August 11 2023 - Earnings, Tech & The Strike

👋 Happy Friday, friends. Wow, another busy week rounding out earnings season– plus a flurry of news across tech, media, publishing, and AI. No fuss, let's get into it

ESPN has signed an exclusive 10-year agreement with casino operator Penn Entertainment Inc. The deal involves licensing the ESPN brand for sports betting purposes, resulting in the rebranding of Penn Entertainment's Barstool sportsbook as "ESPN Bet." Penn Entertainment will pay $1.5 billion in cash over the 10-year term and grant ESPN $500 million worth of warrants to purchase Penn shares. This partnership aligns ESPN with the online gambling industry and as part of the deal, ESPN will also have the right to appoint a non-voting board observer at Penn Entertainment, and the term of the agreement can be extended for another 10 years by mutual agreement.

The New York Times has reported a 6.3% increase in revenue for its second quarter, driven by the addition of 180,000 new digital subscribers. The company's adjusted operating profit for the quarter reached $92.2 million, up from $76.2 million in the same period last year. Total revenue was $590.9 million. Revenue from digital and print subscriptions increased by 6.8%, while digital advertising revenue grew by 6.5% to $73.8 million. The Athletic, a sports news website owned by The New York Times, reported a revenue increase of over 55%, reaching $30.4 million, despite a $7.8 million loss in the quarter.

Disney is increasing the prices of its streaming services, including Disney+ and Hulu. The cost of the ad-free version of Disney+ will rise from $10.99 to $13.99, while the ad-free version of Hulu will increase to $17.99 from $14.99. This move follows Disney's efforts to address losses in its streaming business and declining legacy TV operations. Despite reporting narrower losses in its streaming segment for the latest quarter, Disney's flagship Disney+ service lost domestic subscribers for two consecutive quarters. To counter, Disney has introduced a new bundle called Duo Premium, combining Disney+ and Hulu without ads for $19.99 a month. The company's shift to a streaming-first approach has led to significant losses, exceeding $10 billion, as it tries to adapt to changing consumption patterns.

Airbnb reported its most profitable second quarter, with a 72% increase in net income compared to the same period last year, reaching $650 million. The company's strong performance was driven by higher nightly rates paid by guests, reflecting the continuation of elevated travel prices. Despite this, the number of nights booked, totaling 115.1 million, fell short of analyst expectations, showcasing a slower growth trend since the initial post-pandemic surge. The average daily rate for stays increased by 1% and is now 42% higher than in 2019. Airbnb's revenue rose by 18% to $2.5 billion, surpassing analyst predictions, and the company expects revenue to continue growing faster than the number of stays booked in the third quarter.

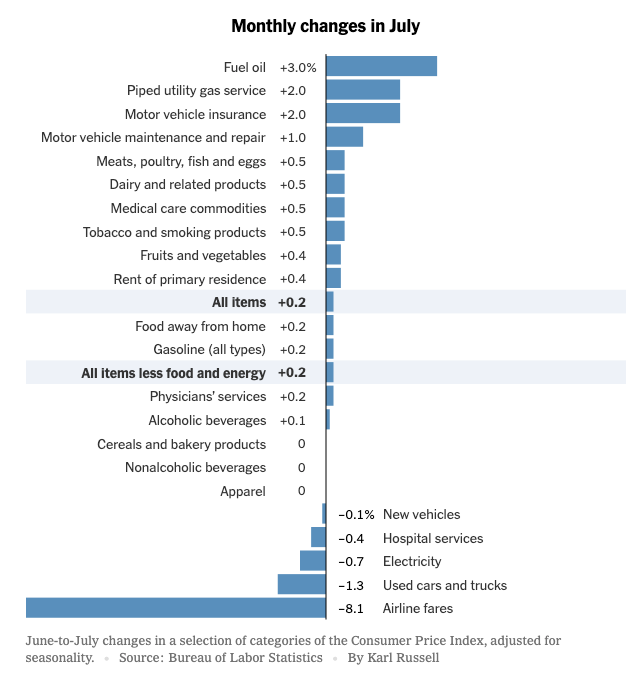

Inflation in the US rose by 3.2% in July compared to a year ago, marking the first acceleration in over a year. However, beneath this headline figure, economists find encouraging signs that price pressures are continuing to moderate. The "core" inflation index, excluding volatile food and fuel prices, increased by 4.7% year-on-year, slightly lower than June's 4.8%. These trends, including moderating rent prices, are being closely watched by the Federal Reserve as it considers its monetary policy decisions.

The WGA and studios have decided to formally resume negotiations for a new three-year contract after 101 days of strike. The move comes with the support of the unified WGA membership amid ongoing backing from union allies. While there's some indication that studios are willing to enhance their contract offer in specific areas, key points like success-based residual payments and safeguarding writers from AI technology remain unresolved.

- Stagwell is facing challenges with a 6% revenue drop in the first half of 2023 and hundreds of job losses. Media agencies have been driving growth among holding companies, while tech-focused agencies like Stagwell and S4 Capital have faced difficulties. Quoting auther Stephen Foster "Historically agency groups have grown by handling FMCG clients and legacy businesses like oil. McCann, the engine room of Interpublic’s growth, grew on the back of Coca-Cola, Exxon (Esso), Martini, Unilever and Nestle. These companies were never likely to replicate creative agency functions, why would they? But tech companies have taken over as the world’s biggest so supposing an agency business can be sustained on selling tech-based services and expertise to tech companies whose R&D budget is hundreds of time bigger than yours is optimistic, to put it mildly. Publicis Groupe finds itself (for now anyway) in a sweeter spot, in part thanks to its $8.8bn acquisition of data businesses Sapient and Epsilon, which gives it something the tech client’s don’t have. For now anyway."

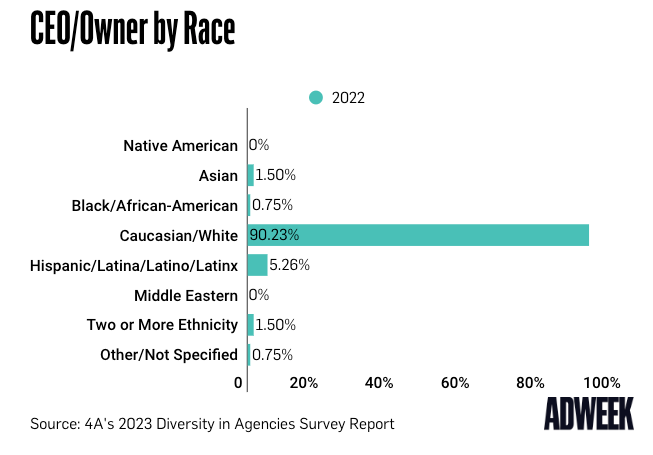

- The 4A's Report reveals a significant lack of progress in diversity at the top levels of agencies. The data shows that in 2021, 73% of agency CEOs, owners, and C-suite employees were white, but that number jumped to 90% in 2022. Black representation among leaders fell from 5% to 0.75%, while Asian and Hispanic representation also declined.

- Lyft is expanding its advertising efforts to develop a consistent revenue stream beyond its core ride-share service. The company is introducing display ads within its app that will appear during various stages of the user experience, including waiting for rides, matching with drivers, and during trips. Lyft plans to incorporate video ads into the app by the end of the year and expand other ad products like in-car screens. The move is in response to the growing advertising businesses of both Lyft and its competitor Uber. Lyft's ad revenue grew 400% YoY in the second quarter, and the company aims to share a portion of ad revenue with drivers to attract more drivers to its platform.

- Crayola has launched a new production division called Crayola Studios, dedicated to creating diverse content for children and families that explores creativity and utilizes color as an essential story element. The first project under Crayola Studios is an animated adaptation of the popular kids' podcast "The Alien Adventures of Finn Caspian," being co-developed with Mimo Studios. The label has a pipeline of titles in development, and it will collaborate with other production companies, animation studios, and IP holders to produce content for global audiences. Victoria Lozano, Executive VP of Marketing, will oversee the content slate with support from Goatfish Agency and Crayola's sister company, Hallmark Media.

- Google and Universal Music are in early-stage negotiations regarding the licensing of artists' voices and melodies for AI-generated songs. The discussions may lead to the creation of a tool allowing fans to create AI-generated songs while ensuring copyright holders receive compensation. Artists would have the choice to opt into this process.

- Netflix has successfully completed its first upfront negotiations, doubling its monthly active users for the ad tier to over 10 million globally, up from nearly 5 million in May. The streaming company secured deals with major advertising holding companies and independent agencies at "top-of-market pricing in the streaming industry," according to sources. Netflix has managed to attract investment from various sectors and has filled nearly all its inventory for 2023-2024. The company's ad-supported plan membership has doubled since Q1, and its offering generates an average revenue per member greater than its standard plan through subscriptions and ads.

- Apple has filed a patent application detailing an In-Air Hand Gesturing system that could allow users to interact with and control virtual objects on various display devices, including Macs and Apple TV. The system would involve using hand gestures, potentially assisted by an Apple Watch, to manipulate content displayed on devices such as iPads, MacBooks, iMacs, and TVs via an Apple TV box. The interactions could encompass a wide range of functions, from image editing and word processing to gaming and video conferencing. The patent application showcases various examples of how hand gestures, in conjunction with devices like the Apple Watch, could be used to control virtual objects and content on different display devices.

- Catch+Release is developing an AI-powered search engine to assist brands in licensing existing user-generated content for their marketing campaigns. The platform offers tools for marketers to find and bookmark suitable content, as well as human curation services for a fee. The company assigns a "licensability" score to content based on factors like brand logos, sensitivity, and the number of people in the image or video. It then approaches creators with licensing offers and charges brands a fee for clearance and a marketplace markup on the content. Catch+Release aims to use its new funding to invest in product development and marketing.

- Disney has concluded its upfront talks with commitments "in line with the prior year." The demand was driven by live events, addressable offerings across sports and entertainment, programmatic and measurement offerings, and inclusion commitments. More than 40% of the total upfront dollars committed this year went towards streaming and digital platforms, with Disney+, ESPN+, and Hulu leading the way. The company also secured increased commitments to Disney+ from agency partners, primarily due to expanded targeting, measurement, and programmatic capabilities. Auto, consumer packaged goods, financial services, media and entertainment, pharmaceutical, sports gaming, and travel and leisure were the well-performing categories.

- TikTok is launching a music contest named Gimme the Mic, resembling popular talent shows like The Voice. The contest will take place on TikTok livestreams and involve live voting from fans. The competition comprises three stages: audition, semifinal, and grand finale. Aspiring artists can submit 30-second audition videos using the hashtag #GIMMETHEMIC. The top 30 submissions will move to the semifinals, where they'll perform in livestreams, and viewers can vote for their favorites. The US finale on September 10th will feature the top 10 performers, and one winner will compete globally.

- BuzzFeed is facing a 27% YoY revenue decrease, with all its major revenue streams declining: ad revenue down 33%, content revenue down 22%, and commerce and "other" revenue down 17%. The decline is attributed to diminishing traffic referrals from major tech platforms prioritizing vertical video. To counter this trend, BuzzFeed is turning to AI-generated content to drive audiences to its owned platforms and away from social media. They plan to focus on AI-powered quizzes and experiences, with readers engaging two to four times longer with AI-enriched quizzes.

- TikTok is expanding beyond mobile screens and entering the digital out-of-home (OOH) landscape by partnering with various digital media networks. The platform has identified nearly 2 billion digital OOH screens globally, including gas station TVs, airport TVs, and Redbox kiosks, to showcase its videos. TikTok's push into digital OOH aims to extend the reach of both user-generated content and paid ads. This expansion is part of TikTok's strategy to bring its content to as many screens as possible beyond mobile devices. The platform curates content that can be appreciated without sound for locations like airports, gas stations, and grocery stores. TikTok's partnerships with OOH networks, such as GSTV and Redbox, enable brands to showcase their content and ads to a larger audience, contributing to sequential messaging strategies.

- Publicis' digital experience division, which includes agencies like Razorfish and Digitas, is mandating that employees work in the office three days a week starting from Labor Day. An internal memo outlines that anyone without an approved "Remote Work Arrangement" will be required to comply, and non-compliance may result in repercussions like impacting salary increases, bonuses, and promotions. The memo also highlights that tracking methods could include visual observations, consulting senior leaders, facilities data, and network connections. Publicis aims to encourage collaboration and growth through in-office engagement, indicating a shift away from remote hiring. The company still offers the "Work Your World" program for up to six weeks of remote work.

- TikTok is undergoing a shakeup in its ecommerce division, with its U.S. ecommerce general manager, Sandie Hawkins, leaving the company. In her place, the company has hired Nicolas Le Bourgeois, a former Amazon executive, and Marni Levine, a former eBay executive associated with Meta Platforms, to jointly oversee its U.S. ecommerce efforts. This change in leadership comes as TikTok aims to expand its ecommerce business, including the launch of the "Shop" service for in-app purchases. The company has faced challenges in attracting American merchants to sell through the platform, and the new hires bring expertise from Amazon's marketplace and eBay's supply chain operations.

- Roblox's shares dropped over 20% following its earnings report, which fell below analysts' expectations. The company reported $781 million in net bookings and $38 million in adjusted EBITDA for the quarter, missing estimates of $785 million and $46 million, respectively. Despite an increase in daily users, average monthly payers, and hours engaged compared to the previous year, Roblox has had a pattern of disappointing results in recent quarters. The lack of financial projections and guidance from Roblox has contributed to the market's negative reaction.

- WeWork has issued a warning about its ability to continue operating as a going concern due to current losses, projected cash needs, higher member churn, and liquidity levels. The co-working company outlined plans to enhance liquidity and profitability, which include cost-cutting through restructuring and renegotiating lease terms, increasing revenue by reducing member churn and adding new sales, and controlling expenses. WeWork also mentioned seeking additional capital through debt issuance, issuing more shares, or selling assets. This announcement was made alongside the company's second-quarter results, which showed sales below estimates and a narrower loss than anticipated.

- Amazon is reducing its private-label operation by eliminating dozens of its in-house brands, including 27 out of 30 clothing brands such as Lark & Ro and Goodthreads. The move aims to address antitrust scrutiny and improve profitability. The remaining clothing division will feature just three brands: Amazon Essentials, Amazon Collection, and Amazon Aware. The company is also phasing out private-label furniture brands like Rivet and Stone & Beam. Amazon Basics, which focuses on home goods and tech accessories, will remain a key part of the business.

- X (formerly Twitter) has taken over the @music handle on the platform, suggesting potential music industry plans or collaborations with artists and labels. X seized the account, which had grown to around half a million followers, from software developer Jeremy Vaught. The company is focusing on the @music handle despite not being explicitly tied to the "X" branding.

16 years ago, I created @music and have been running it ever since. Just now, Twitter / X just ripped it away.

— Jeremy Vaught (@jeremyvaught) August 3, 2023

Super pissed pic.twitter.com/ctacWKY9js

- Apple MLS Season Pass subscriptions have doubled since Lionel Messi joined Inter Miami

- The Emmy Awards have been postponed until January 15, 2024.

- Grimes Says Relationship With Elon Musk Was 'Best Internship Ever'

- AI can identify passwords by the sound of keys being pressed

- Spotify integrates with Patreon to stream subscriber-only content

- Disney’s metaverse head departs

- WandaVision background actors say Disney scanned them, didn't say why

- How celebrity-owned agencies are managing the risks and rewards for brands

- Apple’s services business now has more than 1B subscribers

- Sony Pictures Entertainment First Quarter Profit Slides To $115 Million

- Zoom Ends No-Meeting Wednesday, Calling It Barrier to Collaboration

- Accenture Song Wins The Most Awards at 2023 IAB Bookmarks

- TJ Maxx hires McCann for creative

- US ad employment gained 1,000 jobs in July, but pace of growth slowed

- How ad tech’s measurement titans are pivoting to attention and activation

- Coach owner to buy Michael Kors parent in $8.5 billion deal

- 72andSunny lands blockbuster Call of Duty launch

- TikTok’s head of global brand and creative departs

- Twitch Has Become a Haven for Live Sports Piracy

- Iger’s More Sober Tone Reflects Entertainment’s Existential Crisis

- Zoom wants its remote work company to come back to the office

- Disney's Bob Iger Joins the Camp of Wanting the Strikes to End 'Quickly'

- More than half of US marketers use generative AI every day

- Why luxury brands like Prada and Burberry are stepping into the sports arena

- Hilarious brand kit confirms the X logo is here to stay

- Shutterstock Brings Ethically Sourced NeRFs to Creators

- Barbie Surpasses $1 Billion at the Box Office

- Rivian beats on Q2 revenue, raises EV production guidance for 2023

- PayPal launches digital token in push to capture crypto payments

- Square Enix Drops After ‘Final Fantasy’ and Mobile Setback

- Amazon removes books ‘generated by AI’ for sale under author’s name

- WhatsApp Launches Screen-Sharing On Video Calls

- The Story Behind Tinder's Latest Passion Plays

- Stanley hires GSD&M as its first TikTok agency of record

- The New York Times Updates Terms of Service to Prevent AI Scraping

- Get ready for a repositioned end call button in iOS 17

- Verizon is shutting down the videoconferencing app it bought for $400 million

- Disney is Coming For Password Sharing, Too

- Tome, AI Startup Founded by Ex-Meta Managers, Discusses Fundraising at $600 Million Valuation

- Snapchat Engineer Designs AI-Camera That Runs Stable Diffusion

[NEW] - Joshua Avatar 2.0 🤖✨. Both of these video clips were 100% AI-generated, featuring my own avatar and voice clone. 🎙️🎥

— Joshua Xu (@joshua_xu_) August 8, 2023

We've made massive enhancements to our life-style avatar's video quality and fine-tuned our voice technology to mimic my unique accent and speech… pic.twitter.com/9EgxRA69dg

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion