August 25 2023 - Clicks, Clips & Consolidation

👋Happy Friday, friends. It's been another busy week, especially in the ongoing battle for live sports rights. Amazon and WBD are competing for Nascar broadcast rights, while Disney is engaging in early discussions with Amazon regarding a potential partnership for ESPN streaming. Tech continues with a flurry of feature launches, as social e-commerce continues to dominate headlines. Meta is dropping more open source models and YouTube might be in a little bit of trouble. All this and more below–

Amazon and Warner Bros. Discovery are in competition to secure broadcasting rights for a new package of Nascar races, as the league aims to increase revenue through additional media partnerships. The potential deal involves broadcasting between six and eight races during the summer months. Warner Bros. is interested in filling a gap in its sports schedule left after the NBA season ends, and it plans to include these races on its Max streaming service, possibly requiring an extra subscription fee. Meanwhile, Nascar's current broadcast partners, NBC and Fox, are reportedly close to renewing their contracts, which currently amount to around $820 million annually. Nascar is pursuing a strategy similar to other sports leagues, selling portions of its broadcast rights to streaming services to boost income. The move to potentially involve more broadcasters suggests Nascar could generate higher overall revenue, despite the decline in cable-TV subscribers impacting sports rights spending by media companies.

Amazon is in early talks with Disney about a partnership for ESPN's upcoming streaming service. Amazon might offer the service through its platforms and take a minority stake in ESPN. This could strengthen ESPN's position amid declining TV viewership and rising sports costs. ESPN is considering a monthly fee of $20 to $35. The partnership would also expand Amazon's sports streaming presence, given its existing rights to NFL's "Thursday Night Football" and local Yankees games. While Amazon competes with Apple and Google in sports streaming, their impact has been mixed. The potential alliance could reshape sports media, but discussions involve multiple complexities, including negotiations with sports leagues.

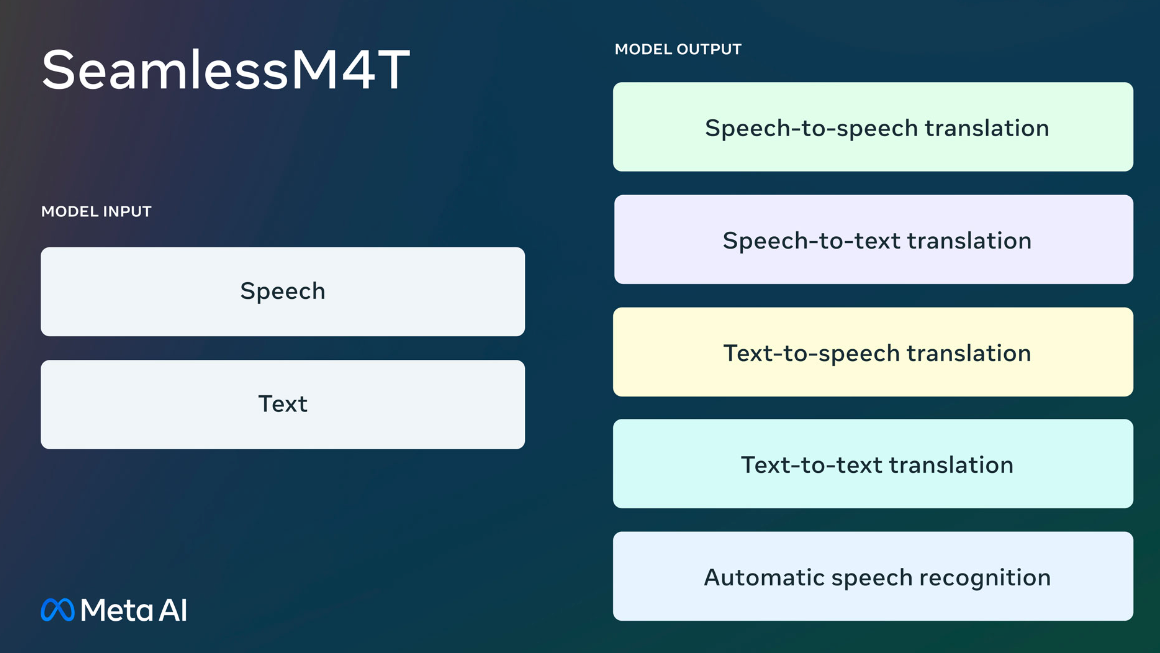

Meta has introduced a new speech-to-text model named SeamlessM4T that aims to translate nearly 100 languages. This model, which stands for Massively Multilingual and Multimodal Machine Translation, can handle speech-to-text and text-to-text translation for various languages. It's designed to be a step toward a universal translator. Released under a Creative Commons license, it's open for researchers to build upon. The model can recognize when speakers switch between languages within a sentence. Meta is also attempting to address issues like gender bias and toxicity in translation output. The release of SeamlessM4T is part of Meta's ongoing efforts to provide AI models to developers and researchers, and it builds on their previous models.

The Department of Labor reported that weekly unemployment claims have decreased to 230,000, which is 10,000 fewer than the previous week's revised figure.

T-Mobile US is planning to lay off around 5,000 employees, which accounts for 7% of its workforce, as the company aims to cut costs due to increased competition. The decision comes in the face of higher expenses for customer acquisition and retention. The layoffs, scheduled over the next five weeks, will primarily affect corporate and back-office roles, however, retail and customer-service positions will be unaffected. The move is driven by the company's efforts to streamline operations following its acquisition of Sprint in 2020.

Hollywood writers are facing pressure from producers after the AMPTP publicly released its counteroffer to the WGA. The counteroffer addresses issues like AI, streaming residuals, and data transparency. The AMPTP claims its proposal tackles the Guild's key concerns, including higher wages, streaming residuals, employment guarantees, and AI-related compensation. However, the WGA rejected the counteroffer, accusing the AMPTP of attempting to pressure the writers into accepting their terms and not genuinely negotiating.

:format(webp)/cdn.vox-cdn.com/uploads/chorus_asset/file/24868225/1619312897.jpg)

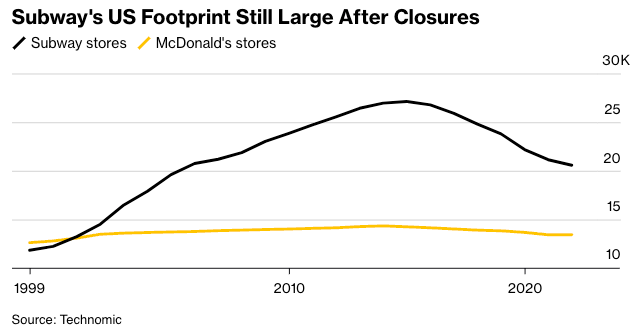

Subway is now under new ownership, as Roark Capital grapples with the challenge of managing the chain's massive size, boasting nearly 37,000 restaurants globally, including around 20,000 in the US. Despite previous efforts to reduce locations due to competition and cannibalized sales, per-store sales still lag behind rivals. While Roark is expected to maintain the current business plan and management, addressing the store count issue is likely given stakeholder appeal.

- Amazon Prime Video is introducing AI-driven enhancements to its streaming coverage of the NFL's Thursday Night Football (TNF) games. These features include Defensive Alerts, which predicts blitzes by highlighting players; Prime Targets, identifying players open for a pass; Fourth Down Territory, offering insights into fourth-down decisions; Field Goal Target Zones, indicating the likelihood of successful field goals; and Key Plays, providing in-game highlights and critical moments. These AI features aim to provide a more insightful and engaging viewing experience. Additionally, Amazon will exclusively stream the NFL's first Black Friday game, offering non-subscribers a chance to watch. Amazon also plans to bring HDR quality to TNF, offering enhanced visual quality.

- YouTube is under scrutiny following a report by Adalytics, revealing that the platform displayed adult-focused ads on videos categorized as "made for kids." These ads were linked to websites that transmitted cookies to devices, potentially targeting children with ads. Google's policies prohibit such practices on content for kids without parental consent. Google's VP of Global Ads, Dan Taylor, criticized the report, calling it flawed and asserting that third-party trackers are not allowed on kid-centric content. Senators Ed Markey and Marsha Blackburn are urging the FTC to investigate potential violations of child privacy laws.

- Disney is set to launch an ad-tier for its streaming platform Disney+ in Europe on 1 November. Media buyers expect Disney to have learned from Netflix's mistakes in launching a similar ad-supported tier, including keeping its price more reasonable. Disney is relabelling its current Disney+ offering as Disney+ Premium and raising its price from £7.99 to £10.99 per month, while introducing a new tier known as Disney Standard at the existing price, with limited simultaneous streaming.

- Threads is finally getting it's most highly request feature – web access. Previously only accessible through mobile apps, Threads can now be accessed on both desktop and mobile devices through web browsers.

- Apple has filed a patent application detailing an augmented reality (AR) windshield system for semi and fully autonomous vehicles. The system generates information on an AR display, such as the windshield, by overlaying graphical elements that simulate specific environmental objects. This overlay is based on the driver's manual driving performance. The AR display can provide relevant information, including vehicle speed and environmental details. The patent also suggests features such as simulating objects in the environment, enhancing occupant-perceived information from signs, and even enabling visual communication between occupants of different vehicles through the AR display.

- Epic Games is witnessing a shift in brand integrations within "Fortnite," with a move from the main game to the user-generated Creative mode. This shift has been spurred by enhancements to the "Fortnite Creative" ecosystem. While the main game's brand integrations have decreased, participation in "Fortnite Creative" has surged, featuring brands like 7-Eleven and Coachella. This trend aligns with the rise of Fortnite-focused studios and agencies, facilitated by Epic's introduction of Unreal Editor for Fortnite. As Epic aims to catch up with the brand-creator economy of platforms like Roblox, the expansion of "Fortnite Creative" contributes to the company's metaverse vision.

- Athleta has undertaken a brand refresh strategy, including wiping its Instagram account and launching new content. This move is part of a broader effort to revamp its brand image and re-engage customers. The new direction involves a video-led strategy, user-generated content, and more influencer collaborations, aligning with themes of nature, travel, and women's empowerment. Athleta's new Chief Creative Officer, Julia Leach, aims to improve brand awareness through digital channels, with Instagram acting as a testing ground for brand perception. The refresh also includes website and retail location updates. Despite changes, the brand isn't increasing content creation budgets and is focusing on maximizing existing resources.

- Hasbro is launching a new division called Hasbro Entertainment, unifying its film, TV, animation, and digital media businesses following the sale of Entertainment One (eOne). Former eOne president of family brands, Olivier Dumont, will lead as the president of the new unit, joined by eOne veterans Zev Foreman as the head of film and Gabriel Marano as the head of television. Hasbro's move comes with over 30 projects in various stages of development and production.

- Warner Bros. Discovery's streaming platform, Max, is introducing a 24/7 news programming service called CNN Max, commencing on September 27. This move follows the closure of CNN+'s standalone subscription service, which was discontinued only a month after its launch. CNN Max will offer breaking news coverage within Max's entertainment streaming service, and it aims to engage a younger audience than traditional TV news. The service will feature shows like CNN Newsroom, Amanpour, Anderson Cooper 360, and more.

- Google's AR projects, including a rumored mixed reality headset developed in partnership with Samsung (internally known as Project Moohan), are reportedly facing setbacks. The partnership with Samsung is said to be causing complications, with Samsung having more influence over product features and a desire to limit Google's other hardware divisions' involvement to avoid potential competition. The release of the mixed reality headset has been delayed, with reports suggesting it might not arrive until the middle of the next year. Google is also exploring AI integration with AR glasses and incorporating software from its Project Iris into another project called Betty, which aims to develop Micro XR software for glasses manufacturers.

- Kraft Heinz's Chief Marketing Officer of Northern Europe, Irina Rodina, has left the company after around a year in the role. She previously worked at Barilla and Unilever. During her tenure, Kraft Heinz launched notable campaigns like "Unbeanlievable" and partnered with Fortnite. The company's global campaign "It has to be Heinz" was released in June 2023. The successor to Rodina's position has not been announced yet.

- TikTok has introduced a new ad placement option called "Search Ads Toggle" that allows advertisers to target users who are actively searching for new products or brands within the app's search results. This feature is an extension of TikTok's video ad buy and enables brands to reach users engaged in search queries related to their business. Advertisers can also ensure brand safety by adding "Negative Keywords" to avoid ad placements against queries that don't align with their brand. Internal tests showed that 70% of ad groups with the Search Ads Toggle turned on experienced a lower CPA. This move positions TikTok as a competitor to platforms like Google, especially among younger users who start their searches on social apps like TikTok and Instagram.

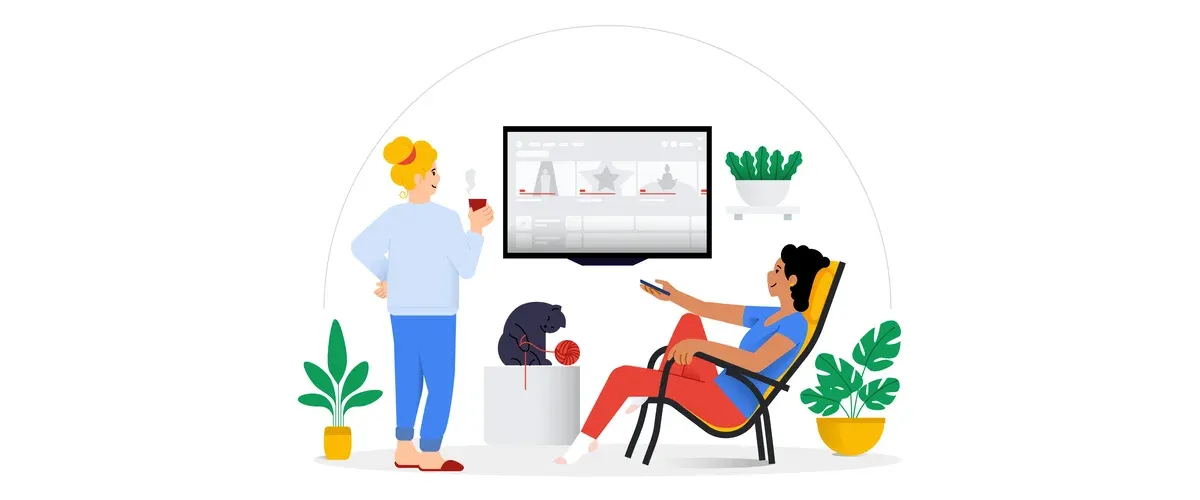

- Google TV is integrating NFL Sunday Ticket, a subscription service that offers access to live out-of-market Sunday afternoon American football games and highlights, ahead of the new season. The service, which Google acquired the rights to in 2022, will be fully integrated into Google TV in the US, allowing users to access games, highlights, and game recommendations on their home screens.

- Twitch is testing a new feature called the "discovery feed," which resembles TikTok's format for browsing content. The feed presents vertical clips from Twitch creators and includes both featured and popular clips. Twitch's experimentation with this TikTok-like feed follows similar moves by Spotify, Amazon, and Reddit. The company had also announced plans to introduce stories to the platform, expanding its range of features.

- YouTube is testing a new search feature on its Android app that allows users to identify songs by humming, singing, or recording a song. The platform subsequently recognizes the melody and guides the user to a YouTube video showcasing the searched song, which could include the official music video, user-generated content, or Shorts.

- Apple's recent launch of several features aimed at helping creators is notable, considering that discussions about Apple and the creator economy often revolve around complaints about its App Store fees. The new features include enhanced analytics for podcasters on Apple Podcasts, allowing them to view metrics related to free trial subscriptions, paid subscriptions, and conversion rates. This move is designed to assist creators in increasing their paid subscriber base. Apple's focus on providing tools for creators comes as it competes with platforms like Spotify for a share of the growing podcast market, especially as podcast subscriptions gain traction.

- OpenAI has introduced GPT-3.5 Turbo API enabling developers to fine-tune the model with their own data, customizing its outputs for specific use cases. This process involves pre-training the model on a unique dataset, allowing it to perform better in specific applications.

- Instacart's revenue grew by over 30% in the first half of the year to approximately $1.4 billion, with the company's ad business helping offset a slowdown in grocery deliveries. However, despite the growth, the volume of goods ordered through Instacart's service only increased by about 5%. Investors will be closely watching the company's performance in terms of order volume and revenue expansion as Instacart prepares for its IPO.

- YouTube has revealed its strategy for compensating artists for AI-generated music, aiming to balance AI's creative potential with protecting artists' rights. The platform's principles include responsibly embracing AI, preserving creative integrity, and scaling trust and safety measures. YouTube's Music AI Incubator program will collaborate with artists, songwriters, and producers to shape its AI approach. The company plans to expand its trust and safety measures, using AI to identify issues like copyright abuse. Universal Music Group (UMG) will be the first partner for the program.

- Kraft Heinz aims to tap into the school lunch market by offering its Lunchables meal kits in cafeterias across the US. Despite concerns about adding processed foods to school menus, the company sees schools as a way to expand its food-service division and market its brands to a new generation. Kraft Heinz has re-engineered Lunchables to comply with federal guidelines for school meals and has been pitching them to schools as a labor-saving option.

- TikTok's ambitious plans to establish itself as a major player in the shopping realm, aiming for $200 billion in annual customer orders from its TikTok Shop by 2028, have significant implications for creators. The platform's approach revolves around transforming the app into a discovery-based commerce leader, where users purchase products featured in videos they come across, even if they didn't initially intend to buy them. Two-thirds of TikTok Shop purchases are made when consumers buy products featured in short-form TikTok videos, while the remainder originates from livestreams and storefronts linked to brands or creators. TikTok is actively promoting shoppable livestreams by offering cash incentives to creators for conducting them. The platform is also developing an affiliate marketplace, connecting brands with creators who receive commissions for recommending products.

- Droga5 New York has hired Chioma Aduba, formerly EVP and head of business leadership at McCann New York, as its president. Aduba will assume her new role in September, overseeing client relationships and agency operations to drive business growth.

- Baidu has exceeded expectations with positive second-quarter revenue, driven by a resurgence in advertising spending post-pandemic and a focus on generative AI initiatives. The company reported a revenue of 34.06 billion yuan ($4.67 billion), benefiting from a 15% rise in online marketing revenue during the quarter. Baidu's adoption of generative AI, including the deployment of its Ernie AI model, has contributed to its success. Despite regulatory challenges, Baidu's AI-driven innovations and advertising rebound have strengthened its position in the digital advertising landscape, enhancing its competition with tech giants like Tencent and Alibaba.

- Netflix has been named the "coolest" brand among 7- to 14-year-olds in a study conducted by Beano Brain, surpassing YouTube as the top choice for this demographic. The study, which involved 60,000 U.K. kids, highlighted Netflix's ability to create cultural moments through shows like "Wednesday" and "Stranger Things," earning its place as the preferred brand. The research revealed that brands appealing to Gen Alpha, those born after 2010, should prioritize authenticity, purpose, and sustainability. Netflix's appeal was attributed to its clear value proposition, engaging content, collaborations, and ability to tackle sophisticated topics.

- John Warnock, Adobe Co-Founder, Dies At 82

- Microsoft Is Finally Done Making Kinect (For Real This Time)

- Drake’s new album art was drawn by a 5-year-old

- Netflix plans to give away DVDs as service shuts down

- Peloton’s business still haunted by recalls

- Accenture Song hires head of social and influencer from McCann

- How Kroger Became the Biggest Sushi Seller in America

- Pickleball went pro. Can it profit?

- Have consumer goods price rises peaked?

- Snap Appoints India Head, Announces Revamp in Growth Push

- Why brands should be thinking about accessibility in design

- Bioware Is Laying Off 50 Employees

- How AI and other emerging tech showed up at the FIFA Women’s World Cup

- Google Pixel Fold 3D billboard campaign by Anomaly

- TikTok Shop has yet to become mainstream amongst Singapore's consumers

- Why are there no more G-rated films?

- The New York Times blocks OpenAI’s web crawler

- NFT Startup Casualties Pile Up

- Tiger Global Nears Deal to Sell Slice of Cohere Stake at $3 Billion Valuation

- This Tomato Sauce Is Delicious. It's Also Worth Billions of Dollars.

- Google and YouTube are trying to have it both ways with AI and copyright

- Microsoft’s AI-powered design tool is now widely available in Edge

- How Twilio Plans To Infuse Its Entire Mar Tech Stack With AI

- Hugging Face raises $235M from investors including Salesforce and Nvidia

- X tests removing headlines from links to news articles

- NBBJ and Flea of the Red Hot Chili Peppers create LA playground

- Christopher Doyle & Co.’s identity for Troye Sivan’s fragrance line is filled with free-form image making

- How Nvidia Built a Competitive Moat Around A.I. Chips

- Pictoplasma Character Design Conference Returns to New York

- Sony’s PlayStation division is acquiring headphone maker Audeze

- New Ray-Ban Stories Will Reportedly Support First Person Livestreaming

RIP

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion