April 28 2023 - Friday Flurry

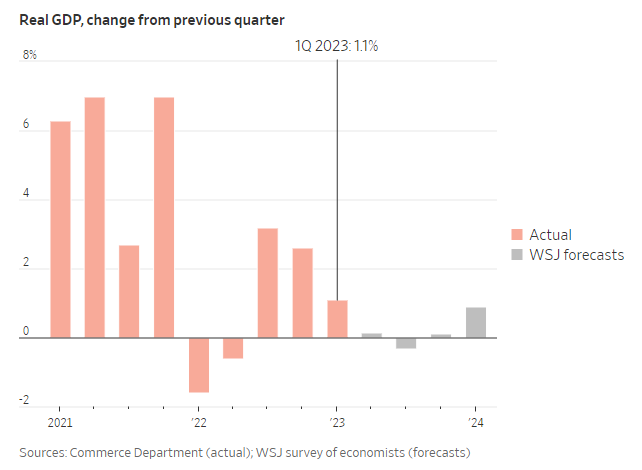

👋Happy Friday everyone. Unfortunately, the Friday Roundup Video is going to be a Weekend or Monday Edition– there is simply too much news. And for one second, just imagine loosing $30 billion on a product. Oof. Okay, let's get into it–

Joe's Quick Take

- Layoffs are piling up (Gap, Dropbox, Lyft, Vice, Clubhouse all yesterday)

- More earnings, mixed bag for media companies and agencies while communication and tech faired well (Reporting: Amazon, Snap, Comcast, Roku, WPP, IPG)

- It's a mixed bag of upside and downside

Snap reported a 7% drop in revenue to $989 million for the first quarter, below Wall Street estimates of $1 billion. Despite recording a narrower net loss of $329 million, its revenue was affected by upgrades to its ad-selling platform, resulting in "disrupted" demand for its ads. However, daily users on Snapchat grew to 383 million, a 15% increase from last year.

Amazon's Q1 revenue of $127.4 billion came in above Wall Street forecasts, causing shares to surge 11%. The company expects revenue between $127 billion and $133 billion in Q2, and operating income between $2 billion and $5.5 billion. CEO Andy Jassy said the results were impressive, particularly given the uncertain economic environment, but the earnings report barely touched on Amazon's entertainment assets.

Peacock streaming service has reached 22 million subscribers, adding 2 million during Q1. The company still posted a loss of $704 million, but this was an improvement on the $978 million loss posted last quarter. Comcast CFO, Jason Armstrong, says that they believe 2023 will be “peak losses” for the platform. The company has no plans to replace former NBCUniversal CEO, Jeff Shell, as yet.

Vice Media will end its flagship TV news show "Vice News Tonight" and lay off over 100 staff members as it shifts focus to digital videos, documentaries and TV production, according to a memo from Vice's new co-CEOs, Bruce Dixon and Hozefa Lokhandwala. The changes come as digital media firms struggle with a reduction in advertising spending due to the uncertain economy and as remaining ad dollars go mainly to tech giants like Facebook and Google.

Lyft announced that it is cutting over 1,000 jobs, or 26% of its workforce, and eliminating more than 250 open roles, as well as scaling back on hiring, in a new round of layoffs. The company also said it will incur $41 million to $47 million in severance and other related costs. The latest cuts come days after a new chief executive took over and a round of layoffs of 700 people in November.

Dropbox announced that it will be cutting 500 jobs, about 16% of its workforce, due to slowing growth and increased investments in artificial intelligence (AI). CEO Drew Houston said that the company's next stage of growth requires a different mix of skill sets, particularly in AI and early-stage product development. While Dropbox remains profitable, headwinds from the downturn in the economy have put pressure on the business and made some investments unsustainable. The company expects to incur charges of between $37 million and $42 million related to the job cuts, largely for severance payments and employee benefits.

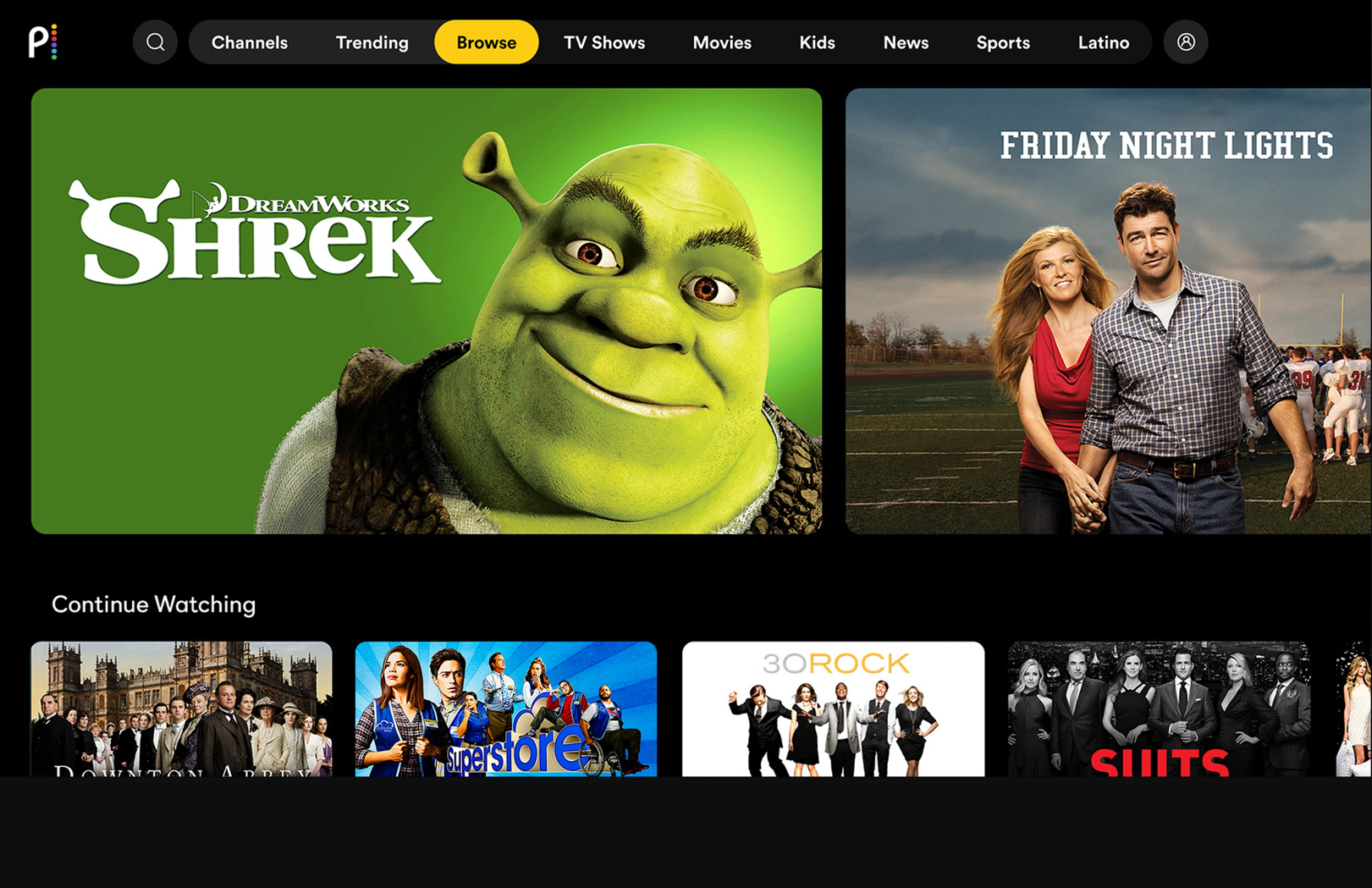

US GDP growth in the first quarter of 2023 was 1.1%, down from 2.6% in the last quarter of 2022, due to a slowdown in housing and business investment. However, consumer spending remains strong, growing at an annual rate of 3.7%. The Federal Reserve's efforts to cool off the economy are having an effect, but spending is expected to weaken due to headlines about layoffs, bank failures, and possible recession.

Gap Inc. has announced it will lay off 1,800 employees as part of a restructuring plan, costing the company $100 million to $120 million in pre-tax expenses, according to an SEC filing. The layoffs will affect the company's headquarters as well as management roles in other regions. The apparel conglomerate has undertaken the restructuring effort without a permanent CEO at the helm, after cutting 500 corporate jobs in September. The restructuring comes as all Gap Inc. brands saw sales declines in Q4, including usually better-performing Old Navy and Athleta businesses.

- General Mills has partnered with branding and design agency Pearlfisher to refresh its fruit snacks portfolio, which includes iconic brands such as Gushers, Fruit By The Foot and Fruit Roll-Ups. The new designs are aimed at resonating with teens' modern reality and experiences, with a distinctive yet flexible design system that works across packaging, partnerships, digital activations and seasonal expressions.

- Meta has announced that time spent on Instagram has grown by over 24% since the launch of Reels, with AI-powered content recommendations driving engagement. Although helping, they are cannibalizing revenue from Stories and feed-based posts, if the larger trend is incremental it will eventually have a positive impact on revenue potential. Reels is on track to be revenue-neutral by the end of 2023 or early 2024.

- Forsman & Bodenfors is acquiring Irish creative agency In The Company Of Huskies for an undisclosed sum. The deal will see Huskies renamed and rolled into the Forsman & Bodenfors network, marking Forsman's first move into Ireland. Huskies' digital-first approach and use of behavioural science was praised by Forsman's global CEO, who hopes to benefit from access to the Irish agency's expertise.

- Roku, the streaming platform, reported Q1 revenue of $741 million, up 1% YoY, and the addition of 1.6 million active streaming accounts. The company expects its advertising business to remain challenged, citing continued macro uncertainties and muted discretionary spending. Roku's Q2 total net revenue is expected to be around $770 million, with a net loss of $75 million.

- Meta has announced in its Q1 2023 financial results that its Reality Labs metaverse division lost nearly $4 billion in its latest quarterly report. Despite the heavy losses, Meta plans to continue investing billions into its XR efforts, which includes the Quest headset platform, and its work in AR and AI. Despite the recent layoffs, Mark Zuckerberg says the company is committed to both AI and the metaverse, noting that breakthroughs in both areas are essentially shared, such as computer vision, procedurally generated virtual worlds, and its work on AR glasses.

- WPP reported organic growth of 2.9% in Q1 2023, with revenue of $4.32bn. CEO Mark Read anticipates annual growth of between 3% to 5%, partly due to recent good results from Google, Microsoft, and Meta. GroupM saw growth of 6.1% during Q1, and the network also reported growth across all its segments. WPP has invested in influencer marketing and AI, and acquired two creator/influencer agencies in recent weeks. Read believes that investment in the creator economy will come from clients’ media budgets.

- WPP has also said that AI will be "fundamental" to its business, citing its use to automate workflows, speed up the process of ideation, and produce creative work for clients. The company also stated that it is committed to using AI responsibly and recognises the challenges the technology poses to society.

- IPG reported a 0.2% fall in organic revenue for Q1 2023, compared to an 11.5% hike in organic revenues in the same period last year. Revenues were $2.18bn for the first quarter, marking a decrease of 2.3%, while net income was $126m. CEO Philippe Krakowsky attributed the drop to areas of softness, most notably from clients in the tech space. UK agencies performed better than US operations, with 2.9% organic revenue growth compared to a decline of 0.9% in the US. Meanwhile, IPG's PR, sports and entertainment, and experiential agencies experienced an increase in revenue of 3.3%.

- The One Club for Creativity has announced the finalists for the global ADC 102nd Annual Awards. Squarespace New York tops the list with 23 finalists entries and Rethink in Toronto, Montréal and Vancouver has 20 finalists entries with the winners to be announced on May 17th during Creative Week in New York.

- According to Samba TV's study, TikTok is a powerful driver of tune-ins beyond traditional TV campaigns, with 97% of TikTok campaigns resulting in viewership and an average tune-in lift of 159%. The platform was 1.2 times more cost-efficient than TV when driving tune-ins, and TikTok is Gen Z's primary platform for discovering new shows.

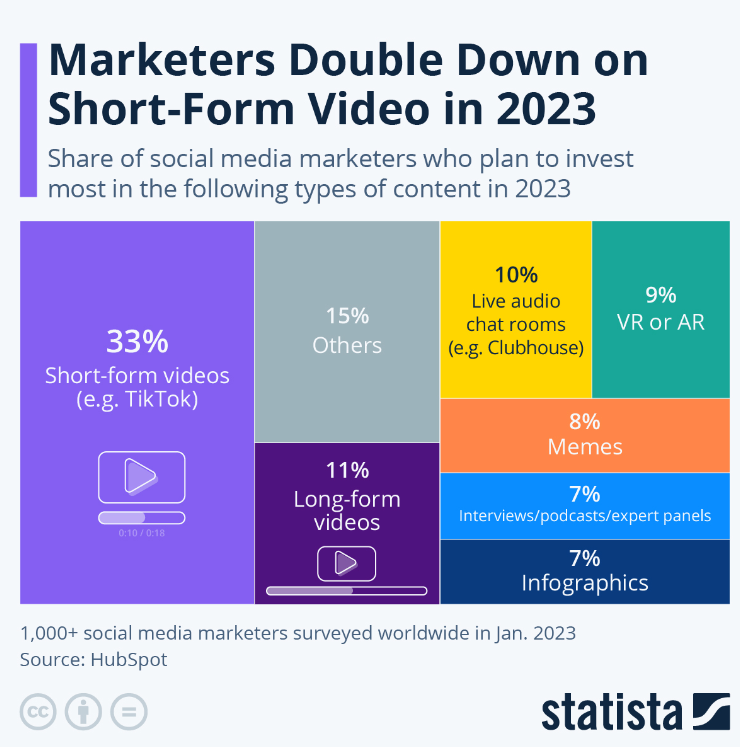

- Social Media Marketers Double Down on Short-Form Video in 2023

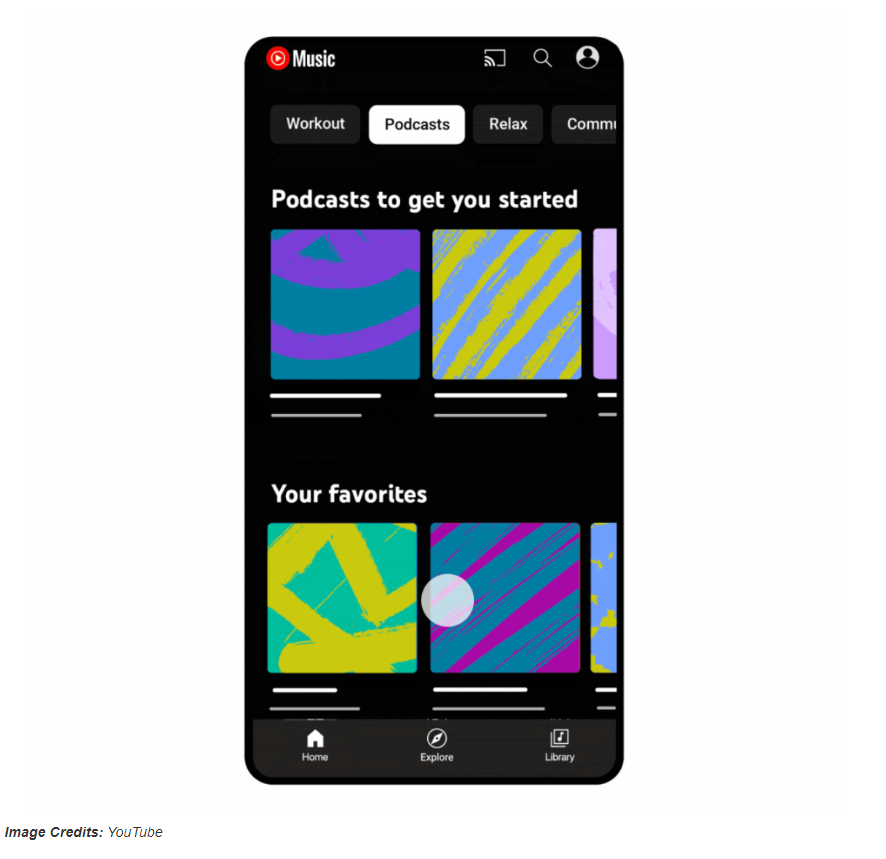

- YouTube Music has rolled out podcasts for its platform in the US on Android, iOS, and the web. Users can continue listening to podcasts on YouTube Music after watching them on the main app, and can listen to them offline, in the background, while casting, and seamlessly switch between audio and video versions. YouTube Music's new podcast feature does not require a premium subscription.

- Clubhouse founders, Paul Davison and Rohan Seth, have announced that the company is laying off over 50% of its workforce in order to reset and focus on the product's evolution. The product needs to evolve, and a smaller, product-focused team will help with focus and speed. The company will pay severance, accelerate equity, provide healthcare coverage, and offer career and immigration support to those affected.

- TBWA\London Hires BBC Creative’s Paul Jordan as Executive Creative Director

- Oatly created a F*ck Oatly website. Here’s why

- More than 184,000 tech-sector employees have lost their jobs since the start of 2023

- US in ‘Worst of Both Worlds’ With High Inflation, GDP Slowdown

- Apple is working on USB-C EarPods for the iPhone 15

- Unilever chief says group is not ‘profiteering’ from inflation

- How Roblox is bringing AI to the metaverse

- DeSantis’s Miscalculation: ‘Disney Is Playing the Long Game’

- Meta Ads Boss Merges Ads and Business Messaging in New Product Group

- How cannabis culture is becoming a bigger part of Jack in the Box’s marketing strategy

- Jerry Springer, dies aged 79

- Chris Hemsworth Leads Star-Studded Animated Prequel Transformers: One

- State Attorneys General Lose Bid to Revive Facebook Antitrust Case

Teenage Engineering’s CM-15 condenser microphone looks right out of Apple X Braun’s design playbook

Adobe Firefly In Action

As always, send us feedback at: thebrandtrackers@gmail.com

Member discussion