August 4 2023 - Earnings, Media & AI

👋Happy Friday friends. Earning season continues on with tech reporting generally positive results, while entertainment and media feeling the pain a bit more. AI partnerships continue to roll through adland and some interesting data on current and future media spend. All that and more, let's get into it –

Apple reported a 1% decline in revenue to $81.8 billion in the three months ending in June, marking the company's third quarterly sales decline of its current fiscal year. However, profits increased 2% to $19.88 billion. The resilience of its iPhone business, with $39.67 billion in sales, down 2% from a year ago, helped buoy the company's results. Apple managed to increase its market share and expand sales in emerging markets like India and Latin America, while other smartphone rivals faced sales declines. The company's services business, including Apple Music, App Store, and Apple Pay, posted $21.21 billion in sales, an 8% increase from last year, while wearables sales rose 2% to $8.28 billion. Despite the decline in iPad and Mac sales, Apple plans to rely on its existing businesses for sales growth in the coming years, as it anticipates launching its high-tech goggles called Vision Pro next year. Additionally, Apple has been focusing on boosting sales in developing markets, particularly in India, where sales have doubled in recent quarters. The company is expected to unveil a new iPhone and updated models of the Apple Watch in September.

Pinterest reported better-than-expected revenue of $708 million in the second quarter, with a 6% rise, but disappointed some investors as digital-ad competitors posted more upbeat results. The company's CEO, Bill Ready, aims to expand beyond advertising and focus on shopping to increase user engagement. Pinterest's monthly users increased 8% to 465 million, and earnings per share were 21 cents, surpassing estimates.

Warner Bros. Discovery reported a 4% decline in total revenue to $10.36 billion in the second quarter, with its streaming segment losing 1.8 million subscribers. The company's direct-to-consumer segment, which includes Max and Discovery+ streaming services, faced fierce competition and produced an adjusted loss of $3 million. Despite efforts to reduce churn, the company's streaming operations remain in the red. The loss narrowed to $1.24 billion, but the company still has a total debt of $47.8 billion. Warner Bros. Discovery's advertising revenue also declined due to a general slowdown, and its networks segment saw a 5% revenue drop. Revenue from the studio segment decreased by 24% to $2.58 billion due to lackluster box office results and a strong performance in the year-ago quarter.

Block raised its adjusted profit forecast for the year due to the growing popularity of its Cash App. The company now expects earnings before interest, taxes, depreciation, and amortization to reach $1.5 billion, up from the previous guidance of $1.36 billion. This increase is supported by strong performances from both Cash App and Square, with companywide gross profits reaching $1.87 billion, surpassing analyst estimates. Cash App, which has 54 million monthly active customers, is now the company's largest business. The positive results have been helped by cost-cutting measures, including reducing office space and controlling hiring and marketing expenses. Despite facing challenges from a short-seller report earlier, the company's stock fully recovered after a 15% drop.

Shopify shares declined as investors expressed concerns about the company's long-term growth, despite the e-commerce platform's strong revenue outlook for the current quarter. Shopify expects its revenue in the current quarter to grow by 20% or more. However, analysts pointed out that investors lack clarity on the company's future growth beyond the current quarter. The company's president, Harley Finkelstein, defended the strategy, emphasizing the focus on commerce and retail software and expansion of the shipping business and merchant base. Shopify's second-quarter revenue exceeded expectations at $1.69 billion.

Amazon reported a strong sales outlook for the current quarter, surpassing analysts' estimates. The company expects revenue to be between $138 billion to $143 billion, with operating income ranging from $5.5 billion to $8.5 billion. This optimistic forecast is attributed to the impressive performance of its main e-commerce business. CEO Andy Jassy has been making significant changes to the company, cutting jobs, reviewing businesses, and investing heavily in the logistics operation to enhance its core online retail business. In the second quarter, Amazon's revenue increased 11% to $134.4 billion, beating expectations, while operating expenses rose 7.5% to $126.7 billion. However, the growth rate of Amazon Web Services (AWS), a major contributor to operating profit, has been slowing down for six consecutive quarters, even though its revenue reached $22.1 billion.

Uber reported a 14% increase in revenue in its most recent quarter, reaching $9.2 billion. However, this growth is the slowest since the pandemic began easing. The company's gross bookings, the amount paid by customers, rose 16% to $33.6 billion. Uber also achieved a net profit of $394 million, compared to a $2.6 billion loss a year earlier, thanks to gains from investments in other companies. The growth in ride-hailing revenue was 38%, with active customers growing by 12% to 137 million. However, Uber's freight service revenue declined by 30%. The company also faced higher costs related to driver incentives and spending on attracting more drivers.

Linear TV experienced it's sharpest decline ever recorded in 2022, dropping from 83% in 2021 to 79%. Older audiences (65 and over) also showed a significant decline in daily broadcast TV viewership by 10% year on year. Traditional broadcasters faced steep declines, losing mass-audience pulling power for soaps and news programs. Broadcast platforms, including linear, TV recordings, and on-demand services, maintained a 60% share of total video viewing. Subscription video-on-demand (SVoD) growth showed signs of slowing down, with 66% of households using SVoD services in Q1 2023, compared to its peak of 68% in Q1 2022.

- Microsoft's worldwide advertising spending decreased by 40% in its latest fiscal year, dropping to $904 million from $1.5 billion in the previous year. This is the lowest level of ad spending for the company since 2004. The decline in advertising is attributed to a decrease in Windows advertising. The ad spending as a percentage of revenue was 0.4%, the lowest since the 1990s. Microsoft's ad spending peaked in 2013 at $2.6 billion, representing 3.3% of revenue. If the pending acquisition of Activision Blizzard is completed, Microsoft's ad spending for the current fiscal year is expected to increase significantly. Activision Blizzard spent $882 million on advertising in 2022, representing 11.7% of its revenue, with indications of a solid increase in ad spending in 2023

- Dept has launched a gaming-focused division called Dept/Games after research showed that 88% of Gen Z and 94% of Gen A identify as gamers. The new division will concentrate on gaming-focused strategy, design, and development, including activations in AR, VR, AI, metaverse, and popular gaming platforms. The team will focus on audience penetration, deep engagement, loyal communities, and new revenue streams for brands. The agency aims to connect brands with players through immersive activations and sees gaming as the new social media, catwalks, stadiums, storefronts, and classrooms. Dept has previously worked with major brands like Apple, Meta, eBay, TikTok, and Disney on gaming activations. Dept/Games plans to help brands connect with audiences in the 3D social spaces of major gaming platforms like Fortnite and Roblox.

- Vice Media has formally closed its sale to a consortium of former lenders, led by Fortress Investment Group, Soros Fund Management, and Monroe Capital, after filing for Chapter 11 bankruptcy in May. The new owners expressed excitement about building upon Vice's iconic brand in news and entertainment and serving audiences, brands, and partners with award-winning content. The company's co-CEOs stated that this marks the start of an exciting new era for Vice, with the resources to strengthen their business and content creation across all platforms.

- Meta's Reality Labs Research team has unveiled two new demo prototypes at SIGGRAPH. The first is called Butterscotch Varifocal, which combines varifocal technology with a retinal-resolution VR display, providing a more natural and comfortable VR experience. The second is Flamera, a computational camera using light field technology for reprojection-free VR passthrough, enabling a more realistic mixed reality experience. While both prototypes are in the research stage and may not become consumer products, they showcase the team's commitment to pushing the boundaries of VR and MR technology.

- Pereira O'Dell has hired Juliana Constantino as the executive creative director. Juliana previously worked at Meta as the global creative product lead, where she was instrumental in leading the go-to-market strategy for innovative products within Instagram, such as Reels, Stories, and IGTV. At Pereira O'Dell, she will work with the creative leadership team to connect data and creativity and foster a stronger connection with maker culture. She also has a keen interest in artificial intelligence and its potential to revolutionize creativity in the advertising industry.

- Publicis-owned Profitero has introduced a new chatbot called "Ask Profitero". This AI assistant is designed to help companies in the e-commerce sector analyze data for 1,000 brands in 50 countries. It can provide insights on various aspects, including price, availability, search rank, ratings, reviews, and more. The tool offers predictive capabilities to drive conversion for specific retailers and categories. While still in beta mode, it aims to help advertisers navigate the complex retail media landscape and make data-driven decisions.

- Salesforce recently laid off more workers in addition to the previously announced 10% reduction in its workforce. The company's goal is to reduce headcount by approximately 8,000 people by the end of fiscal 2024, with a renewed focus on profitability and aggressive margin-expansion targets.

- YouTube is adding new features to its Shorts platform, aiming to compete with TikTok. One of the significant additions is previews of live videos in a user's Shorts feed, similar to TikTok's live videos. Creator monetization features like paid chatting and memberships will also be available in this feed. YouTube is also testing tools to create Shorts from horizontal YouTube videos, suggesting audio clips and effects for creators to use, and enabling side-by-side recording (called Collab) with another clip. These updates are part of YouTube's efforts to attract more creators and compete in the short-form video space dominated by TikTok.

- Netflix has introduced a new mobile game, "Cut the Rope Daily," as a spin-off of the mobile game franchise from ZeptoLab. The game is exclusive to Netflix and is available to all members. Players are presented with daily physics puzzles where they must guide candy to the character Om Nom's mouth. The game does not include ads or in-app purchases and offers different art and visuals for each month's puzzles. Additionally, Netflix is releasing episodes from the animated series "Om Nom Stories" on the app. The platform has been expanding its gaming lineup, offering a mix of original and existing mobile titles.

- Marvel's in-house podcast team has been cut in half as part of Disney's ongoing layoffs. Marvel's podcast unit had previously signed a multi-year agreement with SiriusXM to launch scripted and unscripted podcasts, but the conclusion of the latest season of "Marvel’s Wastelanders" marked the end of the partnership. Meanwhile, SiriusXM reported its second-quarter earnings and is betting on a new "next-gen" app to attract more streaming subscribers.

- Meta is reportedly preparing to launch AI-powered chatbots with different personas as early as next month. These chatbots will engage users in human-like conversations and take on various characters, including a surfer and Abraham Lincoln. The goal is to boost engagement on Meta's social media platforms and provide users with search results and recommendations. Mark Zuckerberg, recently mentioned the development of new AI-powered products during the company's second-quarter earnings call, with more details expected to be revealed at the Connect developer event in September.

- YouTube is testing an AI feature that generates video summaries automatically. These summaries aim to provide viewers with a quick overview of a video's content, helping them decide if the video is of interest to them. However, YouTube clarifies that the AI-generated summaries will not replace the video descriptions written by the creators. The tests are currently limited to a small number of videos and viewers in English on watch and search pages.

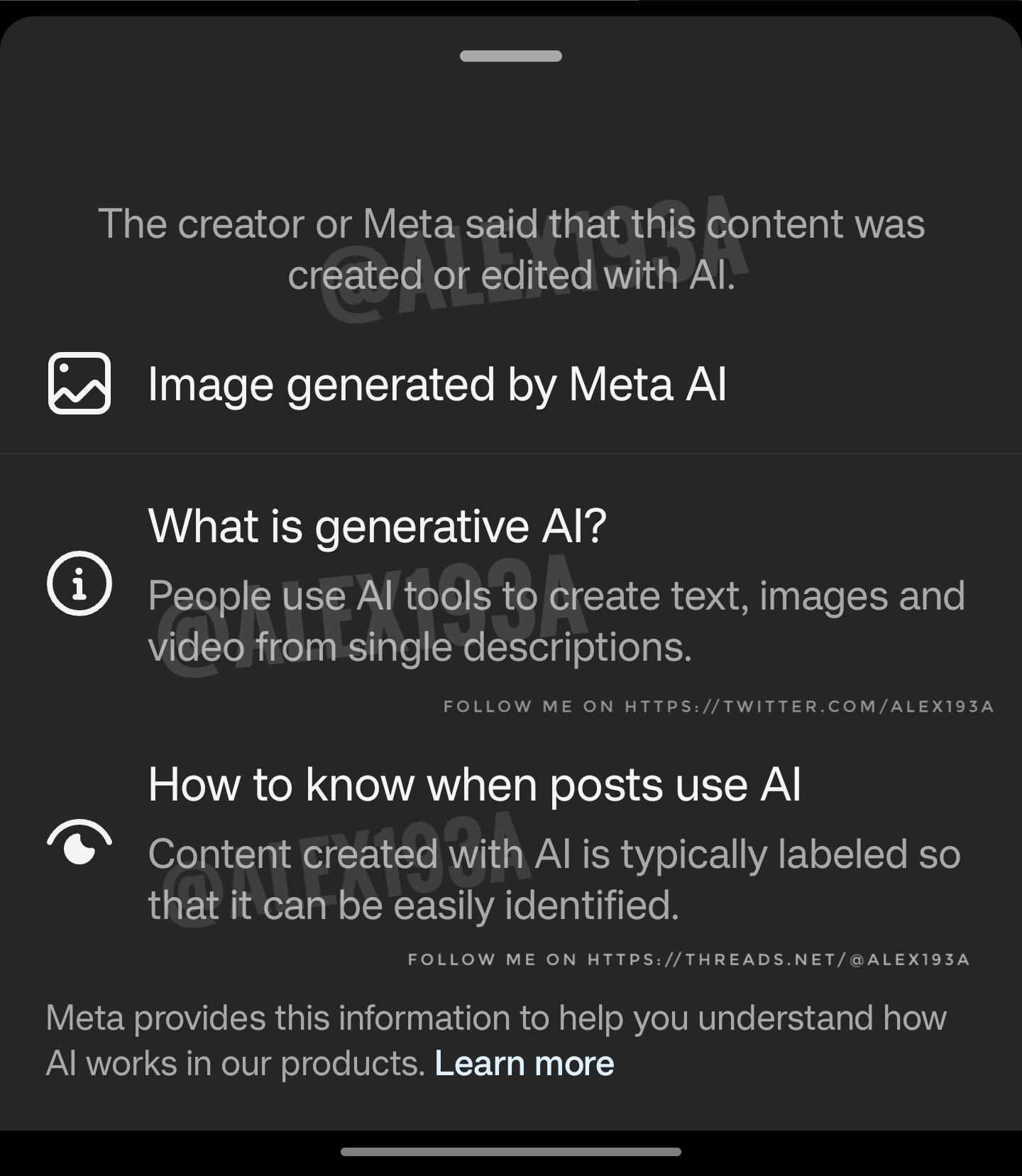

- Instagram is reportedly working on a feature that will label content created or edited with artificial intelligence. A screenshot posted by app researcher Alessandro Paluzzi shows a notification that might appear on a post, informing users that the content was AI-generated or modified. The label will read: "The creator or Meta said that this content was created or edited with AI." It will also provide an explanation of generative AI and offer a link for users to learn more about how Meta uses AI in its products.

- Meta has launched AudioCraft, an open-source generative AI that creates audio and music from text prompts. The AI music generator includes three models: MusicGen for composing music, AudioGen for creating sound effects, and EnCodec for audio compression. MusicGen was trained on Meta-owned and licensed music. AudioCraft is designed to assist musicians and sound designers in generating new ideas and compositions quickly.

- The WGA has pledged to continue efforts to unionize animation writers after resolving the ongoing strike. Susan Kim, WGA East animation caucus co-chair, made the promise during an animation-themed picket in New York, expressing determination to organize the animation industry. She urged animation writers to sign in with WGA volunteers at the event and stated that the WGA would reach out to them after finalizing contracts with the AMPTP to initiate unionization drives in various studios. The Animation Guild (TAG), which operates under IATSE, supports the WGA's efforts and sees it as complementary to their goals of protecting members of the entertainment industry through collective bargaining agreements.

- Hermès reported a 22% growth in sales across all markets in the first half of the year, defying the US luxury slowdown. Overall revenues reached €6.7bn, with sales in France up 24% and in the Americas (dominated by the US) up 20%. The company's strategy of targeting local high-end consumers and its less reliance on tourist spending during the pandemic in certain markets like China contributed to its strong performance. Hermès shares rose 4% in response to the positive results, and the company's resilience has been highlighted in contrast to other luxury brands experiencing slower growth in the US market.

- ESPN, which has been Disney's financial engine for decades, is facing challenges as its revenue growth has slowed. In response, Disney is considering selling a stake in ESPN to strategic partners that could help with distribution or content. Cord-cutting has hurt ESPN's revenue streams, and its costs for sports programming have been increasing significantly. The network's streaming service, ESPN+, has attracted subscribers but still faces challenges due to the economics of the streaming era. Offering ESPN as a stand-alone streaming channel is a possibility in the future, but pricing and its impact on the traditional cable bundle pose significant obstacles.

- Meta's smart sunglasses, Ray-Ban Stories, are reportedly not performing well, with less than 10% of owners using them regularly, according to an internal documents. The company sold about 300,000 of the glasses, but by February 2023, there were only 27,000 monthly active users due to issues such as poor connectivity and battery life problems. Meta's Reality Labs division, which includes the Ray-Ban partnership, also recorded an almost $8 billion loss in the first half of 2023. Nevertheless, Meta is planning to release a new generation of Ray-Ban Stories with improved features and more sunglass models in the fall or spring, hoping to boost sales.

- Innocean Australia has announced 11 new senior hires, including Hannah Melanson as digital creative director, Dave Varney as creative director, and Adam Hosfal as managing partner. The agency has reported a 27% increase in fees this year, leading to a 30% growth in staff over the last year. The growth is attributed to organic growth from existing clients and significant new business project growth in areas such as CX, digital, social, PR, and consultancy services. Innocean's CEO, Jasmin Bedir, has transformed the agency to offer integrated CX, data, and creative capabilities, positioning it as an award-winning boutique agency with an integrated offering.

- Diageo increased its global marketing investment by 5.6% in the fiscal year to June 2023, reaching £3 billion. The results showed net sales of £17.1 billion, up 10.7%, and operating profits of £4.6 billion, up 5%. Marketing spend in Europe rose 7%, with a focus on brands like Tanqueray, Johnnie Walker, Baileys, and Guinness. In North America, marketing spend grew by 2%. Diageo plans to focus on faster innovation, Scotch and tequila brands, and the Guinness brand in the coming year due to strong organic net sales growth in these categories. The company also emphasized its commitment to sustainability, reducing greenhouse gas emissions and achieving growth in premium-plus brands.

- Omar Zayat, senior director, head of industry—Entertainment, at Meta, discusses the future of entertainment marketing highlighting two key factors driving transformation. First, the fan-content relationship is evolving, allowing fans to engage in two-way interactions with the content they love through technologies like Messenger, AR, and VR. Second, the reinvention of movie trailers with short-form videos and Reels offers a dynamic and captivating medium to connect with audiences on social platforms.

- WPP and Spotify have formed a global strategic partnership to offer WPP clients early access to Spotify's ad products and first-party intelligence. Spotify will be integrated directly into WPP's products and solutions, allowing them to use Spotify's first-party occasions insights for more effective digital audio advertising strategies. The partnership will also include market-leading thought leadership and training programs for WPP employees and clients, focusing on digital audio creativity and innovative ad products.

- According to a Digiday+ Research survey of 35 publishers, about half increased their marketing spending in the last year. However, this increase is not expected to continue into the next year. Most of the marketing spend went towards online marketing, with 91% of publishers investing in it, compared to 57% investing in offline marketing. Looking ahead, only 17% of publishers expect marketing spending to increase in the next 12 months.

- Hasbro is selling its eOne television and movie business to Lionsgate in a deal valued at approximately $500 million. The agreement includes $375 million in cash and the assumption of production financing loans. The acquisition will give Lionsgate access to eOne's extensive library of nearly 6,500 titles, including popular shows like "Grey's Anatomy" and "Yellowjackets," and the film development rights to Hasbro's Monopoly based on the board game. The deal allows Lionsgate to expand its operations in the U.K. and Canada, where it has launched production partnerships with various media companies. Hasbro had purchased Entertainment One Ltd. in 2019 for about $4 billion, primarily for its preschool brands like Peppa Pig and PJ Masks. The transaction is expected to close by the end of the year, and Hasbro plans to use the proceeds to retire a minimum of $400 million of floating rate debt.

- Miami Sees Its First Population Drop in Decades

- Chobani taps Thomas Ranese as CMO

- Jury Awards Moonbug $23.5 Million In ‘Cocomelon’ Copyright Lawsuit

- Johannes Leonardo Hires First CMO to Ramp Up New Business

- Sequoia Capital cuts crypto funds by over 50% as it continues to downsize

- Twitch’s Top Streamers Dominate Watch Time

- MrBeast sues his food delivery partner over ‘inedible’ burgers

- Athletics launches web design for career and education platform, Guild

- Amazon Clinic now offers video doctor visits in all 50 states

- Waymo says Austin, Texas, will be its next robotaxi city

- Nothing announces budget-friendly sub-brand, readies new smartwatch

- Facebook and Instagram Begin Their Canadian News Blackout

- ‘Haunted Mansion’ Extends Disney’s Box Office Cold Streak

- The Garage Expands, Signs Director Matt Genesis, EP John Hollingsworth

- Harbor Launches Content Mastering and Distribution Services

- M&A Watch: Private equity-related deals hit 2023 record in June

- How Looney Tunes overhauled its social media strategy to become relevant

A collection of my favorite R/GA tweets (or X's or whatever)

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion