to other roles in the newsroom. The acquisition of The Athletic was aimed at appealing to a broader audience, and although The Athletic has yet to turn a profit, its number of paying subscribers has grown significantly.

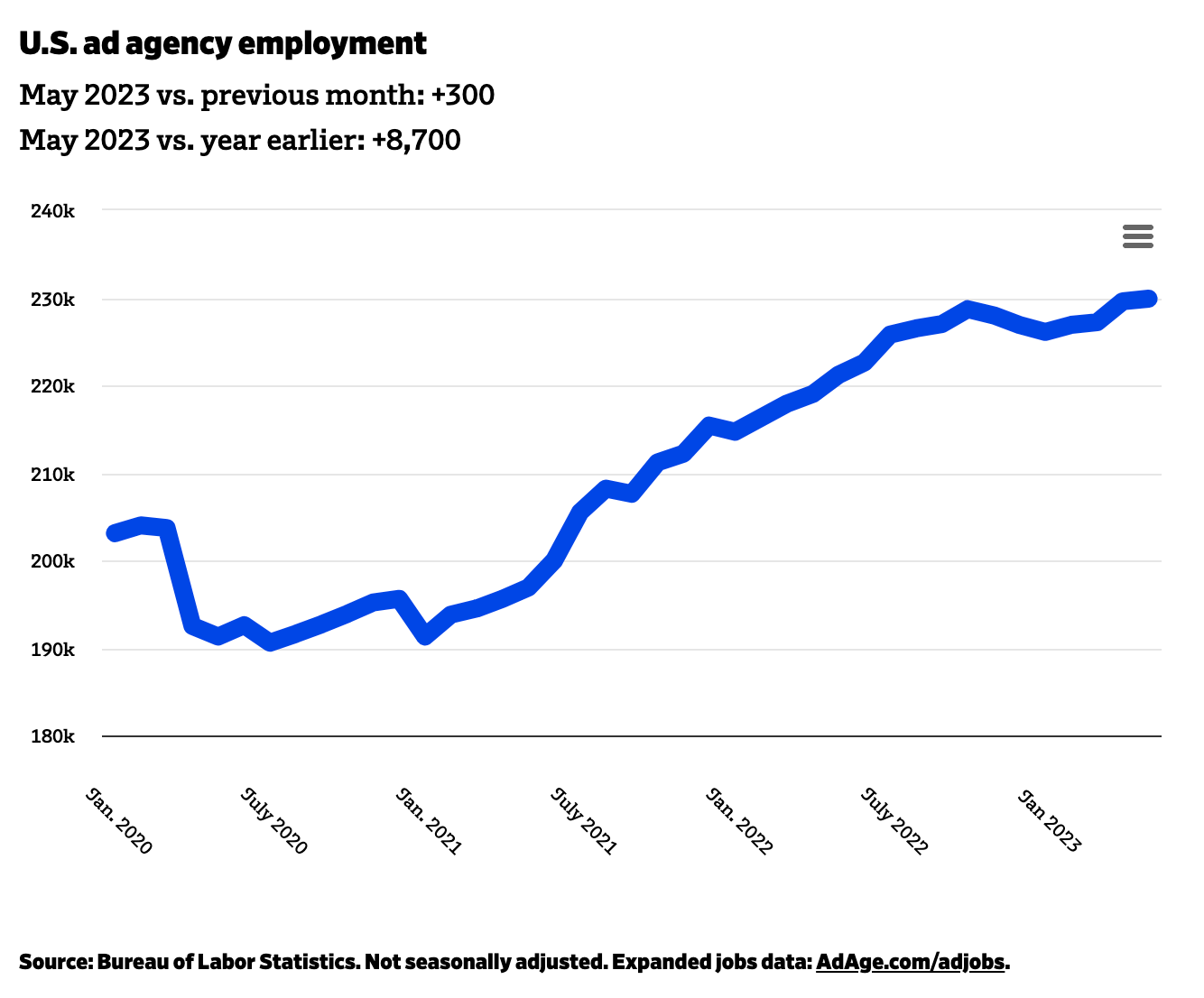

- Employment in the advertising, public relations, and related services sector in the US reached its highest level since 2001, adding 2,200 jobs in June. Ad agency employment specifically increased by 300 jobs, setting a new all-time high. While the overall economy added 209,000 jobs in June, it marked the smallest monthly employment gain in 30 months. The unemployment rate decreased slightly to 3.6%. Despite cutbacks at ad-centric tech firms and media companies, the ad industry experienced consistent staffing increases in the first half of 2023.

- McCann Worldgroup China has launched its 'Influencer Marketing' business unit, aimed at helping brands find suitable influencers and executing integrated marketing campaigns that combine creativity and influence. With the rise of influencers in China's social media landscape, brands are seeking collaborations to enhance their marketing efforts. The new unit will leverage McCann's expertise and offer diverse solutions to clients, embedding influencer marketing into the planning stage of campaigns. The unit provides access to a wide range of opinion leaders and offers strategic thinking to maximize the effectiveness of using key opinion leaders.

- Swiss watchmaker Swatch has reported a half-year sales record due to increasing demand for luxury watches. The company's net sales rose by 18% in the first half of the year, surpassing pre-pandemic levels. Swatch's lower-priced watches, including popular brands like Omega and Tissot, drove the sales growth. The company saw significant growth in Hong Kong and other European markets, as well as in mainland China as travel activity resumed. Separately, Watches of Switzerland, the largest seller of Rolex watches in the UK, also experienced strong sales and profitability, with luxury watch demand outpacing supply.

- Twitter has announced that it will share ad revenue with verified creators on its platform. Users who subscribe to Twitter Blue and have garnered more than 5 million tweet impressions per month for the past three months are eligible to participate. The first round of payouts, totaling $5 million, will be cumulative from February onwards and will be delivered via Stripe. Some creators have shared their earnings, with Brian Krassenstein claiming $24,305, SK earning $2,236, and Benny Johnson receiving $9,546. Payouts are based on tweet impressions, with rates estimated at $0.0085 CPM or $8.52 per million impressions. The ads monetized are those served in tweet replies rather than the main feed.

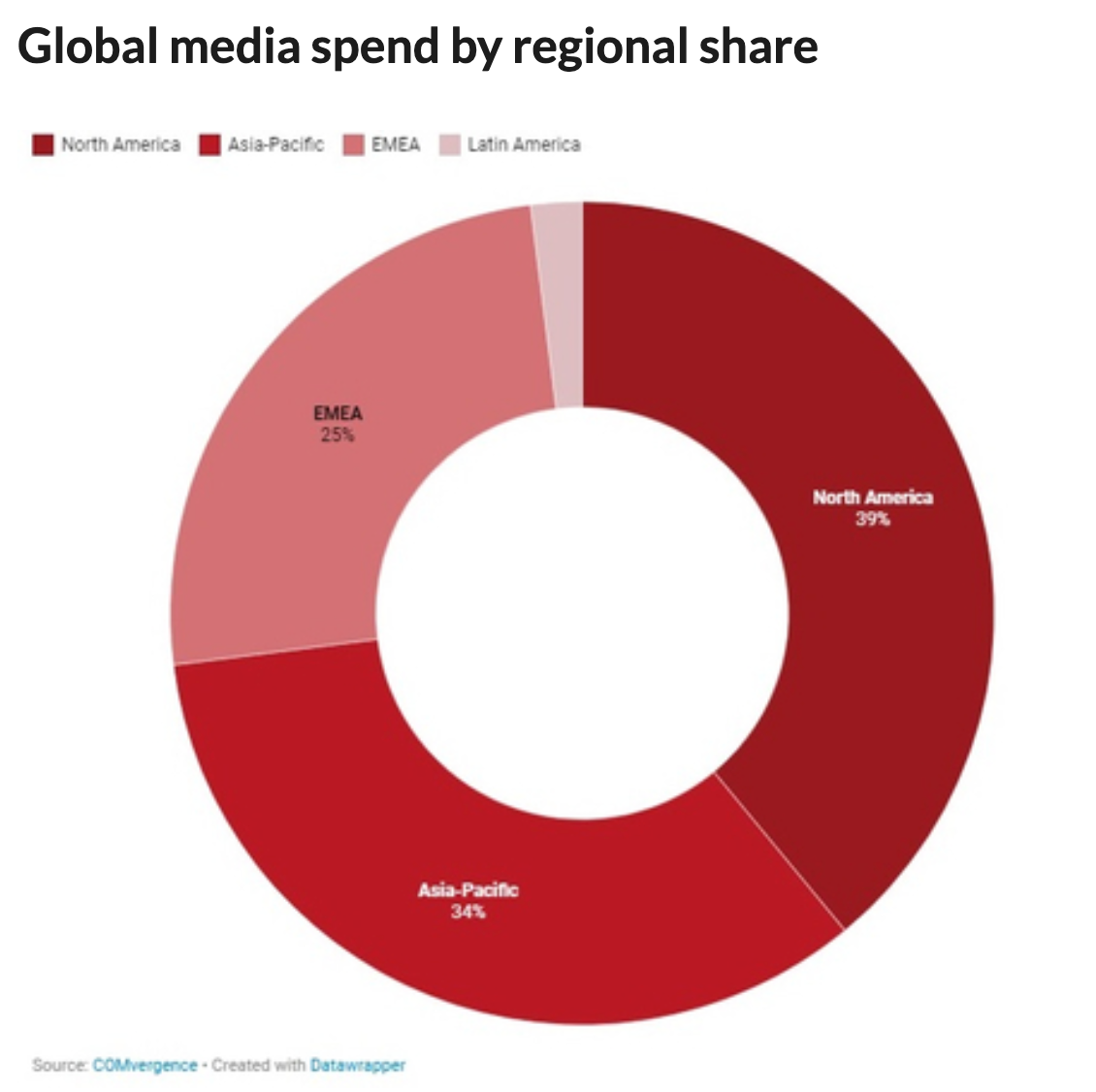

- Global media spend reached over $400 billion in 2022, experiencing a growth rate of more than 6% compared to the previous year. This information is highlighted in a report by research group COMvergence. The report reveals that the "big six" advertising holding groups accounted for $213 billion of the total spend, while major independent agencies contributed to a total spend of $253 billion. Digital media saw significant gains, representing 48% of global spend, with a value of $121 billion. In terms of agency rankings, OMD, a part of Omnicom, emerged as the top agency network globally, handling $22.5 billion in billings. North America was the leading region in terms of media spend, followed closely by Asia-Pacific and EMEA. The UK accounted for 5% of global media spend in 2022.

- It's a quietly big year for the Apple TV and tvOS

- VanMoof explores sale under court protection because it can’t pay bills

- For Threads, Usage Is What Matters, Not Downloads

- MSCHF is crowdsourcing a frame-by-frame recreation of 'Bee Movie'

- Gmail's new tools make it even easier to set up a meeting

- EA to launch single-player Black Panther video game

- Lucid stock falls as sales miss expectations

- Jony Ive’s LoveFrom worked on this limited edition $60,000 turntable

- CreatorIQ develops metrics showing the return on influencer marketing

- Roblox is Coming to Quest

- Evernote is relocating to Europe after laying off most of its US workforce

- Threads has gained over 100 million users within five days of its launch

- Slack’s vision for enterprise AI: Empower ‘everybody to automate’

- Collective, a financial management platform for freelancers, raises $50M

- Anthropic releases Claude 2, its second-gen AI chatbot

- Sarah Silverman Sues OpenAI and Meta Over Copyright Infringement

- Twitter blocks links to Threads as traffic drops

- Netflix appoints new media planning and buying agency in the UK

- Hill Holliday CEO Karen Kaplan steps down after 41 years at the agency

- Sam Altman’s Tangle of Investments

- Disney Explores Strategic Options for India Business

- Kartoon Studios launches film division

- Animation Guild Reaches “Historic” Deal To Represent Artists & Production Workers At Powerhouse Animation In Texas

- Amazon Reels in $12.7 Billion on Prime Day

Every time you're on set for the golden hour shot

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion